- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Corona Remedies IPO

₹14,112/14 shares

Minimum Investment

IPO Details

08 Dec 25

10 Dec 25

₹14,112

14

₹1,008 to ₹1,062

NSE, BSE

₹655.37 Cr

15 Dec 25

Corona Remedies IPO Timeline

Bidding Start

08 Dec 25

Bidding Ends

10 Dec 25

Allotment Finalisation

11 Dec 25

Refund Initiation

12 Dec 25

Demat Transfer

12 Dec 25

Listing

15 Dec 25

Corona Remedies Limited

Corona Remedies is the second fastest-growing company among the top 30 in the Indian Pharmaceutical Market (IPM) based on domestic sales as of MAT December 2024. With a CAGR of 20%, it has grown over 2.25 times the IPM average CAGR of 8.79%. The company focuses on women’s healthcare, cardio-diabetology, pain management, and urology, holding strong positions across these segments. Its success stems from targeting the middle-income market, supported by a wide specialist network and strategic urban presence. Corona operates two advanced manufacturing facilities in Gujarat and Himachal Pradesh.

Corona Remedies Limited IPO Overview

Corona Remedies IPO is a book-built issue worth ₹655.37 crore, fully comprising an offer for sale of 0.62 crore shares. The subscription window opens on December 8, 2025, and closes on December 10, 2025, with the allotment expected on December 11, 2025. The company is set to list on both BSE and NSE, with the tentative listing date scheduled for December 15, 2025. The price band for the IPO is fixed between ₹1008 and ₹1062 per share, and the lot size is 14 shares. For retail investors, the minimum investment requirement is ₹14,868 based on the upper price band. The sNII category requires a bid of 14 lots (196 shares) amounting to ₹2,08,152, while bNII applicants must bid for 68 lots (952 shares), amounting to ₹10,11,024. JM Financial Ltd. is the book-running lead manager, and Bigshare Services Pvt. Ltd. serves as the registrar for the issue.

Corona Remedies Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Offer for Sale (OFS): ₹655.37 crore (Fresh Issue: NA) |

| IPO Dates | December 8, 2025 to December 10, 2025 |

| Price Bands | ₹1008 – ₹1062 per share |

| Lot Size | 14 shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding Pre-Issue | 6,11,60,088 shares |

| Shareholding Post-Issue | 6,11,60,088 shares |

Corona Remedies IPO Important Dates

| Event | Date |

| IPO Open Date | Mon, Dec 8, 2025 |

| IPO Close Date | Wed, Dec 10, 2025 |

| Tentative Allotment | Thu, Dec 11, 2025 |

| Initiation of Refunds | Fri, Dec 12, 2025 |

| Credit of Shares to Demat | Fri, Dec 12, 2025 |

| Tentative Listing Date | Mon, Dec 15, 2025 |

Corona Remedies IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 14 | ₹14,868 |

| Retail (Max) | 13 | 182 | ₹1,93,284 |

| S-HNI (Min) | 14 | 196 | ₹2,08,152 |

| S-HNI (Max) | 67 | 938 | ₹9,96,156 |

| B-HNI (Min) | 68 | 952 | ₹10,11,024 |

Corona Remedies Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Corona Remedies Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 14.80 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 24.65% |

| Net Asset Value (NAV) | 78.55 |

| Return on Equity | 27.50% |

| Return on Capital Employed (ROCE) | 41.32% |

| EBITDA Margin | 20.55% |

| PAT Margin | 12.49% |

| Debt to Equity Ratio | 0.10 |

Objectives of the IPO Proceeds

- Being entirely an OFS issues, the IPO proceeds will entirely go to the selling shareholders and the company will not use the proceeds for corporate purpose

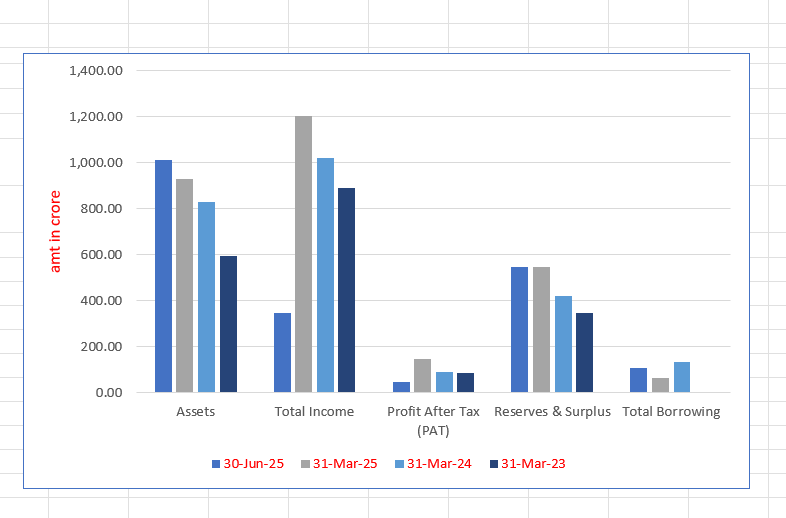

Corona Remedies Limited Financials (in crore)

| Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,012.38 | 929.86 | 830.58 | 595.02 |

| Total Income | 348.56 | 1,202.35 | 1,020.93 | 891.10 |

| Profit After Tax (PAT) | 46.20 | 149.43 | 90.50 | 84.93 |

| Reserves & Surplus | 545.86 | 545.18 | 419.25 | 347.36 |

| Total Borrowing | 106.65 | 62.70 | 134.14 | 2.33 |

Financial Status of Corona Remedies Limited

SWOT Analysis of Corona Remedies IPO

Strength and Opportunities

- Achieved a 20% CAGR, surpassing the Indian Pharmaceutical Market's 8.79% growth rate.

- Holds leadership positions: #6 in women's healthcare, #5 in pain management, #11 in urology, and #21 in cardio-diabetes segments.

- Diversified product portfolio with over 300 products across more than 70 brands in various therapeutic areas.

- Strong PAN-India marketing and distribution network with a field force of approximately 3,100 personnel.

- Two manufacturing facilities in Gujarat and Himachal Pradesh, with certifications like EU-GMP and WHO-GMP.

- Ongoing establishment of a hormone manufacturing facility in Gujarat, indicating expansion and diversification.

- Strategic focus on the middle of the pyramid market segment, targeting specialists and super-specialists.

- Backed by experienced management and support from private equity firm ChrysCapital, enhancing growth prospects.

- Healthy cash flow from operations, supporting capital expenditure and expansion plans.

Risks and Threats

- High dependency on contract manufacturing, which may affect control over production quality and timelines.

- Exposure to price-controlled and highly competitive domestic pharmaceutical formulation market.

- Regulatory risks inherent in the pharmaceutical industry, potentially impacting product approvals and market access.

- Significant increase in working capital intensity could strain financial resources.

- Dependence on a few therapeutic segments may pose risks if market dynamics shift unfavorably.

- Potential challenges in integrating acquisitions or strategic alliances effectively.

- Fluctuations in raw material prices could impact production costs and profitability.

- Changes in healthcare policies and regulations may affect business operations and strategy.

- Intense competition from both domestic and international pharmaceutical companies.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Corona Remedies Limited

Corona Remedies Limited IPO Strengths

Second Fastest Growing Pharmaceutical Company in India’s Top 30

Corona Remedies Limited ranks as the second fastest growing company among the top 30 in the Indian pharmaceutical market (IPM) by domestic sales from MAT December 2021 to MAT December 2024. With a strategic focus on high-growth therapeutic areas and brand-led marketing, the company is well-positioned to capitalise on evolving market opportunities.

Demonstrated Capabilities of Building a Diversified Portfolio, Including “Engine” Brands, in Targeted Therapy Areas

Corona Remedies Limited has consistently demonstrated portfolio strength with 67 brands across core therapy areas like women’s healthcare, cardio-diabeto, pain management, and urology. Its 27 “engine” brands, strong brand leadership, limited NLEM exposure, and strategic chronic-segment focus have driven robust, diversified growth and enabled superior market performance across MAT December 2021–2024.

Quality and cGMP-Driven Manufacturing Excellence

Corona Remedies Limited operates two advanced manufacturing units in Gujarat and Himachal Pradesh with 11 production lines and an annual capacity of 1,285.44 million units. Supported by EU GMP, WHO GMP certifications, R&D-led product innovation, and backward integration through La Chandra, the company consistently delivers differentiated, high-quality pharmaceutical products aligned with global quality standards.

Experienced Leadership Backed by Marquee Investors

Corona Remedies Limited is led by a qualified, entrepreneurial management team with deep industry experience, anchored by founders Niravkumar and Ankur Mehta. Guided by Dr. Kirtikumar Mehta and supported by seasoned professionals and marquee investor ChrysCapital, the company benefits from strong leadership, strategic direction, and robust corporate governance practices.

More About Corona Remedies Limited

Corona Remedies Limited is a branded pharmaceutical formulation company headquartered in India, actively involved in the development, manufacturing, and marketing of a wide portfolio of products. The company primarily focuses on therapeutic areas including women’s healthcare, cardio-diabetology, pain management, urology, and other multispecialty segments.

Market Position and Growth

- As per industry reports, Corona Remedies Limited ranked as the second fastest-growing company among the top 30 in the Indian Pharmaceutical Market (IPM) from MAT December 2021 to MAT December 2024.

- The company achieved a domestic sales CAGR of 19.90%, more than 2.25 times the IPM’s growth rate of 8.79%.

- This impressive performance is attributed to volume growth (9.58%) and new product launches (3.91%), outpacing the respective IPM figures of 1.65% and 1.68%.

Diverse Portfolio

As of December 31, 2024, the company’s product portfolio includes 67 brands spanning multiple therapeutic areas:

- Women’s Healthcare – Products cover all lifecycle stages, from adolescence to menopause.

- Cardio-Diabeto – Offerings address insulin resistance, diabetes complications, and cardiac disorders.

- Pain Management – Includes tablets, sprays, and injections. The acquisition of Myoril from Sanofi in FY 2024 bolstered this segment.

- Urology – Targets conditions like benign prostatic hyperplasia, urinary tract infections, and stone management.

Brand Performance

- Corona’s “engine brands” — including Cor, Trazer, Cor9, B-29, and Myoril — contributed 72.99% to domestic sales in MAT December 2024.

- The chronic and sub-chronic segments made up 69.01% of domestic sales, showing a CAGR of 22.35%, outperforming the IPM’s 9.99%.

Strategic Focus

The company has adopted a specialist-driven model by targeting the “middle of the pyramid” segment through:

- Deployment of 2,598 medical representatives across 22 states.

- 75% of prescriptions originating from specialists and super-specialists, compared to 60.97% in the overall IPM.

Market Rank and Reach

- Ranked 30th in the IPM (up from 41st in 2021).

- Sixth largest in women’s healthcare, 21st in cardio-diabeto, 5th in pain management, and 11th in urology by domestic sales (MAT December 2024)

Industry Outlook

India’s pharmaceutical industry is poised for robust expansion, underpinned by strong domestic demand, policy support, and innovation-led growth.

- Industry Valuation: Valued at USD 50 billion in 2023, the Indian pharmaceutical sector is projected to reach USD 130 billion by 2030.

- CAGR Projection: The industry is expected to grow at a CAGR of 10-12% from 2023 to 2030.

- Global Ranking: India is the third-largest by volume and 14th by value globally.

Growth Drivers

- Rise in Chronic Diseases: Increasing prevalence of diabetes, cardiovascular ailments, arthritis, and urinary disorders.

- Healthcare Access Expansion: Government schemes such as Ayushman Bharat are boosting healthcare coverage.

- Specialised Therapy Areas: Shift towards chronic and lifestyle diseases has spurred demand for targeted treatments.

- R&D and Product Innovation: Emphasis on new drug delivery systems and branded generics.

Segment-wise Outlook

Women’s Healthcare

- Growth Focus: Rising awareness, increased health screenings, and evolving reproductive health needs.

- Key Trends: Surge in demand for gynaecological treatments, hormonal therapies, and menopause-related care.

- Projected CAGR: Around 15% through 2028.

Cardio-Diabetology

- Market Size: Diabetes and cardiovascular drug segments make up over 30% of India’s chronic therapy market.

- Growth Driver: High urbanisation and lifestyle changes fueling insulin resistance and heart ailments.

- CAGR: Expected growth of 12-14% CAGR over the next five years.

Pain Management

- Market Potential: Growing demand for pain relief products due to ageing population and rising musculoskeletal disorders.

- Segment Expansion: Includes NSAIDs, muscle relaxants, and topical agents.

- CAGR Estimate: 10-11% CAGR till 2030.

Urology

- Emerging Segment: Increasing incidences of kidney stones, prostate conditions, and urinary tract infections.

- Focus Areas: Both acute treatments and long-term care therapies.

- Growth Rate: Estimated CAGR of 11-13% from 2023–2028.

How Will Corona Remedies Limited Benefit

- Positioned to capitalise on India’s pharma market growth with its strong 19.90% domestic sales CAGR, far exceeding the industry’s 8.79%.

- Portfolio focus on high-growth segments like women’s healthcare (15% CAGR), cardio-diabetology (12–14% CAGR), pain management (10–11% CAGR), and urology (11–13% CAGR) aligns with sector trends.

- Strategic acquisition of Myoril enhances presence in the expanding pain management market.

- Strong brand performance with five key brands contributing over 72% to sales ensures resilience and recognition.

- Specialist-driven marketing model boosts credibility, with 75% prescriptions from specialists vs. IPM’s 60.97%.

- Expansive presence with 2,598 medical representatives across 22 states supports deep market penetration.

- Rapid market climb from 41st to 30th rank, with top-10 positions in key therapy areas, reflects operational excellence.

- Robust product development and volume-led growth position the company to lead in chronic and sub-chronic therapies.

Peer Group Comparison

| Company Name | Face Value (₹) | P/E | Revenue (₹ Mn) | EPS (Basic) (₹) | RoNW (%) | NAV/Share (₹) |

| CORONA Remedies Ltd | 10.00 | – | 10,144.74 | 14.80 | 18.84% | 78.55 |

| Peer Groups | ||||||

| Abbott India Ltd | 10.00 | 54.28 | 58,489.10 | 565.28 | 32.48% | 1,740.71 |

| Alkem Laboratories Ltd | 2.00 | 32.96 | 1,26,675.80 | 150.19 | 17.41% | 862.46 |

| Eris Lifesciences Ltd | 1.00 | 47.99 | 20,091.43 | 28.82 | 15.16% | 190.14 |

| GlaxoSmithKline Pharmaceuticals Ltd | 10.00 | 83.53 | 34,537.06 | 41.14 | 33.19% | 104.93 |

| J.B. Chemicals & Pharmaceuticals Ltd | 1.00 | 47.21 | 34,841.84 | 35.66 | 18.90% | 188.63 |

| Mankind Pharma Ltd | 1.00 | 54.17 | 1,03,347.75 | 47.75 | 20.43% | 233.73 |

| Pfizer Ltd | 10.00 | 34.56 | 21,931.70 | 120.51 | 15.33% | 785.95 |

| Sanofi India Ltd | 10.00 | 23.76 | 28,511.00 | 261.91 | 59.40% | 440.93 |

| Torrent Pharmaceuticals Ltd | 5.00 | 66.51 | 1,07,278.40 | 48.94 | 24.15% | 202.57 |

Key Strategies for Corona Remedies Limited

Strengthen Domestic Market Share

Corona Remedies Limited seeks to expand its presence in the Indian pharmaceutical market by increasing medical representative productivity, growing its prescriber base, and focusing on high-growth therapy areas. Enhanced digitalisation and targeted engagement with specialists aim to consolidate market share and improve national rankings.

Expand Product Portfolio with Lifecycle Focus

The company plans to grow its product portfolio with long-life-cycle drugs, prioritising chronic and sub-chronic therapies. By leveraging existing networks and R&D capabilities, Corona Remedies introduces high-potential, niche products that fill therapeutic gaps while maintaining profitability and aligning with evolving patient and clinician needs.

Diversify into High-Growth Therapeutic Areas

Corona Remedies intends to broaden its therapeutic footprint by entering underserved areas such as nephrology, oncology, and dermatology. Through focused SBUs, hospital outreach, and backward integration in hormone APIs, it aims to deepen presence in women’s health, urology, and other specialty segments with strong growth potential.

Drive Growth via Strategic Acquisitions and In-Licensing

The company is pursuing acquisitions and in-licensing deals that strengthen its market position in targeted therapies. By acquiring established brands and partnering with global firms, Corona Remedies enhances its portfolio, marketing reach, and long-term value while ensuring scalability and efficient integration across its operations.

Expand International Presence Strategically

Corona Remedies targets international growth by leveraging hormone-based products, regulatory approvals, and market-specific strategies. It aims to boost sales across 20+ countries through product registrations, partnerships, and R&D innovation, focusing on Europe and emerging markets to maximise global reach and operational revenue.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Corona Remedies Limited IPO

How can I apply for Corona Remedies Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the issue size of the Corona Remedies Limited IPO?

The IPO issue size is ₹ ₹655.37 crore and is entirely an Offer for Sale (OFS), meaning no new shares will be issued—only existing shareholders are selling their stakes.

What is the objective of Corona Remedies Limited’s IPO?

Since the IPO is a pure OFS, the company will not receive any funds; instead, existing shareholders are monetising their holdings, allowing for greater liquidity and potential entry of institutional investors.

On which stock exchanges will Corona Remedies Limited be listed?

Corona Remedies Limited shares will be listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), once the IPO process is completed.

Who are the lead managers of the Corona Remedies IPO?

The Book Running Lead Managers (BRLMs) for this IPO are JM Financial Limited, IIFL Securities Ltd, and Kotak Mahindra Capital Company Limited, ensuring smooth handling of the public offering.

What is the promoter holding in Corona Remedies before the IPO?

The promoters hold 72.50% of the total shares before the IPO. Since it’s a pure OFS, the total number of shares remains unchanged post-issue; any dilution depends on how much they sell.