- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Dev Accelerator IPO

₹13,160/235 shares

Minimum Investment

IPO Details

10 Sep 25

12 Sep 25

₹13,160

235

₹56 to ₹61

NSE, BSE

₹143.35 Cr

17 Sep 25

Dev Accelerator IPO Timeline

Bidding Start

10 Sep 25

Bidding Ends

12 Sep 25

Allotment Finalisation

15 Sep 25

Refund Initiation

16 Sep 25

Demat Transfer

16 Sep 25

Listing

17 Sep 25

Dev Accelerator Limited IPO

Dev Accelerator Limited, established in 2017 and popularly known as DevX, offers flexible office space solutions, including coworking environments and managed offices. With a strong presence across 15 centres in cities like Delhi-NCR, Hyderabad, Mumbai, and Pune, the company has grown to operate 25 centres in 11 cities, serving over 230 clients as of August 31, 2024. With 12,691 seats spanning 806,635 sq. ft., DevX plans to expand to Sydney and Surat, adding 11,500 seats. Its subsidiary also offers interior design and execution services.

Dev Accelerator Limited IPO Overview

Gujarat-based Dev Accelerator filed its Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) on 1 April 2025. Dev Accelerator IPO is a book-building public issue comprising 2.47 crore equity shares, all of which are part of a fresh issue. The IPO dates are yet to be announced, and the finalisation of the allotment is expected to take place on a date that is yet to be disclosed. The price band for the IPO is also pending announcement. Pantomath Capital Advisors Pvt Ltd is acting as the book-running lead manager for this offering, while Kfin Technologies Limited will serve as the registrar.

According to the Draft Red Herring Prospectus (DRHP), the IPO will be listed on both BSE and NSE. The face value of each share is ₹2. The total issue size consists of 2,47,00,000 shares, which also represents the entire fresh issue, with the aggregate value to be declared. The pre-issue shareholding stands at 6,66,87,515 shares, which will increase to 9,13,87,515 shares post-issue.

As per the reservation structure, not less than 75% of the offer will be allocated to Qualified Institutional Buyers (QIBs), not more than 10% to retail investors, and not more than 15% to Non-Institutional Investors (NIIs) or High Net-Worth Individuals (HNIs). The DRHP for the Dev Accelerator IPO was filed with SEBI on Tuesday, April 1, 2025. The promoters of the company include Parth Shah, Umesh Uttamchandani, Rushit Shah, and Dev Information Technology Limited. The promoter shareholding before the issue stands at 54.11%, with the post-issue figure yet to be determined based on equity dilution.

Dev Accelerator Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 2.47 crores

Offer for Sale (OFS): NA |

| IPO Dates | 10 Sept 2025 to 12 Sept 2025 |

| Price Bands | ₹56 to ₹61 per share |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 6,66,87,515 shares |

| Shareholding post -issue | 9,01,87,515 shares |

Important Dates

| Activity | Date |

| IPO Open Date | 10 September 2025 |

| IPO Close Date | 12 September 2025 |

| Tentative Allotment | 15 September 2025 |

| Initiation of Refunds | 16 September 2025 |

| Credit of Shares to Demat | 16 September 2025 |

| Tentative Listing Date | 17 September 2025 |

IPO Lots

| Investor Type | Application | Lots | Shares | Amount (₹) |

| Retail (Min) | 1 | 1 | 235 | 14,335 |

| Retail (Max) | 13 | 13 | 3,055 | 1,86,355 |

| S-HNI (Min) | 14 | 14 | 3,290 | 2,00,690 |

| S-HNI (Max) | 69 | 69 | 16,215 | 9,89,115 |

| B-HNI (Min) | 70 | 70 | 16,450 | 10,03,450 |

Dev Accelerator Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 0.08 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 1.52% |

| Net Asset Value (NAV) | 4.10 |

| Return on Equity | – |

| Return on Capital Employed (ROCE) | 17.31% |

| EBITDA Margin | 59.90% |

| PAT Margin | 0.39% |

| Debt to Equity Ratio | 3.51 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Capital expenditure for fit-outs in the new centres and for security deposits of the new centres | 689.57 |

| Repayment and/or pre-payment, in full or part, of certain borrowings availed by the company, including redemption of non-convertible debentures | 300 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

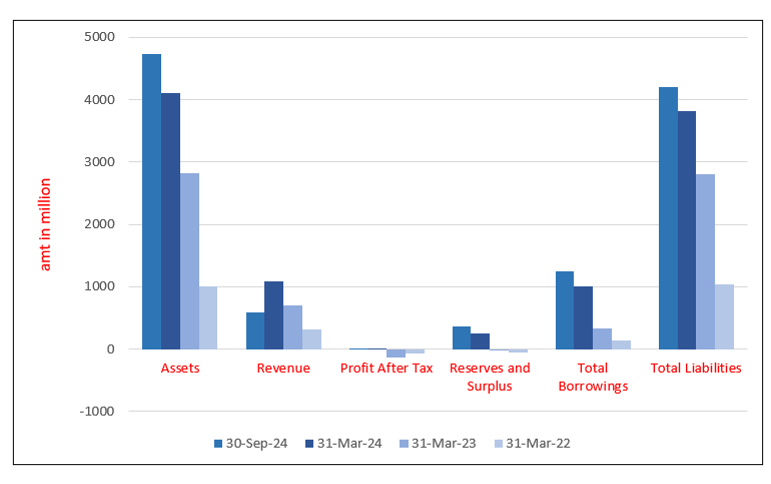

Dev Accelerator Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 4730.94 | 4110.89 | 2824.22 | 1008.02 |

| Revenue | 593.80 | 1080.87 | 699.11 | 308.83 |

| Profit After Tax | 3.84 | 4.37 | (128.30) | (75.12) |

| Reserves and Surplus | 365.16 | 251.97 | (23.68) | (57.14) |

| Total Borrowings | 1244.38 | 1010.50 | 332.01 | 138.76 |

| Total Liabilities | 4196.51 | 3822.92 | 2811.98 | 1029.27 |

Financial Status of Dev Accelerator Limited

SWOT Analysis of Dev Accelerator IPO

Strength and Opportunities

- Rapid expansion with 25 centres across 11 Indian cities and plans for international presence in Sydney.

- Diverse client base including major corporations like Zomato, Tim Hortons, and Hitachi.

- Customized managed office solutions catering to varied business needs.

- Integration of technology in operations for seamless client experiences.

- Recognition as 'Coworking Startup of the Year' at Economic Times Awards 2025.

- Strong financial growth with a 55% increase in operating revenue in FY24.

- Strategic expansion into Tier II cities, tapping into emerging markets.

- Backing from parent company Dev Information Technology, providing financial and strategic support.

- Robust design and execution services through subsidiary Neddle and Thread Designs LLP.

Risks and Threats

- High operational costs due to premium facilities, impacting profitability margins.

- Dependence on the startup ecosystem, leading to revenue volatility during market downturns.

- Underutilization of space during off-peak hours, leading to inefficiencies.

- Challenges in educating Tier II city markets about coworking benefits.

- Intense competition from established global coworking giants with larger resources.

- Limited geographic presence compared to global competitors, restricting market reach.

- High depreciation and finance costs, affecting net profitability.

- Potential challenges in maintaining consistent service quality across rapidly expanding locations.

- Regulatory and compliance challenges associated with rapid expansion and IPO processes.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Dev Accelerator IPO

Dev Accelerator Limited IPO Strengths

- Leadership in Tier 2 Flexible Workspace Market

Dev Accelerator Limited holds a leadership position as one of the largest managed space operators in India’s Tier 2 markets, with a strong presence in cities like Ahmedabad, Indore, and Jaipur. Backed by high occupancy rates and strategic expansion plans, it is well-positioned to benefit from rapid flex space sector growth.

- Strong Pan-India Presence with High Occupancy and Steady Growth

Dev Accelerator Limited has established a robust pan-India footprint across 11 cities, including key Tier 1 and Tier 2 markets. With a deep understanding of customer needs and strategic location choices, it consistently maintains high occupancy rates. As of January 2025, its strong client satisfaction and customisable workspace offerings have supported impressive growth across operational metrics.

- Customer-Centric Model with Integrated Platform for Lasting Relationships

Dev Accelerator Limited operates on a customer-focused business model, offering fully customisable office spaces with zero capital expenditure for clients. With in-house design and execution teams ensuring timely delivery, integrated facility management services, and ISO-certified operations, the company builds long-term relationships across diverse industries, serving over 230 clients as of January 2025.

- Experienced Leadership Driving Strategic Growth

Dev Accelerator Limited benefits from the vision and industry insight of its experienced promoters and management team. Led by founders with over 21 years of combined experience in the flexible workspace sector and supported by a seasoned Board and senior team, the company drives strategic planning, growth, and market expansion effectively.

- Demonstrating Robust Financial and Operational Growth

Dev Accelerator Limited has showcased impressive growth across key operational and financial parameters. From March 31, 2022 to March 31, 2024, its Operational Centers, seats, and Super Built-Up Area expanded at CAGRs of 66.67%, 39.89%, and 53.14%, respectively. Revenue from operations surged at a CAGR of 87.08%, reflecting strong business momentum.

More About Dev Accelerator Limited

Dev Accelerator Limited stands as one of the largest flex space operators in India’s Tier 2 markets in terms of operational flex stock (Source: JLL Report). Since inception, the company has expanded across both Tier 1 and Tier 2 cities including Delhi NCR, Hyderabad, Mumbai, Pune, Ahmedabad, Gandhinagar, Indore, Jaipur, Udaipur, Rajkot, and Vadodara, with operations as of January 31, 2025.

Comprehensive Workspace Solutions

Dev Accelerator offers end-to-end office space solutions, encompassing:

- Sourcing and developing commercial office spaces

- Customising designs to client needs

- Providing complete asset and facility management

- Integrating advanced technology solutions

The company handles everything from HVAC maintenance to cleaning, electricals, plumbing, and admin support—ensuring seamless day-to-day operations for clients.

Expanding Network and Clientele

As of January 31, 2025:

- 25 operational centres

- Presence in 11 cities

- 13,140 operational seats

- 806,635 sq. ft. under management

- Serving over 230 clients

Dev Accelerator’s clientele includes corporates, MNCs, and SMEs.

Segmented Workspace Offerings

Dev Accelerator provides the following workspace solutions:

- Managed Office Spaces: Custom-built workspaces for large businesses (100–500 seats), tailored for specific business needs.

- Coworking Spaces: Flexible seating in shared spaces, ideal for start-ups, freelancers, and remote workers.

- Design & Execution: Through its subsidiary, Neddle and Thread Designs LLP, the company offers turnkey interior design and build solutions for its own centres and external offices.

- Payroll Management: Employee lifecycle solutions using proprietary software.

- Facility Management: Includes IT support, housekeeping, security, valet parking, and stationery.

- IT/ITeS Services: Delivered via Saasjoy Solutions Pvt. Ltd., covering cloud services, software development, data analytics, and digital marketing.

Focus on Managed Office Solutions

Managed office spaces remain the company’s core revenue driver, with average lease tenures of 5–9 years and lock-ins of 3.5–5 years—offering financial stability and long-term client engagement.

Revenue from this segment amounted to:

- ₹411.27 million (H1 FY2025)

- ₹740.35 million (FY2024)

- ₹353.14 million (FY2023)

- ₹170.62 million (FY2022)

This accounted for over 68% of operational revenue in recent periods.

Industry Outlook

India’s flexible workspace industry is witnessing significant expansion, driven by dynamic shifts in work culture, the rise of startups, and increasing demand for efficient, scalable office solutions.

Market Size and Growth Projections

- The Indian co-working space market was valued at around USD 0.71 billion in FY2024 and is projected to reach nearly USD 1.96 billion by FY2032, growing at a CAGR of approximately 13.5% during FY2025–FY2032.

- Another estimate places the market size at USD 761.9 million in 2023, with projections to grow to USD 2.84 billion by 2030, reflecting a strong CAGR of around 20.6% between 2024 and 2030.

Key Growth Drivers

- The widespread adoption of hybrid and remote work models has led to increased demand for flexible office arrangements.

- Startups and SMEs are opting for cost-effective and scalable workspace solutions, especially in Tier 2 and Tier 3 cities.

- Large enterprises are integrating flex spaces into their real estate portfolios to reduce upfront investments and enhance operational flexibility.

Segment Insights

- Managed Office Spaces: Preferred by corporates due to their bespoke design and longer lease terms, ensuring operational stability and brand customisation.

- Co-working Spaces: Popular among freelancers, startups, and remote workers, offering ready-to-use, collaborative work environments.

How Will Dev Accelerator Limited Benefit

- Dev Accelerator Limited is strategically positioned to capitalise on the growing demand for flexible workspaces, especially in Tier 2 cities where it holds a strong presence.

- Its pan-India footprint across 11 cities enables access to a broad and diverse clientele, including corporates, MNCs, and SMEs.

- With over 13,000 operational seats and 806,635 sq. ft. under management, the company is well-equipped to scale in line with industry growth projections.

- Its focus on managed office spaces, a high-demand segment among large enterprises, ensures consistent revenue through long-term lease agreements.

- Offering end-to-end solutions—including design, facility management, and IT services—strengthens client retention and operational efficiency.

- Integration of technology and proprietary platforms in payroll and IT/ITeS services enhances value delivery and differentiation.

- A robust revenue track record from the managed office segment (₹740.35 million in FY2024) positions the company to benefit directly from the projected CAGR of over 13.5% in the Indian flex workspace market.

Peer Group Comparison

| Name of the Company | Revenue (₹ million) | EPS (₹) | RONW (%) | P/E Ratio | NAV (₹/share) | Face Value (₹/share) |

| Dev Accelerator Limited | 1,080.87 | 0.08* | 1.52 | [●] | 4.10* | 2.00 |

| Peer Group | ||||||

| Awfis Space Solutions Ltd | 8,488.19 | (1.71) | (6.99) | NA | 24.45 | 10.00 |

Key insights

- Revenue: Dev Accelerator Limited recorded a revenue of ₹1,080.87 million, significantly lower than Awfis Space Solutions Ltd, which posted ₹8,488.19 million. This indicates that Awfis operates on a much larger scale in terms of operations.

- Earnings Per Share: Dev Accelerator Limited posted a positive EPS of ₹0.08, albeit marginal, while Awfis Space Solutions Ltd had a negative EPS of ₹(1.71), signalling losses. Despite low earnings, Dev shows better profitability prospects than its peer.

- Return on Net Worth: Dev Accelerator achieved a modest RONW of 1.52%, indicating limited returns for shareholders. In contrast, Awfis reflected a negative RONW of (6.99)%, suggesting shareholder value is currently eroding due to operational losses.

- Price-to-Earnings (P/E) Ratio: The P/E ratio for Dev Accelerator is not disclosed. However, Awfis Space Solutions reports no P/E due to negative earnings. Thus, valuation comparison is restricted, but Dev’s positive EPS might hint at a calculable P/E.

- Net Asset Value: Dev Accelerator’s NAV per share stands at ₹4.10, while Awfis Space Solutions reports ₹24.45, reflecting a stronger underlying asset value in Awfis. This suggests Awfis holds more substantial assets per equity share than Dev.

- Face Value: Dev Accelerator’s face value is ₹2.00 per share, lower than Awfis’s ₹10.00. This affects nominal share pricing and capital structure, with Awfislikely issuing fewer shares to raise similar capital compared to Dev.

Key Strategies for Dev Accelerator Limited

- Expansion into New and Existing Markets

Dev Accelerator Limited plans strategic expansion in Indian Tier 1 and Tier 2 cities, driven by infrastructure availability, client demand, and demographic suitability. Additionally, international growth is underway with a proposed Sydney centre, enhancing its presence in dynamic global markets and widening operational capacity.

- Enhancing Client Offerings

To meet rising demand for integrated business solutions, Dev Accelerator Limited has introduced value-added services such as HR consulting, IT support, and software development. Through Saasjoy Solutions, it now provides tailored digital products, reinforcing customer satisfaction, retention, and alignment with India’s growing technology-driven work ecosystem.

- Enhancing Asset Procurement Strategy

Dev Accelerator Limited is diversifying its asset models, including straight lease, revenue share, and furnished spaces. Additionally, it is adopting the Opco-Propco structure via investments in Janak Urja and AEPL, aiming to optimise real estate procurement, improve capital efficiency, and strengthen its long-term infrastructure capabilities.

- Leveraging Global Capability Centres

Recognising India’s appeal as a hub for multinational operations, Dev Accelerator Limited intends to tap into the rising trend of Global Capability Centres. By catering to this growing demand, it plans to provide specialised, managed workspaces tailored to support consolidated business functions in cost-efficient, talent-rich locations.

- Strengthening Presence in Emerging Cities

Dev Accelerator Limited is expanding into Tier 2 cities, aiming to capture untapped market demand for quality flexible workspace. By leveraging improved connectivity and talent availability, it seeks to fill infrastructure gaps and establish a strong regional presence through strategically located, fully serviced office centres.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On Dev Accelerator IPO

How can I apply for Dev Accelerator Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the Dev Accelerator Limited IPO?

Dev Accelerator’s IPO is a fresh issue of up to 27.5 million equity shares, aiming to raise funds for expansion and debt repayment.

What is the price band for the IPO?

Dev Accelerator IPO price band is set at ₹56.00 to ₹61.00 per share.

When will the IPO open and close?

Dev Accelerator IPO opens for subscription on Sep 10, 2025 and closes on Sep 12, 2025.

How can I apply for the Dev Accelerator IPO?

Investors can apply via ASBA through their bank’s net banking or UPI through registered brokers.

Where will the Dev Accelerator shares be listed?

The shares are proposed to be listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).