- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

CIEL HR Services IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

TBA

TBA

TBA

CIEL HR Services IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

CIEL HR Services Limited

Founded in 2015 and based in Bengaluru, CIEL HR Services Limited provides comprehensive HR solutions, including staffing, talent assessment, HR advisory, and managed services. In June 2024, it was featured in Brand Finance’s India 100 report, ranking among India’s most valuable brands. The only HR industry representative, CIEL HR earned an AA brand strength rating and a USD 30 million valuation. Recognised for its rapid growth and promising future, its inclusion highlights its commitment to innovation and excellence in HR solutions.

CIEL HR Services Limited IPO Overview

CIEL HR Services IPO is a bookbuilding issue of 0.47 crore equity shares, entirely comprising a fresh issue. The IPO dates, price band, lot size, and listing date are yet to be announced. Each share has a face value of ₹2, and the total issue size amounts to 47,39,336 shares. The IPO will be listed on BSE and NSE. Ambit Private Limited, Centrum Capital Limited, and HDFC Bank Limited are the book-running lead managers, while Kfin Technologies Limited is the registrar for the issue.

The DRHP was filed with SEBI on November 21, 2024, SEBI approval was received on February 14, 2024, and an addendum to the DRHP was filed on February 24, 2025. The pre-issue shareholding stands at 8,50,05,010 shares, with 87.02% held by promoters. Promoters of the company include Pandiarajan Karuppasamy, Hemalatha Rajan, Aditya Narayan Mishra, Santhosh Kumar Nair, and Doraiswamy Rajiv Krishnan. The allotment and post-issue shareholding details are yet to be disclosed

CIEL HR Services LimitedUpcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹335 crore |

| Offer for Sale: 47.39 lakh shares | |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 8,50,05,010 shares |

| Shareholding post -issue | TBA |

CIEL HR Services IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

CIEL HR Services Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 50% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

CIEL HR Services Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 2.55 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 12.93% |

| Net Asset Value (NAV) | 19.10 |

| Return on Equity | 12.90% |

| Return on Capital Employed (ROCE) | 13.18% |

| EBITDA Margin | 2.00% |

| PAT Margin | 1.00% |

| Debt to Equity Ratio | 0.79 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | (₹ in million) |

| 1. Acquisition of additional shareholding in the following Subsidiaries: | 407.32 |

| (i) Firstventure Corporation Private Limited | 116.10 |

| (ii) Integrum Technologies Private Limited | 31.50 |

| (iii) Next Leap Career Solutions Private Limited | 69.22 |

| (iv) People Metrics Private Limited and Thomas Assessments Private Limited* | 190.50* |

| 2. Investment in the following Subsidiaries: | 552.00 |

| (i) CIEL Skills and Careers Private Limited, towards expansion of its HR Tech Platform, ProSculpt | 26.00 |

| (ii) FirstVenture Corporation Private Limited, towards expansion of its learning experience platform, Courseplay | 64.00 |

| (iii) Integrum Technologies Private Limited, towards the expansion of its HR Tech Platform, HfactoR | 116.00 |

| (iv) Ma Foi Strategic Consultants Private Limited, towards expansion of its HR Tech Platform, EzyComp | 26.00 |

| (v) Next Leap Career Solutions Private Limited, towards expansion of its HR Tech Platform, Jombay | 320.00 |

| Funding incremental working capital requirements | 1,000.00 |

| Unidentified inorganic acquisitions and general corporate purposes | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

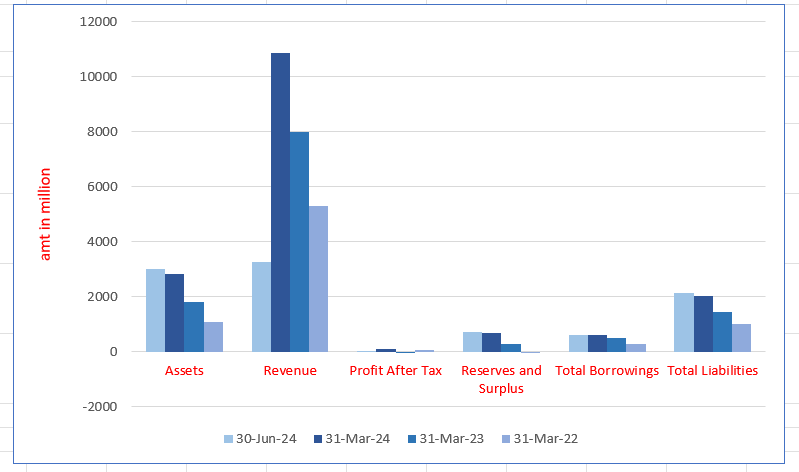

CIEL HR Services Limited Financials ( (in millions)

| Particulars | 30 June 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 2989.12 | 2833.76 | 1796.75 | 1091.167 |

| Revenue | 3259.67 | 10881.96 | 8007.18 | 5285.30 |

| Profit After Tax | 31.71 | 108.48 | (31.53) | 68.75 |

| Reserves and Surplus | 722.29 | 692.67 | 265.01 | (6.77) |

| Total Borrowings | 613.36 | 586.82 | 495.15 | 290.24 |

| Total Liabilities | 2132.27 | 2006.12 | 1442.47 | 1007.92 |

Financial Status of CIEL HR Services Limited

SWOT Analysis of CIEL HR Services IPO

Strength and Opportunities

- Diverse HR services cater to varied client needs.

- Recognized among India's top 100 brands by Brand Finance in June 2024, enhancing market credibility.

- Experienced leadership team with over three decades in the HR industry, driving strategic growth.

- High attrition rates in the staffing industry pose challenges in maintaining service quality.

- Nationwide presence with 60 offices in 45 locations, enabling access to a vast talent pool.

- Integration of technology in HR platforms enhances service efficiency and client satisfaction.

- Strategic acquisitions have expanded service capabilities and market reach.

- Commitment to quality management, retaining ISO 9001:2015 certification, ensures service excellence.

- Robust focus on compliance and upskilling initiatives supports industry relevance and client satisfaction.

- Growing demand for HR outsourcing in India presents significant expansion opportunities.

- Emerging trends in digital transformation and automation in HR offer potential for technological innovation and service differentiation.

Risks and Threats

- Intense competition leads to pricing pressures.

- Inherently low profit margins in the staffing segment, affecting overall profitability.

- High attrition rates in the staffing industry pose challenges in maintaining service quality.

- High working capital requirements due to the 'Pay and Collect' model, impacting cash flow.

- Obligations to pay significant amounts between FY2025 and FY2027 for subsidiary stake acquisitions.

- Economic downturns can adversely impact client sectors, reducing demand for HR services.

- Dependence on top clients, with a substantial portion of revenues from a limited number of customers, poses concentration risk.

- Fragmented manpower outsourcing industry leads to intense competition and reduced pricing flexibility.

- Regional and global policy changes could disrupt operations or impact service demand.

- Regulatory changes or compliance burdens may increase operational costs and complexity.

- Relatively smaller brand visibility compared to major multinational HR firms could limit opportunities in large-scale international projects.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About CIEL HR Services Limited IPO

CIEL HR Services Limited IPO Strengths

- Pioneering Technology-Driven HR Solutions in India

CIEL HR Services Limited offers integrated HR solutions, covering staffing, payroll, and recruitment outsourcing. Since Fiscal 2022, acquisitions and in-house development have strengthened its tech focus. Specialised platforms for assessment and engagement enhance efficiency, driving revenue and EBITDA growth.

- Diversified Business with Strong Client Relationships

Serving 4,019 clients across industries like IT, energy, and manufacturing, CIEL ensures resilience against sector-specific downturns. Long-standing client relationships, combined with tech-driven solutions, drive increased wallet sizes, revenue consistency, and a strong business pipeline.

- Strong Geographical Presence Through Asset-Light Model

With 49 business partners across 33 locations and 67 offices, CIEL’s asset-light model reduces capital expenditure while enabling scalability. Business partners contribute 13.92%–14.33% of revenue, supported by training and systems for customised HR solutions.

- Robust In-House Capabilities in HR Tech Development

An in-house tech team allows CIEL to develop and enhance HR platforms, ensuring adaptability to industry trends. Control over updates and source code enables the company to deliver innovative, high-quality HR solutions tailored to client needs.

- Proven Inorganic Growth and Financial Performance

CIEL has expanded through strategic acquisitions, including Next Leap, Aargee Staffing, and Firstventure. These integrations have boosted professional staffing, digital learning, and tech capabilities, driving revenue, profitability, and operational efficiency.

- Experienced Leadership Driving Success

Founded by Pandiarajan Karuppasamy and Hemalatha Rajan, with MD and CEO Aditya Narayan Mishra, CIEL’s leadership brings 21+ years of HR expertise. Their focus on innovation, governance, and efficiency contributes to the company’s sustained growth and industry recognition.

More About CIEL HR Services Limited

Comprehensive HR Solutions

CIEL HR Services Limited provides end-to-end HR solutions, covering recruitment, staffing, payroll, and skill development. Leveraging technology, it enhances talent acquisition, compliance, and employee engagement, helping organisations attract and retain top talent efficiently.

Technology Integration in HR

CIEL combines traditional HR solutions with advanced digital platforms, streamlining assessment, learning, compliance, and performance management. This ensures seamless operations, measurable outcomes, and enhanced workforce efficiency for clients.

Impressive Growth and Market Position

Between Fiscal 2021 and 2024, CIEL achieved a 62% revenue CAGR, surpassing the industry’s 18.1% average. This highlights its ability to scale and adapt to market dynamics.

Diverse Clientele Across Sectors

Serving 4,000+ clients across consumer retail, IT, BFSI, and manufacturing, CIEL’s portfolio includes Swiggy Logistics, Puma India, and Aditya Birla Group, showcasing strong industry relevance.

Asset-Light and Scalable Model

With operations in 33 locations and 49 business partners, CIEL’s asset-light model ensures cost efficiency while expanding its reach into tier-two and tier-three cities.

Proven Leadership and Industry Recognition

Backed by experienced promoters, CIEL’s success stems from strategic acquisitions and innovations. It holds ISO 9001:2015 certification and is recognised as a “Great Place to Work.”

Business Segments

- HR Services: Staffing, RPO, executive search, payroll, compliance, and HR advisory.

- HR Tech Platforms: Talent assessment, employee learning, HR management, compliance, and fresher upskilling.

Innovative HR Technology

CIEL’s platforms include:

- HfactoR: AI-driven recruitment, onboarding, and payroll.

- Courseplay: Personalised learning and performance management.

- Jombay: Leadership development and engagement programs.

- ProSculpt: Fresher upskilling and corporate hiring solutions.

Industry Outlook

Employment and Skilling Infrastructure in India

Employment in India remained stable from FY2012 to FY2018, supported by urbanisation and technological advancements. By FY2024, total employment reached 643.1 million, driven by initiatives such as ‘Make in India’, ‘Skill India’, and MGNREGA. Key sectors include agriculture (45.8%), construction (13%), trade, hotel & restaurant (12.1%), and services (11.4%).

Challenges like informal employment, skill mismatches, and youth unemployment persist, requiring a focus on upskilling, quality jobs, and inclusivity. Apprenticeship training plays a vital role in skill development, supported by schemes like NAPS and NATS, which offer stipends and practical training, contributing to India’s goal of becoming the “skill capital of the world.”

Global HR Solutions Market Overview

The HR solutions market is set to grow from USD 487 billion in 2018 to USD 1,753 billion by 2028, driven by automation in recruitment, payroll, and performance management. In India, services such as Professional Staffing, RPO, and Value Staffing are expanding, driven by a demand for skilled talent. Key trends include HR-Finance integration, compliance automation, AI-driven recruitment, and mobile-friendly HR platforms, shaping the future of workforce management.

How Will CIEL HR Services Limited Benefit?

- Adapting to Industry Growth Trends: CIEL leverages automation and technology to streamline HR services, ensuring efficiency and scalability.

- Leveraging Technology in HR Solutions: CIEL enhances HR solutions through digital platforms, focusing on talent assessment, learning, and compliance.

- Capitalising on India’s Employment Growth: CIEL addresses workforce needs through recruitment, payroll, and skill development, supporting employment initiatives.

- Expanding Through Strategic Industry Segments: CIEL serves diverse industries via staffing, recruitment outsourcing, and advisory, driving business expansion.

- Responding to the Rise of Gig Economy: CIEL’s flexible staffing solutions cater to gig workforce needs, enhancing adaptability and scalability.

- Meeting Talent Demand in a Globalized Workforce: CIEL provides strategic workforce planning and recruitment, meeting the growing demand for skilled professionals.

- Aligning with Skill India Initiatives: CIEL upskills fresh talent, supporting India’s vision of becoming a global skill capital.

- Enhancing Employee Well-Being: CIEL integrates well-being initiatives into HR services, fostering workplace productivity and employee retention.

- Addressing HR Compliance and Regulatory Needs: CIEL offers compliance automation and advisory, ensuring businesses meet legal and regulatory requirements.

- Supporting Remote Work and Workforce Agility: CIEL provides scalable HR solutions for remote work, enhancing talent engagement and performance management.

Peer Group Comparison

| Company | Face Value per Equity Share (₹) | EPS (₹) | NAV (₹) | P/E | RoNW (%) | Revenue (in ₹ millions) |

| CIEL HR Services Limited | 2 | 2.55 | 19.10 | NA | 12.93 | 10,857.35 |

| Peer Groups | ||||||

| Quess Corp Limited | 10 | 18.72 | 191.22 | 36.26 | 9.78 | 191,001.33 |

| Team Lease Services Limited | 10 | 67.00 | 475.74 | 41.96 | 14.06 | 93,215.30 |

| Spectrum Talent Management Ltd | 10 | 5.30 | 63.48 | 36.79 | 7.91 | 10,162.01 |

Key Insights

- Face Value per Equity Share: CIEL HR Services Limited has a face value of ₹2 per equity share, which is lower compared to its peers, such as Quess Corp, Team Lease Services, and Spectrum Talent, which all have a face value of ₹10. This impacts share pricing.

- EPS: Team Lease Services Limited leads with an impressive EPS of ₹67.00, reflecting strong profitability. CIEL HR Services Limited shows a modest EPS of ₹2.55, indicating relatively lower profitability. Quess Corp and Spectrum Talent also report higher EPS than CIEL HR.

- NAV: Team Lease Services Limited demonstrates significant asset value with a NAV of ₹475.74 per share, followed by Quess Corp at ₹191.22. CIEL HR Services Limited holds a moderate NAV of ₹19.10, while Spectrum Talent has a relatively lower NAV of ₹63.48.

- P/E Ratio: Team Lease Services Limited and Quess Corp Limited boast high P/E ratios of 41.96 and 36.26, respectively, indicating market confidence. CIEL HR Services Limited lacks a P/E ratio, possibly due to profitability concerns. Spectrum Talent’s P/E stands at 36.79, indicating positive investor sentiment.

- RoNW: Team Lease Services Limited excels with a RoNW of 14.06%, reflecting efficient capital utilisation. CIEL HR Services Limited follows closely with a RoNW of 12.93%, showcasing decent returns on equity. In contrast, Quess Corp and Spectrum Talent show lower RoNW percentages, indicating relatively weaker profitability.

- Revenue: Quess Corp Limited leads with substantial revenue of ₹191,001.33 million, showing a dominant market position. Team Lease Services follows with ₹93,215.30 million in revenue, highlighting a strong operational scale. CIEL HR Services and Spectrum Talent have comparatively lower revenues, reflecting a smaller market presence.

Key Strategies for CIEL HR Services Limited

- Focused Growth Through Strategic Acquisitions

CIEL HR Services Limited aims to continue growing through strategic acquisitions, expanding its capabilities and client base. The company intends to enhance its solutions portfolio by targeting high-margin businesses, HR technology platforms, and new segments like EPC and healthcare staffing. Their experience with past acquisitions has solidified their approach, and they plan to use proceeds from the Fresh Issue to fund future acquisitions, strengthening their market position.

- Strengthening Technology Capabilities for Improved HR Solutions

CIEL HR Services is committed to enhancing its technology-driven HR solutions. By investing in technology, we aim to improve productivity, operational efficiency, and margins. Our HR Tech Platforms, including EzyComp, HfactoR, Jombay, and Prosculpt, will undergo enhancements with AI-driven features, improving talent screening and user experience. These upgrades will offer seamless client solutions, boost customer satisfaction, and support organisational growth.

- Organic Growth Through Geographical Expansion, Cross-Selling, and Margin Improvement

The company plans to drive organic growth by expanding into new regions such as Kerala, Maharashtra, and Uttar Pradesh, leveraging its successful asset-light franchisee model. It aims to deepen client relationships through cross-selling its diverse HR services. Additionally, the company focuses on improving margins by enhancing operational efficiency through automation, AI, and data analytics while expanding high-margin businesses like HR Tech Platforms.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

What is the issue size of the CIEL HR Services IPO?

The IPO comprises a ₹335 crore fresh equity issue and 47.39 lakh shares under an Offer-for-Sale (OFS) by existing shareholders.

How will the IPO funds be utilised?

Funds will be allocated for working capital, increasing stakes in subsidiaries, expanding learning platforms, inorganic acquisitions, and general corporate purposes.

What is the promoter holding in CIEL HR Services?

Promoters Aditya Narayan Mishra, Santhosh Kumar Nair, and Doraiswamy Rajiv Krishnan collectively hold 87.02% in the company.

Is CIEL HR Services considering a pre-IPO placement?

Yes, the company may raise ₹67 crore via a pre-IPO placement, reducing the fresh equity issue size accordingly.

What is the listing plan for CIEL HR Services IPO?

The IPO is proposed to list on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

When will the price range for the IPO be announced?

The price range will be disclosed in the final red herring prospectus (RHP) closer to the bidding start date.