- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Commtel Networks IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Commtel Networks IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Commtel Networks Limited

Commtel Networks Ltd. is a specialised engineering and technology firm providing integrated telecommunications, security, and safety systems (iTSS) for critical national infrastructure, mainly in the oil & gas and power sectors. Recognised as one of India’s top iTSS vendors, it delivers turnkey and engineering services, offering end-to-end project execution and long-term system support. As of March 31, 2025, the company integrated 44 technologies, completed 600 projects across 19 countries, and served 463 clients, including Indian Oil and Hindustan Petroleum.

Commtel Networks Limited IPO Overview

Commtel Networks Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 29, 2025, intending to raise capital through an Initial Public Offer (IPO). The proposed IPO will be a book-built issue with a total size of ₹900 crore, which includes a fresh issue of shares worth ₹150 crore and an offer for sale (OFS) of ₹750 crore. The company plans to list its equity shares on both the NSE and BSE. Equirus Capital Pvt. Ltd. has been appointed as the book-running lead manager, while MUFG Intime India Pvt. Ltd. will serve as the registrar of the issue. Details such as the IPO opening and closing dates, price band, and lot size are yet to be announced. Investors can refer to the Commtel Networks IPO DRHP for further information.

The IPO will have a face value of ₹2 per share and will follow the book-building process. The total issue size aggregates up to ₹900 crore, comprising a fresh issue of ₹150 crore and an offer for sale amounting to ₹750 crore. Post-issue, the equity shares will be listed on the BSE and NSE. Prior to the IPO, the company has a total shareholding of 5,09,80,877 equity shares.

Commtel Networks Ltd. is promoted by Shriprakash R. Pandey and Dinesh Pandey. The promoters currently hold 76.82% of the company’s shares before the issue, and their shareholding will be diluted post-IPO.

Commtel Networks Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹150 crore |

| Offer for Sale (OFS) | ₹750 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 5,09,80,877 shares |

| Shareholding post-issue | TBA |

Commtel Networks IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Commtel Networks Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Commtel Networks Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹21.80 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 27.51% |

| Net Asset Value (NAV) | ₹80.97 |

| Return on Equity (RoE) | 24.90% |

| Return on Capital Employed (RoCE) | 21.41% |

| EBITDA Margin | 21.05% |

| PAT Margin | 17.27% |

| Debt to Equity Ratio |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment or prepayment, in full or in part, of all or a portion of certain outstanding borrowings availed by our Company | |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

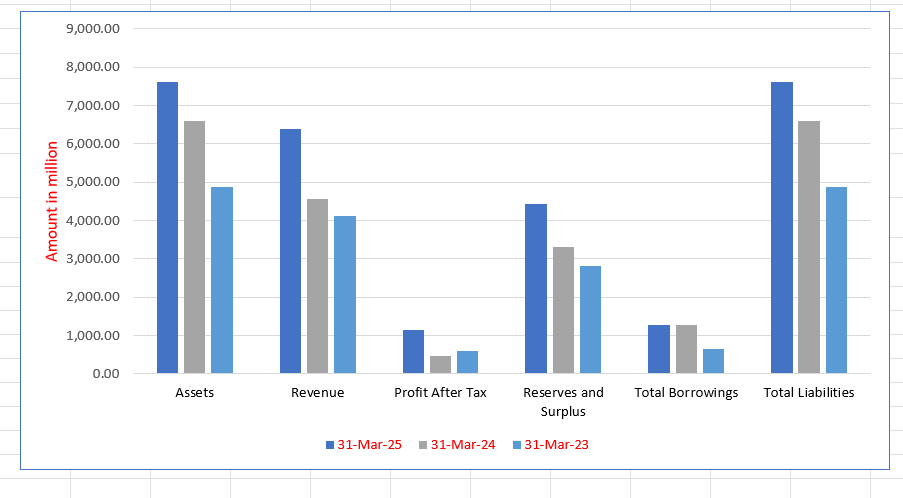

Commtel Networks Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 7,622.38 | 6,600.20 | 4,877.83 |

| Revenue | 6,392.51 | 4,569.42 | 4,122.69 |

| Profit After Tax | 1,135.60 | 474.98 | 601.06 |

| Reserves and Surplus | 4,437.22 | 3,304.92 | 2,807.43 |

| Total Borrowings | 1,278.59 | 1,284.04 | 654.46 |

| Total Liabilities | 7,622.38 | 6,600.20 | 4,877.83 |

Financial Status of Commtel Networks Limited

SWOT Analysis of Commtel Networks IPO

Strength and Opportunities

- Over 25 years of expertise in delivering integrated iTSS solutions for critical national infrastructure.

- Global presence with more than 600 projects completed across 19 countries and over 400 clients.

- Offers end-to-end turnkey and lifecycle services, ensuring recurring revenue and long-term partnerships.

- Focus on AI-driven monitoring, predictive maintenance, and digital operations enhances innovation edge.

- Certified for quality, safety, and data security standards, strengthening client trust and credibility.

- Growing demand for infrastructure safety and digital transformation drives new business opportunities.

- Scope to expand into new geographies and diversify into emerging industries.

- Proprietary lifecycle management models provide a strong competitive advantage.

- Strong reputation among major clients, ensuring credibility for large-scale contracts.

Risks and Threats

- Heavy dependence on niche sectors like oil & gas and power, limiting diversification.

- Long project execution cycles create risks of cost overruns and delayed client payments.

- Continuous technology advancements demand high R&D investment to stay competitive.

- Exposure to currency fluctuations and geopolitical uncertainties from global operations.

- Faces stiff competition from global system integrators with greater financial resources.

- Rising costs of components and supply-chain disruptions may impact margins.

- Cybersecurity risks and changing regulations can affect operations and compliance.

- Rapid technological evolution requires constant workforce upskilling and training.

- Fluctuations in the oil & gas sector can affect project inflows and revenues.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Commtel Networks Limited

Commtel Networks Limited IPO Strengths

Extensive CNI Domain Expertise and Integration Capability

Commtel Networks Limited (CNL) possesses 26 years of domain experience in the oil, gas, and power sectors, serving over 463 customers. This extensive track record allows CNL to anticipate complex operational requirements and meet stringent prequalification standards for Critical National Infrastructure (CNI) projects. Furthermore, its vendor-agnostic integration provides customers with necessary flexibility in technology selection.

Technical Mastery of Complex Industrial Design Facets

CNL has developed specialized competencies in designing high-reliability, industrial-grade iTSS systems for extreme CNI environments, such as offshore platforms and explosive atmospheres. This technical expertise is built on six fundamental design facets, including RAMS (Reliability, Availability, Maintainability, and Safety) framework implementation, compliance, and effective operational environment adaptation, ensuring design adequacy.

Strategically Located Global Integration Centers

The company operates primary integration and delivery centers in Navi Mumbai (India) and Sharjah (UAE), enabling diversified implementation capabilities for global customers. These centers replicate entire customer networks for rigorous pre-deployment testing, ensuring consistent quality and significantly reducing on-site installation time and complexity, while leveraging regional logistical and technical advantages.

Long-Term Customer and EPC Contractor Relationships

CNL maintains strong, long-term relationships with key Indian oil, gas, and power companies, with top customers averaging over 10 years of association. Crucially, its relationships with global EPC contractors provide extensive market access and operational advantages, reducing bidding costs and commercial risks while continuously fostering technical innovation through collaborative association.

Robust OEM Partnerships and Technology Agnosticism

CNL’s technology ecosystem relies on strategic, comprehensive OEM partnerships spanning all major iTSS categories, cultivated through extensive project experience. This provides access to specialized, industrial-grade equipment. The company’s vendor-agnostic approach ensures seamless interoperability across diverse systems, avoiding vendor dependency, and is demonstrated by integrating up to 20 distinct OEM technologies per project.

Strong Order Backlog Providing Revenue Visibility

The company maintains a substantial Order Backlog, which reflects its operational capabilities and underpins its future growth and profitability. This backlog, along with a diversified customer base, provides revenue certainty and diversification, mitigating risks associated with the loss of a key customer. This strong pipeline ensures business continuity and supports sustainable growth.

Qualified Leadership with Deep Domain Expertise

The company is led by qualified and experienced Promoters who have been instrumental in shaping its growth, supported by an accomplished management team. This leadership structure possesses substantial domain knowledge and sectoral experience, providing a competitive advantage and the necessary flexibility and agility to adapt to future business needs and capitalize on emerging market opportunities.

More About Commtel Networks Limited

Commtel Networks Limited is a specialised engineering and technology company with over 26 years of experience in designing, building, and implementing integrated telecommunication, security, and safety (iTSS) systems for critical national infrastructure (CNI). The company primarily focuses on the oil and gas and power sectors.

Defining Critical National Infrastructure

CNI represents the essential systems, assets, and networks that support a nation’s economic growth, public safety, and security. It encompasses both physical and digital infrastructure, including:

- Power grids, transportation, and water systems

- Healthcare and financial networks

- Communication and defence systems

Commtel Networks Limited designs integrated technology platforms that serve as the digital nervous system of CNI, ensuring secure connectivity and uninterrupted real-time operations.

Industry Leadership

According to the F&S Report, Commtel Networks Limited is one of India’s leading iTSS vendors with global coverage, specialising in converged telecommunications, security, surveillance, and safety system integration.

- As of March 31, 2025, the company has integrated 44 technology systems within the iTSS framework.

- It has successfully completed over 600 projects across 19 countries, serving more than 400 clients.

Comprehensive Service Model

Commtel Networks Limited offers a lifecycle-based business model, covering both:

- Turnkey Project Delivery – complete end-to-end system design, integration, commissioning, and handover.

- Engineering Services – field engineering, digital operations, and lifecycle management ensuring system reliability for up to 20 years.

This approach creates long-term partnerships and recurring revenue streams through maintenance, optimisation, and upgrade services.

Global Projects and Expertise

Notable projects include:

- iTSS systems for one of the world’s largest refineries in Kuwait

- A floating LNG project in Mexico

- A digital communication network for a gas field in Turkmenistan

Leadership and Vision

Guided by experienced promoters with over 29 years in the industry, and a professional management team, Commtel Networks Limited continues to strengthen its position as a trusted technology partner for mission-critical infrastructure worldwide.

Industry Outlook

Telecommunication and System Integration Segment

India’s telecommunication and system integration industry is witnessing significant expansion, driven by digital transformation and infrastructure modernisation. The Indian telecom market, valued at around USD 192.7 billion in 2023, is projected to grow at a CAGR of about 9.2% from 2024 to 2030, reaching nearly USD 356.8 billion.

The system integration market in India, which includes infrastructure, application integration, and consulting services, is expected to rise from USD 22.17 billion in 2023 to USD 65.91 billion by 2030, at a CAGR of approximately 16.8%.

Growth drivers include:

- Rapid rollout of 5G networks and increasing network complexity.

- Expansion of IoT, cloud computing, and smart infrastructure across oil, gas, and power sectors.

- Greater investment in critical national infrastructure (CNI) and industrial communication networks.

These trends strongly align with Commtel Networks Limited’s expertise in integrated telecommunication systems and digital connectivity platforms.

Security, Surveillance, and Critical Infrastructure Protection

India’s electronic security market is projected to grow from USD 3.05 billion in 2025 to USD 5.19 billion by 2030, registering a CAGR of around 11.2%. Similarly, the cybersecurity market is expected to expand from USD 10.84 billion in 2025 to USD 20.59 billion by 2032, at a CAGR of 9.6%.

The critical infrastructure protection (CIP) sector is estimated to reach USD 9.5 billion by 2033, growing at about 4.7% CAGR.

Key drivers include:

- Rising cyber and physical security threats to vital infrastructure.

- Government-led smart city and infrastructure modernisation programmes.

- Growing demand for integrated telecom, security, and safety solutions.

With its converged iTSS offerings, Commtel Networks Limited is strategically positioned to benefit from India’s accelerating focus on secure, interconnected, and resilient infrastructure systems.

How Will Commtel Networks Limited Benefit

- Growing investments in 5G deployment and industrial connectivity will drive demand for Commtel’s integrated telecommunication and digital networking solutions.

- Expansion of IoT, cloud, and data-driven operations across energy and power sectors aligns with the company’s expertise in creating intelligent communication frameworks.

- Rising need for critical infrastructure protection positions Commtel as a preferred partner for secure and resilient system integration.

- Government initiatives promoting smart cities, modern power grids, and digital safety networks will generate long-term project opportunities.

- Increasing adoption of converged security and monitoring systems enhances demand for the company’s iTSS offerings.

- Its strong global project execution experience enables Commtel to deliver end-to-end, future-ready technology solutions, strengthening its market leadership in critical national infrastructure sectors.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue from Operations (₹ million) | EPS (₹) | NAV (per share) (₹) | P/E | RoNW (%) |

| Commtel Networks Limited | 2 | 6,392.51 | 21.80 | 80.97 | NA | 27.51% |

| Peer Group | ||||||

| ABB India Limited | 2 | 1,21,883.10 | 88.32 | 333.49 | 60.57 | 26.48% |

| Honeywell Automation India Limited | 10 | 41,896.00 | 592.15 | 4,578.51 | 62.41 | 12.93% |

| Hitachi Energy India Limited | 2 | 63,849.30 | 90.36 | 945.76 | 220.94 | 9.11% |

| Nelco Limited | 10 | 3,048.70 | 4.18 | 55.97 | 201.70 | 7.46% |

Key Strategies for Commtel Networks Limited

Sectoral Diversification and Capability Expansion

Commtel Networks Limited (CNL) plans to leverage its core expertise in oil and gas and power to diversify into new CNI sectors like transportation, mining, defense, and government. The strategy includes continuous operational enhancement through expanding delivery centers and investing in advanced testing and human capital development for specialized project execution.

Strategic Geographic Market Expansion

CNL intends to capitalize on high-growth regions where infrastructure investment is accelerating, specifically expanding its presence in the GCC and North American markets. This approach is supported by established delivery capabilities and aims to serve these markets through enhanced local presence and strategic collaborations with EPC contractors and local entities.

Expanding Market Share and Strengthening Customer Bonds

The company aims to strengthen its market position in existing sectors like oil and gas and power by providing continued value and lifecycle engagement. The strategy focuses on expanding the sales team to enhance market reach and leveraging successful project completion via EPCs to secure post-handover maintenance contracts and deepen direct customer relationships.

Increasing Focus on Innovation-Led R&D Solutions

CNL will increase its expenditure and team strength for innovation-led R&D solutions with broad industry adoption. The focus is on developing proprietary solutions like NetRRA 360 (AI-based analytics) and CRIMPS (pipeline monitoring) to provide advanced engineering services, enabling predictive maintenance and intelligent lifecycle management for customers.

Exploring Inorganic Growth and Strategic Acquisitions

The firm will pursue a strategy of vigilance for inorganic growth opportunities, including strategic alliances and potential acquisitions. This aims to accelerate scale and capability development, providing access to new geographic markets and complementary technologies like cybersecurity or advanced analytics that align with its existing expertise and financial profile

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Commtel Networks Limited IPO

How can I apply for Commtel Networks Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of the Commtel Networks IPO?

The total IPO size is ₹900 crore, including a fresh issue of ₹150 crore and an OFS of ₹750 crore.

When was Commtel Networks’ DRHP filed with SEBI?

Commtel Networks Limited filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 29, 2025.

On which stock exchanges will Commtel Networks shares be listed?

The equity shares of Commtel Networks Limited are proposed to be listed on both NSE and BSE.

Who are the lead manager and registrar for the Commtel Networks IPO?

Equirus Capital Pvt. Ltd. is the book-running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar.

What will Commtel Networks use the IPO proceeds for?

The company plans to repay borrowings worth ₹109 crore and fund general corporate purposes.