- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Crizac IPO

₹14,213/61 shares

Minimum Investment

IPO Details

02 Jul 25

04 Jul 25

₹14,213

61

₹233 to ₹245

NSE, BSE

₹860 Cr

09 Jul 25

Crizac IPO Timeline

Bidding Start

02 Jul 25

Bidding Ends

04 Jul 25

Allotment Finalisation

07 Jul 25

Refund Initiation

08 Jul 25

Demat Transfer

08 Jul 25

Listing

09 Jul 25

Crizac Limited

Crizac Limited, established in 2011, is a global B2B education platform facilitating international student recruitment for higher education institutions in the UK, Canada, Australia, Ireland, and New Zealand. With over 7,900 agents worldwide and proprietary technology, it connects students from 75+ countries to 135+ institutions. Crizac processed nearly 5.95 lakh applications and had 329 employees as of September 2024.

Crizac Limited IPO Overview

Crizac IPO is a bookbuilding issue worth ₹860.00 crores, consisting entirely of an offer for sale of 3.51 crore equity shares. The IPO opens for subscription on July 2, 2025, and closes on July 4, 2025. The allotment is expected to be finalised on July 7, 2025, with a tentative listing on BSE and NSE scheduled for July 9, 2025. The price band for the IPO is set between ₹233 to ₹245 per share. The minimum lot size is 61 shares, requiring a minimum investment of ₹14,213. However, investors are advised to apply at the cut-off price, amounting to ₹14,945, to improve chances in case of oversubscription. For sNII investors, the minimum application is 14 lots (854 shares) costing ₹2,09,230, while bNII investors must apply for a minimum of 67 lots (4,087 shares), amounting to ₹10,01,315. Equirus Capital Private Limited is the book-running lead manager for the issue, and MUFG Intime India Private Limited (Link Intime) is the registrar.

Crizac Limited IPO Details

| Particulars | Details |

| IPO Date | 2 July 2025 to 4 July 2025 |

| Listing Date | 9 July 2025 |

| Face Value | ₹2 per share |

| Issue Price Band | ₹233 to ₹245 per share |

| Lot Size | 61 Shares |

| Total Issue Size | 3,51,02,040 shares (₹860.00 Cr) |

| Fresh Issue | NA |

| Offer for Sale | 3,51,02,040 shares (₹860.00 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 17,49,82,500 shares |

| Share Holding Post Issue | 17,49,82,500 shares |

Crizac Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Net Offer |

| Retail | Not less than 35% of the Net Offer |

| NII (HNI) | Not less than 15% of the Net Offer |

Crizac Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 61 | ₹14,945 |

| Retail (Max) | 13 | 793 | ₹1,94,285 |

| sNII (Min) | 14 | 854 | ₹2,09,230 |

| sNII (Max) | 66 | 4,026 | ₹9,86,370 |

| bNII (Min) | 67 | 4,087 | ₹10,01,315 |

Crizac Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 100.00% |

| Post-Issue | — |

Crizac Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹8.74 |

| Price/Earnings (P/E) | 28.03x |

| Return on Net Worth | 30.24% |

| Return on Equity | 30.24% |

| Return on Capital Employed (ROCE) | 40.03% |

| EBITDA Margin | 25.05% |

| PAT Margin | 17.28% |

| Debt to Equity Ratio | — |

| NAV | ₹28.76 |

| Price to Book Value | 8.48x |

Objectives of the Proceeds

- This is a complete Offer for Sale; company will not receive any IPO proceeds.

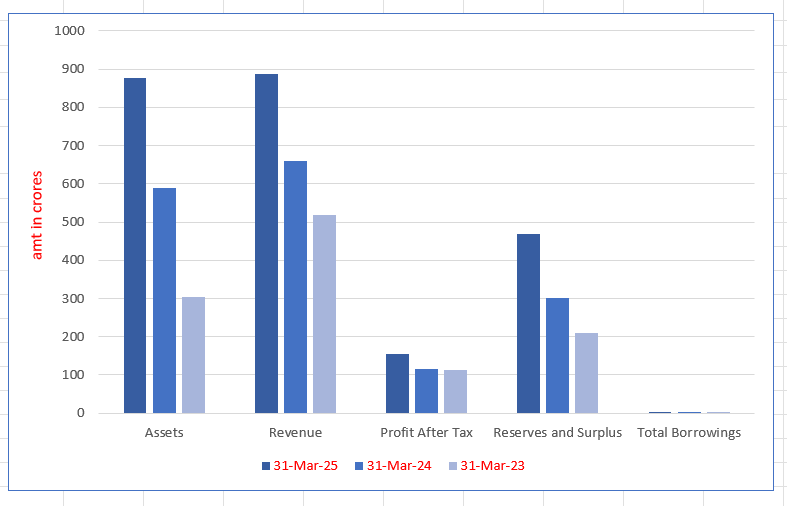

Key Financials (in ₹ crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 877.73 | 588.27 | 304.99 |

| Revenue | 887.53 | 658.62 | 517.85 |

| Profit After Tax | 154.99 | 115.86 | 112.14 |

| Reserves and Surplus | 468.37 | 302.09 | 209.97 |

| Total Borrowings | 0.08 | 0.08 | 0.08 |

SWOT Analysis of Crizac IPO

Strength and Opportunities

- Proprietary tech platform connecting 7,900+ global agents.

- Operates in over 75 countries with global reach.

- Processed 5.95 lakh student applications.

- Strong partnerships with 135+ international institutions.

Risks and Threats

- Entire IPO is OFS; no proceeds for company growth.

- High competition from EdTech and other platforms.

- Regulatory changes may impact global enrolments.

- Business model depends heavily on partner agents.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Crizac Limited

Crizac Limited IPO Strengths

- Leading provider of international recruitment solutions with strong presence across key global education destinations.

- Wide geographic reach sourcing student applications from over 72 countries through a robust agent platform.

- Established long-term relationships with over 140 global institutions of higher education across multiple disciplines.

- Extensive agent network of 5,300+ members globally ensures diverse student base and operational scalability.

- Scalable proprietary technology platform streamlining student application processing and enhancing institutional engagement and efficiency.

- Experienced promoters and skilled professional team ensuring growth, innovation, and strong client and student relationships.

Peer Group Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹) | P/E (x) | RoNW (%) |

| Crizac Limited | 8.74 | 8.74 | 28.76 | — | 30.38 |

| Peer Groups | |||||

| Indiamart Intermesh Ltd | 91.84 | 91.59 | 363.43 | 27.18 | 25.20 |

| IEL Education Ltd (AUD) | 0.48 | 0.48 | 1.88 | 7.86 | 25.51 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Crizac Limited IPO

What is the Crizac Limited IPO issue size?

The issue size is ₹860.00 crores, consisting entirely of an offer for sale.

What is the minimum lot and investment for Crizac IPO?

Minimum lot is 61 shares with an investment of ₹14,945 at the upper band.

When will Crizac Limited IPO list on the stock exchanges?

The IPO is tentatively scheduled to list on BSE and NSE on July 9, 2025.

How can I apply for Crizac IPO online?

You can apply via UPI-based ASBA platforms such as Zerodha, Groww, or HDFC Sky.