- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Deon Energy IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Deon Energy IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Deon Energy Limited

Founded in 2020, Deon Energy Limited provides comprehensive renewable energy solutions, specialising in engineering, procurement, and construction (EPC) of solar energy projects on a turnkey basis. The company caters mainly to commercial and industrial clients across India, offering EPC execution and operations and maintenance (O&M) services such as panel cleaning and inverter upkeep. It has completed 78 solar projects with a combined installed capacity of 140.29 MWDC and 118.80 MWAC. As of August 31, 2025, it held an order book worth ₹5,051.55 million and employed 137 personnel.

Deon Energy Limited IPO Overview

Deon Energy Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 25, 2025, proposing to raise ₹150 crore through an Initial Public Offering (IPO). The issue will be a Book Build Issue consisting entirely of a fresh issue of shares, with no offer for sale component. The company plans to list its equity shares on both the NSE and BSE. While the book-running lead manager has not yet been announced, Bigshare Services Pvt. Ltd. has been appointed as the registrar of the issue. Details such as the IPO dates, price band, and lot size are yet to be disclosed. Investors can refer to the Deon Energy IPO DRHP for more comprehensive information.

According to the DRHP, the face value of each share is ₹10, and the total issue size aggregates up to ₹150 crore through fresh capital. The IPO will follow the book-building route and aims to list on both major stock exchanges — BSE and NSE. Prior to the issue, the company’s shareholding stood at 2,40,10,000 shares.

The DRHP was officially filed with SEBI on September 25, 2025. The promoters of Deon Energy Ltd. include Dharmesh Ashokbhai Makadiya, Chiragbhai Dineshbhai Kalariya, Archanaben Kalariya, and Bhargav Chaturbhai Kavar. Their collective shareholding before the IPO stands at 100%, which will reduce post-issue upon the allotment of new shares

Deon Energy Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹150 crore |

| Fresh Issue | ₹150 crore |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 2,40,10,000 shares |

| Shareholding post-issue | TBA |

Deon Energy Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Deon Energy Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Deon Energy Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹26,158.40 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 102.41% |

| Net Asset Value (NAV) | ₹25,542.61 |

| Return on Equity (RoE) | 181.96% |

| Return on Capital Employed (RoCE) | 118.72% |

| EBITDA Margin | 11.85% |

| PAT Margin | 8.75% |

| Debt to Equity Ratio | 0.15 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding the long-term working capital requirements of the Company. | 1000 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

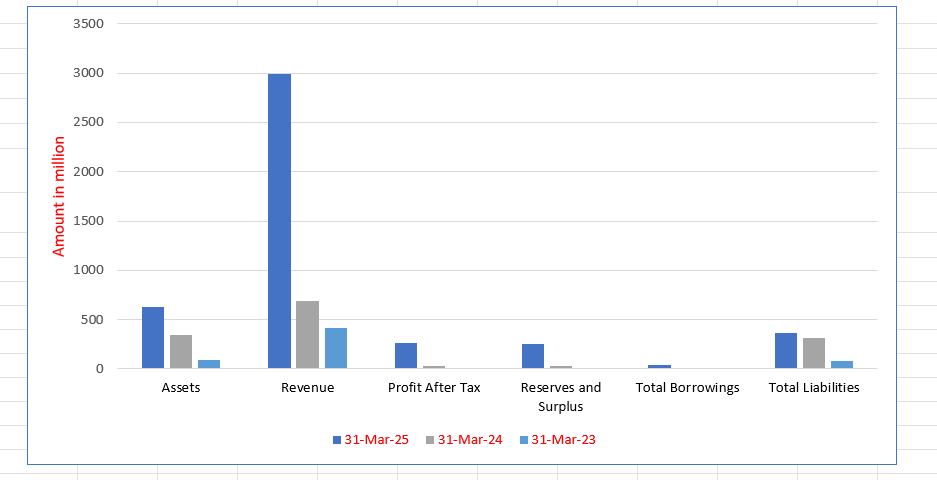

Deon Energy Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 623.07 | 344.97 | 94.50 |

| Revenue | 2,988.03 | 684.31 | 418.37 |

| Profit After Tax | 261.58 | 29.93 | 2.22 |

| Reserves and Surplus | 255.33 | 28.85 | 1.73 |

| Total Borrowings | 39.45 | 7.22 | 3.55 |

| Total Liabilities | 367.64 | 312.87 | 84.46 |

Financial Status of Deon Energy Limited

SWOT Analysis of Deon Energy IPO

Strength and Opportunities

- Strong experience in solar infrastructure projects across Gujarat and India.

- Expertise in turnkey solar PV, commercial rooftop, and ground-mounted systems.

- Experienced leadership team with a decade of industry expertise.

- Focused vision on sustainable and innovative clean energy solutions.

- Rising demand for commercial and industrial solar installations in India.

- Opportunity to diversify into energy storage and hybrid renewable systems.

- Increasing global emphasis on ESG and sustainability enhances brand positioning.

- Ability to serve rising corporate sustainability commitments.

- Potential expansion into new regions and international markets.

Risks and Threats

- Smaller operational scale compared to major renewable energy players.

- Regional concentration may expose the firm to local policy or regulatory risks.

- High dependence on imported solar components could raise costs.

- Growing competition in the renewable sector may pressure profit margins.

- Capital-intensive operations may strain liquidity and project timelines.

- Policy shifts and tariff changes can impact project viability.

- Technological upgrades may be required frequently to stay competitive.

- Unpredictable weather or grid-connectivity issues could delay projects.

- Currency volatility and import duties may increase project costs.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Deon Energy Limited

Deon Energy Limited IPO Strengths

C&I-Focused Turnkey Solar EPC Solutions

Deon Energy Limited specializes in turnkey solar EPC solutions for the high-growth Commercial and Industrial (C&I) sectors. The Company provides customized, end-to-end services, including engineering, procurement, construction, and securing necessary approvals. This model addresses the C&I segment’s strong drive toward decarbonization and cost-effective power procurement, evidenced by significant revenue from Textile and Ceramic industries.

Robust Order Book & Cash Flow Visibility

Deon Energy Limited maintains a robust and growing Order Book, securing ₹5,051.55 million in orders as of August 31, 2025. This strong pipeline of ongoing and upcoming projects provides clear cash flow visibility and significant growth potential. The Company’s consistent success stems from its commitment to quality execution and strong client management, leading to repeat orders.

Proven Execution in Key Solar Market

The Company boasts a proven track record of successful project execution, with 100% of its Fiscal 2025 revenue generated from Gujarat, India’s second-largest solar market. Deon Energy Limited has cultivated a marquee client base (e.g., Omax Cotspin), leveraging the significant industry experience of its promoters. This regional focus underscores its expertise and reliability in a high-potential market.

Comprehensive O&M with Advanced Monitoring

Deon Energy Limited provides comprehensive Operations and Maintenance (O&M) services to the majority of its EPC clients, covering 44 power plants in Fiscal 2025. This includes daily cleaning, repairs, and security. The use of advanced SCADA and GSM data loggers ensures robust remote monitoring and swift fault resolution, cementing client relationships and driving repeat service renewals.

Integrated In-house EPD Capabilities

Deon Energy Limited’s integrated, in-house Engineering, Procurement, and Design (EPD) team is a core strength, backed by specialized software like PVsyst and AutoCad. This allows the Company to manage complex processes from design to construction efficiently, offering customized, cost-effective solutions. By having strong internal expertise, Deon Energy Limited minimizes delays and ensures the timely, quality execution of solar power projects.

Experienced Leadership and Management

Deon Energy Limited is guided by an experienced team of Promoters and Key Management Personnel (KMP). Promoters, including Dharmesh Ashokbhai Makadiya (12 years experience), bring deep expertise in the solar industry across client acquisition, project management, and strategic initiatives. This collective, vast experience is pivotal to the Company’s growth and success, ensuring effective control and direction over all core business operations.

More About Deon Energy Limited

Deon Energy Limited is engaged in delivering comprehensive renewable energy solutions with a strong focus on solar EPC (Engineering, Procurement and Construction) services. The company undertakes turnkey solar projects, primarily for commercial and industrial clients, ensuring seamless execution from conceptualisation to commissioning. Its expertise extends across every project stage — including land acquisition, regulatory approvals, evacuation line facilitation, and technology selection.

Core Operations

Deon Energy provides customised EPC solutions by analysing clients’ power usage and recommending optimal solar technologies. Since its inception in 2020, the company has executed 78 solar power projects with a cumulative installed capacity of 140.29 MWDC and 118.80 MWAC as of 31 March 2025.

Business Segments

- Ground-Mounted Solar Projects: These systems are deployed on open land and industrial spaces. Representing India’s largest solar category, they contribute over 81 GW to the national capacity as of FY 2025.

- Rooftop Solar Projects: Installed on commercial and industrial structures, this segment continues to grow, registering a 12 % rise with 5.15 GW of new capacity in FY 2025.

Operations and Maintenance (O&M)

Deon Energy also provides post-installation O&M services, ensuring maximum efficiency and longevity of client assets. In FY 2025, it maintained 44 solar power plants with a combined capacity of 127.79 MWDC / 107.98 MWAC.

Its O&M division employs advanced technologies such as SCADA and GSM data loggers for remote monitoring, enabling quick fault detection and real-time performance tracking. A dedicated 42-member technical team oversees daily cleaning, repairs, and security operations across project sites.

Financial Growth

For FY 2025, Deon Energy reported ₹ 2,988.02 million in revenue from operations — up from ₹ 684.26 million in FY 2024 and ₹ 418.36 million in FY 2023 — reflecting a CAGR of 167.25 %. The company’s order book stood at ₹ 5,051.55 million as of August 2025, supported by a robust clientele that includes Omax Cotspin, Fiotex Cotspin, and Megacity Vitrified LLP.

Industry Outlook

India’s renewable energy sector remains a rapidly expanding frontier, with solar power leading its clean-energy transformation. By 2025, the country’s installed renewable capacity is projected to exceed 170 GW, driven by strong policy support, private investment, and technological advancement. The renewable market, valued at approximately USD 24 billion in 2024, is expected to touch USD 37 billion by 2030, reflecting a CAGR of around 9 %.

Solar Energy Outlook

Solar energy constitutes the largest component of India’s renewable portfolio and continues to grow at an exceptional pace.

- The solar market is anticipated to expand at a CAGR of about 19.8 % between 2025–2030.

- Installed solar capacity is forecast to reach 195 GW within a few years, compared to roughly 92 GW in 2024.

- Long-term estimates project solar installations at nearly 284 GW by 2033, signalling sustained demand.

EPC and Equipment Growth

For companies engaged in solar EPC and power equipment manufacturing, growth prospects remain equally strong.

- The solar equipment market (modules, inverters, and mounting systems) was valued at USD 13.6 billion in 2024, expected to reach USD 27.7 billion by 2033.

- The power EPC market in India is forecast to grow from USD 22.4 billion to USD 39.1 billion over the same period, with a CAGR of 6.4 %.

Growth Drivers

- Favourable government targets to achieve 280 GW of solar capacity by 2030.

- Falling photovoltaic module prices and improved technology efficiency.

- Rising corporate sustainability goals and demand from industrial users.

- Expansion in rooftop and distributed solar installations.

Outlook for Deon Energy Limited

With its focus on solar EPC and O&M solutions, Deon Energy Limited is strategically placed to benefit from India’s robust renewable-energy expansion. The company’s expertise, technical innovation, and execution capabilities align seamlessly with the industry’s long-term growth trajectory.

How Will Deon Energy Limited Benefit

- Deon Energy Limited stands to gain from India’s accelerating renewable energy push, driven by strong policy incentives and the national goal of achieving 280 GW of solar capacity by 2030.

- The company’s expertise in EPC solutions positions it favourably to capture a growing share of the expanding solar installation market.

- Increasing demand for commercial and industrial rooftop solar systems creates new opportunities for customised, high-efficiency projects.

- Falling solar equipment costs and improved technology enhance project profitability and scalability.

- The surge in solar EPC investments will likely boost Deon Energy’s order inflows and strengthen its revenue visibility.

- Expansion in O&M services ensures recurring income through long-term client relationships.

- Supportive government policies, including production-linked incentives, can reduce procurement costs and improve margins.

- Rising corporate sustainability commitments open partnerships with large industrial clients seeking clean-energy solutions.

- The overall industry’s double-digit growth potential ensures sustainable expansion for Deon Energy Limited in the coming years.

Peer Group Comparison

| Name of Company | Revenue (₹ million) | Face Value (₹) | P/E (Times) | EPS (Basic) (₹) | EPS (Diluted) (₹) | RoNW (%) | NAV (₹) |

| Deon Energy Limited | 2,988.02 | 10 | [●] | 26,158.40 | 26,158.40 | 102.41% | 25,542.61 |

| Peer Group | |||||||

| KPI Green Energy Limited | 17,354.54 | 10 | 8.66 | 16.23 | 16.09 | 12.37% | 265.05 |

| Zodiac Energy Limited | 4,077.77 | 10 | 29.71 | 13.38 | 13.27 | 20.68% | 63.97 |

Key Strategies for Deon Energy Limited

Expanding Domestic Solar EPC Operations

The company’s primary focus is to expand its solar EPC business by improving execution efficiency and strategically increasing its geographical presence, especially in Gujarat and the newly targeted state of Maharashtra. It aims to leverage its expertise in land acquisition and regulatory approvals to secure new clients and projects, building on its strong track record in the industry.

Diversifying into Independent Power Producer (IPP) Model

The company is diversifying its business by entering the Independent Power Producer (IPP) segment, where it will develop, own, and operate solar assets to sell power through Power Purchase Agreements (PPAs). It has already commissioned one IPP project and is developing another in Gujarat. This expansion is supported by the creation of several special purpose vehicle subsidiaries.

Enhancing Operational Controls and Service Quality

Deon Energy Limited continues to prioritize enhancing operational controls and cost efficiencies to ensure the timely and high-quality completion of services. By focusing on industry best practices and providing training, the company aims to maintain its strong reputation, reduce construction risk, and ultimately facilitate further business expansion in the competitive solar energy sector

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Deon Energy Limited IPO

How can I apply for Deon Energy Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the issue size of Deon Energy Limited IPO?

Deon Energy Limited aims to raise ₹150 crore through a fresh issue of equity shares.

When did Deon Energy file its Draft Red Herring Prospectus (DRHP)?

The company filed its DRHP with SEBI on 25 September 2025 for IPO approval.

On which stock exchanges will Deon Energy shares be listed?

The equity shares are proposed to be listed on both BSE and NSE.

What will the IPO proceeds be used for?

Funds will primarily support long-term working capital needs (₹100 crore) and general corporate purposes.

Who are the promoters of Deon Energy Limited?

The promoters include Dharmesh Ashokbhai Makadiya, Chiragbhai Dineshbhai Kalariya, Archanaben Kalariya, and Bhargav Chaturbhai Kavar.