- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Credila Financial Services IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Credila Financial Services IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

About Credila Financial Services Limited

Credila Financial Services Limited, a subsidiary of HDFC, is a specialised NBFC offering education loans for students pursuing undergraduate and postgraduate studies in India and abroad. It provides customised loan solutions covering tuition, travel, living costs, and more, with flexible repayment options including a moratorium period. Loans may require a co-applicant or collateral based on the applicant profile. Credila supports students enrolling in top global universities and has a strong presence across India, working closely with families and institutions to simplify the education financing process.

Credila Financial Services Limited IPO Overview

Credila Financial IPO is a book-building public issue valued at ₹5,000.00 crores. The offer consists of a fresh issue amounting to ₹3,000.00 crores and an offer for sale (OFS) worth ₹2,000.00 crores. The IPO aims to raise capital through a combination of new equity and the sale of existing shares by current stakeholders. However, the IPO opening and closing dates, along with the price band and lot size, are yet to be officially announced. The allotment of shares is expected to be finalised on a date that will be communicated in due course.

The face value of each share is ₹10, and the issue is structured as a fresh capital-cum-offer for sale. The total issue size, number of shares in the fresh issue and OFS, and the specific price band will be declared closer to the IPO launch. The listing of shares is proposed on both the BSE and NSE. Prior to the issue, the company’s total number of shares stands at 21,87,87,715.

Axis Capital Limited is the book-running lead manager for the IPO, and Kfin Technologies Limited is acting as the registrar for the issue. For more detailed and official disclosures, investors are encouraged to refer to the Draft Red Herring Prospectus (DRHP) filed by Credila Financial Services Limited.

As per the DRHP status, the company filed the document with SEBI and the stock exchange on January 1, 2025, and received approval on May 15, 2025. Regarding promoter holding, Credila Financial Services reported a pre-issue promoter holding of 63.96%. The post-issue holding percentage will be updated upon finalisation and will reflect the equity dilution resulting from the fresh issue.

Credila Financial Services Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹3000 crore

Offer for Sale (OFS): ₹2000 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 21,87,87,715 shares |

| Shareholding post -issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Credila Financial Services Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Credila Financial Services Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 47.80 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 14.41% |

| Net Asset Value (NAV) | 397.39 |

| Return on Equity (RoE) | 14.41% |

| Return on Capital Employed (ROCE) | 47.85% |

| EBITDA Margin | 20.97 |

| PAT Margin | 89.91% |

| Debt to Equity Ratio | 4.47 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Augmenting capital base to meet the Company’s future capital requirements arising out of growth of the business and assets | 30,000 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

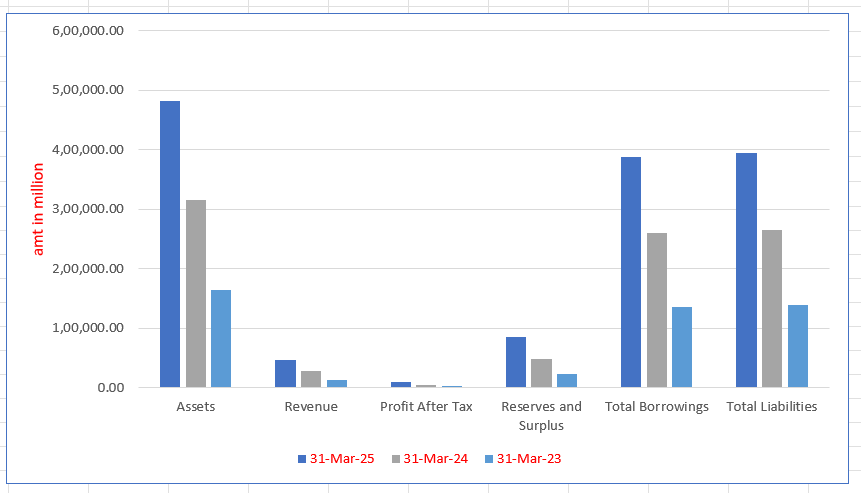

Credila Financial Services Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 481,945.04 | 315,659.69 | 164,460.43 |

| Revenue | 47,197.31 | 27,710.39 | 13,521.74 |

| Profit After Tax | 9899.58 | 5288.39 | 2759.25 |

| Reserves and Surplus | 84,757.18 | 48,641.65 | 22,872.92 |

| Total Borrowings | 388,690.14 | 260,328.27 | 136,552.21 |

| Total Liabilities | 394,999.98 | 265,226.05 | 140,109.51 |

Financial Status of Credila Financial Services Limited

SWOT Analysis of Credila Financial Services IPO

Strength and Opportunities

- Market leader in Indian education loans, especially for overseas studies

- Strong and experienced management with domain expertise since 2006

- Significant recent AUM growth to ₹36,800 crore by Sept 2024

- Well-capitalized via equity infusions from private equity investors

- Highly digitised MIS and underwriting systems enhancing risk controls

- Large outreach: funded over 2.26 lakh students across 64 countries

- Vast untapped domestic demand due to low gross enrolment ratio in India

- Opportunity to cross-sell and diversify income beyond interest margins

- Growing middle-class and strong demand for STEM education abroad

Risks and Threats

- Portfolio concentrated solely in education loans—a monoline business

- High moratorium exposure—majority of loans under moratorium, limiting seasoning

- Asset quality concerns if rapid growth doesn’t mature effectively

- Credit risk inherent in long-tenure, unsecured education loans

- Exposure to foreign currency and geopolitical risks due to international focus

- Growing competition from banks, NBFCs, and fintech players

- Regulatory shifts and immigration policy changes affecting overseas demand

- Rising EMI burden and liquidity risk in a tightening interest rate environment

- Difficult to sustain differentiation without continuous innovation

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Credila Financial Services Limited

Credila Financial Services Limited IPO Strengths

Strategic Advantage in a Growing Education Loan Market

Credila Financial Services Limited holds a strong position in India’s rapidly expanding education loan sector. Backed by rising overseas education demand, low Gross Enrolment Ratio, and NBFCs’ growing market share, Credila benefits from customised offerings, faster processing, and a vast untapped student population, making it a key player in this high-growth opportunity.

Robust Pan-India Distribution with Asset-Light Model

Credila Financial Services Limited operates a nationwide, omni-channel, asset-light distribution network across 41 cities. Supported by regional offices, digital channels, and 1,672 distribution agents, Credila leverages banks, consultants, and joint marketing to generate leads, ensure student support, and drive efficiency—achieving high disbursements per employee through a scalable hub-and-spoke model.

High-Quality Loan Portfolio Backed by Specialised Underwriting

Credila Financial Services Limited maintains superior asset quality through a robust, data-driven underwriting process. Its in-depth credit analysis, risk-based pricing, experienced team, and strong focus on employability and co-borrower strength ensure low delinquency across credit cycles. A diversified, resilient portfolio and stringent ECL practices further support Credila’s position as a disciplined and stable lender.

Technology-Led Risk Management Driving Asset Stability

Credila Financial Services Limited employs a robust risk management framework enhanced by data analytics and AI. With real-time monitoring, advanced credit modelling, and tech-driven systems like LOS, LMS, and a data lake, Credila ensures proactive risk detection, strong collections, and regulatory compliance—achieving high asset quality and collection efficiency across dynamic economic environments.

Diversified Funding and Prudent Asset-Liability Management

Credila Financial Services Limited maintains a well-funded, diversified liability profile with strong liquidity, low borrowing costs, and conservative asset-liability practices. With top-tier credit ratings, wide lender relationships, and robust interest rate risk management, Credila ensures financial stability and resilience—supported by high capital adequacy, dynamic monitoring, and a disciplined funding strategy across market cycles.

Experienced Leadership with Strategic Institutional Backing

Credila Financial Services Limited is led by a seasoned management team and a distinguished board, with deep expertise across finance, strategy, and governance. Supported by marquee investors like HDFC Bank, ChrysCapital, EQT, and Shinhan Bank, Credila leverages institutional knowledge, structured rewards, and strong governance to drive long-term growth, alignment, and operational excellence.

More About Credila Financial Services Limited

Credila Financial Services Limited, founded in 2006, is a specialised education finance company based in India. As a non-deposit-taking NBFC registered with the Reserve Bank of India (RBI), it is classified as a “middle layer” NBFC under the RBI’s Scale-Based Regulations (2023). The company focuses exclusively on providing education loans to Indian students for higher education in India and abroad.

With a mission to empower aspiring students and a vision to transform lives through quality education, Credila has grown to become a trusted name in education financing.

Industry Position and Financial Highlights

According to industry reports, Credila is a leading player among education-focused NBFCs (peer set includes three companies). Key highlights include:

- India’s largest education-focused NBFC with net loans of ₹414,693.08 million as of March 31, 2025

- Net profit after tax of ₹9,899.58 million in FY 2025

- Highest disbursements of ₹140,892.15 million in FY 2024

- Fastest growth in net loans, recording a CAGR of 64.96% (FY 2023–2025)

- 84.26% YoY AUM growth between March 2023 and March 2024

- Second-fastest loan growth YoY (47.67% from FY 2024–2025)

- Lowest gross stage 3 assets at 0.19% and second-lowest net stage 3 assets at 0.07% as of March 31, 2025

- Lowest cost-to-income ratio among peers: 19.65% (FY25) and 27.10% (FY24)

Loan Products and Customer Base

Credila offers tailored loan products primarily for:

- Master’s in Science (69.03% of total gross loans in FY25)

- MBA and postgraduate diplomas (11.32%)

- Other master’s programs, bachelor’s degrees, executive and certificate programs

As of March 31, 2025:

- 94.65% of AUM supported students studying abroad

- 5.35% of AUM went to students studying in India

- Average loan ticket size was ₹3.59 million

- Students financed in 64 countries, including the US, Canada, UK, Australia, Germany, and Ireland

Distribution Network and Outreach

Credila maintains the largest distribution network among education-focused NBFCs:

- 1,095 distribution agents (FY 2024)

- 1,672 total distribution channels as of March 31, 2025

- Presence in 41 Indian cities, including 32 branches and 8 regional offices

The company promotes brand visibility through seminars, student festivals, education fairs, and online engagement.

Risk Management and Technology

With a highly specialised underwriting model, over 91.98% of AUM as of FY25 involved borrowers with earning co-borrowers. A machine learning-based early warning system enables timely risk detection and resolution. Gross NPAs for the EMI portfolio stood at just 0.59% as of March 31, 2025.

Capital Strength and Credit Ratings

Credila has a diversified liability base, borrowing from 29 banks and financial institutions. It holds AA+ (CRISIL) and AA (CARE and ICRA) credit ratings, the highest among its peers, showcasing its strong asset quality, prudent management, and robust funding structure.

Leadership and Governance

Led by MD & CEO Arijit Sanyal, the leadership team includes seasoned professionals, many of whom have prior experience with HDFC. Its 12-member board comprises experts in finance, strategy, and governance. The company also benefits from institutional backing by EQT Group, ChrysCapital, HDFC entities, and Shinhan Bank.

Industry Outlook

- The Indian higher education sector (domestic and overseas) is projected to grow at 12–13% CAGR between FY2024 and FY2029, expanding from ₹13.5–14.0 trillion in FY2024 to over ₹24 trillion by FY2029.

- The domestic education financing segment (student loans) reached approximately ₹678 billion in FY2023, growing about 5% year-on-year.

- CRISIL estimates that education loan book growth among NBFCs may slow significantly, potentially falling to about half the rate seen in the prior year due to tighter overseas visa norms, especially in the US.

Key Growth Drivers

- Rising higher education aspirants: Increase in enrollments at both Indian and international universities continues to fuel demand for education loans.

- Escalating tuition costs: Education costs are rising faster than household incomes, making financing a necessity for many families.

- Government reforms:

- The National Education Policy 2020 aims for a 50% Gross Enrollment Ratio in higher education by 2035, promoting infrastructure growth and skilling.

- The Economic Survey 2024–25 outlines significant public investment in state-run institutions to support rising student demand.

- Tech-driven transformation: Fintech adoption and AI-based underwriting have made education loans more accessible and efficient.

Future Outlook & Segment Trends

- Retail Education Financing (Domestic + Overseas): Expected to remain strong through FY2029. Domestic loans, in particular, may grow at ~20% CAGR due to expanding college-age population and rising tuition fees.

- International Education Loans: This segment still holds promise but faces short-term challenges due to immigration and visa policy changes in destination countries like the US and Australia.

- NBFC and Alternative Lender Role: NBFCs are expected to continue expanding their market share by leveraging data, automation, and digital channels to serve both urban and underserved segments.

How Will Credila Financial Services Limited Benefit

- Increasing student enrolments will boost demand for education financing, expanding Credila’s loan portfolio.

- Escalating tuition fees will make education loans more essential, driving consistent growth.

- Government policies like NEP 2020 and public investment in education will strengthen domestic loan opportunities.

- Rising preference for Indian institutions offers a counterbalance to overseas loan challenges.

- Fintech and AI adoption aligns with Credila’s tech-driven underwriting, enhancing efficiency and scalability.

- Despite temporary global visa tightening, long-term aspirations for overseas education will sustain international loan demand.

- Credila’s widespread distribution network and presence in 41 cities position it to serve a broad customer base.

- High asset quality and prudent risk models ensure stability amid market shifts.

- Strong credit ratings and diversified funding allow Credila to grow competitively and securely.

Peer Group Comparison

| Name of the Company | Revenue

(₹ in millions) |

Face Value (₹) | EPS

(₹) |

Return on Net Worth (%) | NAV | Price to Earning |

| Credila | 47,197.3 | 10.00 | 47.80^ | 14.41# | 397.39# | [•]* |

| Peer Groups | ||||||

| Avanse Financial Services Limited | 23,470.72 | 5.00 | 19.94 | 12.84% | N.A. | N.A |

| Auxilio Finserve Private Limited | 5,280.97 | 10.00 | 2.13 | 9.39% | N.A | N.A |

| Listed Peers | ||||||

| Home First Finance Company Limited | 15,299.47 | 2.00 | 42.83 | 16.46% | 279.97 | 32.36 |

| Five Star Business Finance Limited | 28,478.40 | 1.00 | 36.61 | 18.65% | 214.13 | 20.58 |

| Chola mandalam Investment and Finance Company Limited | 258,459.8 | 2.00 | 50.72 | 19.71% | 281.45 | 31.72 |

| Bajaj Housing Finance Limited | 95,756.10 | 10.00 | 2.67 | 13.44% | 23.95 | 45.56 |

| Aavas Financiers Limited | 23,545.05 | 10.00 | 72.54 | 14.12% | 550.93 | 25.93 |

| Bajaj Finance Limited | 696,835.10 | 1.00 | 268.94 | 19.35% | 1,557.43 | 34.51^ |

Key Strategies for Credila Financial Services Limited

Strategic Expansion through Diversification and Innovation

Credila Financial Services Limited is focused on scaling its education finance business by strengthening university ties, expanding globally, tapping emerging markets, introducing value-added services, and launching tailored products. It continues exploring inorganic growth to deepen its presence across student segments and geographies.

Expanding Reach through Diversified Distribution Channels

Credila Financial Services Limited is strengthening its distribution network by onboarding new agents, enhancing school and college partnerships, launching scholarship initiatives, expanding into Tier 2 and 3 cities, and investing in digital acquisition—broadening customer access and boosting visibility across India’s evolving education finance landscape

Driving Efficiency through Digital Innovation and Automation

Credila Financial Services Limited is leveraging advanced technologies—including AI, machine learning, automation, and analytics—to optimise lead sourcing, credit decisioning, underwriting, collections, and customer journeys. These initiatives enhance operational efficiency, ensure faster approvals, and deliver a seamless digital experience for borrowers

Strengthening Funding Resilience and Sustainability

Credila Financial Services Limited seeks to enhance its liability profile by optimising funding mix, leveraging innovative instruments like social bonds, improving treasury operations, and maintaining capital buffers—aligning funding strategies with sustainability goals while actively managing costs and market opportunities through technology and automation

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Credila Financial Services Limited IPO

How can I apply for Credila Financial Services Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Credila Financial Services IPO?

The IPO totals ₹5,000 crore, comprising a ₹3,000 crore fresh issue and ₹2,000 crore offer-for-sale.

What is the IPO structure?

It includes ₹3,000 crore of new equity (fresh issue) and ₹2,000 crore shares offered by existing shareholders.

Who are the lead managers of this IPO?

The book-running lead managers are Axis Capital, Citigroup, Goldman Sachs India, IIFL Capital, and Jefferies India

What will the IPO proceeds be used for?

Proceeds from the fresh issue will bolster Credila’s capital base and support future business growth

On which exchanges will Credila shares be listed?

Equity shares are proposed to list on both the National Stock Exchange (NSE) and BSE