- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Curefoods India IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Curefoods India IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Curefoods India Limited

Curefoods is a rapidly expanding cloud kitchen and food-tech company in India, focused on building and scaling a diverse portfolio of popular food brands across multiple cuisines. It owns brands like EatFit, Sharief Bhai, Arambam, Krispy Kreme, Nomad Pizza, and Cakezone, offering North Indian, South Indian, Biryani, Healthy Meals, and Desserts. As of March 31, 2025, Curefoods operates 502 service locations across 70 cities, including cloud kitchens, restaurants, kiosks, and warehouses. Leveraging AI, data analytics, and proprietary tech platforms, it optimizes supply chains, demand forecasting, and customer experience, making it the second-largest digital-first food business in India, supported by an experienced management team and institutional investors.

Curefoods India Limited IPO Overview

Curefoods India Ltd. filed a Draft Red Herring Prospectus (DRHP) with SEBI on July 1, 2025, to raise funds through an Initial Public Offering (IPO). The IPO is a book-built issue comprising a fresh issue of ₹800 crore and an Offer for Sale (OFS) of up to 4.85 crore equity shares. The equity shares are proposed to be listed on NSE and BSE. JM Financial Ltd. is the book running lead manager, while Kfin Technologies Ltd. serves as the registrar of the issue. The IPO’s face value is ₹1 per share, and it follows a fresh capital-cum-offer for sale structure. Key details such as the IPO dates, price band, and lot size are yet to be announced. The total pre-issue shareholding stands at 9,54,38,319 shares, with promoter Ankit Nagori holding 83.43% of the company. Post-IPO shareholding details will be determined after allotment and listing. This public issue aims to strengthen the company’s capital base, support expansion plans, and enhance its presence in the rapidly growing digital-first food and cloud kitchen segment in India.

Curefoods India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Fresh Issue | ₹800 crore |

| Offer for Sale (OFS) | 4.85 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 9,54,38,319 shares |

| Shareholding post -issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Curefoods India Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Curefoods India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹(5.58) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | (31.29%) |

| Net Asset Value (NAV) | ₹18.12 |

| Return on Equity (RoE) | (32.90%) |

| Return on Capital Employed (RoCE) | (20.45%) |

| EBITDA Margin | (7.72%) |

| PAT Margin | (22.79%) |

| Debt to Equity Ratio | 0.38 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Expenditure by our Company towards: (i) setting up of new cloud kitchens, restaurants, kiosks and Krispy Kreme Theatres; (ii) expansion of certain existing cloud kitchens by way of brand addition; and (iii) purchase of machinery and equipment | 1525.35 |

| Repayment/pre-payment, in full or part, of certain borrowings availed by our Company | 1269.25 |

| Expenditure towards lease payments for existing properties of our Company, in India | 400 |

| Investment in our Subsidiary, Fan Hospitality Services Private Limited towards: (i) acquisition of additional shareholding; and (ii) setting up of a new central kitchen, cloud kitchens and restaurants | 919.61 |

| Investment in our Subsidiary, Cakezone Foodtech Private Limited for: (i) acquisition of additional shareholding; and (ii) sales and marketing initiatives | 113.47 |

| Acquisition of additional shareholding in our Subsidiaries, namely (i) Millet Express Foods Private Limited; (ii) Munchbox Frozen Foods Private Limited; and (iii) Yum Plum Private Limited | 811.5 |

| Payment of deferred consideration by our Company under the business transfer agreement entered into by our Company with Jaika Hospitality Ventures Private Limited and its founders | 25 |

| Expenditure towards sales and marketing initiatives by our Company | 140 |

| Funding inorganic growth through unidentified acquisitions and strategic initiatives and general corporate purposes * | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

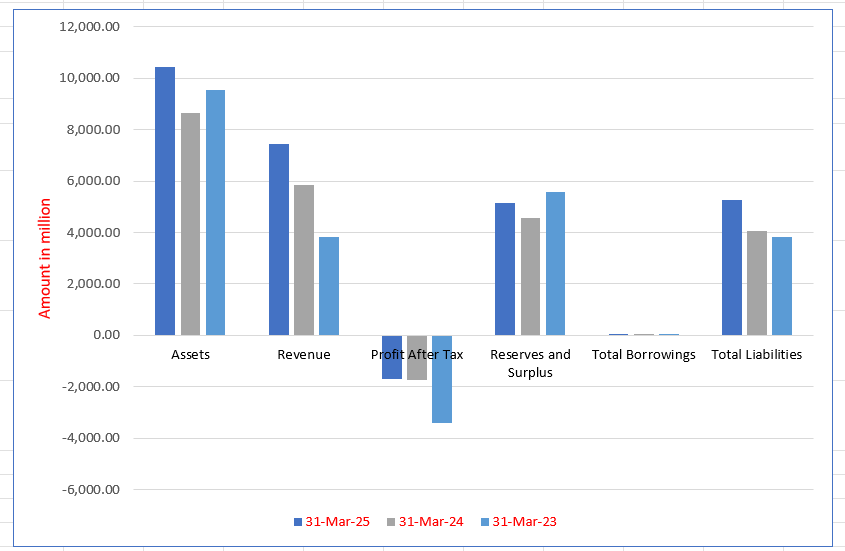

Curefoods India Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 10,427.07 | 8661.45 | 9525.28 |

| Revenue | 7457.96 | 5851.19 | 3820.42 |

| Profit After Tax | (1699.68) | (1726.10) | (3427.32) |

| Reserves and Surplus | 5129.99 | 4575.18 | 5579.34 |

| Total Borrowings | 3.01 | 12.78 | 16.49 |

| Total Liabilities | 5252.27 | 4051.21 | 3830.77 |

Financial Status of Curefoods India Limited

SWOT Analysis of Curefoods India IPO

Strength and Opportunities

- Operates over 500 cloud kitchens across 70 cities, establishing a strong market presence.

- Diverse brand portfolio including EatFit, Sharief Bhai, Krispy Kreme, and CakeZone caters to varied customer preferences.

- Strong revenue growth with a 53.17% increase in FY24, indicating effective strategies and market demand.

- Strategic partnerships and acquisitions, such as Krispy Kreme rights, enhance brand portfolio and market reach.

- Utilizes advanced technology for demand forecasting, supply chain optimization, and customer experience enhancement.

- Expansion into new markets and international regions presents growth opportunities.

- Focus on sustainable and hygienic food practices aligns with growing health-conscious consumer trends.

- Experienced management team backed by institutional investors provides strategic guidance and financial stability.

Risks and Threats

- High dependency on third-party platforms like Swiggy and Zomato for customer acquisition.

- Operational scaling challenges due to rapid expansion and integration of new brands.

- Intense competition in the cloud kitchen and online food delivery market.

- Vulnerability to changing consumer preferences and dietary trends.

- Regulatory compliance and food safety challenges in diverse markets.

- High operational costs associated with maintaining multiple service formats.

- Economic downturns and price sensitivity may affect consumer spending on premium food offerings.

- Potential risks associated with brand integration and maintaining consistent quality across diverse offerings.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Curefoods India Limited

Curefoods India Limited IPO Strengths

Second Largest Digital-First Food Business in India with Wide Geographical Footprint

Curefoods India Limited is the second largest digital-first food services company in India, operating 502 Service Locations across 70 cities as of March 31, 2025. Its hub-and-spoke model, combining cloud kitchens, kiosks, and restaurants, enables scalable operations, efficient delivery, and multi-brand offerings, driving revenue growth, operational efficiency, and extensive market reach nationally and internationally.

Second Largest Digital-First Food Business in India with Wide Geographical Footprint

Curefoods India Limited ranks as the second largest digital-first food services company in India, with 502 Service Locations across 70 cities as of March 31, 2025. Its hub-and-spoke model, integrating cloud kitchens, kiosks, and restaurants, ensures scalable operations, efficient deliveries, multi-brand offerings, enhanced revenue, operational efficiency, and broad national and international market presence.

Robust Supply Chain and Quality Control Driving Operational Excellence

Curefoods India Limited’s robust supply chain ensures consistent quality and freshness, leveraging strategic sourcing, efficient packaging, and reliable logistics. Its scalable operations use technology and data-driven demand planning to minimize waste and ensure timely deliveries. ISO-certified central kitchens, temperature-controlled transport, rigorous quality checks, and a dedicated R&D team maintain hygiene, safety, and operational excellence across all locations.

Ability to Acquire, Integrate, and Scale New Brands

Curefoods India Limited’s strategic acquisitions and brand integrations have driven its growth and diversification. By identifying market gaps, the company acquires high-potential brands or franchising rights, focusing on proven product-market fit. Notable acquisitions include Sharief Bhai, Olio Pizza, Krispy Kreme, Nomad Pizza, and Millet Express. Post-acquisition, Curefoods scales these brands across Tier I and Tier II+ cities, adapts menus for local preferences, and leverages central kitchens for consistent quality, resulting in significant revenue growth and expanded presence nationwide.

Advanced Technology Stack

Curefoods India Limited leverages an advanced technology stack across its operations, integrating AI, data analytics, SaaS tools, and unified dashboards. This enables efficient order management, inventory optimization, demand forecasting, personalized marketing, and seamless point-of-sale transactions. By analyzing consumer insights and market trends, Curefoods ensures timely delivery, reduces waste, enhances customer satisfaction, and maintains high operational efficiency

Experienced Leadership and Institutional Support

Curefoods India Limited is led by Promoter and CEO Ankit Nagori, supported by a seasoned board and professional management team with extensive experience across consumer internet, health, and F&B sectors. With 5,641 employees as of March 2025, the company’s growth is backed by institutional investors including 3State Ventures, Iron Pillar, Chiratae Ventures, and Accel India.

More About Curefoods India Limited

Curefoods India Limited is an internet-driven multi-brand food services company, offering diverse cuisines catering to varied consumer preferences and dietary needs. As of March 31, 2025, it ranks as the second largest digital-first food services company in India (excluding food delivery marketplaces) by revenue from operations in Fiscal 2024. The company operates through multiple channels, including cloud kitchens, kiosks, and restaurants, collectively referred to as Service Locations. It is among the top two cloud kitchen companies in India in terms of service locations and has emerged as the fastest-growing food services company in Fiscal 2025. Curefoods was the first in the sector to surpass annual revenues of ₹7,500 million within its first five years of operations.

Multi-Brand Strategy

Curefoods operates a portfolio of ten key brands that cater to different price points, cuisines, and meal occasions, including breakfast, lunch, snacks, and dinner. Notable brands include EatFit, HRX, Sharief Bhai, Arambam, Krispy Kreme, Nomad Pizza, and CakeZone. The multi-brand strategy enables the company to:

- Serve a broader customer base with diverse food preferences

- Enhance customer satisfaction through variety and innovation

- Reduce dependency on any single brand or cuisine

- Continuously refresh offerings to maintain engagement

In addition to its home-grown brands, Curefoods strategically acquires other food service companies and integrates their brands into its portfolio, expanding both growth and diversification. Since launching EatFit in 2020, the company has added over nine brands, including acquiring franchising rights for Krispy Kreme across multiple regions by 2025.

Network and Operations

Curefoods leverages a hub-and-spoke model with central kitchens (‘hubs’) and strategically located cloud kitchens, restaurants, and kiosks (‘spokes’) to maximize efficiency and ensure consistent quality. As of March 31, 2025, it operates 502 Service Locations across 70 cities and towns, supported by five central kitchens, 281 cloud kitchens, 99 kiosks, 122 restaurants, and 13 warehouses. The company integrates with online delivery platforms such as Swiggy and Zomato, alongside its own website, providing seamless ordering and payment options.

Technology and Product Innovation

Curefoods employs AI, data analytics, and advanced technology to enhance operations, optimize supply chains, and improve customer experience. Its innovation team develops differentiated food offerings, including gluten-free, protein-rich, and health-focused meals. EatFit emphasizes nutrition transparency, while HRX promotes fitness-oriented dining.

Commitment to Quality and Leadership

The company adheres to ISO 22000:2018 standards, ensuring food safety, hygiene, and consistency. Led by Ankit Nagori, supported by an experienced management team and institutional investors, Curefoods continues to expand its market presence, leveraging technology and consumer insights to capitalize on India’s rapidly growing food services market, projected to reach ₹12–12.6 trillion by 2030

Industry Outlook

Market Size and Growth Projections

- The Indian food services market was valued at approximately ₹6.92 lakh crore (USD 80 billion) in 2024.

- It is projected to reach between ₹12.46 lakh crore (USD 144 billion) and ₹13.15 lakh crore (USD 152 billion) by 2030, growing at a CAGR of 10–11%.

Cloud Kitchen Market Dynamics

- The cloud kitchen segment within the food services industry is experiencing significant growth.

- In 2024, the Indian cloud kitchen market was valued at approximately USD 1.13 billion.

- This market is expected to expand to USD 2.84 billion by 2030, reflecting a CAGR of 16.66%.

Key Growth Drivers

- Urbanization and Changing Lifestyles: Rapid urbanization and evolving consumer lifestyles are increasing the demand for convenient food options.

- Technological Advancements: Integration of technology in food ordering and delivery systems enhances customer experience and operational efficiency.

- Rising Disposable Incomes: Increasing disposable incomes are enabling consumers to spend more on dining out and food delivery services.

- Health and Wellness Trends: Growing awareness of health and wellness is driving demand for nutritious and specialty food offerings.

Product Segmentation and Consumer Preferences

- Cloud Kitchens: Facilities focus solely on food preparation for delivery or takeout, eliminating the need for physical dining spaces.

- Multi-Brand Offerings: Companies are adopting multi-brand strategies to cater to diverse consumer preferences across various cuisines and price points.

- Health-Conscious Menus: There is an increasing trend toward offering health-focused menus, including gluten-free, high-protein, and low-calorie options.

How Will Curefoods India Limited Benefit

- Curefoods India Limited is well-positioned to capitalize on the growing Indian food services market, benefiting from rising demand and urbanization.

- Its multi-brand portfolio allows the company to cater to diverse consumer preferences and price points, enhancing market reach.

- The cloud kitchen model enables rapid scalability without high capital expenditure, supporting faster expansion across cities.

- Advanced technology and AI-driven systems optimize operations, streamline order management, and improve customer experience.

- Health-focused and innovative menu offerings align with rising consumer demand for nutritious and specialty foods.

- Integration with major online delivery platforms increases visibility, accessibility, and revenue potential.

- Strategic acquisitions and franchising opportunities help expand the brand portfolio and diversify revenue streams.

- Centralized kitchens and efficient supply chain management ensure consistent quality, timely delivery, and operational efficiency.

- The company’s digital-first approach allows it to leverage data analytics for targeted marketing and customer engagement.

Peer Group Comparison

| Name of the Company | Face Value Per Share (₹) | Revenue (₹ Millions) | EPS (Basic) (₹) | P/E | RoNW (%) | NAV (₹) |

| Curefoods India | 1.00 | 7,457.96 | (5.58) | [●] | (31.29%) | 17.84 |

| Peer Groups | ||||||

| Jubilant FoodWorks Limited | 2.00 | 81,417.26 | 3.41 | 209.09 | 9.95% | 33.08 |

| Devyani International Limited | 1.00 | 49,510.52 | 0.08 | 2,152.63 | (0.49%) | 11.62 |

| Sapphire Foods India Limited | 2.00 | 28,818.64 | 0.60 | 547.75 | 1.20% | 43.47 |

| Westlife Foodworld Limited | 2.00 | 24,911.92 | 0.78 | 961.22 | 2.01% | 38.70 |

| Eternal Limited | 1.00 | 202,430.00 | 0.60 | 446.31 | 1.74% | 31.41 |

| Swiggy Limited | 1.00 | 152,267.55 | (13.72) | NA | (30.50%) | 40.98 |

Key Strategies for Curefoods India Limited

Continue to Expand Portfolio of Brands and Introduce Brand Extensions

Curefoods India Limited focuses on expanding its brand portfolio by launching new brands, acquiring franchising rights for international names, and integrating high-potential brands. This strategy addresses market gaps across cuisines and price points, introduces innovative offerings like Krispy Kreme, and targets emerging categories such as coffee, desserts, and fried chicken.

Focus on Expedited Delivery Channels

Curefoods prioritizes quick commerce by curating menus for delivery under 15 minutes, increasing kitchen density in key clusters, and introducing packaged foods and health snacks. The company leverages delivery metrics and customer feedback to enhance operational efficiency, optimize drive times, and consistently improve expedited delivery performance.

Expand Presence in Existing Markets and Deepen Offline Presence in Tier II+ Cities

Curefoods aims to strengthen market reach by increasing kiosk and restaurant density in existing cities and expanding into Tier II+ regions. Utilizing established supply chains, AI-driven demand planning, and SOPs, the company ensures operational efficiency while offering diverse dining formats and enhancing offline brand visibility.

Expand Presence in International Markets

Curefoods is extending its global footprint, building on its UAE launch. The company leverages delivery and non-delivery models, partners with established platforms, and targets regions with a significant Indian diaspora to tap into growing demand for Indian cuisine and digital food delivery solutions.

Leverage Technology and Data-Driven Insights

Curefoods integrates advanced technology across supply chain, kitchen, and delivery operations. Using AI, analytics, and unified dashboards, it forecasts demand, optimizes inventory, personalizes menus, and enhances customer experience, driving efficiency, scalability, and informed decision-making throughout its operations.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Curefoods India Limited IPO

How can I apply for Curefoods India Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of Curefoods' IPO?

Curefoods India Limited aims to raise ₹800 crore through its Initial Public Offering (IPO).

Who are the lead managers for the IPO?

The IPO is being managed by JM Financial, IIFL Capital Services, and Nuvama Wealth Management.

When is the IPO expected to open?

The IPO is tentatively scheduled to open in the latter half of the fiscal year 2025.

How can I apply for the IPO?

Investors can apply through the ASBA (Application Supported by Blocked Amount) process via banks or online platforms.

Where will the IPO shares be listed?

Curefoods’ IPO shares are expected to be listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).