- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

CMR Green Technologies IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

CMR Green Technologies Limited

CMR Green Technologies Limited is a leading non-ferrous metal recycler in the secondary aluminium market, with expertise in aluminium and zinc die-casting alloys. It manufactures recycled aluminium alloys in both ingot and liquid form, zinc alloy ingots, and furnace-ready scrap including stainless steel, copper, brass, zinc, lead, and magnesium. The company also produces aluminium billets for automotive and non-automotive industries. Its clientele includes major OEMs and Tier-1 automotive manufacturers such as Honda Cars India, Bajaj Auto, Hero MotoCorp, Royal Enfield, Maruti Suzuki, and Jindal Stainless.

CMR Green Technologies Limited IPO Overview

CMR Green Technologies Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on August 29, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is a Book Build Issue comprising a complete offer for sale of up to 4.29 crore shares. The equity shares will be listed on both NSE and BSE. Equirus Capital Pvt. Ltd. is acting as the book-running lead manager, while Kfin Technologies Ltd. is the registrar. Details such as IPO dates, price band, and lot size are yet to be announced. The promoters of the company include Mohan Agarwal, Pratibha Agarwal, Akshay Agarwal, and Raghav Agarwal, with a pre-issue holding of 86.95%.

CMR Green Technologies Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | NA |

| Fresh Issue | NA |

| Offer for Sale (OFS) | 4.29 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 21,90,55,489 shares |

| Shareholding post-issue | TBA |

CMR Green Technologies IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

CMR Green Technologies Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

CMR Green Technologies Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹6.50 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 31.08% |

| Net Asset Value (NAV) | ₹20.93 |

| Return on Equity (RoE) | 10.83% |

| Return on Capital Employed (RoCE) | 11.02% |

| EBITDA Margin | 5.55% |

| PAT Margin | 2.51% |

| Debt to Equity Ratio | 0.58 |

Objectives of the IPO Proceeds

- Being entirely an OFS issue, the IPO proceeds will entirely go to the selling shareholders, and the company will not use the proceeds for corporate purposes.

Based on this format-

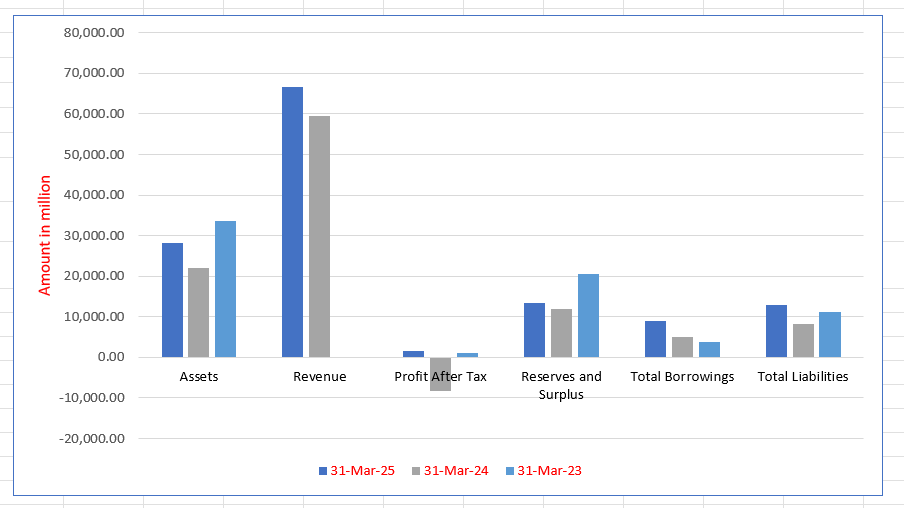

CMR Green Technologies Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 28,158.61 | 21,944.08 | 33,516.61 |

| Revenue | 66,664.85 | 59,524.42 | 58.685.07 |

| Profit After Tax | 1,550.38 | (8385.57) | 1,045.07 |

| Reserves and Surplus | 13,288.38 | 11,879.92 | 20,647.60 |

| Total Borrowings | 8940.33 | 4986.52 | 3681.86 |

| Total Liabilities | 12,945.71 | 8280.08 | 11,138.44 |

Financial Status of CMR Green Technologies Limited IPO

SWOT Analysis of CMR Green Technologies IPO

Strength and Opportunities

- Market leader in recycled aluminium and zinc die-casting alloys in India, with high domestic share.

- Extensive production capacity across 12 plants, set to reach ~500,000 tpa by FY2025.

- Strong technical capabilities supported by advanced technology and joint ventures with global partners.

- Hub-and-spoke molten aluminium supply model ensures logistical efficiency and reliability.

- Comfortable financial profile with healthy accruals, low leverage, and strong coverage metrics.

- Diversification into recycled steel, copper, and other metals beyond aluminium.

- Plants located strategically near auto clusters, improving customer proximity and delivery.

- Expansion of new plants expected to boost revenues and capacity significantly by FY2026.

- Strong positioning as a green and sustainable recycling brand with long-term growth prospects.

Risks and Threats

- Operating margins have declined from 9–11% earlier to around 3–6%, reflecting cost pressures.

- Highly vulnerable to raw material price volatility and limited ability to pass on cost increases.

- Customer concentration risk, with significant revenue from a few key clients.

- High dependence on cyclical automotive demand, exposing the business to industry downturns.

- Debt-funded expansion projects may increase gearing and liabilities in the short term.

- Working capital intensive operations, requiring careful receivables and inventory management.

- Increasing competition and capacity expansions by peers putting pressure on margins.

- Any further large debt-funded expansion could weaken the financial profile.

- Modest pricing power with customers may restrict margin recovery.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About CMR Green Technologies Limited

CMR Green Technologies Limited IPO Strengths

Market Leadership and Scale

CMR Green Technologies Limited is India’s leading aluminium recycler with significant entry barriers. It holds the highest market share and possesses an installed capacity approximately four times larger than its nearest domestic competitor. This scale, coupled with a ~23% revenue CAGR since FY2007, solidifies its position as a critical enabler for the industry’s decarbonization.

Dominance in Liquid Aluminium Supply

The company is India’s largest supplier of recycled liquid aluminium. This operation requires high technical expertise and proximity to customers, creating strong entry barriers. By delivering molten metal directly to client facilities, CMR provides significant cost and energy savings while substantially reducing CO₂ emissions, fostering deep, interdependent customer relationships.

Strong and Diversified Global Supplier Base

CMR ensures operational continuity through a robust, diversified global network of approximately 198 suppliers across 73 countries. This extensive base mitigates supply chain risks, allows for competitive raw material procurement, and provides leverage to negotiate favourable terms. The company specializes in sourcing mixed scrap, securing future availability.

Long-Standing Customer Relationships

The company maintains enduring relationships with major automotive OEMs and Tier-1 suppliers, with some partnerships exceeding 19 years. This is evidenced by a 97.4% revenue retention rate in Fiscal 2025. These deep ties provide revenue visibility and a strong platform for expansion into new alloy segments and non-automotive markets.

Strategic Joint Ventures with Global Leaders

CMR strengthens its technological and market reach through strategic joint ventures with renowned Japanese firms like Toyota Tsusho Corporation and Nippon Light Metal. These alliances provide access to advanced technology, enhance product quality, and aid in developing long-term customers, creating a significant competitive edge unmatched by domestic peers.

Advanced Manufacturing and Technology Infrastructure

With 13 strategically located plants, CMR employs advanced technologies like AI-powered supply chain systems, automated sorting, and patented processes for liquid metal transport. Its stringent quality control results in a remarkably low defect rate (~0.07%). This tech-driven infrastructure ensures efficiency, scalability, and consistent high-quality product delivery.

ESG Leadership and Sustainable Impact

CMR’s core business is inherently sustainable, with recycling using 95% less energy than primary production. It holds a top S&P Global CSA sustainability score and has saved millions of kgs of CO₂ emissions. The company is a key driver of India’s circular economy, reducing mining impacts and supporting industrial decarbonization

More About CMR Green Technologies Limited

CMR Green Technologies: A Market Leader in Non-Ferrous Metal Recycling

CMR Green Technologies Limited is a leading non-ferrous metal recycler in India, holding the highest market share in the secondary aluminium market by revenue for the fiscal year 2025. The company’s installed capacity is approximately four times that of its nearest domestic competitor as of March 31, 2025, and it ranks among the largest players in the global aluminium recycling industry. This dominant position is further reinforced by its geographically diversified business model, with revenue generation from North, West, and South India.

Sustainable Products and Environmental Leadership

The company’s product portfolio includes recycled aluminium alloys (ingot and liquid), zinc alloy ingots, and segregated furnace-ready scrap. These products are manufactured to cater to both the automotive and non-automotive sectors. A core pillar of the business is its commitment to sustainability. This is highlighted by the significant environmental benefits of its products:

- Reduced Carbon Footprint: The production of recycled aluminium emits only 0.3 tonnes of CO2 per tonne, a stark contrast to the 14 tonnes emitted by primary aluminium production in India.

- Lower Capital Expenditure: Secondary aluminium production requires approximately 90% less capital expenditure compared to primary production.

- Endless Recyclability: Aluminium is endlessly recyclable without any loss in quality, making it an ideal material for sustainable industrial use.

Furthermore, CMR Green Technologies Limited has the 6th highest score in the S&P Global Corporate Sustainability Assessment among companies in the aluminium industry.

Strategic Expansion and Operational Excellence

CMR Green Technologies Limited has strategically expanded its market presence by entering the extrusion and rolled alloy segments. This move has opened up new growth opportunities by expanding its serviceable market to include a significant portion of the total recycled aluminium market in India. The company operates 13 strategically located recycling facilities and has a strong customer base, including top OEMs and Tier 1 companies like Honda Cars India Limited and Bajaj Auto Limited. The company’s long-standing customer relationships and operational expertise have been key to sustaining stable long-term demand. The market for recycled aluminium in India is projected to grow substantially, reaching a volume of 3.71 million MT by FY2030, representing a CAGR of 11.2%

Industry Outlook

Market Growth & Projections

- India’s aluminium scrap market was valued at around USD 3.8 billion in 2024 and is expected to reach nearly USD 11.3 billion by 2034, growing at a strong CAGR of about 10.9%.

- The broader aluminium market (primary and secondary) is forecast to rise from USD 17.5 billion in 2024 to USD 36.8 billion by 2035, at a CAGR of around 6.5%.

Sector Drivers

- Key demand drivers include rapid automotive growth, especially the rise of electric vehicles and lightweighting trends, infrastructure expansion, and stricter sustainability mandates.

- The automotive sector alone accounts for approximately 40% of secondary aluminium demand and is set to grow further as vehicle electrification accelerates.

- Recycling infrastructure investments, technology improvements such as AI-driven sorting and advanced melting systems, and government incentives are expected to support growth.

Segment-Specific Insights

- Automotive end-use is the leading demand segment for recycled aluminium, projected to expand at a CAGR of about 11.7%.

- Old scrap (end-of-life aluminium) is the largest source of supply, with growth near 9.8% CAGR, while packaging and electronic scrap segments are also expanding at close to 9.9% CAGR.

- On a national scale, the overall aluminium industry is estimated to grow at about 7.4% CAGR between 2025 and 2031.

How Will CMR Green Technologies Limited Benefit

- Increased demand for recycled aluminium in the automotive sector will directly boost CMR’s sales and utilisation of its existing capacity.

- Expansion into extrusion and rolled alloy segments positions the company to capture a larger share of the growing recycled aluminium market.

- Strategic location of 13 recycling facilities enables faster delivery to high-demand regions, strengthening customer relationships.

- Technological expertise in sorting, melting, and molten metal delivery provides a competitive advantage as demand grows.

- Government incentives and sustainability policies support growth in the secondary aluminium sector, enhancing profitability.

- Rising focus on lightweight and green materials aligns with CMR’s environmentally sustainable products, increasing market appeal.

- Long-term customer contracts with top OEMs ensure stable revenue streams amid market growth.

- Capacity expansion and operational efficiency improvements allow CMR to scale production to meet projected industry growth.

- Increased end-of-life scrap availability reduces raw material costs and supports circular economy initiatives.

Peer Group Comparison

| Name of Company | Face Value (₹) | Total Income (₹) | EPS (₹) | NAV (₹) | P/E | RONW (%) |

| CMR Green Technologies Limited | 2 | 66,966.63 | 6.50 | 6.50 | 20.93 | NA |

| Peer Group | ||||||

| Pondy Oxides and Chemicals Limited | 5 | 20,591.56 | 13.60 | 13.56 | 210.82 | 82.70 |

| Gravita India Limited | 2 | 39,806.10 | 45.11 | 45.11 | 280.44 | 39.76 |

| Baheti Recycling Industries Limited | 10 | 5,245.39 | 17.37 | 17.37 | 57.02 | 32.69 |

Key Strategies for CMR Green Technologies Limited

Diversification into New Metals and Sectors

CMR Green Technologies plans to diversify into recycling lithium-ion batteries, copper, and lead, capitalizing on EV and energy storage trends. This strategy, supported by new regulations, expands its reach beyond automotive into packaging and aerospace, reducing market concentration risks and positioning it as an integrated recycling leader.

Capitalizing on the Green Aluminium Boom

The company will leverage the growing global demand for low-carbon, recycled aluminium. CMR aims to help customers reduce costs and carbon footprints, ensuring compliance with international policies like the EU’s CBAM. This positions CMR to benefit from supportive government initiatives and shifting market preferences.

Expansion into Wrought Alloys and Partnerships

CMR is expanding into high-growth wrought aluminium segments for extrusions and rolled products, servicing construction and EV battery enclosures. Its new plants and partnerships with primary producers, backed by long-term contracts, diversify its product portfolio and provide stable, visible revenue streams while supporting customer decarbonization goals.

Leveraging Automotive Sector Trends

CMR is poised to benefit from increased aluminium usage in both EVs and ICE vehicles. With higher aluminium intensity in SUVs and EVs, and supported by government schemes, the company’s strong OEM relationships position it to capture this growing demand driven by lightweighting and EPR norms.

Continuous Technological Investment

The company is committed to continuous investment in advanced technology and capacity expansion. This includes pursuing strategic joint ventures for new capabilities, implementing cost-saving automation, and enhancing its proprietary IT systems to improve operational efficiency, maintain product quality, and support scalable, integrated operations

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On CMR Green Technologies Limited IPO

How can I apply for CMR Green Technologies Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the offer size of CMR Green Technologies IPO?

The IPO is entirely an Offer For Sale of 4.29 crore equity shares.

Will the company use the IPO proceeds?

No, the IPO proceeds will go entirely to the selling shareholders the company will not receive any funds.

On which stock exchanges will the shares be listed?

The equity shares are proposed to be listed on the Mainboard of BSE and NSE.

What is the face value of each equity share?

Each equity share has a face value of ₹ 2.