- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Capillary Technologies India IPO

₹13,725/25 shares

Minimum Investment

IPO Details

14 Nov 25

18 Nov 25

₹13,725

25

₹549 to ₹577

NSE, BSE

₹877.50 Cr

21 Nov 25

Capillary Technologies India IPO Timeline

Bidding Start

14 Nov 25

Bidding Ends

18 Nov 25

Allotment Finalisation

19 Nov 25

Refund Initiation

20 Nov 25

Demat Transfer

20 Nov 25

Listing

21 Nov 25

Capillary Technologies India Limited

Capillary Technologies India Ltd, founded in 2008 and based in Bengaluru, is a prominent SaaS company offering customer loyalty and engagement solutions. It provides scalable loyalty programs, personalised marketing automation via SMS, email, and push notifications, and AI-driven insights through advanced analytics. The platform supports omnichannel CRM, enabling consistent customer interaction across digital and physical channels. Capillary serves over 250 brands across 30+ countries, including Tata, Domino’s, and Shell. Operating on a subscription-based model, it earns revenue from software licenses, support services, and professional offerings.

Capillary Technologies India Limited IPO Overview

Capillary Technologies is set to launch a book-built IPO of ₹877.50 crore, comprising a fresh issue of 0.60 crore shares worth ₹345 crore and an offer for sale of 0.92 crore shares aggregating to ₹532.50 crore. The IPO will open for subscription on November 14, 2025, and close on November 18, 2025, with allotment expected to be finalised on November 19, 2025. The shares are scheduled to list on BSE and NSE, with a tentative listing date of November 21, 2025. The price band for the IPO has been fixed between ₹549 and ₹577 per share, with a lot size of 25 shares. For retail investors, the minimum investment required is ₹14,425 based on the upper price, while the lot size for small non-institutional investors (sNII) is 14 lots (350 shares) amounting to ₹2,01,950, and for big non-institutional investors (bNII) it is 70 lots (1,750 shares), amounting to ₹10,09,750. JM Financial Ltd. is acting as the book running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar of the issue.

Capillary Technologies India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹877.50 crores (Fresh Issue: ₹345.00 crores, OFS: ₹532.50 crores) |

| IPO Dates | November 14, 2025 to November 18, 2025 |

| Price Bands | ₹549 to ₹577 per share |

| Lot Size | 25 shares |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding Pre-Issue | 7,33,29,138 shares |

| Shareholding Post-Issue | 7,93,08,340 shares |

| Employee Discount | ₹52 per share |

Capillary Technologies India Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Capillary Technologies India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 1.93 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 2.85% |

| Net Asset Value (NAV) | 65.03 |

| Return on Equity | 3.54% |

| Return on Capital Employed (ROCE) | 2.76% |

| EBITDA Margin | 13.13% |

| PAT Margin | 2.37% |

| Debt to Equity Ratio | 0.18 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding our cloud infrastructure cost | 1200 |

| Investment in research, designing and development of our products and platform | 1515.44 |

| Investment in purchase of computer systems for our business | 103.16 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

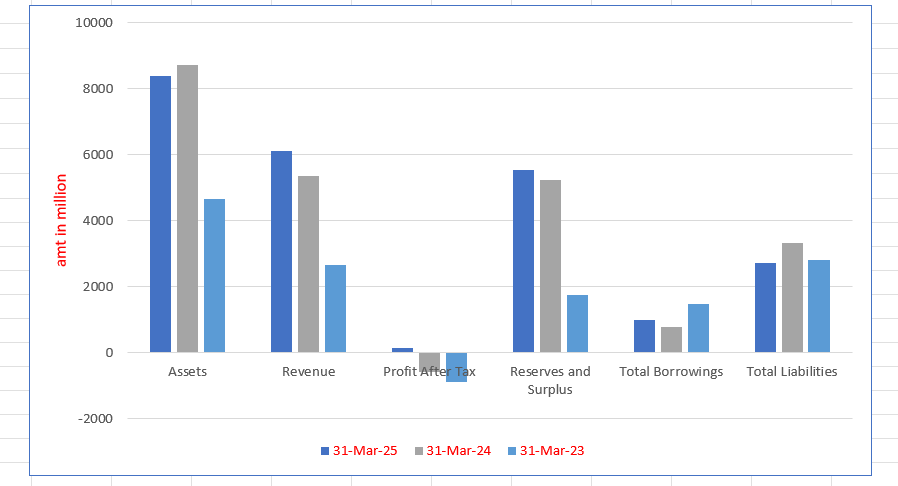

Capillary Technologies India Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 8386.54 | 8710.68 | 4664.13 |

| Revenue | 6118.69 | 5354.40 | 2662.53 |

| Profit After Tax | 132.80 | (593.78) | (877.19) |

| Reserves and Surplus | 5535.82 | 5243.06 | 1759.90 |

| Total Borrowings | 1000.94 | 771.66 | 1474.71 |

| Total Liabilities | 2704.07 | 3321.16 | 2798.44 |

Financial Status of Capillary Technologies India Limited

SWOT Analysis of Capillary Technologies India IPO

Strength and Opportunities

- Leading loyalty and engagement SaaS platform with AI-powered personalization.

- Market leader in loyalty management across Asia with significant market share.

- Broad global presence serving hundreds of brands in over 30 countries.

- Strong IP portfolio with multiple patents and trademarks.

- Strategic acquisitions enhancing global footprint and service capabilities.

- Industry recognition from top global analyst firms validating platform strength.

- Growing demand for personalised, omnichannel loyalty in retail and hospitality.

- Upselling via modular CDP, commerce, and analytics suites increasing client value.

- Expanding global budgets for e-commerce analytics and personalization.

- Opportunity to differentiate through new AI features like AskAira.

Risks and Threats

- Intense competition from global loyalty and CRM players affecting pricing and differentiation.

- Heavy reliance on a concentrated enterprise customer base, posing revenue risk.

- Lower market visibility compared to legacy CRM and loyalty software giants.

- Cost structure challenges in scaling client acquisition may reduce profitability.

- Macroeconomic uncertainties and AI disruptions may increase churn and reduce sales.

- Platform adoption may be slower in regions less inclined to adopt digital loyalty solutions.

- Rapid AI advancements require constant R&D and innovation investments.

- Revenue dependence on specific verticals like retail and hospitality creates vulnerability.

- Data security and compliance risks linked to managing large-scale customer data.

- Increasing regulatory demands may complicate cross-border compliance and operations.

Live Capillary Technologies India IPO

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Capillary Technologies India Limited

Capillary Technologies India Limited IPO Strengths

Market Leader in Loyalty Solutions

Capillary Technologies India Limited delivers AI-led SaaS solutions across loyalty, CRM, CDP, analytics, and engagement. With over 1.26 billion consumers hosted, a robust product suite, Fortune 500 clients, and recognition by Forrester, Gartner, and Everest, Capillary leads globally in loyalty innovation, customer retention, and measurable business impact with a 121.25% NRR in Fiscal 2025.

Comprehensive Solutions for Diverse Segments

Capillary Technologies India Limited offers a full-spectrum, AI-powered loyalty management platform adaptable across industries. With modular solutions like Loyalty+, Engage+, Insights+, Rewards+, and CDP, the company supports multiple use cases in retail, BFSI, energy, healthcare, CPG, and travel. Its scalable, co-innovative approach ensures personalised engagement and real-time, data-driven customer retention strategies

Robust Cloud Infrastructure with Scalable Integration Capabilities

Capillary Technologies India Limited operates on a scalable cloud-based architecture that supports real-time processing of massive data volumes, ensuring high-speed and reliable performance at scale. With seamless API-first integration, enterprise-grade security, and vertical-specific adaptability, the platform efficiently serves 390+ brands and over 1.26 billion consumers globally as of March 2025

Enduring Customer Relationships with Scalable Growth and Retention

Capillary Technologies India Limited serves over 390 brands, including 16 Global Fortune 500 companies, across 25 countries. With scalable cloud infrastructure, seamless integrations, and vertical-specific solutions, it maintains long-term, high-value relationships. Its strong NRR—121.25% in FY25—and negligible churn reflect its deep brand integration, up-selling capabilities, and sustained client engagement across industries.

Strong Sales Engine and Partnership Network Driving Brand Expansion

Capillary Technologies India Limited has built a strong sales engine, powered by a global go-to-market team and a growing partner ecosystem, enabling consistent brand additions across regions and verticals. Strategic acquisitions like Persuade Group and AI-driven innovations such as Creatives and Promotions Co-Pilots further enhance customer engagement, retention, and data-led decision-making for continued growth

Proven Playbook for Seamless Integration and Business Turnaround

Capillary Technologies has developed a structured playbook to integrate and scale acquired businesses efficiently. Leveraging this approach, the company successfully turned around acquisitions like Persuade Group, Brierley & Partners, and Rewards+ by migrating operations to India, driving platform synergies, and automating service delivery. These efforts enhanced profitability—improving contribution margins and EBITDA—while expanding market presence in North America and Europe. Strategic acquisitions have not only added marquee clients but also enabled Capillary to unlock operational efficiencies, elevate customer engagement, and drive sustainable growth across its expanding global footprint.

Strong Financial Performance with Consistent Growth and Operating Leverage

Capillary Technologies India Limited achieved consistent growth with revenue rising from ₹2,553.72 million in FY23 to ₹5,982.59 million in FY25. Improved EBITDA and profit before tax highlight operational efficiency. Multi-year subscriptions, customer expansion, cost optimisation, and platform integration strategies contributed to scalable, predictable revenues and strengthened long-term customer value delivery

Experienced Leadership Team Backed by Marquee Investor Base

Capillary Technologies India Limited is led by an accomplished leadership team with deep domain expertise in loyalty and CRM, backed by marquee investors like Peak XV and AVP Funds. Their strategic guidance, global experience, and successful integration of acquired leadership teams have enabled sustained innovation, operational excellence, and global market expansion

More About Capillary Technologies India Limited

Capillary Technologies India Limited is a leading software product company offering AI-powered, cloud-native Software-as-a-Service (SaaS) solutions. The company focuses on building and managing consumer and channel partner loyalty for enterprise customers worldwide, defined as those contributing over ₹8 million annually.

Recognised as a global market leader in loyalty and engagement management (Zinnov Report, Fiscal 2025), Capillary offers one of the most comprehensive loyalty platforms in the industry.

Comprehensive Product Suite

Capillary’s integrated solutions include:

- Loyalty+ – Advanced loyalty management

- Engage+ – Connected engagement platform

- Insights+ – Predictive analytics

- Rewards+ – Rewards management

- CDP – Customer Data Platform

These platforms allow real-time, omni-channel, and hyper-personalised consumer experiences, boosting engagement, repeat sales, and conversions.

Technology and Innovation

Capillary’s products are powered by modern technology stacks with AI and ML capabilities. Key technological features include:

- Seamless integration via APIs with customer ERPs, POS systems, e-commerce, and analytics tools

- AI-driven personalisation and campaign management

- Co-pilot tools for customised promotions and multilingual messaging

Global Presence and Customer Base

With 13 global offices across India, the US, UK, UAE, and Southeast Asia, Capillary serves over 390 brands in 46 countries. Its enterprise clients include:

- Aditya Birla Fashion and Retail

- Abbott Laboratories

- Tata Digital

- Frontier Communications

- A major European bank

Capillary has achieved substantial industry penetration across verticals like retail, healthcare, CPG, BFSI, and energy.

Market Leadership and Growth

Operating in a growing loyalty management market (USD 17B in 2024, projected USD 27.3B by 2029), Capillary stands out for:

- A high Net Revenue Retention (NRR): 121.25% (Fiscal 2025)

- Proven ‘Land and Expand’ strategy

- Both organic and inorganic growth avenues

Loyalty solutions are no longer transactional but strategic assets, and Capillary Technologies continues to evolve with the changing landscape, delivering real business impact.

Industry Outlook

Market Size & Growth Prospects

- The Indian loyalty programs market reached about USD 4.79 billion in 2023, growing to approximately USD 5.37 billion in 2024, and is projected to reach USD 7.9–8.0 billion by 2028—implying a CAGR of ~10–10.5% through 2028

- More bullish analyses forecast a 15.7% CAGR from 2023 to 2033, with the market expanding to USD 14.5 billion by 2033.

- Separately, the loyalty-management software platform segment (cloud/SaaS) generated roughly USD 670.6 million in 2024, expected to rise to USD 1.3 billion by 2030 (CAGR ~11.7%).

Key Growth Drivers

- AI & Personalization: Integration of AI/ML enables real-time predictive offers, hyperpersonalized rewards, and dynamic engagement—projected to enhance customer retention by 15–20%.

- Mobile & Digital Integration: With nearly 900 million smartphone users by 2025, app-based loyalty and digitalwalletlinked programs are becoming dominant.

- Omnichannel & Crossindustry Partnerships: Brands increasingly offer crossbrand redemption, cobranding between retail, fintech, travel, and entertainment for broader reach.

- Gamification & Subscription Models: Gamified challenges and paidtier loyalty (e.g. subscriptions with premium perks) are delivering higher engagement and revenue).

Segment Outlook: SaaS Loyalty Platforms & Analytics (e.g. Capillary’s Products)

- Solution vs. Service: Platforms (solutions such as Loyalty+, Engage+, Insights+, Rewards+, CDP) dominate revenue share, while services (implementation, consulting) are growing fastest.

- AIdriven Capabilities: Predictive analytics, dynamic campaign tools and copilotstyle generative interfaces align with market demand for realtime personalization.

- Integration & Scalability: High demand for seamless ERP/POS/ecommerce integration and cloud scalability supports product adoption across large enterprises.

How Will Capillary Technologies India Limited Benefit

- Capillary Technologies is well-positioned to capitalise on India’s rapidly growing loyalty market, projected to reach USD 8 billion by 2028, supported by rising digital adoption.

- Its AI-powered SaaS platforms directly align with the industry shift towards real-time personalisation and predictive analytics.

- With products like Loyalty+, Engage+, and Insights+, Capillary meets the demand for integrated, omni-channel loyalty solutions.

- The increasing preference for gamified and subscription-based loyalty models supports Capillary’s personalised engagement tools and co-pilot AI capabilities.

- As businesses seek seamless ERP/POS/e-commerce integration, Capillary’s scalable platforms with extensive API compatibility provide a strong competitive advantage.

- Growing smartphone penetration and digital-wallet-linked loyalty usage strengthen Capillary’s mobile-first approach.

- The platform’s modularity and ability to support third-party tools appeal to enterprises aiming to modernise loyalty programs without overhauling their tech stack.

- With enterprises shifting focus from acquisition to retention, Capillary’s data-driven customer insights and CLTV optimisation tools become increasingly vital.

- The company’s early global presence gives it a head start in meeting cross-regional loyalty needs as the market becomes more borderless.

Peer Group Comparison

| Name of the Company | Face value (₹) | Revenue (₹) | EPS (₹) | P/E | RoNW (%) | NAV (₹) |

| Capillary Technologies | 2.00 | 5,982.59 | 1.93 | * | 2.85% | 65.03 |

| Peer Groups | ||||||

| Salesforce, Inc. | 0.08 | 3,182,153.41 | 540.79 | 42.94 | 10.26% | 5,441.60 |

| Adobe Inc. | 0.01 | 1,796,333.97 | 1,038.29 | 32.98 | 36.74% | 2,650.28 |

| HubSpot, Inc. | 0.09 | 219,869.21 | 7.53 | Not Avail | -0.29% | 3,153.16 |

| Braze, Inc. | 0.01 | 49,830.36 | (85.65) | NA | (22.58%) | 402.61 |

Key Strategies for Capillary Technologies India Limited

Targeting Enterprise Customers for Scalable Growth

Capillary Technologies focuses its go-to-market strategy on large enterprises across verticals such as retail, travel, and CPG. By leveraging customer advisory boards, strategic partnerships, and analyst engagement, it aims to expand market share, improve financial metrics, and deliver customized solutions aligned with enterprise needs.

Maximizing Revenue from Existing Customers

Capillary Technologies seeks to improve Net Revenue Retention through pricing model shifts, cross-selling, and product innovations. With transaction-based pricing and usage-based revenue strategies, the company drives deeper engagement and revenue growth, supported by strong farming metrics and customer expansion into new geographies and business lines.

Expanding in North America with Strategic Acquisitions

Capillary Technologies aims to grow in the U.S. and Europe by acquiring firms with strong enterprise presence and modernizing legacy platforms. It leverages post-acquisition synergies, CAC substitution, and balanced capital allocation to drive operational efficiency, margin improvement, and deeper market penetration across evolved loyalty ecosystems.

Scaling Industry-Specific Loyalty Solutions

Capillary Technologies is expanding into sectors like healthcare, BFSI, telecom, energy retail, and travel. It combines organic growth with acquisitions to build customized loyalty solutions. This diversification strengthens its value proposition, expands its addressable market, and reduces dependency on traditional retail verticals.

Investing in AI and Advanced Engagement Platforms

Capillary Technologies prioritizes AI-driven R&D to build proprietary tools like CDPs, personalization engines, and predictive analytics. By integrating ML and automation into its platforms, the company enhances targeting, segmentation, and engagement—driving superior marketing outcomes and reinforcing its leadership in loyalty technology innovation.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Capillary Technologies India Limited IPO

How can I apply for Capillary Technologies India Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Capillary Technologies IPO?

Capillary Technologies IPO is a book build issue of ₹877.50 crores. The issue is a combination of fresh issue of 0.60 crore shares aggregating to ₹345.00 crores and offer for sale of 0.92 crore shares aggregating to ₹532.50 crores.

What will Capillary use the IPO proceeds for?

Funds will be allocated to cloud infrastructure, product R&D, computer systems, acquisitions, and general corporate purposes.

Which brokerages are managing the Capillary IPO?

The book running lead managers are JM Financial, IIFL Capital Services, and Nomura Financial Advisory.

Why is Capillary issuing an IPO now?

To finance technology upgrades, accelerate growth, improve profitability, and support inorganic expansion strategies.

What’s Capillary’s recent profitability status?

Capillary turned profitable in FY25, reporting a net profit of approximately ₹13 crore after two prior years of losses.