- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Corporate actions and their impact on stock

By HDFC SKY | Updated at: Apr 24, 2025 04:47 PM IST

Summary

Corporate action means any decision made by a company that could have a material impact on its stock price and, thus, affect its shareholders.

Let’s look at the seven most common corporate actions and their impact on the stock price.

Dividends

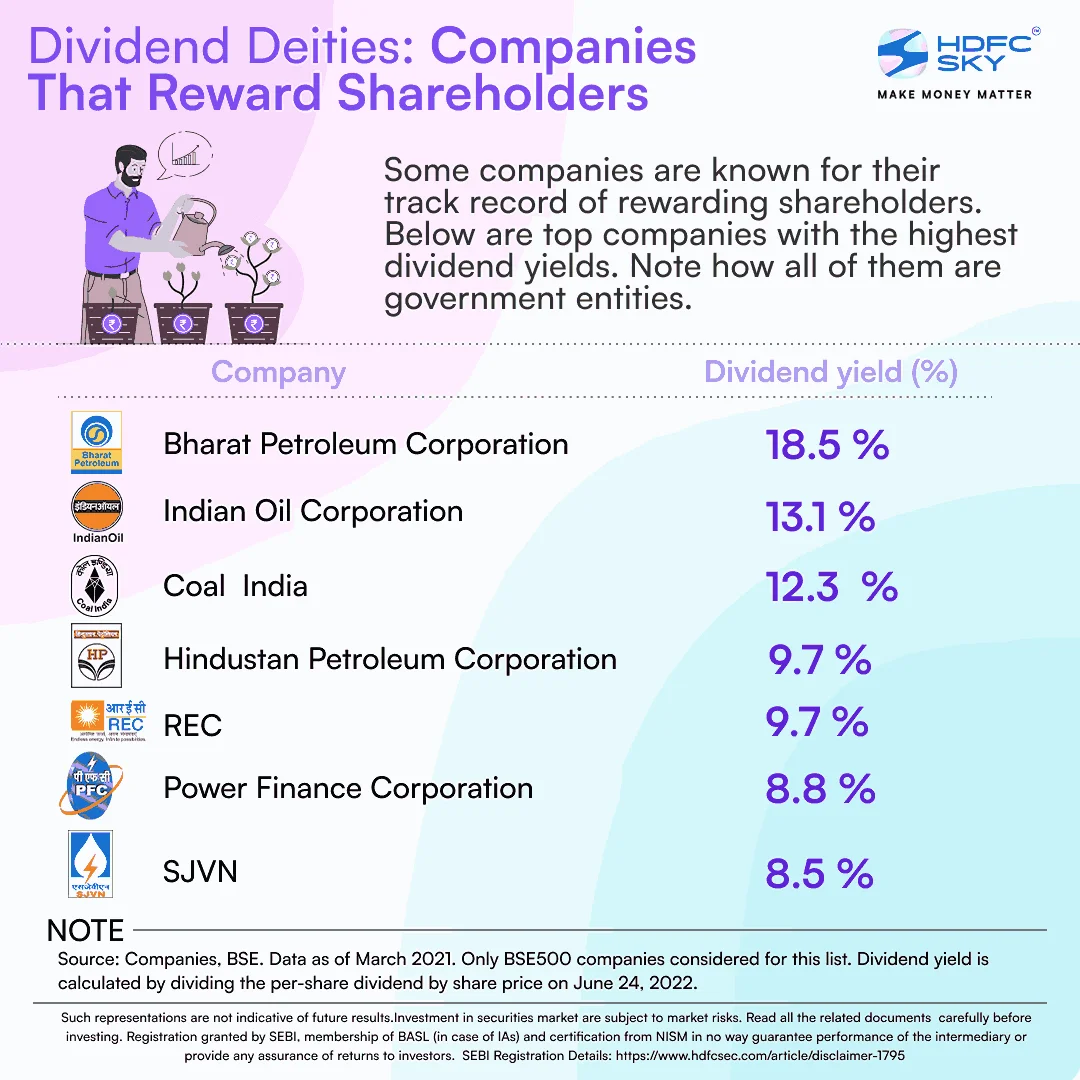

Dividends are part of the company’s earnings distributed to the equity shareholders. When a company makes a profit, it can either reinvest it (put the profit earned back into the business) or distribute it among the shareholders.

Companies announce dividends on the basis of face value, and they are distributed on a per-share basis.

For example, if a company announces a dividend of 50% on face value of Rs 10 per share. It means the dividend per share will be Rs 5 (50% of Rs 10). Now, if you hold 1,000 shares of this company you will receive Rs 5,000 as the dividend in your bank account.

There are various forms of dividends, but the most common is cash. Other types of dividends are stock dividend, property dividend, scrip dividend, liquidating dividend

Typically, mature companies with strong cash flows are more likely to pay a dividend. Companies often pay dividend quarterly; sometimes, it is paid semi-annually or annually. If the dividend is paid during the year, it is called the interim dividend. If it is paid at the end of the year, it is called the final dividend.

Keep in mind, companies are not obligated to pay a dividend. Also, the dividend does not necessarily have to come from profits. Some even pay a dividend if they have made a loss during that quarter/year but have healthy cash reserves. Investors who look for a steady return can opt for dividend paying stocks.

Stock prices usually go down by the dividend amount on the ex-dividend date — only shareholders who own the stock before the ex-dividend date are entitled to the dividend.

Bonus Shares

A company can also pay back its shareholders in the form of additional shares for free. Think of it as an incentive. The bonus shares are issued out of the reserves of the company. They are typically paid out in fixed ratios — 1:1, 2:1 and so on. For example, in a 2:1 bonus issue you will get 2 additional shares for every 1 share you hold.

Remember, even though you get additional shares, your overall investment remains the same. For example, if the company pays out bonus shares at 2:1 and you already have 100 shares each costing Rs 10, after the bonus issue, you will have 300 shares, but the price will come down to Rs 3.33 per share so that your total investment remains Rs 1,000. This will also adjust other metrics such as earnings per share (EPS).

Think of it is as a cake. You can cut it into 6 slices or 12; it doesn’t change the size of the cake.

Companies issue bonus shares to award their existing shareholders or bring down the share price in the market to attract new investors.

Stock Splits

As the name suggests, it literally means division of the stock into more parts. The result of this is mostly similar to bonus issues, as the number of outstanding shares in the market increases, but it doesn’t affect the value on the whole. But unlike bonus shares, the company doesn’t issue shares from its reserves but only splits the shares already available in the market.

For example, assume the stock has a face value of Rs 10. The company announces a stock split reducing the face value from Rs 10 to Rs 2. After the split, you will have 5 shares for every one share you held earlier.

Rights Issue

If a company wants to raise fresh capital, it can do so via a rights issue. In a rights issue, the company offers existing shareholders the option to purchase additional shares of the company.

For example, if it’s a 1:3 rights issue, existing shareholders have the option to buy one additional share for every three shares they hold. Also, the new share will be issued at a discount to the prevailing market price of the stock.

The shareholders can also sell this ‘right’ in the market the same way that they would sell ordinary shares.

A rights issue dilutes existing shares’ value as it spreads the company’s net profit over a larger number of shares. As a result, the stock price is likely to go down.

Share buyback

In a share buyback, the company purchases its shares from the market, usually at a higher price. As a result, the number of outstanding shares in the market decreases and the earnings per share increases. This is a positive for the stock price.

Acceptance ratio is the key parameter shareholders look before applying for the Buyback offer.

Companies usually announce buyback when they have excess cash and feel their stock is undervalued in the market.

Other reasons why a company could buy back its shares are:

a) To prevent hostile takeover — a situation where a competitor or any other entity buys enough shares from the open market to obtain a majority stake and thus ownership of the company.

b) To consolidate their stake in the company.

c) Support share price in a bear market.

d) To take the company private.

Note: Shareholders can choose to participate in the buyback or avoid it.

Tender Offer

Tender offer is a conditional offer where an investor or a group of investors offer to buy a large number of shares from the shareholders of a company. Usually, these investors are looking to acquire a controlling stake in the company.

It is conditional because these investors are required to buy a specified minimum number of shares, otherwise the offer gets cancelled.

Generally, investors offer to buy these shares at a significant premium to the prevailing market price. This creates value for the existing shareholders, and as a result, the stock price may also move up.

Merger and acquisition

Merger is a formal agreement between two companies to combine their operations and operate as one company.

Mergers are generally considered positive for the stock as they open doors for the company to enter new markets or solidify its position in those where they already compete.

Acquisition refers to the takeover of one entity by another.

Generally, when one company takes over another company, the stock price of the acquiring company goes down and the stock of the company which is getting acquired goes up.

The stock of the acquiring company goes down because they are paying a premium to acquire the other firm. Meanwhile, the stock of the company getting acquired receives that premium, hence, its stock rises.