- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

CSM Technologies IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

CSM Technologies IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

About CSM Technologies Limited

CSM Technologies, founded in 1998, is a leading IT solutions provider with over 27 years of expertise in GovTech and digital transformation for government and private clients. The company delivers e-governance platforms, digital infrastructure, and consulting services across sectors including agriculture, healthcare, education, trade, tourism, and urban development. Its solutions enhance efficiency, support data-driven decisions, and improve citizen-focused services. Notable projects include Odisha’s KRUSHAK and SAMS platforms, Ethiopia’s Wheat Rust Warning System, AI-enabled grievance redressal systems, and international donor aid management solutions.

CSM Technologies Limited IPO Overview

CSM Technologies Ltd. has filed a Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) on 25 September 2025 to raise funds through an Initial Public Offering (IPO). The proposed IPO is a book-built issue consisting solely of a fresh issue of up to 1.29 crore equity shares, with a face value of ₹10 per share. The equity shares are intended to be listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). Keynote Financial Services Ltd. has been appointed as the book running lead manager, while Kfin Technologies Ltd. will act as the registrar of the issue. Details regarding the IPO dates, price band, and lot size are yet to be announced.

The IPO will involve a fresh capital raise of 1,29,01,000 shares, aggregating up to an expected amount yet to be disclosed. Prior to the IPO, the company has a total shareholding of 3,87,02,472 shares, which is expected to increase to 5,16,03,472 shares post-IPO, reflecting the additional capital infusion. The IPO filing with SEBI was completed on 25 September 2025, marking the official start of the regulatory process.

Promoters of the company, Priyadarshi Pany and Lagna Panda, currently hold 94.90% of the company’s equity, with post-IPO holdings to be determined based on the equity dilution resulting from the fresh issue. This IPO represents a significant step for CSM Technologies Ltd. in mobilising fresh capital for its business expansion and operational growth.

CSM Technologies Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 1.29 crore equity shares |

| Fresh Issue | 1.29 crore equity shares |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 3,87,02,472 shares |

| Shareholding post-issue | 5,16,03,472 shares |

CSM Technologies IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

CSM Technologies Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

CSM Technologies Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹3.72 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 18.49% |

| Net Asset Value (NAV) | ₹79.89 |

| Return on Equity (RoE) | 20.73% |

| Return on Capital Employed (RoCE) | 22.62% |

| EBITDA Margin | 14.69% |

| PAT Margin | 7.02% |

| Debt to Equity Ratio | 0.46 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ crore) |

| Funding working capital requirements of our Company | 53 |

| Prepayment or repayment of all or a portion of certain outstanding borrowings availed by our Company | 25.88 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

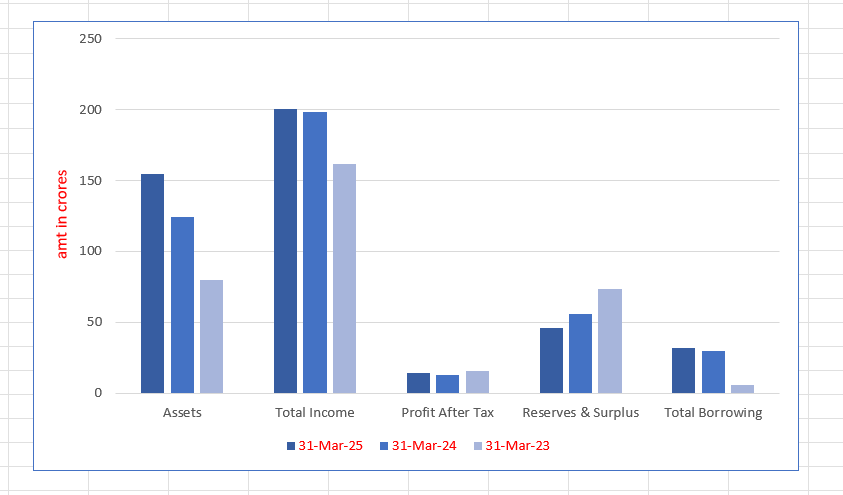

CSM Technologies Limited Financials (in crore)

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 154.55 | 124.45 | 80.02 |

| Total Income | 200.63 | 198.65 | 161.50 |

| Profit After Tax | 14.09 | 12.55 | 15.82 |

| Reserves & Surplus | 45.69 | 55.88 | 73.21 |

| Total Borrowing | 32.17 | 30.04 | 5.55 |

Financial Status of CSM Technologies Limited

SWOT Analysis of CSM Technologies IPO

Strength and Opportunities

- Experienced promoters and management with domain expertise

- Strong order book and long-term government engagements

- Diversified sectoral reach: agriculture, education, governance etc.

- Ability to build e-governance & citizen services platforms (GovTech niche)

- Expansion of digital infrastructure projects in India and overseas

- New software development centre investment (Bhubaneswar)

- Growing demand for digital transformation & e-governance

- Potential to enter adjacent verticals (health, tourism, urban tech)

- Rising international aid & donor-funded digital projects (Africa, etc.)

Risks and Threats

- Moderate scale of operations relative to larger IT service firms

- Profit margins are under pressure due to rising employee and overhead costs

- Net worth base remains modest, limiting balance-sheet strength

- Heavy dependence on government / tender-based contracts

- Foreign exchange exposure due to revenues in USD vs costs in INR

- Intense competition from large IT firms with deeper resources

- Regulatory changes, procurement rules and policy shifts could impact operations

- Risk of order delays, cancellations or underbidding on tenders

- Possible technology disruption, cyber risk exposure, evolving client expectations

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About CSM Technologies Limited

CSM Technologies Limited IPO Strengths

Deep Sectoral Expertise and Diversified IT Offerings

CSM Technologies Limited possesses deep sectoral expertise across ten diversified industry verticals, including Mining, Governance, and Healthcare. This allows the company to deliver tailored, scalable, and outcome-oriented digital solutions. Supported by a comprehensive portfolio of end-to-end services, the company is well-positioned to drive large-scale digital transformation for public and private sector clients, as noted in the CARE Report.

Proprietary Technology and In-House Innovation

The company’s competitive edge is strengthened by its suite of proprietary technology platforms and in-house patented solutions. These innovations include a Low Code No Code (LCNC) Framework, an AI Model Orchestration Platform, a Document Management System (DMS), and a patented ore sampling technology. This focus on innovation-led delivery enables the firm to provide scalable, efficient, and compliant digital solutions to government and enterprise clients.

Extensive Geographic Footprint and Scalable Operations

CSM Technologies Limited maintains an extensive and diversified geographic presence across India and select international markets. Beyond its Bhubaneshwar headquarters, the company operates across multiple Indian states and has successfully executed projects in numerous African nations, Canada, and the USA. This scalable operational footprint allows the firm to effectively serve a broad client base and de-risk concentration across regions.

Established Presence in a High-Entry-Barrier Industry

The company has an established presence in the high-entry-barrier IT-ITeS market, primarily due to its proven execution credentials in mission-critical digital transformation and e-governance projects. Holding certifications like CMMI level-5 and securing empanelments with government ministries enhance its eligibility for bids, reinforcing its capacity to address complex operational and regulatory requirements that challenge new entrants.

Experienced Promoters and Senior Management

CSM Technologies Limited benefits from the guidance of its experienced Promoters and Senior Management team. The leadership, including Chairman and Managing Director Priyadarshi Pany with 27 years of industry experience, leverages extensive domain knowledge and industry connections. This collective experience is vital for executing effective business strategies and navigating the evolving complexities of the information technology sector to drive sustained growth.

Track Record of Healthy Financial Performance

The company has demonstrated a strong and consistent financial performance track record. It reported healthy revenue from operations of ₹ 19,924.42 lakhs in Fiscal 2025, alongside a Net Working Capital day trend supporting efficiency. This financial health, driven by a focus on operational excellence, ensures revenue visibility and positions the company to continue delivering scalable and profitable business outcomes.

More About CSM Technologies Limited

CSM Technologies Limited (CSM), incorporated in 1998, has twenty-seven years of experience in designing, developing, and implementing e-governance platforms and digital infrastructure. The company operates as a long-term digital transformation partner for government agencies, aiming to streamline operations, facilitate data-driven decision-making, and improve citizen-centric services. CSM is noted for being among the few IT solutions companies that have delivered first-of-its-kind projects for both the government and private sectors, specializing in GovTech solutions (Source: CARE Report).

Service Portfolio and Sectoral Expertise

CSM provides technology solutions and digital transformation services across a diverse set of sectors:

- Government & Public Services

- Mining and allied services

- Agriculture and allied services

- Education

- Healthcare

- Industry and trade facilitation

- Tourism

The company also offers consulting and advisory services and provides self-service technologies that enable clients to migrate, automate, and manage customer-facing business processes through self-service channels.

Global Presence and Key Interventions

CSM’s solutions are built on a foundation of sectoral knowledge, scalable technology platforms, and analytics, which support governments in adopting data-driven processes.

Geographical Reach

As of the Draft Red Herring Prospectus date, the company has a presence in 12 countries, including:

- India

- Ethiopia

- Kenya

- Rwanda

- Gambia

- Gabon

- The United States of America

- Canada

Project Highlights

Over the past twenty-seven years, CSM has executed numerous projects focused on the development of public digital infrastructure and the implementation of scalable e-governance platforms. Key interventions include:

- Agriculture: Development of farmer empowerment platforms like KRUSHAK and SAFAL in Odisha, and advanced agricultural intelligence tools such as the Wheat Rust Early-Warning System in Ethiopia.

- Education: Digitizing education governance through integrated administrative platforms like the Student Academic Management System (SAMS) in Odisha, which won the National e-Governance Award (Gold).

- Mining: Development and deployment of the Digital Logistics Management System (DLMS) for corporate clients (JSW Steel Limited) and government agencies.

- Governance: Implementation of AI/ML-enabled grievance redressal systems like Mo Sarkar and the development of the Social Protection Delivery Platform (SPDP), a dynamic beneficiary registry for targeted service delivery.

Industry Outlook

The Indian digital transformation and GovTech industry is poised for strong growth, driven by government initiatives and increasing adoption of technology across public and private sectors. The digital transformation market in India is estimated at USD 124.42 billion in 2025 and is expected to reach USD 267.01 billion by 2030, reflecting a CAGR of around 16.5%. Similarly, projections indicate growth from USD 26.7 billion in 2024 to USD 126.8 billion by 2033, with a CAGR of 17.5%. The GovTech segment, covering citizen-centric services, smart government solutions, and AI/ML-enabled platforms, is forecast to expand at a CAGR of 11–12.5%, while the Indian smart government market is projected to grow from USD 1,741.9 million in 2023 to USD 5,722.9 million by 2030, at a CAGR of ~18.5%.

Growth Drivers

- Government programs like Digital India and Smart Cities promoting accessible and transparent governance.

- Rising internet and smartphone penetration, including in rural and semi-urban regions.

- Increasing demand for efficient public service delivery and data-driven decision-making.

- Growing investments in cloud infrastructure, AI/ML analytics, edge computing, and cybersecurity.

- Expansion of digital identity solutions, grievance redressal systems, and single-window citizen service portals.

Key Product Segments & Outlook

- E-governance platforms and citizen services portals are witnessing rapid adoption as governments digitize welfare, education, and agriculture services.

- Government cloud infrastructure and data centers are expanding to support scalable digital solutions.

- Managed and professional services including consulting, platform deployment, and maintenance are seeing strong demand from public sector clients.

Challenges

- Cybersecurity risks and evolving technology threats.

- Skill gaps in digital expertise among public sector staff and vendors.

- Infrastructure limitations in rural areas.

- Regulatory and policy uncertainty affecting project execution.

- Procurement delays and budgetary constraints that may slow adoption.

Overall, the Indian digital transformation and GovTech sector presents substantial opportunities, driven by strong policy support, citizen demand, and the push for efficient, data-driven governance.

How Will CSM Technologies Limited Benefit

- CSM Technologies will benefit from the growing digital transformation market in India, leveraging the projected CAGR of 16–17% to expand its GovTech solutions.

- Increasing government initiatives like Digital India and Smart Cities will create consistent demand for its e-governance platforms and citizen service portals.

- Rising adoption of cloud infrastructure, AI/ML analytics, and data-driven governance will enhance the value of CSM’s consulting, deployment, and managed services.

- Expansion of rural and semi-urban digital connectivity will enable CSM to scale platforms such as farmer empowerment systems and education portals.

- Growing emphasis on citizen-centric services and efficiency in public service delivery will boost recurring government contracts.

- International projects in Africa and other regions will benefit from global GovTech adoption trends.

- Increased demand for single-window systems, grievance platforms, and social protection solutions aligns with CSM’s core offerings.

- The company can strengthen its market leadership and brand recognition in both domestic and international GovTech sectors.

Peer Group Comparison

| Name of the Company | Face Value (₹ per share) | Revenue (₹ lakhs) | EPS Basic (₹) | EPS Diluted (₹) | NAV (₹) | P/E Ratio | RoNW (%) |

| CSM Technologies Limited | 10 | 19,924.42 | 3.72 | 3.72 | 118.73 | [●]# | 18.49 |

| Peer Group | |||||||

| Trigyn Technologies Limited | 10 | 89,805.18 | 3.82 | 3.82 | 240.71 | 19.42 | 1.59 |

| Allied Digital Service Limited | 5 | 80,707.00 | 4.98 | 4.91 | 106.73 | 33.79 | 5.34 |

| Dev Information Technology Limited | 24 | 17,066.38 | 6.85 | 6.84 | 30.45 | 6.29 | 21.54 |

| Silver Touch Technologies Limited | 10 | 28,838.01 | 17.50 | 17.50 | 105.44 | 41.47 | 16.60 |

Key Strategies for CSM Technologies Limited

Optimize and Expand Technology Infrastructure

CSM Technologies Limited will focus on expanding and optimizing its technology infrastructure through rigorous lifecycle management and embracing next-generation systems. This initiative ensures optimal performance, robust security, reduced operational costs, and highly reliable service delivery to maximize customer value and scalability.

Develop Advanced AI/ML Capabilities and Productivity

CSM Technologies Limited plans to invest heavily in building advanced AI/ML capabilities to enhance client solutions, including automation and predictive analytics. Concurrently, it will integrate AI across internal operations for improved productivity, automated processes, and intelligent, scalable decision-making to address complex client needs.

Accelerate Growth via Market Expansion and M&A

CSM Technologies Limited aims to accelerate growth by strategically deepening its presence in core markets and entering high-potential international markets like the US and Canada. This involves selective mergers and acquisitions (M&A) to enhance service offerings in emerging sectors such as cybersecurity, and to rapidly build platform expertise and market reach.

Cultivate a Highly Skilled and Scalable Workforce

CSM Technologies Limited recognizes that a skilled and diverse workforce drives value creation. The firm invests in structured talent acquisition, retention, and continuous capability development to build integrated, multi-sectoral teams. This focus enhances execution efficiency and delivery readiness, enabling the rapid scaling of proven solutions across all geographies.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On CSM Technologies Limited IPO

How can I apply for CSM Technologies Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the issue size of CSM Technologies IPO?

The IPO is a fresh issue of up to 1.29 crore equity shares aggregating to ₹[.] crore.

Where will CSM Technologies IPO shares be listed?

The equity shares are proposed to be listed on both NSE and BSE stock exchanges.

Who is managing the CSM Technologies IPO?

Keynote Financial Services Ltd. is the book running lead manager, and Kfin Technologies Ltd. is the registrar.

What is the purpose of the IPO proceeds?

Funds will be used for working capital, debt repayment, inorganic growth, and general corporate purposes.

Who are the promoters of CSM Technologies Ltd.?

Priyadarshi Pany and Lagna Panda are the company promoters, holding 94.90% pre-IPO shares.