- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Cotec Healthcare IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Cotec Healthcare IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Cotec Healthcare Limited

Cotec Healthcare Limited is a Contract Development and Manufacturing Organization (CDMO) with expertise in 24 formulation types, producing injectables, tablets, capsules, ointments, syrups, infusions, and more. Its portfolio spans therapeutic areas such as anaesthetics, antibiotics, cardiovascular, dermatology, endocrinology, women’s health, nutrition, and supplements. The company operates a Roorkee facility covering 21,871.71 sq. m. with an installed capacity of 4,051.38 million units. Serving 154, 177, and 122 customers in FY 2025, 2024, and 2023, Cotec caters to leading pharma companies and exports to 14 countries.

Cotec Healthcare Limited IPO Overview

Cotec Healthcare Ltd. has filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 10, 2025, to raise funds through an Initial Public Offer (IPO). The proposed IPO is a book-building issue consisting of a fresh issue of ₹295.00 crore and an offer for sale of up to 0.60 crore equity shares. The company’s equity shares are proposed to be listed on both NSE and BSE. While the book-running lead manager is yet to be appointed, Kfin Technologies Ltd. will act as the registrar of the issue.

Key details such as IPO dates, price band, and lot size are yet to be announced, and investors are advised to refer to the Cotec Healthcare IPO DRHP for further information. As per the DRHP, the company has a face value of ₹5 per share, with a pre-issue shareholding of 11,42,06,346 equity shares. Promoters of the company, Harsh Tiwari and Vandana Tiwari, currently hold 99.99% of the shares, which will change post issue.

Cotec Healthcare Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Fresh Issue | ₹295 crore |

| Offer for Sale (OFS) | 0.60 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 11,42,06,346 shares |

| Shareholding post-issue | TBA |

Cotec Healthcare IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Cotec Healthcare Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Cotec Healthcare Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹1.75 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 33.91% |

| Net Asset Value (NAV) | ₹5.16 |

| Return on Equity (RoE) | 33.91% |

| Return on Capital Employed (RoCE) | 36.43% |

| EBITDA Margin | 16.36% |

| PAT Margin | 10.40% |

| Debt to Equity Ratio | 0.44 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure requirements for setting up a new project to enhance existing manufacturing capacities and manufacture new products | 2262.49 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

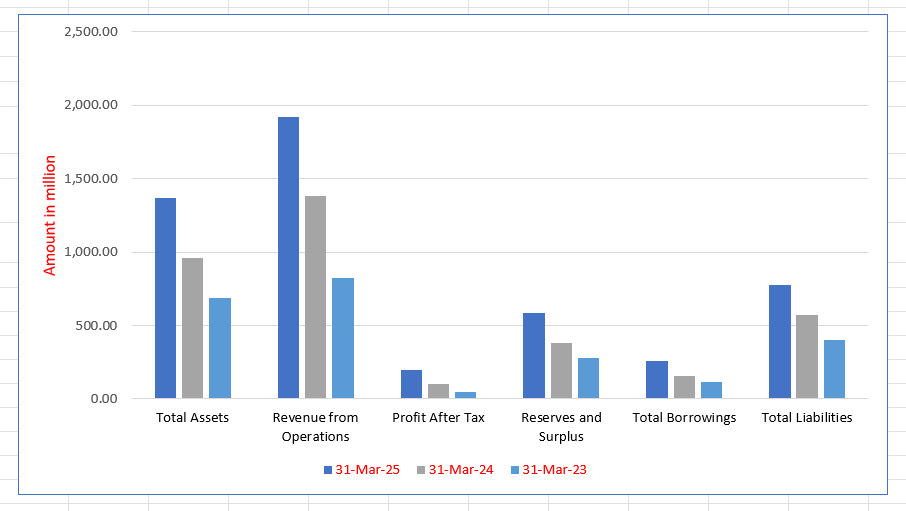

Cotec Healthcare Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Total Assets | 1,366.29 | 958.26 | 686.45 |

| Revenue from Operations | 1,922.36 | 1,379.96 | 824.23 |

| Profit After Tax | 200.00 | 104.60 | 50.32 |

| Reserves and Surplus | 584.59 | 383.85 | 278.29 |

| Total Borrowings | 260.72 | 154.85 | 112.40 |

| Total Liabilities | 776.56 | 569.27 | 403.02 |

Financial Status of Cotec Healthcare Limited

SWOT Analysis of Cotec Healthcare IPO

Strength and Opportunities

- Strong industry experience since 1998 with leadership expertise in chemistry and pharmaceuticals.

- Wide product portfolio including tablets, capsules, injectables, syrups, and ointments

- Manufacturing base in Uttarakhand with dedicated facilities

- Consistent growth in net worth and operating profits

- Specialisation in third-party and contract manufacturing

- Rising demand for generic medicines creating strong growth opportunities

- Potential to raise capital through IPOs or external funding for expansion

- Supportive government policies encouraging pharmaceutical manufacturing

- Increasing healthcare awareness boosting demand for affordable medicines

Risks and Threats

- Low paid-up capital compared to overall operations.

- Relatively modest revenue size within lower operating brackets

- Limited geographical reach with focus mainly on domestic markets

- Thin margins in certain years affecting profitability

- High dependence on regulatory approvals and compliance

- Intense competition from large and established pharmaceutical firms

- Exposure to raw material cost fluctuations and supply chain issues

- Regulatory risks including drug pricing caps and approval delays

- Quality or compliance lapses could cause reputational and financial damage

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Cotec Healthcare Limited

Cotec Healthcare Limited IPO Strengths

Leading Market Position and Diverse Product Portfolio

Cotec Healthcare Limited is India’s second-largest CDMO player by dosage forms, with capabilities across 24 distinct formulations. Its comprehensive portfolio spans major therapeutic areas and includes injectables, tablets, capsules, and more, enabling it to serve a wide range of client needs and participate across various pharmaceutical segments. (Source: F&S Report)

Proven Product Development and Client Collaboration

The company has a strong track record of developing and commercializing pharmaceutical products from start to finish. Its collaborative approach and technical expertise, demonstrated in projects like enhancing the ‘Ring Cutter’ product and rapidly establishing a sanitizer facility, have strengthened client trust and solidified its role as a reliable manufacturing partner.

Significant Barriers to Entry and Scalability

Cotec Healthcare benefits from high industry entry barriers, including stringent regulatory compliance requirements and significant capital expenditure. Its scalable infrastructure and advanced technological adoption create a competitive advantage, making it challenging for new entrants to achieve similar scale and sustainability. (Source: F&S Report)

Scalable and Compliant Manufacturing Infrastructure

The company operates a strategically located, diversified manufacturing facility in Roorkee, with three dedicated units for different product categories. Its investment in automation, advanced quality control systems (like LIMS), and certifications (ISO, SEDEX) ensures high-quality, regulatory-compliant production and high entry barriers for competitors without similar capabilities.

Strong Financial Performance and Profitability

Cotec Healthcare has demonstrated strong financial growth, with a revenue CAGR of 52.72% from Fiscal 2023 to 2025. It also recorded industry-leading returns, with a RoCE of 36.43% and RoE of 33.91% in Fiscal 2025, supported by improved EBITDA margins. (Source: F&S Report)

Experienced Leadership and Management Team

The company is led by promoters with over 36 years of collective industry experience. This leadership is supported by a seasoned management team and key personnel with deep, diverse expertise across all critical functional areas, providing strong strategic direction and operational execution.

More About Cotec Healthcare Limited

Cotec Healthcare Limited is a prominent Indian Contract Development and Manufacturing Organization (CDMO), ranking as the second-largest player in the country by the number of dosage forms it can produce. The company boasts capabilities across 24 distinct formulation types, specializing in complex generics and advanced delivery systems like modified and sustained-release forms.

Core Business & Offerings

Cotec’s integrated CDMO services encompass the entire pharmaceutical value chain:

- Formulation Development: Including pre-formulation, analytical studies, and technology transfer.

- Commercial Manufacturing: A diverse portfolio across injectables, tablets, capsules, ointments, and syrups.

- Packaging & Distribution: Providing primary, secondary, and cold-chain packaging solutions.

The company serves a broad spectrum of over 50 therapeutic areas, including antibiotics, anti-diabetics, cardiovascular drugs, vitamins, and central nervous system (CNS) products.

Strategic Growth & Financial Performance

Cotec is one of the fastest-growing companies in its sector, demonstrated by exceptional financial metrics between Fiscal 2023 and 2025:

- Revenue CAGR: 52.72%

- EBITDA CAGR: 81.79%

- Profit After Tax CAGR: 99.36%

- The company also recorded the highest Return on Capital Employed (RoCE) and Return on Equity (RoE) among its peers in Fiscal 2025.

Manufacturing Infrastructure

Cotec operates a strategic, semi-automated facility in Roorkee, Uttarakhand, spanning over 21,871 sq. meters. The facility is equipped with:

- Three dedicated manufacturing units with an aggregate installed capacity of 4.05 billion units.

- Advanced sensors and programmable logic controllers to ensure quality and minimize contamination.

- Certifications: ISO 9001:2015, ISO 14001:2015, ISO 45001:2018, and various international GMP approvals.

Customer Base & Strategy

The company serves a large and growing clientele, including major pharmaceutical firms like Mankind Pharma Ltd. and Zydus Healthcare Ltd. Cotec employs a hybrid model, serving both institutional and private customers, which mitigates risk. A key strategic shift towards high-value customers is evidenced by the fact that repeat customers contributed over 92% of its ₹1,922 million revenue in Fiscal 2025.

Industry Outlook

The Indian CDMO market, valued at around USD 7–8 billion in 2024, is expected to double to approximately USD 14 billion by 2028, reflecting the strong demand for contract development and manufacturing services. India’s contract manufacturing for generic pharmaceuticals is projected to grow at a CAGR of nearly 11–12% between 2025 and 2030. The overall Indian generic drugs market, which includes finished dosage forms such as tablets, capsules, syrups, and injectables, is anticipated to grow from about USD 26–28 billion in the mid-2020s to USD 35–50 billion by 2030–33, at a CAGR of 6–7%.

Key Growth Drivers

- Rising global demand for generics as many blockbuster drugs lose patent protection, creating opportunities for complex formulations like sustained and controlled release.

- The “China-plus-one” strategy encouraging global firms to source from India due to cost efficiency and compliance.

- Government support through Production Linked Incentives and schemes aimed at strengthening pharmaceutical manufacturing.

- Growing domestic demand driven by chronic diseases, ageing population, rising middle class, and higher health awareness.

Challenges & Constraints

- Strict regulatory and quality compliance requirements that can delay approvals.

- Margin pressures due to raw material price volatility and currency fluctuations.

- Intense competition from both Indian and global CDMO and generics players.

- High capital and infrastructure investment needed for advanced facilities.

How Will Cotec Healthcare Limited Benefit

- Strong growth in the Indian CDMO sector allows Cotec to expand its production and capture new client contracts.

- Rising global demand for generics provides opportunities to supply complex and advanced dosage forms.

- Government incentives and supportive policies reduce operational costs and encourage capacity expansion.

- Increasing domestic healthcare demand boosts sales across multiple therapeutic areas served by Cotec.

- Focus on modified and sustained-release products positions Cotec to benefit from higher-margin, specialised formulations.

- Global firms diversifying supply chains (“China-plus-one”) can drive international client acquisition.

- Repeat customers and a hybrid client model ensure stable revenue and mitigate market risks.

- Advanced manufacturing infrastructure allows Cotec to meet stringent quality and regulatory requirements efficiently.

- Strong financial performance and high CAGR enable reinvestment into R&D and capacity expansion.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue (₹ million) | Basic EPS (₹) | NAV (₹) | P/E Ratio | RONW (%) |

| Cotec Healthcare Limited | 5.00 | 1,922.36 | 1.75 | 5.16 | [●] | 33.91 |

| Peer Group | ||||||

| Innova Captab Ltd | 10.00 | 12,436.76 | 22.41 | 167.66 | 41.71 | 13.37 |

| Sai Life Sciences Ltd | 1.00 | 16,945.70 | 8.83 | 102.12 | 105.34 | 7.99 |

| Windlas Biotech Ltd | 5.00 | 7,598.78 | 29.19 | 241.31 | 34.50 | 12.06 |

Key Strategies for Cotec Healthcare Limited

Capacity Expansion for Increased Demand

Cotec Healthcare is expanding its Roorkee manufacturing capacity to capitalize on the growing Indian pharmaceutical market. The recent addition of a beta-lactam and cephalosporin unit, funded internally, increases its total installed capacity to 4,594.76 million units to meet domestic and international demand.

Diversification into Specialized Products

The company plans to establish a new EU-GMP compliant unit to diversify into oncology and specialized products. This expansion onto adjacent land will add sterile lines and a penicillin portfolio, targeting high-margin regulated markets like Europe and increasing total capacity to 16,602.65 million units.

Strategic Entry into Oncology Therapeutics

Cotec Healthcare is strategically foraying into oncology by building a dedicated EU-GMP compliant manufacturing line. This move capitalizes on the growing global oncology market and patent expirations, aiming to strengthen its presence in specialty care with generics and biosimilars that offer long-term profitability.

Global Market Expansion

Cotec Healthcare plans to expand its export operations into Central Asia, Africa, and other emerging markets. By securing international certifications and introducing products in active therapeutic areas, the company aims to diversify its revenue base and mitigate risks associated with regional economic fluctuations.

Deepening Customer Relationships

The company focuses on increasing its wallet share with existing customers by broadening its product portfolio and providing competitive, quality products. It also aims to leverage its track record to engage new high-value customers and groups within existing client organizations to expand its market reach.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Cotec Healthcare Limited IPO

How can I apply for Cotec Healthcare Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When did Cotec Healthcare file its IPO DRHP?

Cotec Healthcare Ltd. filed its Draft Red Herring Prospectus with SEBI on September 10, 2025.

What is the size and type of the IPO?

The IPO is a Book Building issue, including a fresh issue of ₹295 crores and an Offer for Sale.

On which stock exchanges will the IPO be listed?

Cotec Healthcare IPO is proposed to be listed on both NSE and BSE.

Who are the promoters of Cotec Healthcare Ltd.?

Harsh Tiwari and Vandana Tiwari are the company promoters holding 99.99% pre-IPO shares.

What are the objects of the IPO proceeds?

Proceeds will fund new manufacturing capacity, expansion projects, and general corporate purposes to support growth.