- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Canara HSBC Life Insurance Company IPO

₹14,000/140 shares

Minimum Investment

IPO Details

10 Oct 25

14 Oct 25

₹14,000

140

₹100 to ₹106

NSE, BSE

₹2,517.50 Cr

17 Oct 25

Canara HSBC Life Insurance Company IPO Timeline

Bidding Start

10 Oct 25

Bidding Ends

14 Oct 25

Allotment Finalisation

15 Oct 25

Refund Initiation

16 Oct 25

Demat Transfer

16 Oct 25

Listing

17 Oct 25

Canara HSBC Life Insurance Company Limited

Incorporated in 2007, Canara HSBC Life Insurance Company Limited is a joint venture backed by Canara Bank (51%), HSBC Insurance (Asia Pacific) Holdings Limited (26%), and Punjab National Bank (23%). Headquartered in Gurugram with over 100 branches nationwide, the company operates as a bancassurance-led insurer. Leveraging partnerships with Canara Bank and HSBC, it serves customers across Tier 1, 2, and 3 cities. Offering a wide range of life, health, and retirement products, the company remains committed to its “Promises Ka Partner” philosophy for simplified insurance and efficient claims.

Canara HSBC Life Insurance Company Limited IPO Overview

Canara HSBC Life Insurance is set to launch its Initial Public Offering (IPO) through a book-building process involving 23.75 crore equity shares. The entire issue comprises an offer for sale of these 23.75 crore shares, with no fresh issue component. The IPO dates, price band, and lot size details have not yet been announced. The allotment date is also pending confirmation.

The IPO is being managed by a consortium of book-running lead managers including SBI Capital Markets Limited, BNP Paribas, HSBC Securities & Capital Markets Pvt Ltd, JM Financial Limited, and Motilal Oswal Investment Advisors Limited. KFin Technologies Limited has been appointed as the registrar for the issue. The shares are proposed to be listed on both BSE and NSE.

The face value of each equity share is ₹10. Once the price band is announced, the final issue size in terms of value (₹ crores) will be determined. The IPO will not result in any fresh equity issuance, as the entire offering is being made through an offer for sale by the existing shareholders.

As per the Draft Red Herring Prospectus (DRHP), the IPO filing process began with the Securities and Exchange Board of India (SEBI) and exchanges on April 11, 2025, with subsequent filings on April 28, 2025, and May 2, 2025.

Canara Bank and HSBC Insurance (Asia-Pacific) Holdings Limited are the promoters of the company. The promoter holding before the IPO stands at 77%, while the post-issue holding will be updated once equity dilution is finalised.

Canara HSBC Life Insurance Company Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: NA

Offer for Sale (OFS): 23.75 crore equity shares |

| IPO Dates | October 10, 2025 to October 14, 2025 |

| Price Bands | ₹100 to ₹106 per share |

| Lot Size | 140 Shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 9,07,06,51,260 |

| Shareholding post -issue | 9,07,06,51,260 |

Canara HSBC Life Insurance IPO Important Dates

| IPO Activity | Date |

| IPO Open Date | October 10, 2025 |

| IPO Close Date | October 14, 2025 |

| Basis of Allotment Date | October 15, 2025 |

| Refunds Initiation | October 16, 2025 |

| Credit of Shares to Demat | October 16, 2025 |

| IPO Listing Date | October 17, 2025 |

Canara HSBC Life Insurance Company Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Canara HSBC Life Insurance Company Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 1.19 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 8.18% |

| Net Asset Value (NAV) | 14.94% |

| Return on Equity | – |

| Return on Capital Employed (ROCE) | – |

| EBITDA Margin | – |

| PAT Margin | – |

| Debt to Equity Ratio | – |

Objectives of the IPO Proceeds

- Being entirely an OFS issues, the IPO proceeds will entirely go to the selling shareholders and the company will not use the proceeds for corporate purpose

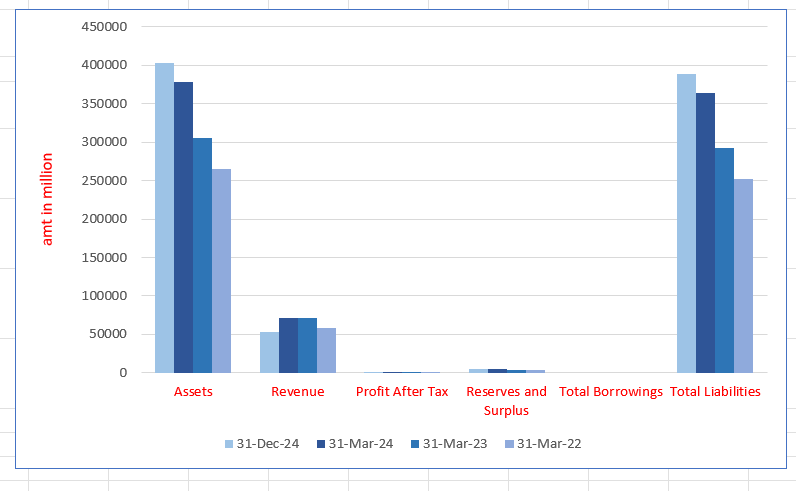

Canara HSBC Life Insurance Company Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 403165 | 378158 | 305489 | 265482 |

| Revenue | 52655 | 71287 | 71974 | 58899 |

| Profit After Tax | 849 | 1133 | 912 | 102 |

| Reserves and Surplus | 5347.5 | 4688.82 | 4030.65 | 3403.71 |

| Total Borrowings | – | – | – | – |

| Total Liabilities | 388317 | 363969 | 291958 | 252582 |

Financial Status of Canara HSBC Life Insurance Company Limited

SWOT Analysis of Canara HSBC Life Insurance Company IPO

Strength and Opportunities

- Strong backing from Canara Bank and HSBC Insurance (Asia Pacific) .

- High claim settlement ratio averaging 98.95% over the past three years .

- Diverse product portfolio including life, health, and retirement plans .

- Extensive distribution network through over 100 branches nationwide .

- Strong solvency margin of 282% as of March 31, 2022 .

- Emphasis on digital initiatives for policy management and customer service .

- Consistent profitability with 11 consecutive years of profits .

- Opportunities to expand in underserved rural and semi-urban markets.

- Potential for growth through strategic partnerships and alliances.

Risks and Threats

- Limited brand visibility compared to larger private insurers.

- Dependence on bancassurance channels may limit diversification.

- Intense competition from established private and public sector insurers.

- Regulatory changes in the insurance sector could impact operations.

- Economic downturns may affect premium collections and policy renewals.

- Technological disruptions and cybersecurity risks.

- High complaint volume compared to industry median, though improving .

- Potential challenges in integrating advanced technologies across operations.

- Dependence on key personnel for strategic initiatives.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Canara HSBC Life Insurance Company Limited

Canara HSBC Life Insurance Company Limited IPO Strengths

Established Parentage and a Trusted Brand Amplifying Customer Attraction

Canara HSBC Life Insurance Company Limited, incorporated in 2007, benefits from strong promoters—Canara Bank (51%) and HSBC Insurance (Asia-Pacific) Holdings (26%). Leveraging its parentage, the Company has built a trusted brand, demonstrated by improving persistency ratios, high claims settlement, growing NPS, and multiple recognitions as a customer-friendly life insurer.

Multi-Channel Distribution Network with Pan-India Presence

Canara HSBC Life Insurance Company Limited operates a wide-reaching, multi-channel distribution network, primarily through bancassurance with Canara Bank, HSBC, and regional rural banks. Complemented by brokers, corporate agents, and digital platforms, this cost-efficient, customer-centric approach enables nationwide accessibility, scalable growth, and consistent profitability across Tier 1 to Tier 3 Indian cities.

Long-Term Value Creation through Consistent and Profitable Performance

Canara HSBC Life Insurance Company Limited has demonstrated strong financial performance with steady growth in premiums, assets under management, and embedded value. Backed by strategic initiatives, cost efficiency, and prudent capital practices, it has consistently delivered profitability, high solvency, and returns, establishing a self-sustaining model for long-term value creation.

Diversified, Customer-Centric Portfolio Powering Sustained Growth

Canara HSBC Life Insurance Company Limited offers a balanced, research-driven product portfolio catering to diverse customer needs across life stages. With strong ULIP and annuity segments, superior claims performance, and customer-focused digital services, the company drives consistent growth across business cycles while earning industry recognition for excellence and customer experience.

Diversified, Customer-Centric Portfolio Powering Sustained Growth

Canara HSBC Life Insurance Company Limited offers a balanced, research-driven product portfolio catering to diverse customer needs across life stages. With strong ULIP and annuity segments, superior claims performance, and customer-focused digital services, the company drives consistent growth across business cycles while earning industry recognition for excellence and customer experience.

Technology-Integrated Business Platform with Focus on Automation and Analytics

Canara HSBC Life Insurance leverages advanced AI, data analytics, and automation to enhance revenue, service, and risk management. With the highest IT expenditure among peers in Fiscal 2024, it digitised onboarding, integrated distribution partners, and deployed predictive models—boosting digital services and operational efficiency while reducing turnaround times and costs.

Experienced Management Team Backed by Dedicated Professionals

Canara HSBC Life Insurance is led by Managing Director and CEO Anuj Dayal Mathur, whose 17-year tenure and industry accolades reflect strong leadership. Supported by a seasoned Board and senior management with deep expertise and long tenures, the company fosters a collaborative culture, earning a ‘Great Place to Work’ certification for three consecutive years.

More About Canara HSBC Life Insurance Company Limited

Canara HSBC Life Insurance Company Limited is a prominent private life insurer in India. Incorporated in 2007, the Company is jointly promoted by Canara Bank, India’s fourth-largest public sector bank by total assets (as of December 31, 2024), and HSBC Insurance (Asia-Pacific) Holdings Limited, a member of the globally recognised HSBC Group.

Strong Market Position

- Ranked third highest in individual Weighted Premium Income (WPI) among bank-led insurers from Fiscal 2021 to 2024.

- Recorded the highest year-on-year growth in WPI among its peer set during the nine months ending December 31, 2024.

- Held the third-highest Assets Under Management (AUM) among public sector-promoted life insurers as of March 31, 2024.

- Ranked among the top five bank-led life insurers based on the number of lives covered in Fiscal 2024.

Financial Growth and Stability

- Profit After Tax (PAT) increased at a CAGR of 232.61%, from ₹102.43 million in Fiscal 2022 to ₹1,133.17 million in Fiscal 2024.

- Embedded Value rose from ₹42,719.35 million (March 2023) to ₹59,295.24 million (December 2024).

- Maintained a robust solvency ratio of 215.00%, surpassing the regulatory minimum of 150.00%.

Extensive Distribution Network

- Leverages bancassurance partnerships with Canara Bank and HSBC India.

- Bancassurance accounted for 88.56% of new business premium (nine months ended December 2024).

- Access to over 15,700 branches via Canara Bank and regional rural bank agreements.

Customer-Centric Offerings

- Offers a diverse product portfolio: 17 individual, 7 group products, and 2 rider benefits.

- Focused on digital innovation: 72% of policies processed through straight-through processing; over 99% processed digitally.

- Persistency ratios have shown consistent improvement, reflecting growing customer satisfaction.

Recognition and Performance

- Achieved an NPS of 69 by December 2024, up from 41 in March 2022.

- Honoured with awards for technological innovation and analytics.

- Delivered consistent profitability, with Operating RoEV at 20.42% (nine months ended December 2024).

Canara HSBC Life continues to evolve as a resilient and customer-focused insurer, backed by strong promoter partnerships and robust digital infrastructure.

Industry Outlook

India’s life insurance industry is poised for substantial growth, driven by increasing financial awareness, digital adoption, and supportive regulatory frameworks. The market is projected to expand from approximately USD 110.60 billion in 2024 to USD 248.37 billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 8.70% during 2025–2033.

Growth Drivers

- Digital Transformation: Enhanced digital infrastructure and the proliferation of online platforms have streamlined policy issuance and customer engagement, contributing to sector growth.

- Regulatory Support: Initiatives by the Insurance Regulatory and Development Authority of India (IRDAI) have fostered innovation and increased market penetration.

- Product Innovation: Insurers are diversifying offerings with products like Unit-Linked Insurance Plans (ULIPs) and tailored retirement solutions to meet evolving consumer needs.

- Economic Growth: India’s robust economic trajectory enhances disposable incomes, enabling higher investment in life insurance products.

Segment Insights

- Traditional Life Insurance: Continues to dominate the market, with a significant share attributed to endowment and term plans.

- ULIPs: Gaining traction due to their dual benefit of investment and insurance, appealing to a younger demographic seeking wealth creation.

- Retirement and Pension Plans: Experiencing increased demand as awareness about retirement planning grows among the working population.

Future Outlook

The Indian life insurance sector is expected to maintain its growth momentum, supported by technological advancements, innovative product offerings, and a favorable regulatory environment. Insurers focusing on customer-centric approaches and digital integration are likely to gain a competitive edge in the evolving market landscape.

How Will Canara HSBC Life Insurance Company Limited Benefit

- Positioned to capitalise on India’s expanding life insurance market, forecast to reach USD 248.37 billion by 2033.

- Benefits from growing financial awareness and demand for digital-first insurance solutions.

- Strong bancassurance partnerships offer wide access to customers amid increasing policy uptake.

- Rising interest in ULIPs and retirement plans aligns with its diverse product suite.

- Technological infrastructure enables efficient policy processing, appealing to digitally savvy consumers.

- High persistency ratios reflect customer satisfaction in a competitive market.

- Favourable regulatory reforms and IRDAI initiatives support innovation and market expansion.

- Economic growth and rising disposable income create opportunity for premium growth.

- Strength in Weighted Premium Income and AUM positions it for larger market share.

- Sustained profitability and high solvency ratios support long-term stability and investor confidence.

- Enhanced customer engagement and Net Promoter Score support brand loyalty and retention.

Peer Group Comparison

| Name of Company | Revenue (₹ million) | Face Value (₹) | EPS (₹) | NAV (₹) | P/E Ratio | RoNW (%) |

| Canara HSBC Life Insurance Company (1) | 71,287.01 | 10 | 1.19 | 14.94 | [●]* | 8.18 |

| Peer Groups | ||||||

| SBI Life Insurance Company Limited | 814,306.39 | 10 | 18.92 | 145.70 | 82.68 | 13.76 |

| HDFC Life Insurance Company Limited | 630,815.58 | 10 | 7.32 | 66.09 | 96.40 | 11.58 |

| ICICI Prudential Life Insurance Company Limited | 432,356.44 | 10 | 5.91 | 73.99 | 96.29 | 8.31 |

Key Strategies for Canara HSBC Life Insurance Company Limited

Deepening Bancassurance Penetration

Canara HSBC Life Insurance leverages its bancassurance partners, especially Canara Bank’s extensive network, to expand reach. Through customer segmentation and analytics, it offers tailored insurance products. Ongoing training and digital onboarding streamline sales and improve customer experience across diverse life insurance needs.

Strengthening Multi-Channel Distribution

The company diversifies its revenue by expanding distribution beyond bancassurance to include rural banks, digital platforms, fintech, and InsurTech partnerships. Establishing an agency channel targets underpenetrated markets, helping increase market share and enhance profitability through a broad, resilient distribution network.

Enhancing Customer Centricity

Focusing on sustainable profitability, Canara HSBC Life Insurance prioritizes need-based sales and strong customer engagement through CRM, fintech solutions, and integrated payment systems. Initiatives include loyalty programmes and reducing acquisition costs to boost retention and deliver a seamless, customer-friendly experience.

Leveraging Technology and Analytics

The company uses AI, data analytics, and digital self-service channels to improve operational efficiency, risk management, and customer experience. Collaborations with fintechs enhance health services, while automation and AI-driven tools streamline communications, fostering innovation and growth in a competitive market.

Ensuring Profitable Growth Through Product Balance

Canara HSBC Life Insurance sustains growth with a diversified product portfolio including term plans, riders, and group insurance. Regular pricing reviews and a focus on non-participating policies ensure profitability while addressing market demand, maintaining an optimal mix across product categories.

Amplifying Brand Awareness via Digital Channels

The company boosts its digital presence by expanding social media engagement and multilingual content, leveraging analytics for targeted marketing. Strategic campaigns, brand ambassador Jasprit Bumrah, and innovative content foster trust and recognition, strengthening its market position and customer relationships.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Canara HSBC Life Insurance Company IPO

How can I apply for Canara HSBC Life Insurance Company Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Canara HSBC Life Insurance IPO?

The IPO consists of 23.75 crore equity shares, entirely offered for sale by existing shareholders. There is no fresh issue component, and the final value will be determined once the price band is announced.

When will the Canara HSBC Life Insurance IPO open for subscription?

The IPO opening and closing dates are yet to be announced. Investors are advised to monitor official updates from the company or stock exchanges for the confirmed bidding timeline and related milestones.

Who are the promoters of Canara HSBC Life Insurance Company?

The company is promoted by Canara Bank (51%) and HSBC Insurance (Asia-Pacific) Holdings Limited (26%). Punjab National Bank holds the remaining 23% as an investor, making it a strong joint venture in bancassurance.

On which stock exchanges will the IPO be listed?

The equity shares of Canara HSBC Life Insurance Company Limited are proposed to be listed on both BSE and NSE after the completion of the IPO and allotment formalities, as stated in the DRHP.

Who are the lead managers for the Canara HSBC Life Insurance IPO?

The IPO is being managed by SBI Capital Markets, BNP Paribas, HSBC Securities, JM Financial, and Motilal Oswal Investment Advisors, with KFin Technologies Limited appointed as the registrar for the issue.