- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Chartered Speed IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Chartered Speed IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Chartered Speed Limited IPO

Chartered Speed is among India’s leading passenger mobility companies, operating a fleet of over 2,000 buses as of June 30, 2025, offering inter-city and intra-city travel across six states. Intra-city services, particularly in Gujarat and Madhya Pradesh, include over 620 buses. The company follows an annuity model, deploying 1,382 buses under long-term contracts with government, educational, and corporate clients, alongside a ticket revenue model, serving 8,400 passengers on 258 daily trips across five states. Its fleet, comprising 46 electric buses and various categories from low-floor to super-luxury, covers 500 cities with 650+ pick-up points, supported by 2,480 drivers, generating 71.7% revenue from government contracts and 23.95% from ticket sales in FY25

Chartered Speed Limited IPO Overview

Chartered Speed Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 4, 2025, to raise funds through an Initial Public Offering (IPO). The IPO, structured as a book-building issue, aims to raise ₹855 crore, comprising a fresh issue of ₹655 crore and an offer for sale (OFS) of ₹200 crore. The company’s equity shares are proposed to be listed on NSE and BSE. Motilal Oswal Investment Advisors Ltd. is the book running lead manager, while MUFG Intime India Pvt. Ltd. is the registrar. Key details such as IPO dates, price bands, and lot size are yet to be announced. Pre-IPO, the promoters—Pankaj Gandhi, Alka Pankaj Gandhi, and Sanyam Gandhi—hold 96.65% of the company’s 7,18,05,660 shares.

Chartered Speed Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹855 crore |

| Fresh Issue | ₹655 crore |

| Offer for Sale (OFS) | ₹200 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post-issue | TBA |

Chartered Speed IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Chartered Speed Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Chartered Speed Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹10.37 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 107.31% |

| Net Asset Value (NAV) | ₹9.31 |

| Return on Equity (RoE) | 267.76% |

| Return on Capital Employed (RoCE) | 29.01% |

| EBITDA Margin | 31.62% |

| PAT Margin | 10.52% |

| Debt to Equity Ratio | 7.75 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding the capital expenditure requirements of our Company towards purchase of electric buses | 980 |

| Pre-payment or re-payment, in full or in part, of certain outstanding borrowings availed by our Company | 3964.74 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

Based on this format-

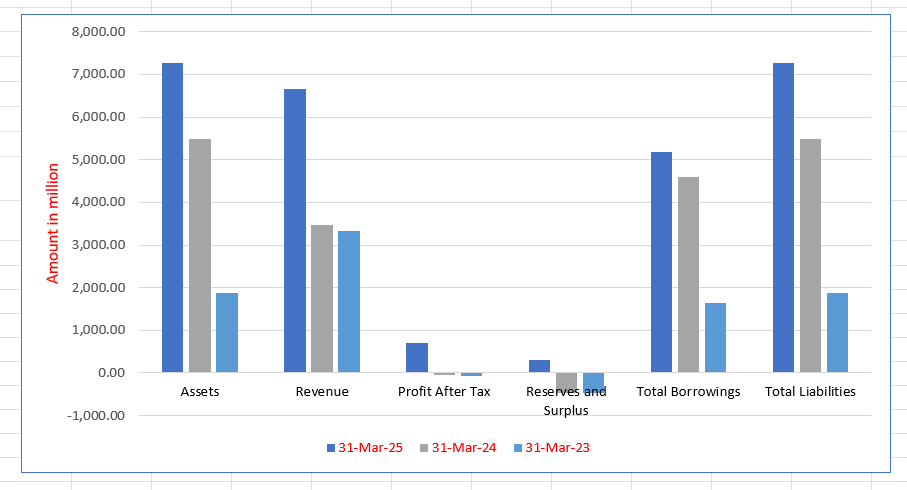

Chartered Speed Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 7,269.85 | 5,488.26 | 1,873.10 |

| Revenue | 6,667.74 | 3,473.02 | 3,320.76 |

| Profit After Tax | 700.96 | (54.94) | (83.16) |

| Reserves and Surplus | 309.61 | (472.16) | (482.61) |

| Total Borrowings | 5,179.59 | 4,587.48 | 1,648.95 |

| Total Liabilities | 7,269.85 | 5,488.26 | 1,873.10 |

Financial Status of Chartered Speed Limited

SWOT Analysis of Chartered Speed IPO

Strength and Opportunities

- Established market position with over two decades of experience in passenger mobility.

- Diverse service offerings including intercity, intracity, school, staff transport, and tourism services.

- Strong brand identity and operational track record in cities like Ahmedabad, Surat, Indore, and Bhopal.

- Plans to raise ₹855 crore through an IPO to support expansion and operational funding.

- Partnership with EKA Mobility to deploy 675 electric buses under the Pradhan Mantri e-Bus Sewa Scheme.

- Self-owned fleet of approximately 2,000 vehicles, ensuring control over operations.

- Focus on safety, speed, and customer-first approach in service delivery.

- Emphasis on innovation and technology integration in transportation solutions.

- Active engagement in corporate social responsibility and community development initiatives.

Risks and Threats

- Exposure to risks related to tender-based business models.

- Geographic and segment concentration in revenue.

- Vulnerability to changes in state government transportation policies.

- Dependence on government contracts and policy changes.

- Competition from other public and private transport providers.

- Potential challenges in scaling operations across diverse regions.

- High capital expenditure requirements for fleet expansion and maintenance.

- Regulatory hurdles and compliance requirements in the transportation sector.

- Fluctuations in fuel prices impacting operational costs.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Chartered Speed Limited

Chartered Speed Limited IPO Strengths

Leading Customer-Centric Passenger Mobility Company

Chartered Speed Limited is a leading Indian passenger mobility company operating over 2,000 self-owned buses across 500 cities. This extensive network serves about 3.5 lakh daily passengers with high user ratings, reflecting a strong market position and control over operational quality in a fragmented sector, positioning the company for future growth.

Business Model with High Revenue Visibility

The company’s growth is driven by a two-pronged business model: annuity contracts and a ticket revenue model. Long-term contracts, often spanning 5 to 12 years with government bodies, provide guaranteed, predictable revenue, significantly reducing market volatility. This annuity model, which accounted for 71.70% of Fiscal 2025 revenue, ensures strong financial stability and high revenue visibility.

Cost Efficiency and Operational Integration

Chartered Speed Limited achieves enhanced profitability and margins through strategic operational integration. This includes in-house maintenance facilities, reducing downtime and costs, and direct fuel sourcing for competitive rates. Furthermore, reliance on direct booking channels and a dedicated, stable in-house workforce of over 4,300 employees minimizes outsourcing expenses and ensures consistent service quality.

Maximizing Revenue Potential Across Multiple Streams

The company maximizes asset utilization by employing multiple complementary revenue streams. Under the ticket revenue model, revenue is generated through passenger fares, express parcel services, and brand advertising on the buses. This diversification hedges against seasonal fluctuations, complementing the stable, contract-backed revenue from the annuity model for robust financial performance.

Technology-Focused Approach for Safety and Comfort

Chartered Speed Limited prioritizes passenger safety and experience by leveraging IoT-enabled operations. Over 1,800 buses are equipped with GPS, smart sensors, and CCTV, providing real-time data for route optimization, predictive maintenance, and driver assistance systems. This technology-driven strategy ensures a secure, reliable, and comfortable journey for all customers.

Experienced Management Team and Workforce

The company benefits from an experienced management team, including its promoters with over 23 years in the passenger mobility industry. This is supported by a large, dedicated, and stable workforce of 4,356 employees as of June 2025, including 2,480 drivers. The in-house recruitment and training processes ensure a high-quality, experienced team to maintain operational consistency.

More About Chartered Speed Limited

Chartered Speed Limited is a leading passenger mobility company in India, operating a fleet of over 2,000 buses as of June 30, 2025 (Source: F&S Report). The company primarily maintains a self-owned fleet, enabling greater operational control and reducing reliance on third-party vendors. With more than 15 years of experience in the mobility sector, Chartered Speed Limited is committed to delivering sustainable, affordable, and efficient inter-city and intra-city transportation solutions across six states. Its extensive network spans 500 cities, serving approximately 3.5 lakh passengers daily. Leveraging a skilled workforce and an integrated technology platform, the company’s revenue from operations grew at a CAGR of 41.70%, from ₹3,320.76 million in Fiscal 2023 to ₹6,667.74 million in Fiscal 2025.

Chartered Speed Limited operates more than 650 dedicated pick-up and drop points and 65 branch offices nationwide, supported by a team of over 4,000 employees, including 2,480 drivers.

Revenue Model

The company follows two key business models:

Annuity Model

- Long-term contracts with state transport undertakings, government-backed entities, and corporate/educational institutions.

- Fixed payments based on kilometers traveled, ensuring predictable cash flows and reduced revenue risk.

- Contracts typically span 5–12 years, covering operation and maintenance responsibilities.

- As of March 31, 2025, 1,382 buses were deployed under this model across Odisha, Madhya Pradesh, and Gujarat, covering 62.88 million kilometers annually.

Ticket Revenue Model

- Retains all revenue from ticket sales, with opportunities for advertising and parcel delivery revenue.

- Targets high-traffic and underserved inter-city and intra-city corridors.

- In Fiscal 2025, the model operated 258 daily trips, serving 8,400 passengers across Gujarat, Madhya Pradesh, Rajasthan, Maharashtra, and Assam.

The annuity model contributed 71.70% of revenue in Fiscal 2025, up from 33.74% in Fiscal 2023, while the ticket revenue model provided upside potential through increased demand and ancillary income.

Services

Inter-City Services

- High-speed, reliable, and comfortable transportation connecting major cities and regional hubs.

- Operations span six states, including Gujarat, Odisha, Madhya Pradesh, Rajasthan, Assam, and Maharashtra.

- Over 1,200 buses serve routes under both annuity and ticket revenue models, catering to millions of passengers annually.

Intra-City Services

- Focused on efficient urban mobility, including Bus Rapid Transit Systems and shared mobility solutions.

- Fleet of 620 buses operates in high-density urban areas of Gujarat and Madhya Pradesh.

- Provides school and corporate transportation, with over 270 buses serving clients such as GHCL Limited and Apple Global School.

Technology and Safety

Chartered Speed Limited integrates technology across its fleet to enhance safety and efficiency:

- On-Board Diagnostics (OBD) for live vehicle monitoring, fuel, and energy management.

- Advanced Driver Assistance Systems (ADAS) to reduce accidents.

- CCTV and a dedicated control room for fleet monitoring.

- AI-powered dynamic pricing on selected routes under the ticket revenue model.

Fleet and Expansion

The fleet comprises over 2,000 buses, including 46 electric buses, with seating capacities ranging from 25 to 90 passengers. Chartered Speed Limited plans to convert 25% of its fleet to electric vehicles by Fiscal 2027, with 945 EVs already on order.

Management

Led by Chairman and Managing Director Pankaj Kumar Gandhi and Whole-time Director Sanyam Gandhi, the company combines over 23 years of industry experience. The workforce of 4,356 employees ensures smooth nationwide operations.

Industry Outlook

Market Overview

- Total Bus Market: Valued at USD 2.24 billion in 2024, projected to reach USD 3.22 billion by 2033, growing at a CAGR of 3.80% during 2025–2033.

- Electric Bus Market: Valued at USD 753.3 million in 2024, expected to expand to USD 2,435.2 million by 2030, with a CAGR of 21.6% from 2025 to 2030.

Growth Drivers

- Urbanization: Increasing urban populations necessitate efficient public transportation solutions.

- Government Initiatives: Schemes like FAME II and PM e-Bus Sewa promote electric vehicle adoption.

- Environmental Concerns: Rising pollution levels drive the shift towards cleaner transportation options.

- Technological Advancements: Improvements in battery technology and charging infrastructure enhance the feasibility of electric buses.

Key Figures

- Electric Bus Deployment: Over 2,100 electric buses were registered in India in the first half of 2025, marking a 33% increase from the previous year.

- Charging Infrastructure: The number of public charging points has grown from 1,800 in February 2022 to 29,277 by May 2025, indicating significant infrastructure development.

Future Outlook

- Electric Bus Adoption: The market is expected to continue its rapid growth, driven by supportive policies and increasing environmental awareness.

- Infrastructure Development: Expansion of charging networks and advancements in battery technology will further facilitate the adoption of electric buses.

- Market Dynamics: The shift towards electric buses presents opportunities for manufacturers and operators to innovate and lead in the evolving transportation landscape.

How Will Chartered Speed Limited Benefit

- Expanded electric bus adoption will allow Chartered Speed Limited to enhance its sustainable fleet and reduce operating costs.

- Government initiatives and subsidies under schemes like FAME II and PM e-Bus Sewa provide financial support for fleet expansion.

- Growing urbanization and rising passenger demand create opportunities for higher ticket revenue and route expansion.

- Increasing public awareness of clean transportation positions the company as a preferred provider of eco-friendly mobility solutions.

- Technological advancements in fleet management, ADAS, and AI-based dynamic pricing improve operational efficiency and passenger safety.

- Expansion of charging infrastructure facilitates faster deployment of electric buses and reduces downtime.

- Diversified revenue models, including annuity and ticket sales, ensure stable cash flows while offering upside potential.

- Strong presence across inter-city, intra-city, school, and corporate transportation segments enables scalable growth.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Chartered Speed Limited

Expanding Annuity Business

Chartered Speed Limited aims to grow its annuity segment by actively participating in government, corporate, and school contracts. Targeting high-density metropolitan and tier-II cities, the company plans to strategically add routes and increase its fleet, including advanced electric buses, to meet rising urban transport demand.

Building a Sustainable Fleet

The company is focused on creating a large, eco-friendly fleet by investing in electric buses. Leveraging its integrated operations, maintenance systems, and digital capabilities, Chartered Speed Limited seeks to enhance route-level profitability while advancing sustainability, reducing carbon footprint, and supporting India’s transition to greener public transportation solutions.

Expanding Inter-City Network

Chartered Speed Limited intends to strengthen its inter-city presence by expanding its fleet under both ticketing-revenue and annuity models. The strategy targets high-demand corridors, underserved routes, and emerging tier-II and tier-III cities, while integrating digital booking, real-time tracking, dynamic pricing, and sustainable transportation solutions.

Investing in Technology

The company plans to invest in IoT, AI, and smart systems to enhance passenger safety and operational efficiency. Real-time data, predictive maintenance, advanced surveillance, and analytics-driven decision-making will optimize routes, improve fuel efficiency, ensure security, and deliver a seamless and customer-centric travel experience.

Enhancing Operational Efficiency

Chartered Speed Limited continues to modernize its technological ecosystem, integrating GPS, CCTV, automated ticketing, and fleet management systems. Investments in driver simulation, collision avoidance, and internal software platforms aim to optimize costs, maximize asset utilization, and improve customer service and profitability across inter-city and intra-city operations.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Chartered Speed Limited IPO

How can I apply for Chartered Speed Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Chartered Speed Limited IPO?

The IPO is ₹855 crore, comprising a ₹655 crore fresh issue and ₹200 crore offer for sale (OFS).

Where will Chartered Speed shares be listed?

The equity shares are proposed to be listed on the NSE and BSE.

Who are the lead managers and registrar for the IPO?

Motilal Oswal Investment Advisors Ltd. is the book running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar.

How will the IPO proceeds be used?

Proceeds will fund electric bus purchases, repay borrowings, and meet general corporate purposes.

What is the reservation for different investor categories?

QIBs get at least 75%, retail investors up to 10%, and non-institutional investors up to 15% of the net offer.