- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Clean Max Enviro Energy Solutions IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Clean Max Enviro Energy Solutions IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Clean Max Enviro Energy Solutions Limited

Clean Max Enviro Energy Solutions Limited is a leading provider of sustainable energy solutions, specializing in renewable energy across India and the Middle East. The company offers end-to-end solutions in solar power, including project development, financing, installation, and operations. Focused on reducing carbon footprints for businesses, Clean Max has worked with several large corporates to provide cost-effective and green energy alternatives. They aim to accelerate the transition towards a cleaner, greener future by harnessing solar and other renewable energy technologies.

Clean Max Enviro Energy Solutions Limited IPO Overview

Clean Max Enviro Energy Solutions Ltd. filed a Draft Red Herring Prospectus (DRHP) with SEBI on August 16, 2025, to raise funds through an Initial Public Offer (IPO). The IPO, valued at ₹5,200 crores, includes a fresh issue of ₹1,500 crores and an Offer for Sale (OFS) of ₹3,700 crores. The company plans to list its equity shares on the NSE and BSE. Axial Capital Pvt. Ltd. is the book-running lead manager, while MUFG Intime India Pvt. Ltd. is the registrar for the issue. Key details such as IPO dates, price bands, and lot sizes will be announced later. Clean Max’s promoters hold a 74.89% pre-issue stake.

Clean Max Enviro Energy Solutions Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹5200 crore |

| Fresh Issue | ₹1500 crore |

| Offer for Sale (OFS) | ₹3700 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 10,14,41,820 shares |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Clean Max Enviro Energy Solutions Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Clean Max Enviro Energy Solutions Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹2.88 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 1.09% |

| Net Asset Value (NAV) | ₹250.93 |

| Return on Equity (RoE) | 1.09% |

| Return on Capital Employed (RoCE) | 7.64% |

| EBITDA Margin | 67.87% |

| PAT Margin | 1.30% |

| Debt to Equity Ratio | 2.49 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment and/or pre-payment, in part or full, of all or certain outstanding borrowings of our Company and/or certain of our Subsidiaries | 11,250 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

Based on this format-

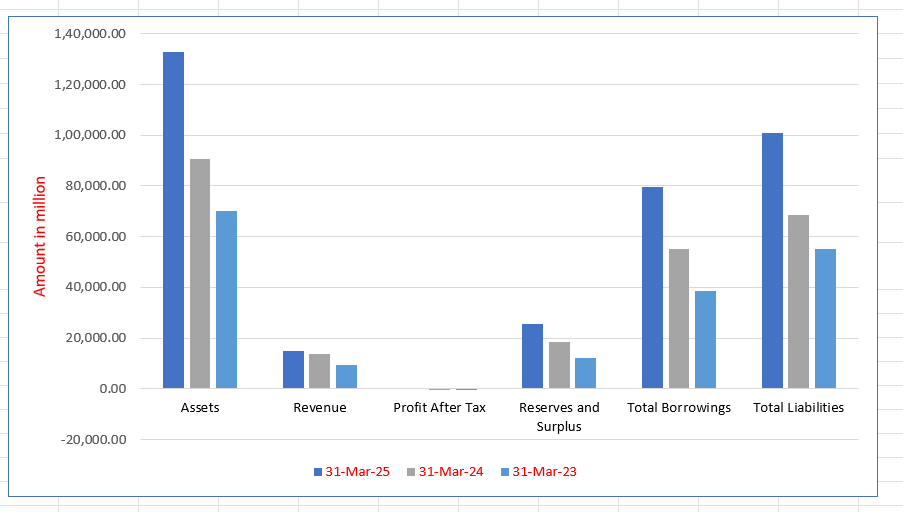

Clean Max Enviro Energy Solutions Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 132,792.53 | 90,765.47 | 70,001.38 |

| Revenue | 14,957.01 | 13,898.37 | 9,295.82 |

| Profit After Tax | 194.29 | (376.43) | (594.73) |

| Reserves and Surplus | 25,584.08 | 18,290.69 | 12,071.16 |

| Total Borrowings | 79,736.98 | 55,053.64 | 38,434.56 |

| Total Liabilities | 100,744.80 | 68,425.68 | 55,313.82 |

Financial Status of Clean Max Enviro Energy Solutions Limited

SWOT Analysis of Clean Max Enviro Energy Solutions IPO

Strength and Opportunities

- Strong brand presence in renewable energy sector

- Expertise in end-to-end solar energy solutions

- Strong client base across multiple industries

- Presence in multiple geographies (India, Middle East)

- Focus on reducing carbon footprints for businesses

- Innovative business model with customized solar solutions

- Strong growth trajectory in renewable energy sector

- Potential for growth in the commercial and industrial sectors

- Growing focus on sustainability and green energy initiatives

- Strategic partnerships with global companies

Risks and Threats

- High dependency on government policies for incentives

- Limited diversification beyond solar power

- Intense competition from established energy providers

- Challenges in scaling operations in new markets

- Fluctuations in solar energy market demand

- High upfront capital requirements for new projects

- Technological risks related to solar power advancements

- Potential regulatory hurdles in international markets

- Price sensitivity due to competitive pricing in the renewable sector

- Dependency on weather conditions affecting solar energy production.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Clean Max Enviro Energy Solutions Limited

Clean Max Enviro Energy Solutions Limited IPO Strengths

Market Leadership in the C&I Sector

CleanMax Enviro Energy Solutions has a strong position in the commercial and industrial (C&I) segment, holding a 12% share of renewable energy capacity additions. The company is well-positioned to capitalize on the increasing corporate demand for sustainable energy, as more businesses commit to decarbonization and “Net Zero” targets. Its expertise in both onsite and offsite renewable energy solutions meets this rising need.

Capitalizing on India’s Renewable Energy Growth

CleanMax Enviro Energy Solutions is poised to benefit from India’s significant renewable energy growth. The company is well-positioned to leverage the projected 12-15% CAGR in the sector, particularly within solar, wind, and hybrid technologies. Its portfolio of long-term Power Purchase Agreements (PPAs) and backing from global investors ensure stable and sustained growth amidst this rapid expansion.

Strategic Focus on EPC Services and Government Initiatives

CleanMax’s specialization in engineering, procurement, and construction (EPC) services aligns with government policies and increasing private sector investments. This focus allows the company to benefit from national initiatives aimed at boosting renewable energy infrastructure. The company’s business model is well-aligned with the broader economic and regulatory environment, which supports its continued expansion.

Based on the information you provided, here are the other two strengths of CleanMax Enviro Energy Solutions Limited rephrased in the third person, each with its own heading and within the 55-word limit.

Stable Growth and Investor Confidence

CleanMax’s extensive portfolio of long-term Power Purchase Agreements (PPAs) ensures stable revenue and a clear growth trajectory. The company’s strong backing from global investors, including Brookfield Global Transition Fund, provides crucial financial flexibility and capital for continued expansion, positioning it to meet India’s ambitious renewable energy capacity targets.

Strong Client Base and Repeat Business

The company has cultivated a robust client base, including major multinational corporations like Google, Apple, and HCL. This is a significant strength, demonstrated by a high rate of repeat business, with roughly 70% of new projects originating from existing customers. This speaks to CleanMax’s ability to deliver reliable and effective solutions.

More About Clean Max Enviro Energy Solutions Limited

CleanMax Enviro Energy Solutions Limited, India’s largest commercial and industrial (C&I) renewable energy provider as of March 31, 2025, has emerged as a key player in the renewable energy sector. With 2.54 GW of operational capacity and 2.53 GW of contracted capacity as of July 31, 2025, the company offers a comprehensive suite of decarbonization solutions. Specializing in renewable power generation and energy services, CleanMax serves both technology and conventional C&I customers across diverse industries such as data centres, manufacturing, and infrastructure.

Core Services and Expertise

Renewable Energy Solutions

CleanMax provides a wide range of renewable energy services, focusing on:

- Onsite Energy Solutions: Solar power plants installed at customer premises.

- Offsite Energy Solutions: Renewable energy sourced from CleanMax’s farms, including solar, wind, and hybrid energy plants.

These services are tailored to meet the specific needs of corporate clients, helping them achieve their Net Zero and decarbonization goals.

Engineering and Operations

With nearly 15 years of industry experience, CleanMax offers a range of services including:

- Engineering, Procurement, and Construction (EPC)

- Operations and Maintenance (O&M): These services are provided for renewable energy plants at both onsite and offsite locations.

Business Model and Market Presence

Tailored Contracting for Corporate Clients

Unlike utility-scale renewable energy developers, CleanMax focuses on customer-specific contracting. It works closely with clients, offering bespoke renewable energy solutions. This has helped the company build long-term relationships with over 530 customers by Fiscal 2025, with a repeat customer rate of 77.28% in its contracted capacity.

Market Leadership

CleanMax holds a 12% share in India’s annual open access renewable energy capacity additions for C&I customers in Fiscal 2024. The company enjoys significant presence in key markets like Gujarat and Karnataka, which host most of its operational capacity.

Financial Performance

CleanMax has consistently demonstrated strong financial growth, with a 52.71% CAGR in renewable energy power sales revenue from Fiscal 2023 to Fiscal 2025. This growth is well above the median revenue growth rate of its peers, at 20.08%, as per CRISIL’s report. The company has also shown a disciplined approach to balance sheet risk management and maintains a robust cash return on invested capital (ROIC) of 13.03% and cash return on equity (ROE) of 17.73%.

Future Growth and Investments

CleanMax’s expansion strategy is supported by strategic investments, including partnerships with global renewable energy investors like Brookfield and Augment India I Holdings. The company’s portfolio continues to grow, and its energy offerings are strategically diversified across multiple geographical regions.

Renewable Energy Segments

CleanMax’s offerings are divided into two key segments:

- Renewable Energy Power Sales: This includes both onsite and offsite renewable power generation for corporate clients.

- Renewable Energy Services: The company also provides capital expenditure services for turnkey renewable energy projects, as well as carbon services to help clients achieve their carbon neutrality targets.

By focusing on premium, customer-centric offerings, CleanMax is poised for sustained growth and continues to lead the renewable energy transition in India’s commercial and industrial sectors.

Industry Outlook

The renewable energy sector in India is witnessing rapid growth, driven by increasing demand for clean energy and the government’s push towards achieving sustainability goals. India is committed to meeting its renewable energy target of 500 GW by 2030, and this sector is expected to play a pivotal role in the country’s energy transition.

Growth Prospects & Future CAGR

- The Indian renewable energy market is projected to grow at a CAGR of 12-15% from 2025 to 2030, driven by advancements in solar, wind, and hybrid energy technologies.

- Renewable energy’s share in India’s power generation is expected to increase from 24% in 2024 to over 50% by 2030, offering significant growth opportunities for industry players.

Growth Drivers

- Government Initiatives: Policies like the National Action Plan on Climate Change and Ujjwal Bharat are accelerating the adoption of renewable energy solutions.

- Technological Advancements: Improved efficiency of solar panels, wind turbines, and energy storage systems are reducing costs and increasing market adoption.

- Corporate Decarbonization: Companies are increasingly prioritizing Net Zero commitments, creating demand for sustainable energy solutions like those provided by CleanMax.

Key Figures & Values

- Total Renewable Capacity: India’s total renewable energy capacity is expected to reach 175 GW by 2025, with solar power contributing the largest share.

- Investment Growth: Private investments, particularly in commercial and industrial (C&I) sectors, are expected to surge, with global investors focusing on India’s renewable energy potential.

Products & Services in Focus

For CleanMax, its focus on Onsite and Offsite renewable energy solutions positions it well to cater to the growing demand in both the corporate and industrial sectors. With a 12% market share in C&I renewable energy capacity additions, CleanMax is set to benefit from India’s green energy transition, ensuring continued growth in both power sales and renewable energy services.

How Will Clean Max Enviro Energy Solutions Limited Benefit

- CleanMax Enviro Energy Solutions Limited will benefit from India’s renewable energy growth by tapping into the projected 12-15% CAGR in the sector, particularly in solar, wind, and hybrid technologies.

- The company’s strong market presence in the C&I segment, with a 12% share of renewable energy capacity additions, positions it to capitalize on the expanding corporate demand for sustainable energy.

- CleanMax’sexpertise in Onsite and Offsite renewable energy solutions aligns with the rising demand for corporate decarbonization and Net Zero commitments.

- With India’s renewable energy capacity expected to reach 175 GW by 2025, CleanMax’s portfolio of long-term PPAs and its global investor backing ensure stable growth and continued expansion.

- The company’s focus on engineering, procurement, and construction (EPC) services will benefit from government initiatives and private investments flowing into the sector.

Peer Group Comparison

| Name of Company | Face Value | Revenue

(₹ Million) |

EPS (₹) | NAV

(₹) |

RoNW (%) |

| CleanMax Enviro Energy Solutions Ltd | 1 | 14,957.01 | 2.88 | 250.93 | NA |

| Peer Group | |||||

| ACME Solar Holdings Ltd | 2 | 14,051.31 | 4.55 | 74.54 | 42.38 |

| NTPC Green Energy Ltd | 10 | 22,096.40 | 0.67 | 21.88 | 150.10 |

| Adani Green Energy Limited | 10 | 112,120.00 | 8.37 | 58.63 | 113.39 |

| ReNew Energy Global PLC | $0.0001 USD | 97,513.00 | 10.92 | 310.40 | 46.63 |

Key Strategies for Clean Max Enviro Energy Solutions Limited

Market Leadership in C&I Renewables and Customer Relationships

CleanMax Enviro Energy Solutions Limited aims to solidify its leadership in India’s commercial and industrial (C&I) renewable energy sector by leveraging its extensive track record, flexible solutions, and pan-India presence. By developing land, wind, and solar evacuation pipelines, the company seeks to tap into key high-potential states, strengthening relationships with technology and conventional C&I customers. Expanding its footprint to new geographies such as Saudi Arabia further supports its growth ambitions.

Execution Excellence and ESG Focus

The company focuses on maintaining high standards of project delivery, safety, and operational performance as it scales operations. Strengthening in-house capabilities in land aggregation, EPC, and asset management, CleanMax aims to improve plant availability and lifecycle optimization. Additionally, the company remains committed to embedding environmental, social, and governance (ESG) considerations into all operational phases.

Incorporation of BESS in Renewable Energy Solutions

CleanMax plans to integrate Battery Energy Storage Systems (BESS) into its renewable energy offerings, in response to growing demand for flexible, reliable power solutions. With the declining cost of storage and supportive policies, CleanMax is evaluating strategic partnerships to scale BESS integration, meeting the evolving needs of C&I customers.

Scaling Carbon Services

The company is capitalizing on the rapidly growing global carbon markets by expanding its carbon services offering. By leveraging its expertise in renewable energy and sustainability, CleanMax aims to position itself as a leader in the voluntary carbon market, supported by dedicated teams for project origination, registration, and advisory.

Expanding Renewable Energy Services

In addition to carbon services, CleanMax plans to grow its Renewable Energy Services segment by exploring opportunities in wind turbine O&M services, turnkey Capex solutions, and potential energy efficiency offerings. These services aim to deepen customer relationships while positioning CleanMax to meet future energy demands.

Focus on Capital Efficiency

CleanMax intends to enhance capital efficiency to support future growth. By pursuing co-investment partnerships with major global investors, the company aims to achieve non-dilutive growth, retaining majority control while improving overall unit economics. This disciplined approach will ensure sustainable financial health and long-term success.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Clean Max Enviro Energy Solutions Limited IPO

How can I apply for Clean Max Enviro Energy Solutions Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of CleanMax Enviro Energy Solutions Limited’s IPO?

The IPO size is ₹5,200 crores, consisting of a ₹1,500 crore fresh issue and a ₹3,700 crore offer for sale.

What is the purpose of the funds raised in CleanMax’s IPO?

The proceeds will be used to repay outstanding borrowings and for general corporate purposes.

What is the listing date for CleanMax Enviro Energy Solutions Limited’s IPO?

The exact listing date is yet to be announced, but the IPO will be listed on BSE and NSE.

Who are the lead managers and registrar for the CleanMax IPO?

Axial Capital Pvt. Ltd. is the book running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar for the issue.

What are the key financials for CleanMax Enviro Energy Solutions Ltd.?

For FY March 2025, CleanMax reported a revenue of ₹1,610.34 million, with a profit after tax of ₹19.43 million.