- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Dhariwal Buildtech IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Dhariwal Buildtech IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Dhariwal Buildtech Limited IPO

Incorporated in 2016, Dhariwal Buildtech Limited is an infrastructure construction company engaged in building roads, highways, state highways, PMGSY roads, bridges, railway overbridges, tunnels, railways, irrigation, and other civil works. As of March 31, 2025, the company had 27 ongoing projects across India, serving various government departments and state-owned entities. Its project portfolio includes Engineering, Procurement and Construction (EPC) projects and Hybrid Annuity Model (HAM) projects, reflecting its strong execution capabilities and diverse presence in the infrastructure sector.

Dhariwal Buildtech Limited IPO Overview

Dhariwal Buildtech Limited has submitted its Draft Red Herring Prospectus (DRHP) to the Securities and Exchange Board of India (SEBI) on September 27, 2025, to raise funds through an Initial Public Offering (IPO). The proposed IPO is a Book Built Issue amounting to ₹950 crore, entirely comprising a fresh issue of equity shares with no offer-for-sale component. The company’s shares are planned to be listed on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

MUFG Intime India Pvt. Ltd. has been appointed as the registrar to the issue, while the book running lead manager is yet to be announced. Key IPO details such as the issue price band, lot size, and opening and closing dates will be disclosed in due course. Each equity share will carry a face value of ₹10, with the total issue size aggregating to ₹950 crore through fresh capital issuance.

As per the DRHP, Dhariwal Buildtech Limited’s pre-issue shareholding stands at 9,51,31,800 shares. The company’s promoters include Chet Ram Dhariwal, Aditya Dhariwal, Chet Ram Dhariwal HUF, Saroj Dhariwal, Navita, Deepak Dhariwal, and Mohinder Singh Dhariwal, collectively holding 100% of the pre-issue equity.

Dhariwal Buildtech Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹950 crore |

| Fresh Issue | ₹950 crore |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 9,51,31,800 shares |

| Shareholding post-issue | TBA |

Dhariwal Buildtech IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Dhariwal Buildtech Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Dhariwal Buildtech Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹16.91 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 38.56% |

| Net Asset Value (NAV) | ₹43.78 |

| Return on Equity (RoE) | 38.56% |

| Return on Capital Employed (RoCE) | 24.64% |

| EBITDA Margin | 21.39% |

| PAT Margin | 13.93% |

| Debt to Equity Ratio | 1.16 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment or prepayment of all or a portion of certain outstanding borrowings availed by the Company | 1742.26 |

| Investment in the Material Subsidiaries for repayment or prepayment of all or a portion of certain of its outstanding borrowings | 3000 |

| Funding capital expenditure for purchase of construction equipment by the Company | 2030 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

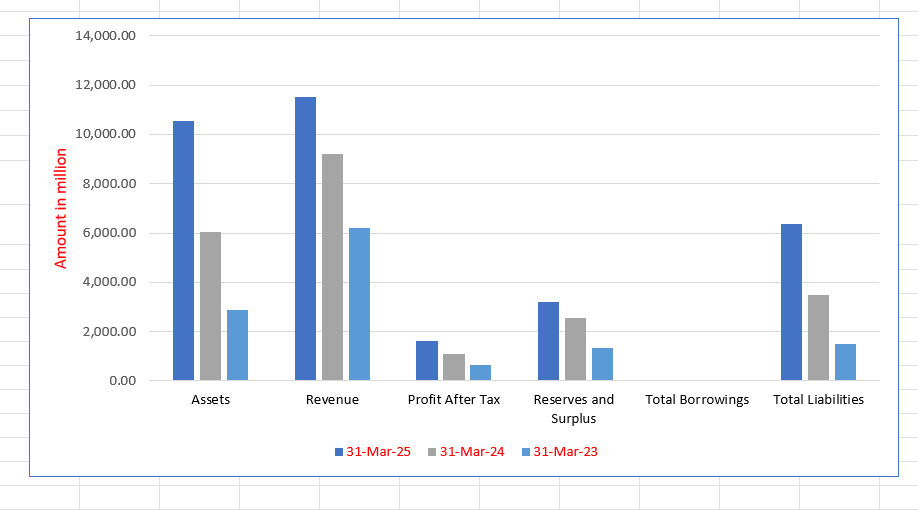

Dhariwal Buildtech Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 10,534.16 | 6,044.32 | 2,867.24 |

| Revenue | 11,529.80 | 9,211.23 | 6,185.11 |

| Profit After Tax | 1,605.90 | 1,101.45 | 643.88 |

| Reserves and Surplus | 3,213.86 | 2,542.88 | 1,351.23 |

| Total Borrowings | 4,840.88 | 1,611.65 | 756.77 |

| Total Liabilities | 6,368.98 | 3,474.35 | 1,491.28 |

Financial Status of Dhariwal Buildtech Limited

SWOT Analysis of Dhariwal Buildtech IPO

Strength and Opportunities

- Extensive promoter experience and strong track record in road and infrastructure projects.

- Healthy order book size providing stable revenue visibility for the medium term.

- Strong client relationships with government agencies and established contractors.

- Comfortable financial profile with prudent capital structure and controlled debt levels.

- Increasing turnover and expanding equipment fleet strengthen operational capacity.

- Opportunity to diversify into new regions and allied construction segments such as bridges and tunnels.

- Government’s continued investment in road infrastructure supports future growth.

- Specialised expertise in executing challenging terrain projects offers niche advantages.

- Strong brand reputation for timely delivery and quality ensures repeat business.

Risks and Threats

- Scale of operations remains moderate compared with large peers in the infrastructure space.

- High concentration of projects in north-eastern states, increasing geographical risk.

- Dependence on timely execution; any delay or cost overrun may reduce profitability.

- Infrastructure projects are exposed to regulatory, land acquisition, and environmental risks.

- Margins remain sensitive to raw material and fuel price fluctuations.

- Intense competition from large national infrastructure companies may pressure margins.

- Working capital requirements could rise with larger project volumes.

- Economic slowdown or higher interest rates could reduce new project inflows.

- Delays in project approvals or funding could impact cash flow and revenue.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Dhariwal Buildtech Limited

Dhariwal Buildtech Limited IPO Strengths

Specialized Execution of Complex Projects

Dhariwal Buildtech Limited consistently demonstrates its capability to handle extreme and complex projects, leveraging advanced project management and sector-specific execution expertise. This is exemplified by securing the contract for constructing the uni-directional two-lane twin tunnels at the challenging Shinkun La Pass in Ladakh. This bespoke capability positions the company well to pursue diverse new opportunities and maintain its industry standing.

Pan-India Presence with Robust Government-Focused Order Book

The Company maintains a Pan-India presence across 13 states, primarily focusing on North, North-East, and Central India, with recent expansion into the West. Its core business strategy centers on government-owned entities and departments, which contributed over 96% to its Order Book across Fiscals 2023–2025. This focus on a diversified, reliable client base reduces non-recovery risk and secures prestigious, larger projects.

Integrated In-House Capabilities and Experienced Leadership

Dhariwal Buildtech’s success is driven by an efficient business model backed by strong in-house capabilities, a qualified workforce including 143 engineers, and a large fleet of modern construction equipment. This reduces dependency on third parties and enhances project execution schedules. The company also benefits from its experienced Promoters and a seasoned management team, ensuring high-quality, timely project delivery.

Timely Project Completion and Financial Incentives

Dhariwal Buildtech Limited has a proven record of completing projects ahead of schedule, as demonstrated by the construction of a major bridge on the Shillong Bypass, finished 79 days early in 2023. This efficiency not only showcases their execution capabilities but also results in tangible financial benefits, such as the ₹ 2.50 million bonus earned for the early completion of the aforementioned bridge project.

Consistent and Sustainable Order Book Growth

The Company has achieved consistent and sustainable growth in its Order Book, which grew from ₹22,440.26 million in Fiscal 2023 to ₹47,669.98 million in Fiscal 2025. This growth reflects their success in diversifying their Order Book across geographies and project types, notably with a significant increase in HAM projects. Their favorable Book-to-Bill ratio of 4.13 times in Fiscal 2025 indicates a strong pipeline of future revenue.

Commitment to Sustainable Construction

Dhariwal Buildtech actively integrates sustainability into its operations, particularly through work in pond ash transportation, which involves using the material for road construction. This focus on utilizing waste materials contributes to sustainable development. Furthermore, the company regularly conducts dust suppressant processes on public roads to mitigate environmental risks, ensuring their projects are more environmentally friendly and responsible.

Other IPO Pages Linking

More About Dhariwal Buildtech Limited

Dhariwal Buildtech Limited (DBL) has emerged as a leading infrastructure company in India, specialising in road, bridge, and tunnel construction through EPC, HAM, and BOQ models. The company also undertakes projects like pond ash transportation and other civil works across multiple states. From time to time, DBL forms joint operations with other entities for project bidding and execution, strengthening its collaborative expertise and project portfolio.

Leadership and Vision

The company’s foundation is guided by the leadership of Mr. Chet Ram Dhariwal, its Promoter, Chairman, and Managing Director, who brings over three decades of experience in the civil construction industry. His tenure with the Engineering Wing of the Panchayati Raj, Government of Haryana, for more than 21 years has provided a deep understanding of infrastructure development. His contributions to projects such as the Mohammadpur-Chaapra Road and the Ujjain-Dewas NH-752 D highway have earned him notable commendations.

Operational Strength and Market Presence

According to the CRISIL Report, DBL’s operations are supported by a robust promoter background, a skilled management team, and modern machinery. As of March 31, 2025, the company’s Order Book stood at ₹47,669.98 million, compared to ₹24,879.46 million in 2024 and ₹22,440.26 million in 2023 — showcasing consistent growth.

Client-wise composition (FY2025):

- NHAI: 57.97% (EPC and HAM)

- BRO: 25.36%

- NHIDCL: 9.85%

- Others (Railway & EPC): 6.82%

Its Book-to-Bill Ratio improved to 4.13x in FY2025, reflecting strong order inflows relative to revenue.

Key Milestones

- Incorporated in 2017 as SKC Infra Projects Limited.

- Executed early projects in Bihar, Maharashtra, and Mizoram.

- Delivered projects ahead of schedule in Assam and Meghalaya, earning performance bonuses.

- Expanded into new regions including Rajasthan, Himachal Pradesh, and Ladakh.

- Awarded the Shinkula Tunnel Project in 2025 — set to become the world’s highest-altitude highway tunnel.

Performance and Capabilities

With a Return on Equity of 38.56% and PAT of ₹1,605.90 million in FY2025, Dhariwal Buildtech Limited demonstrates operational excellence, efficient resource utilisation, and strong financial discipline, positioning itself among India’s most promising infrastructure developers.

Industry Outlook

The Indian infrastructure industry is experiencing rapid growth, driven by increasing government investment, private participation, and a strong focus on connectivity. The sector is projected to grow from around USD 190 billion in 2025 to approximately USD 280 billion by 2030, at a CAGR of about 8%.

The road and highway construction segment, where DBL primarily operates, is estimated to expand from USD 142 billion in 2024 to USD 341 billion by 2033, registering a CAGR of 10%. This makes it one of the fastest-growing infrastructure segments in India.

Growth Drivers

- Government programmes like Bharatmala Pariyojana and PM Gati Shakti are accelerating the development of national and state highways.

- The rising need for urban connectivity, logistics infrastructure, and rural road networks continues to generate large EPC and HAM project opportunities.

- Increased use of modern machinery and construction technology enhances efficiency and project execution speed.

- Public-private partnerships (PPPs) and asset monetisation initiatives are attracting private investment and ensuring steady project pipelines.

Segment Performance

Within the industry, bridge and tunnel infrastructure is expected to grow steadily at around 6% CAGR till 2032, supported by border connectivity and expressway projects in mountainous regions.

Future Outlook

With strong policy support, higher capital expenditure, and improved project financing models, the Indian road, bridge, and tunnel construction industry is set for sustained double-digit growth. Companies like Dhariwal Buildtech Limited are well-positioned to benefit from this momentum due to their expertise in EPC and HAM models and proven project execution capability.

How Will Dhariwal Buildtech Limited Benefit

- Dhariwal Buildtech Limited (DBL) will benefit from the government’s massive investment in road and highway infrastructure under flagship programmes like Bharatmala Pariyojana and PM Gati Shakti.

- The growing demand for EPC and HAM projects aligns directly with DBL’s operational strengths and expertise in executing large-scale civil construction projects.

- Expanding opportunities in tunnel and bridge construction will support DBL’s diversification into complex, high-value engineering works such as the Shinkula Tunnel.

- Increasing private participation and PPP models will enable DBL to collaborate strategically and secure long-term, revenue-generating projects.

- The company’s modern machinery fleet and experienced management team will help it deliver projects faster, enhancing profitability and reputation.

- Rising infrastructure spending across urban and rural India will strengthen DBL’s order book and geographical reach.

- With its strong financial performance and proven execution track record, DBL is well-positioned to capitalise on India’s robust infrastructure growth cycle

Peer Group Comparison

| Name of the Company | Total Revenue (₹ in million) | Face Value (₹) | P/E | EPS (Basic) | EPS (Diluted) | RoNW (%) | NAV (₹) |

| Dhariwal Buildtech Ltd. | 11,529.80 | 10 | NA | 16.91 | 16.91 | 38.56 | 43.78 |

| Peer Group | |||||||

| Ceigall India Limited | 34,367.32 | 5 | 15.39 | 17.04 | 17.04 | 15.54 | 105.84 |

| G R Infraprojects Ltd. | 73,947.04 | 5 | 11.93 | 104.88 | 104.81 | 11.94 | 878.97 |

| H.G. Infra Engineering Ltd. | 50,561.82 | 10 | 12.13 | 77.55 | 77.55 | NA | 452.62 |

| J. Kumar Infraprojects Ltd. | 56,934.88 | 5 | 12.09 | 51.70 | 51.70 | 13.01 | 397.42 |

| KNR Constructions Ltd. | 47,531.66 | 2 | 5.56 | 35.62 | 35.62 | NA | 161.47 |

| PNC Infratech Ltd. | 67,686.84 | 2 | 9.35 | 31.79 | 31.79 | NA |

Key Strategies for Dhariwal Buildtech Limited

Focused Expansion and Market Maximization

The Company plans to maximize opportunities within its 13 existing markets while selectively expanding into new, politically and economically stable geographies like Kerala and Gujarat. This strategic diversification leverages existing expertise, targets diverse growth, and mitigates risks associated with market concentration, ensuring a broader revenue base and sustainable growth.

Capitalizing on Infrastructure Industry Growth

Dhariwal Buildtech intends to capitalize on strong industry tailwinds in the Indian construction sector, particularly the significant infrastructure investment projected by the National Infrastructure Pipeline. As an experienced player, the firm aims to secure benefits from government initiatives, leveraging its long-term client relationships and expertise in executing complex projects to drive sustained growth through 2030.

Expanding Bid Opportunities and Service Portfolio

The firm actively seeks newer and larger bid opportunities to significantly expand its client portfolio and Order Book, as evidenced by its bids in new states like Punjab and Arunachal Pradesh. It also seeks sectoral diversification beyond EPC/HAM into areas such as airport runways and elevated roads, targeting specialized projects that offer better profit margins due to higher pre-qualification barriers.

Continuous Enhancement of Execution Efficiency

Dhariwal Buildtech is committed to enhancing project execution efficiency to improve operating margins and reputation. This involves the adoption of new technologies like rigid bonded pavement, drainage composites, and pre-cast elements. By integrating efficient practices and centralizing procurement, the Company aims to scale operations cost-effectively and continue its track record of timely completion.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Dhariwal Buildtech Limited IPO

How can I apply for Dhariwal Buildtech Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Dhariwal Buildtech Limited IPO?

The IPO size is ₹950 crore, consisting entirely of a fresh issue of equity shares with no offer-for-sale component.

When was Dhariwal Buildtech Limited’s IPO filed with SEBI?

The company filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 27, 2025.

On which stock exchanges will Dhariwal Buildtech Limited shares be listed?

The equity shares are proposed to be listed on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

How will the IPO proceeds be utilised by Dhariwal Buildtech Limited?

Funds will be used for debt repayment, subsidiary investments, equipment purchase, and general corporate purposes.