- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Dividend Reinvestment Plans (DRIP): How They Work, Types, Benefits and Key Considerations

By HDFC SKY | Published at: May 28, 2025 04:42 PM IST

Receiving dividends from companies you’ve invested in is always a welcome event. It represents a share of the company’s profits being returned directly to you. Once you receive this cash dividend, you have a choice – spend it, save it, or reinvest it. For long-term investors focused on wealth accumulation, reinvesting those dividends back into the same investment can significantly boost returns over time through the power of compounding.

Dividend Reinvestment Plans (DRIPs) provide an automated and often cost-effective way to do just that. This article explains what is dividend reinvestment plans, the meaning of dividend reinvestment, how the drip plan works, its types, benefits, and key considerations for Indian investors.

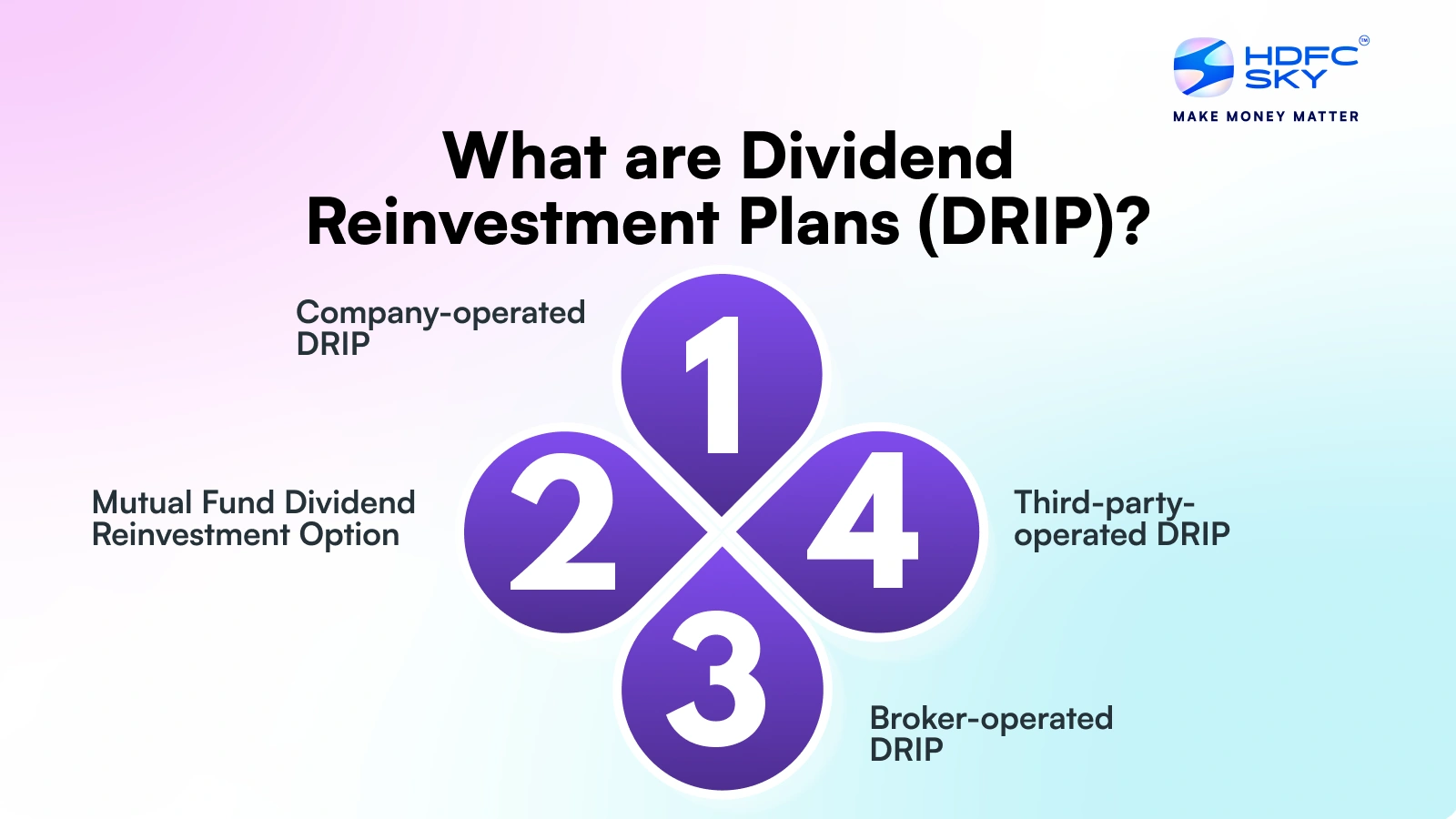

What are Dividend Reinvestment Plans (DRIP)?

A dividend reinvestment plan, or DRIP, is a scheme that allows investors to automatically reinvest their cash dividends or mutual fund distributions (IDCW – Income Distribution cum Capital Withdrawal) back into purchasing additional shares or units of the underlying security, instead of receiving the cash payout.

In India, several investors invest through dividend reinvestment plans to increase their holdings automatically. It’s an intelligent way where reinvested dividends are turned into ownership growth. DRIP dividend also helps you benefit from compounding over time.

Types of Dividend Reinvestment Plans

Dividend reinvestment plans exist in several forms, each providing investors with a different means of expanding their holdings. Let’s examine them:

- Company-operated DRIP: In a company-operated DRIP, the firm handles the entire reinvestment process. The dividend is under a dividend reinvestment plan and is directly reinvested into more shares or fractions of the company’s stock. This is the most frequent type where investors are in direct contact with the company handling their dividends.

- Third-party-operated DRIP: In a third-party-run DRIP, the firm contracts out the reinvestment process to a third party. This is usually for cost-cutting purposes for the firm. The third party invests in further shares with the dividend payout. Shareholders receive the advantages of a DRIP, but there is an external management.

- Broker-operated DRIP: A DRIP operated by a broker enables investors to reinvest dividends on stocks available through a broker, even if the company itself does not have a DRIP. The dividend is under a dividend reinvestment plan and is utilised to purchase shares in the open market. Brokers tend to provide these plans with minimal commissions or fees, thus making it an economical investment for investors.

- Mutual Fund Dividend Reinvestment Option: This is the most prevalent form of drip dividend mechanism in India. When investing in a mutual fund scheme that declares dividends (now formally termed IDCW, investors typically choose between ‘Payout’ and ‘Reinvestment’ options. If ‘Reinvestment’ is selected, under the dividend reinvestment plan, the dividend is automatically used by the Asset Management Company (AMC) to purchase additional units of the same scheme for the investor at the Net Asset Value (NAV) prevailing on the ex-dividend date. The dividend is part of a dividend reinvestment planintegrated within the mutual fund scheme itself.

How Do Dividend Reinvestment Plans Work?

The process is generally automated once set up:

- Dividend Declaration: The company’s board or mutual fund AMC declares a dividend or IDCW payment per share or unit.

- Record Date & Ex-Dividend Date: Shareholders orunitholders holding the security as of the record date are eligible. The price typically adjusts downwards on the ex-dividend date.

- Investor Enrolment: The investor must be enrolled in the DRIP – either by selecting the ‘Reinvestment’ option for their mutual fund folio, activating the feature with their broker, or enrolling in a direct company plan.

- Dividend Payment Date: On the scheduled payment date instead of crediting cash to the investor’s bank account (as in the payout option) the total dividend amount due to the investor is calculated.

- Automatic Reinvestment: This calculated dividend amount is automatically used to purchase additional shares or units of the same security.

- Purchase Price/NAV: For mutual funds, new units are typically allotted at the NAV of the ex-dividend date. For stocks reinvested via brokers, the purchase usually happens at the prevailing market price around the payment date.

- Crediting: The newly purchased full and fractional shares/units are credited directly to the investor’s Demat account or mutual fund folio. If any excess cash which cannot be reinvested remains, then it is deposited into the investor’s linked bank account.

Advantages and Disadvantages of DRIP

Dividend reinvestment plans provide excellent investment opportunities, but there are risks you should be aware of. Some benefits of Dividend Reinvestment Plans are highlighted below:

- No brokerage charges: Investors can purchase additional shares without paying commission fees, which saves money in the long run.

- Discounted shares: Most companies with DRIP plans distribute shares at a lower rate than the market price, thus saving money in accumulating holdings.

- Compounding effect: As dividends are used to purchase more shares, which generate still more dividends, your money earns interest more rapidly through compounding.

- Fosters long-term investment: DRIP investing makes one patient as the investor becomes devoted to years of reinvesting.

- Enhances company capital: Through the dividend reinvestment plan, the dividend is reinvested by the firm to augment its capital without soliciting outside funding.

- Easy and automatic: Reinvestment occurs automatically without requiring effort each time.

Here are some drawbacks of Dividend Reinvestment Plans:

- Dilution of ownership: If you don’t participate in a DRIP dividend plan, your ownership percentage could shrink as fresh shares are released.

- No control over stock price: The stock is purchased automatically regardless of its high price at the moment.

- Sluggish for short-term gains: When dividends are paid half-yearly or yearly, fast-return seekers may feel trapped.

- Tax implications: Although the dividends are being reinvested, they are still taxable, which demands proper bookkeeping.

- Lack of diversification: Drip investing tends to over-expose investors to one stock, which amplifies portfolio risk.

Important Considerations with DRIPs

Although Dividend Reinvestment Plans have advantages, there are some things to remember before joining.

- Tax implications are one of the main considerations. Dividends remain taxable, even though they are reinvested in more shares. Investors need to monitor cost basis and capital gains for tax reporting, which can be complicated.

- Investment strategy is another aspect. DRIPs are ideal for long-term investors since they promote reinvestment regularly. Short-term investors, seeking short-term gains, might not find DRIPs as useful.

- Company stability is also important. Although DRIPs facilitate automatic reinvestment, they depend on the company’s performance. If the business experiences financial stress, it could affect dividend payments and reinvestment value.

- Finally, non-diversification should be taken into account. Over the long term, investing in only one company via a DRIP builds up holdings in the stock of that one company, lessening the diversification and risk exposure of the investor’s portfolio.

Conclusion

Dividend Reinvestment Plans (DRIPs) provide a painless method through which long-term investors can add to their holdings by reinvesting dividends into additional shares. DRIPs bring along advantages in terms of commission-free purchases, compounding interest, and the possibility of discounts. Nevertheless, there are drawbacks investors must watch out for, including tax complications, loss of share price control, and diminishment of diversification. DRIPs can be an effective instrument for those devoted to a long-term investment policy, but one must assess them in accordance with personal financial objectives.

Related Articles

FAQs on Dividend Reinvestment Plans (DRIP)

What if the dividend payment is not sufficient to buy a whole share?

When the dividend payment is not enough to buy a whole share, the leftover amount is used to buy fractional shares. Through this, investors can reinvest all their dividends into shares, regardless of the size of the dividend payment.

Are there any limitations on investing in a drip, like residency or citizenship restrictions?

Usually, DRIPs are open to any shareholder of the company issuing the plan. A few companies may have residency or citizenship requirements. Be sure to review the company’s DRIP terms before signing up to determine if any restrictions exist.

Are there any risks involved with investing in a DRIP?

Yes, DRIPs carry risks like market volatility. Because dividends are reinvested automatically, investors may find themselves purchasing shares when prices are high. Furthermore, over-concentration in one stock can result in a lack of diversification in your portfolio.

Are DRIPs cost-effective?

Yes, DRIPs are also cost-friendly since they enable investors to purchase shares commission-free or at a low fee. Besides, most companies provide their shares at a discount, hence an affordable method for investors to add more shares to their portfolios.

Do I have to be the owner of shares in the company to join a DRIP?

You will usually need to hold at least one share of the firm to sign up for their DRIP. A few firms will permit you to buy shares from them directly to begin participating in their DRIP plan.

What are the charges to join a DRIP?

Most DRIPs come with little or no enrollment fees, and several firms even allow reinvestment of dividends without paying any commission. Still, a few programs may come with a nominal fee for each transaction or first-time purchase of a share, so be sure to go over the terms of the program.

How DRIPs affect your taxes?

Reinvested dividends under a DRIP remain taxable, although you don’t get them in cash. The amount of reinvested dividend is income and should be reported on your tax return, possibly impacting your overall tax bill.

Do you need to pay taxes if you reinvest dividends?

Yes, dividends reinvested through a DRIP are still subject to taxation. The dividends that are reinvested are viewable as taxable income in the same year they are distributed, even though the funds are being utilised to buy more shares.

Can you opt out of participating in a dividend reinvestment plan?

Yes, you can opt out of a DRIP. If you would rather take cash dividends than reinvest them, you can choose the cash option through your broker or with the company sponsoring the DRIP.

Can I join a DRIP through my brokerage account?

In most cases, you can sign up for a DRIP through the brokerage account. But not all brokers provide this facility, so you may have to contact your broker or sign up directly with the company issuing the DRIP.

How do you sign up for DRIP?

To enrol in a DRIP, you must own stock in a company sponsoring the plan. You may then sign up directly with the company or through your broker account. The company will send you instructions on how to arrange automatic reinvestment of dividends.