- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Canara Robeco Asset Management Company IPO

₹14,168/56 shares

Minimum Investment

IPO Details

09 Oct 25

13 Oct 25

₹14,168

56

₹253 to ₹266

NSE, BSE

₹1,326.13 Cr

16 Oct 25

Canara Robeco Asset Management Company IPO Timeline

Bidding Start

09 Oct 25

Bidding Ends

13 Oct 25

Allotment Finalisation

14 Oct 25

Refund Initiation

15 Oct 25

Demat Transfer

15 Oct 25

Listing

16 Oct 25

Canara Robeco Asset Management Company Limited

Canara Bank, a government-owned bank with over 118 years of experience and a AAA CRISIL rating, serves more than 89 million customers through 9,816 branches across India, making it one of the country’s oldest and largest banks. OCE, a wholly owned subsidiary of Japan’s ORIX Corporation a diversified conglomerate listed on Tokyo and New York stock exchanges—brings global expertise in finance and investment. Together, Canara Bank and Robeco combine deep experience and international knowledge to deliver strong, sustained financial performance for your future.

Canara Robeco Asset Management Company Limited IPO Overview

The Canara HSBC Life Insurance IPO is a bookbuilding issue of 23.75 crore shares, offered entirely through an offer for sale. The IPO dates and price bands are yet to be announced, with the allotment expected to be finalized shortly. The face value of each share is ₹10. The IPO will be listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

The total issue size comprises 23.75 crore shares aggregating to an amount yet to be disclosed. SBI Capital Markets Limited, BNP Paribas, HSBC Securities & Capital Markets Pvt Ltd, JM Financial Limited, and Motilal Oswal Investment Advisors Limited are appointed as the book running lead managers for the IPO, while Kfin Technologies Limited acts as the registrar for the issue.

Canara Bank and HSBC Insurance (Asia-Pacific) Holdings Limited are the company’s promoters, holding 77% of shares pre-issue. Post-issue promoter shareholding will be calculated based on equity dilution, which equals the difference between pre-issue and post-issue shareholding.

Canara Robeco Asset Management Company Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: NA

Offer for Sale (OFS): 4.99 crore shares |

| IPO Dates | October 9, 2025 to October 13, 2025 |

| Price Bands | ₹253 to ₹266 per share |

| Lot Size | 56 Shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 19,94,17,428 Shares |

| Shareholding post -issue | 19,94,17,428 Shares |

Important Dates

| IPO Activity | Date |

| IPO Open Date | Oct 09, 2025 |

| IPO Close Date | Oct 13, 2025 |

| Basis of Allotment Date | Oct 14, 2025 |

| Refunds Initiation | Oct 15, 2025 |

| Credit of Shares to Demat | Oct 15, 2025 |

| IPO Listing Date | Oct 16, 2025 |

Canara Robeco Asset Management Company Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Canara Robeco Asset Management Company Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 7.57 |

| Return on Net Worth (RoNW) | 33.22% |

| Net Asset Value (NAV) | 91.16 |

| Return on Equity | – |

| Return on Capital Employed (ROCE) | – |

| EBITDA Margin | – |

| PAT Margin | – |

| Debt to Equity Ratio | – |

Objectives of the IPO Proceeds

- Being entirely an OFS issues, the IPO proceeds will entirely go to the selling shareholders and the company will not use the proceeds for corporate purpose

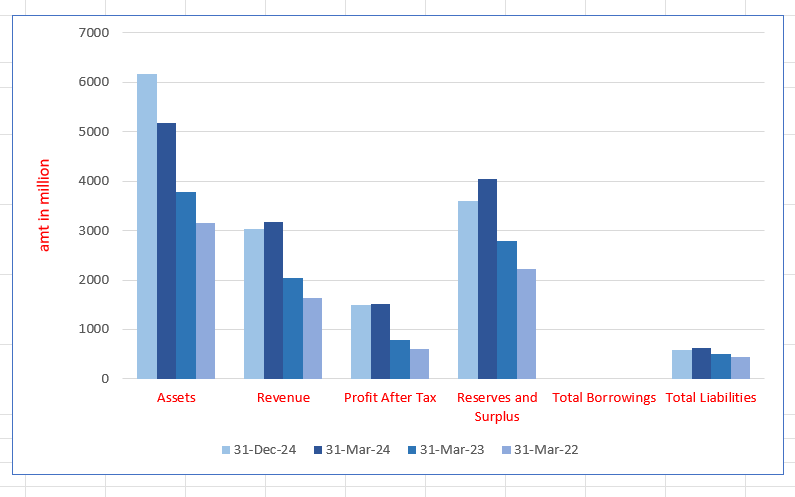

Canara Robeco Asset Management Company Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 6169 | 5168.14 | 3779.65 | 3156.76 |

| Revenue | 3028.92 | 3180.90 | 2045.95 | 1642.17 |

| Profit After Tax | 1489.76 | 1509.95 | 790.01 | 601.61 |

| Reserves and Surplus | 3589.32 | 4046.35 | 2786.95 | 2223.36 |

| Total Borrowings | – | – | – | |

| Total Liabilities | 585.51 | 623.25 | 494.16 | 434.86 |

Financial Status of Canara Robeco Asset Management Company Limited

SWOT Analysis of Canara Robeco Asset Management Company IPO

Strength and Opportunities

- Long-standing presence in the Indian asset management industry since 1987.

- Strong joint venture between Canara Bank and Robeco, combining local and global expertise.

- Diverse range of mutual fund offerings catering to various investor profiles.

- Robust risk management framework ensuring portfolio stability.

- Experienced management team with a track record of performance.

- Access to Canara Bank’s extensive distribution network for wider reach.

- Emphasis on sustainable and quantitative investing strategies.

- Focus on investor education and awareness initiatives.

- Potential for growth through digital transformation and online platforms.

Risks and Threats

- Dependence on market cycles affecting AUM and revenue.

- Intense competition from established and emerging AMCs.

- Regulatory changes impacting fund operations and compliance.

- Vulnerability to market volatility affecting investor sentiment.

- Limited international presence compared to global peers.

- Potential conflicts of interest due to dual sponsorship structure.

- Operational challenges in adapting to rapidly changing market dynamics.

- Exposure to credit and liquidity risks in debt fund portfolios.

- Limited product differentiation in a saturated market.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Canara Robeco Asset Management Company Limited

Canara Robeco Asset Management Company Limited IPO Strengths

Recognized Brand with Legacy of Operations and Established Parentage

Canara Robeco Asset Management Company Limited, a joint venture between Canara Bank (51%) and OCE (49%), was founded in 1993 as India’s second-oldest AMC. Leveraging Canara Bank’s vast network and OCE’s global expertise, it benefits from strong governance, risk management, and diverse product offerings, managing ₹87.74 billion AUM via Canara Bank branches.

Operations Led by Professional Management Team and Established Corporate Governance Standards

Canara Robeco Asset Management is guided by an experienced management team with long tenures and diverse expertise. Supported by robust corporate governance, it ensures transparency, accountability, and risk management. This leadership drives strategic growth, earning multiple industry awards and enabling sustainable value creation for investors through informed, ethical decision-making.

Well-Diversified Equity Products Mix Backed by Research-Driven Investment Process

Canara Robeco manages 14 equity schemes, with seven over 10 years old, demonstrating consistent outperformance versus benchmarks. Equity QAAUM grew at a 38.98% CAGR (2022–2024), holding India’s highest equity-oriented AUM share. Its research-led approach integrates macro, sector, and fundamental analysis, driving strong, risk-adjusted returns and robust long-term performance.

Pan-India Multi-Channel Sales and Distribution Network

Canara Robeco operates a pan-India multi-channel network with 49,412 distribution partners, including banks, national distributors, and mutual fund distributors. Serving 23+ cities via 23 branches, digital platforms, and a dedicated sales team, it has steadily grown direct and third-party channel AUM, capitalising on rising financial awareness and strong growth in B-30 cities.

Expanding Proportion of AUM from Individual Investors and SIP Contributions

Canara Robeco’s focus on acquiring individual investors grew MAAUM from ₹419 billion in 2022 to ₹975 billion by December 2024, contributing nearly 89% of total AUM. With 4.92 million individual folios and rising SIP counts, the company holds a leading retail AUM share among India’s top asset managers.

Integrated Technology-Led Operations with a Well-Established Digital Ecosystem

Canara Robeco Asset Management Company Limited operates a comprehensive digital ecosystem enhancing customer convenience and engagement. Its mobile app, direct investment platform, and eKYC simplify access, while multi-channel digital marketing and paperless distributor onboarding improve service. Advanced tools like social listening and brand monitoring strengthen customer insights and brand reputation management.

More About Canara Robeco Asset Management Company Limited

Canara Robeco Asset Management Company Limited stands as India’s second oldest asset management company (AMC), according to the CRISIL Report. Established in 1993 as Canbank Investment Management Services Limited, the company initially managed the assets of Canbank Mutual Fund with full ownership by Canara Bank. In 2007, it became a joint venture named Canara Robeco Asset Management Company Limited after Canara Bank partnered with ORIX Corporation Europe N.V. (formerly Robeco), which acquired a 49% stake while Canara Bank retained 51%.

Business Activities and Portfolio

- The company manages 25 schemes as of December 31, 2024, including:

- 12 equity schemes

- 10 debt schemes

- 3 hybrid schemes

- It provides investment advice on Indian equities to Robeco Hong Kong Limited, part of its Promoter Group.

Assets Under Management (AUM) and Growth

- Quarterly Average Assets Under Management (QAAUM) reached ₹1,083.66 billion as of December 31, 2024.

- From March 31, 2022, to March 31, 2024, QAAUM grew at a CAGR of 34.75%, surpassing the industry growth rate of 18.8% (CRISIL Report).

- The equity-oriented schemes showed a strong CAGR of 38.98%, with QAAUM rising from ₹413.19 billion to ₹798.11 billion in the same period.

Market Position and Customer Base

- Canara Robeco increased its market share from 1.2% in March 2022 to 1.6% by December 2024.

- It holds the third highest share of retail AUM among the top 20 AMCs in India and leads among the top 10 AMCs.

- Retail investors constitute 88.84% of the Monthly Average AUM (MAAUM), with over 4.92 million individual customer folios representing nearly 99% of total folios.

Investment Approach and Recognition

- The company employs a disciplined investment process focused on:

- Competent management and robust fundamentals for equity schemes

- Safety, liquidity, and risk-adjusted returns for debt schemes

- Its performance has been recognised with industry awards, including the Best Fund House (Equity) at the Morningstar Fund Awards 2021.

Distribution and Digital Initiatives

- Canara Robeco operates through 23 branches across 14 states and 2 union territories, supported by 49,412 empanelled distributors.

- The company has expanded presence in B-30 cities (beyond top 30 cities), holding the second highest B-30 AUM share among the top 20 AMCs.

- Digital platforms facilitate customer onboarding, online payments, and fund tracking, enhancing customer convenience and expanding reach.

Parentage and Strategic Support

- Canara Bank, founded in 1906 and nationalised in 1969, supports brand strength with its extensive branch network.

- ORIX Corporation Europe N.V., a subsidiary of Japanese conglomerate ORIX Corporation, provides strategic guidance on capital stewardship.

Industry Outlook

The Indian Asset Management Industry has witnessed robust growth over the past decade, driven by rising financial literacy, growing disposable incomes, and increased participation from retail investors. As of 2024, the industry’s Assets Under Management (AUM) crossed ₹40 lakh crore, reflecting a strong CAGR of around 18-20% over the last few years.

Key Growth Drivers:

- Rising Retail Participation: Increasing preference for mutual funds among individual investors has accelerated growth in equity and hybrid schemes.

- Regulatory Support: SEBI’s initiatives to promote transparency, investor protection, and digital onboarding have boosted market confidence.

- Economic Expansion: India’s sustained GDP growth and expanding middle class create a favorable environment for financial product adoption.

- Digital Transformation: Technology adoption has made investment easier, broadening reach into Tier-2 and Tier-3 cities.

Future Prospects:

- The industry is expected to maintain a CAGR of approximately 15-18% over the next 5 years.

- Equity-oriented schemes, including large-cap, mid-cap, and sectoral funds, will drive AUM growth, propelled by favorable market conditions and increasing risk appetite.

- Debt and hybrid schemes will continue to attract conservative investors seeking stable, risk-adjusted returns.

Industry Figures & Trends:

- Retail investors now constitute over 70% of total AUM.

- B-30 cities and rural markets represent emerging opportunities for asset managers expanding beyond metropolitan areas.

- The mutual fund penetration rate in India remains below global averages, indicating substantial growth potential.

Overall, the Indian asset management industry offers promising growth prospects, with increasing investor awareness and innovative product offerings shaping the future landscape

How Will Canara Robeco Asset Management Company Limited Benefit

- Growing retail participation aligns well with Canara Robeco’s strong retail investor base, boosting inflows into its equity and hybrid schemes.

- Industry growth and rising AUM potential will accelerate Canara Robeco’s QAAUM expansion, continuing its above-industry CAGR performance.

- Increasing investor awareness and SEBI’s regulatory support enhance trust in Canara Robeco’s disciplined investment approach and product transparency.

- Economic growth and expanding middle class will widen Canara Robeco’s market opportunity, especially in B-30 cities where it holds a top share.

- Digital transformation in the industry complements Canara Robeco’s digital onboarding and transaction platforms, improving customer experience and acquisition.

- Rising preference for equity and hybrid funds benefits Canara Robeco’s diverse product portfolio, supporting sustained AUM growth.

- The company’s partnership with Canara Bank and ORIX provides strategic strength and brand credibility, aiding competitive positioning.

Peer Group Comparison

| Name of the Company | Revenue (₹ million) | Face Value (₹) | EPS (₹) | P/E | RoNW (%) | NAV (₹) |

| Canara Robeco Asset Management Company Limited | 3,180.90 | 10 | 7.57* | [●] | 33.22% | 91.16 |

| Peer Groups | ||||||

| HDFC Asset Management Company Limited | 25,843.70 | 54 | 91.00 | 50.17 | 29.47% | 331.41 |

| Nippon Life India Asset Management Limited | 16,432.20 | 10 | 17.71 | 38.25 | 29.54% | 63.21 |

| Aditya Birla Sun Life AMC Limited | 13,531.90 | 5 | 27.09 | 24.69 | 27.45% | 110.00 |

| UTI Asset Management Company Limited | 17,369.60 | 10 | 60.26 | 18.85 | 18.14% | 390.80 |

Key Strategies for Canara Robeco Asset Management Company Limited

Sustained Investment Performance through Research-Driven Approach

Canara Robeco focuses on delivering sustained investment returns via a robust research-driven process. Their approach combines top-down and bottom-up fundamental analysis, evaluating business, management, and balance sheet quality. A collaborative team with operating freedom supports portfolio construction, targeting long-term, risk-adjusted returns for investors.

Expanding Distribution and Geographic Presence

The company aims to grow by enhancing its distribution network and geographic reach, especially in B-30 cities. Leveraging Canara Bank’s branch network and brand, it attracts new distributors with tailored incentives, while improving digital platforms to boost customer experience and broaden market penetration.

Diversifying AUM Across Asset Classes and Products

Canara Robeco plans to diversify assets under management by increasing focus on debt-oriented schemes alongside equity products. Marketing initiatives and new scheme launches respond to market conditions, addressing evolving investor needs and capturing broader growth opportunities across multiple asset categories.

Leveraging Technology to Enhance Operational Efficiency

The company invests in technology to optimize operations and user experience. A seamless digital ecosystem supports customers and distributors with paperless onboarding, transaction management, and real-time data access. Upcoming digital upgrades aim to streamline processes and enhance service quality across platforms.

Enhancing Employee Value Proposition to Retain Talent

Canara Robeco fosters a supportive, transparent, and collaborative work culture, reflected in long employee tenures. It offers career growth, work-life balance, education support, and recognition programs, attracting and retaining high-quality talent essential for business success and competitive differentiation.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Canara Robeco Asset Management Company IPO

How can I apply for Canara Robeco Asset Management Company Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When will the Canara Robeco Asset Management Company Limited IPO open and close?

The IPO opening and closing dates are currently To Be Announced (TBA). Investors should keep an eye on official announcements for the exact bidding period.

What is the size and nature of the Canara Robeco IPO?

The IPO comprises an Offer for Sale (OFS) of 4.99 crore shares. There is no fresh issue; existing shareholders are selling their stakes through this IPO.

On which stock exchanges will the Canara Robeco IPO be listed?

The shares of Canara Robeco Asset Management Company Limited will be listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) post-IPO.

Who are the promoters of Canara Robeco Asset Management Company Limited?

Canara Bank and HSBC Insurance (Asia-Pacific) Holdings Limited are the promoters, holding 77% equity pre-IPO. Post-IPO shareholding will depend on the extent of equity dilution.

Who are the lead managers and registrar for the Canara Robeco IPO?

The lead managers appointed are SBI Capital Markets, BNP Paribas, HSBC Securities, JM Financial, and Motilal Oswal Investment Advisors. Kfin Technologies Limited is the registrar for the IPO.