- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

CJ Darcl Logistics IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

CJ Darcl Logistics IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

CJ Darcl Logistics Limited IPO

Incorporated in 1986, CJ Darcl Logistics Ltd. is a leading logistics company with over 30 years of experience, offering integrated multimodal logistics along with warehousing and distribution services to enterprise clients in India and abroad. Its services include full truck load (FTL), rail, air cargo, coastal shipping, project logistics, freight forwarding, and warehousing solutions. As of March 31, 2025, the company operated 202 branch offices, 6 administrative offices, 14 warehouses, and 1 railway stock yard, serving 2,277 customers, including major corporates like Tata Steel, Arcelormittal, Welspun, Godrej, and KRBL. CJ Darcl’s asset-right model leverages a partnered fleet of 955,023 vehicles from 554,781 business partners, ensuring scalable operations.

CJ Darcl Logistics Limited IPO Overview

CJ Darcl Logistics Ltd. filed a Draft Red Herring Prospectus (DRHP) with SEBI on September 30, 2025, to raise funds through an Initial Public Offer (IPO). The IPO will follow a book-building process, and the company’s equity shares are proposed to be listed on both the NSE and BSE. While MUFG Intime India Pvt. Ltd. has been appointed as the registrar of the issue, the book running lead manager has not yet been declared. Key details, including the IPO dates, price band, and lot size, are still awaited. For more information, refer to the CJ Darcl Logistics IPO DRHP.

The IPO will involve a fresh capital-cum-offer for sale, with the equity shares to be listed on BSE and NSE. The face value, issue price band, and lot size will be announced in due course. The DRHP filing with SEBI was completed on September 30, 2025..

CJ Darcl Logistics Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 3.637 crore equity shares |

| Fresh Issue | 2.647 crore equity shares |

| Offer for Sale (OFS) | 0.99 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post-issue | TBA |

CJ Darcl Logistics IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

CJ Darcl Logistics Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

CJ Darcl Logistics Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹8.22 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 12.40% |

| Net Asset Value (NAV) | ₹66.27 |

| Return on Equity (RoE) | 13.20% |

| Return on Capital Employed (RoCE) | 18.25% |

| EBITDA Margin | 5.20% |

| PAT Margin | 1.80% |

| Debt to Equity Ratio |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/ prepayment, in full or in part, of certain outstanding borrowings availed by the Company | 2750 |

| Funding capital expenditure requirements of the Company towards purchase of equipment | 2038.57 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

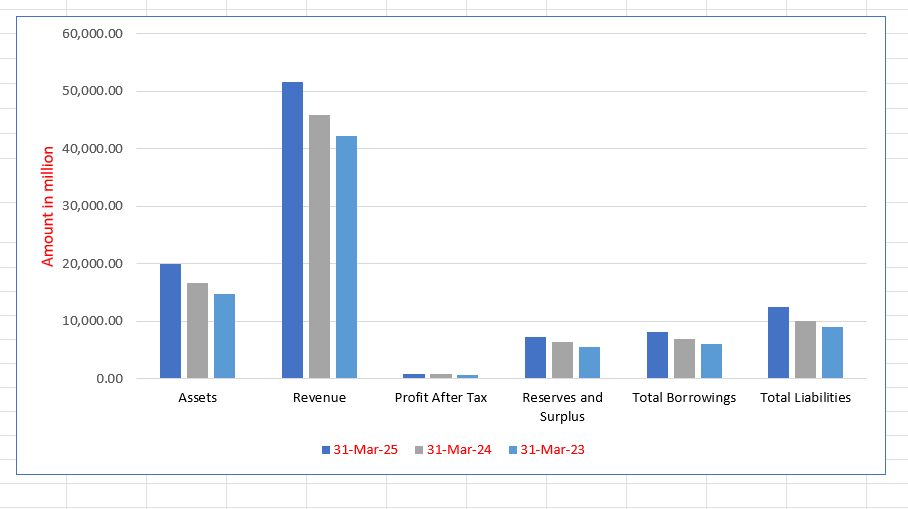

CJ Darcl Logistics Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 20,064.61 | 16,722.05 | 14,801.75 |

| Revenue | 51,611.09 | 45,944.14 | 42,158.26 |

| Profit After Tax | 931.19 | 827.80 | 677.01 |

| Reserves and Surplus | 7,282.74 | 6,372.07 | 5,539.86 |

| Total Borrowings | 8,096.32 | 6,918.41 | 6,122.62 |

| Total Liabilities | 12,555.25 | 10,123.36 | 9,035.27 |

Financial Status of CJ Darcl Logistics Limited

SWOT Analysis of CJ Darcl Logistics IPO

Strength and Opportunities

- Extensive national network covering over 6,691 locations across India.

- Large partnered fleet of over 9.5 lakh vehicles through 5.5 lakh business partners.

- Assetright business model enabling scalability and flexibility.

- Diversified service portfolio including FTL, rail, air, sea, warehousing & distribution.

- Backed by the global parent CJ Logistics Corporation, providing financial and managerial support.

- Strong technology integration for logistics visibility, operations and customer service.

- Growing opportunity from the rise in multimodal logistics and warehousing demand.

- Ability to scale newer segments like rail, air, sea to improve margins and reduce reliance on FTL.

- Strong client base including large corporates across industries providing steady demand.

- Scope for expansion into adjacent geographies and value added logistics services.

Risks and Threats

- Highly fragmented roadtransport industry with fierce competition.

- Operational scale in multimodal segments still modest compared to road FTL business.

- Significant working capital requirements due to receivables and high fleet utilisation.

- Vulnerability to regulatory changes in rail container operations (haulage charges, policy).

- Margins remain modest (around 4.55%) and need improvement to drive returns.

- Heavy dependence on the cyclical freight market which can impact volumes in downturns.

- Entry of tech driven new age competitors disrupting traditional logistics models.

- External risks from fuel price volatility and supplychain disruptions impacting costs.

- Fleet asset management and maintenance risks as owned/leased assets age and utilisation increases.

- Geopolitical, regulatory or infrastructure bottlenecks (ports, rail infrastructure) may hamper growth.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About CJ Darcl Logistics Limited

CJ Darcl Logistics Limited IPO Strengths

Pan-India Integrated Logistics Leadership

CJ Darcl has scaled its operations to become a diversified logistics company and one of the largest players in domestic B2B road transportation by Fiscal 2025 revenue. It offers comprehensive, end-to-end multimodal solutions across road, rail, air, and W&D. Its pan-India network includes 202 branches and access to over 955,000 partnered fleet vehicles, enabling efficient, timely service across 6,691 locations.

Dynamic Asset-Right Business Model

The Company utilizes a dynamic ‘asset-right’ model, balancing selective asset ownership (including over 2,400 containers and 1,100+ owned/leased vehicles) with the operational flexibility of an extensive vendor network of over 554,000 business partners. This strategy minimizes capital expenditure requirements, mitigates operational risks, and ensures high efficiency, scalability, and cost-optimized service delivery across its portfolio.

Robust Parentage and Experienced Leadership

Backed by its Corporate Promoter, the globally established CJ Logistics Corporation, CJ Darcl benefits from financial strengthening, technology integration, and governance aligned with global standards. The Company is further supported by well-established Promoters, an experienced management team, and a dedicated employee base of nearly 6,000 individuals, with 792 having over ten years of tenure.

Long-Standing and Diverse Customer Base

CJ Darcl maintains multi-decade relationships with major Indian public and private enterprises, demonstrating operational reliability. This depth provides a stable revenue base, with 83.01% of Fiscal 2025 revenue from contracts lasting over one year. The Company serves 2,277 customers across diverse sectors—including metals, chemicals, and FMCG—reducing concentration risk and supporting service cross-selling.

Technology-Driven Customised Solutions

The Company leverages robust technology, including proprietary Freight Intelligence for optimized routing and dynamic pricing. It utilizes a cloud-native Transport Management System (MoveX) and its Corporate Promoter’s advanced Warehousing Management System (WMS) for real-time tracking, end-to-end visibility, and enhanced vendor self-service. This foundation delivers customized, cost-efficient, and high-quality logistics solutions.

More About CJ Darcl Logistics Limited

CJ Darcl Logistics Limited is a leading logistics company with over 39 years of operational experience, providing integrated multimodal logistics and warehousing and distribution services to enterprise clients across India and international markets. It operates as a subsidiary of CJ Logistics Corporation, one of South Korea’s largest logistics companies by revenue. CJ Logistics Corporation, listed on the Korea Exchange, reported consolidated sales of KRW 12,116,761.15 million (USD 8,196.25 million) for the year ended December 31, 2024, and operates in 38 countries offering services such as contract logistics, freight forwarding, express parcel delivery, and supply chain management.

Service Portfolio

CJ Darcl has evolved into a comprehensive logistics service provider, offering:

- Integrated multimodal logistics including full truck load (FTL), rail transportation, air cargo, coastal shipping, project logistics, and freight forwarding.

- Warehousing and distribution solutions (W&D), encompassing built-to-suit, multi-sector, and multi-customer models.

As of March 31, 2025, CJ Darcl operated through 202 branch offices, 6 administrative offices, 14 warehousing facilities, and 1 railway stock yard, covering 6,691 locations nationwide.

Operational Strengths

The company leverages its strengths through:

- Extensive route coverage and reliable vehicle availability.

- Integrated multimodal services ensuring flexibility across transportation modes.

- Proprietary vendor and freight databases, providing market intelligence and operational insights.

- Industry-specific domain expertise and tailored logistics solutions.

- Large network of business partners, comprising 955,023 vehicles from 554,781 partners.

CJ Darcl follows a dynamic ‘asset-right’ business model, deploying owned, leased, or partner-sourced vehicles, ensuring capital efficiency and scalability.

Customer Base

CJ Darcl serves 2,277 customers across diverse sectors such as metals, chemicals, FMCG, automotive, agriculture, and construction. Major clients include Tata Steel, Arcelormittal Nippon Steel India, Welspun Corp, Godrej Consumer Products, and KRBL. Long-term contracts contribute significantly to revenue, with ~83% of FY2025 revenue derived from contracts of at least one year.

Technology & Innovation

CJ Darcl has developed a robust digital infrastructure supporting real-time visibility, system integration, and operational scalability. Through global innovations from its parent company, the company leverages automation, artificial intelligence, and digital freight systems to enhance efficiency.

Its multimodal operations are supported by over 1,800 specialized containers and 14 strategically located warehouses, making CJ Darcl one of India’s most integrated and technology-driven logistics providers.

Industry Outlook

The Indian logistics industry is poised for sustained growth, driven by economic expansion, infrastructure investment, and evolving supplychain requirements. The overall logistics market in India reached USD 228.4 billion in 2024 and is projected to grow at a CAGR of ~6.5% from 2025 to 2033, reaching approximately USD 428.7 billion by 2033.

Growth Drivers

- Expansion of ecommerce and organised retail is boosting demand for faster, more reliable logistics and warehousing services.

- Government initiatives like national logistics policies, multimodal corridors, and infrastructure investments are improving efficiency and reducing costs.

- Manufacturing revival, including PLI schemes, and growth in sectors like automotive, metals, and FMCG are creating higher freight tonnages and logistics volumes.

Key Figures & Values

- The road freight transport segment in India was estimated at USD 153.9 billion in 2025, with a projected CAGR of 8.95% to reach USD 236.29 billion by 2030.

- For warehousing, the Indian market was valued at USD 58.1 billion in 2024 and is expected to grow at a CAGR of ~10.3% between 20252030.

Outlook for Multimodal & W&D Services

For companies offering integrated multimodal logistics (truck, rail, air, shipping) and warehousing & distribution services (W&D), opportunities are significant:

- Multimodal logistics: Greater emphasis on rail and coastal shipping to decongest roads and reduce costs will benefit integrated transport services.

- Warehousing & distribution: As supplychain models become more complex with omnichannel retail, 3PL demand, and valueadded services, the W&D segment is expected to grow faster than traditional logistics.

How Will CJ Darcl Logistics Limited Benefit

- CJ Darcl Logistics Limited can capitalise on the growing Indian logistics market, projected to reach USD 428.7 billion by 2033.

- Increasing demand from ecommerce and organised retail will drive higher volumes for its multimodal transport and W&D services.

- Government initiatives in infrastructure and multimodal corridors will reduce operational costs and improve efficiency.

- Growth in manufacturing sectors like automotive, metals, and FMCG will create additional freight opportunities.

- Expansion of road, rail, and coastal transport aligns with the company’s integrated multimodal capabilities.

- Rising demand for 3PL and valueadded warehousing services will support CJ Darcl’s W&D segment.

- Technology-driven operations and strong partner networks allow scalable and flexible service offerings.

- Long-term contracts with enterprise clients will benefit from increasing logistics and warehousing needs.

- The company can leverage its asset-right model to maintain capital efficiency while expanding service capacity.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue (₹ million) | EPS FY 2025 (Basic) (₹) | EPS FY 2025 (Diluted) (₹) | NAV (₹) | P/E FY | RoNW (%) |

| CJ Darcl Logistics Limited | 12.00 | 51,611.09 | 8.22 | 8.22 | 66.27 | NA | 12.40 |

| Peer Group | |||||||

| Transport Corporation of India Limited | 2.00 | 44,917.76 | 53.43 | 53.32 | 281.27 | 22.44 | 19.14 |

Key Strategies for CJ Darcl Logistics Limited

Expanding Business and Customer Penetration

CJ Darcl Logistics Limited, a large domestic B2B road transport player, is expanding across industries like FMCG and electronics, and deepening customer relationships. They are adopting containerised vehicles, specialised services, and cost-optimisation efforts like in-house fuel units and higher-capacity vehicles to drive growth.

Growth Through Integrated Multimodal and Specialised Services

The company is strengthening its integrated multimodal services by leveraging a relationship with the Ministry of Railways and a large inventory of specialised containers. CJ Darcl is expanding its offerings into project logistics, freight forwarding, air cargo, and coastal shipping/NVOCC to capture market share across different transport modes.

Strategic Investment, Automation, and Cross-Selling

Supported by a significant investment from Corporate Promoter CJ Logistics Corporation, the company plans strategic expansion in the warehousing and distribution (W&D) business. They will implement the T.E.S. automation model (Technology, Engineering, System) to enhance efficiency, reduce human error, and cross-sell services to existing customers.

Strategic Branch Network Expansion

CJ Darcl is expanding its branch network, increasing locations to 202 to align with growing industrial activity and transportation corridors. This expansion, leveraging an ‘asset-right’ model, improves market access, operational efficiency, and customer relationships, supporting profitable volume growth and strengthening its pan-India presence.

Focus on Technology and Automation

The company intends to automate key processes using a cloud-based platform to boost efficiency and reduce costs. Key technology projects include a WhatsApp-based e-bidding mechanism, AI for route optimisation, and a digital marketplace for its partner network, alongside a new feature for contract pricing control in its TMS (MoveX).

Clean Energy and Sustainable Growth

CJ Darcl aims for sustainable growth by integrating environmental practices, focusing on fleet transition to clean energy like electric and LNG-powered commercial vehicles. They plan to improve operational efficiencies through eco-friendly warehouse practices, network flow optimisation, and automation to achieve greener operations.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On CJ Darcl Logistics Limited IPO

How can I apply for CJ Darcl Logistics Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When will the CJ Darcl Logistics IPO open and close?

The IPO open and close dates are yet to be announced by the company.

What is the issue size and type of the IPO?

The IPO is a book-built issue of 3.637 crore equity shares, including fresh issue and OFS.

On which stock exchanges will the shares be listed?

CJ Darcl’s equity shares are proposed to be listed on both NSE and BSE.

Who is the registrar and lead manager for the IPO?

MUFG Intime India Pvt. Ltd. is the registrar, while the book running lead manager is yet to be declared.

What is the face value of each share and allocation for investors?

Each share has a face value of ₹10, with at least 35% for retail, 15% for HNI, and up to 50% for QIBs.