- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Duroflex IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Duroflex IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Duroflex Limited IPO

Duroflex Limited is a leading provider of sleep and comfort solutions in India, with a legacy tracing back to 1963. The company boasts a diversified product portfolio including mattresses, sofas, recliners, beds, pillows, and accessories, marketed under strong brands like Duroflex, Sleepyhead, and Perfect Rest. It operates a robust omnichannel distribution network comprising 73 COCO stores, 375 distributors, over 5,576 general trade stores, and a significant presence on major e-commerce platforms. Duroflex distinguishes itself through vertical integration, with seven manufacturing facilities and in-house foam production capabilities, ensuring quality control and cost efficiency. The company caters to retail, institutional, and OEM customers, making it a prominent and integrated player in the Indian sleep solutions market.

Duroflex Limited IPO Overview

Duroflex Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on October 15, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is structured as a Book Building Issue, comprising a fresh issue of ₹183.60 crores and an Offer for Sale (OFS) of up to 2.26 crore equity shares. The equity shares are proposed to be listed on both the NSE and BSE. While the book running lead manager has not yet been declared, KFin Technologies Ltd. has been appointed as the registrar of the issue. Key details such as the IPO dates, price bands, and lot size are yet to be announced. For more information, refer to the Duroflex IPO DRHP.

The IPO will have a face value of ₹1 per share and is being offered under a fresh capital-cum-OFS structure. The fresh issue will comprise shares aggregating up to ₹183.60 crores, while the Offer for Sale includes 2,25,64,569 shares of ₹1 each. The issue type is a bookbuilding IPO, with the shares proposed to be listed on both BSE and NSE. Prior to the issue, Duroflex Ltd. has a total shareholding of 9,56,12,576 shares.

The company’s promoters, Jacob Joseph George, Mathew Chandy, Mathew George, and Mathew Antony Joseph, hold 66.10% of the shares pre-issue. Details regarding their post-issue holdings will be updated after the IPO.

Duroflex Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue of up to ₹1,836 million and OFS of up to 22,564,569 shares |

| Fresh Issue | ₹ 1,836 million |

| Offer for Sale (OFS) | ₹ [.] (Up to 22,564,569 shares) |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 9,56,12,576 shares |

| Shareholding post-issue | TBA |

Duroflex Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Duroflex Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Net Offer |

| Retail Shares Offered | Not more than 10% of the Net Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Net Offer |

Duroflex Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹ 4.93 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 11.82% |

| Net Asset Value (NAV) | ₹ 41.67 |

| Return on Equity (RoE) | 12.72% |

| Return on Capital Employed (RoCE) | 14.90% |

| EBITDA Margin | 8.64% |

| PAT Margin | 4.16% |

| Debt to Equity Ratio | 0.025 |

Objectives of the IPO Proceeds

The Net Proceeds from the Fresh Issue are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Capital expenditure for new COCO Stores | 504.40 |

| Lease, rent for existing COCO Stores & Manufacturing Facility | 421.32 |

| Marketing and advertisement expenses | 451.88 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

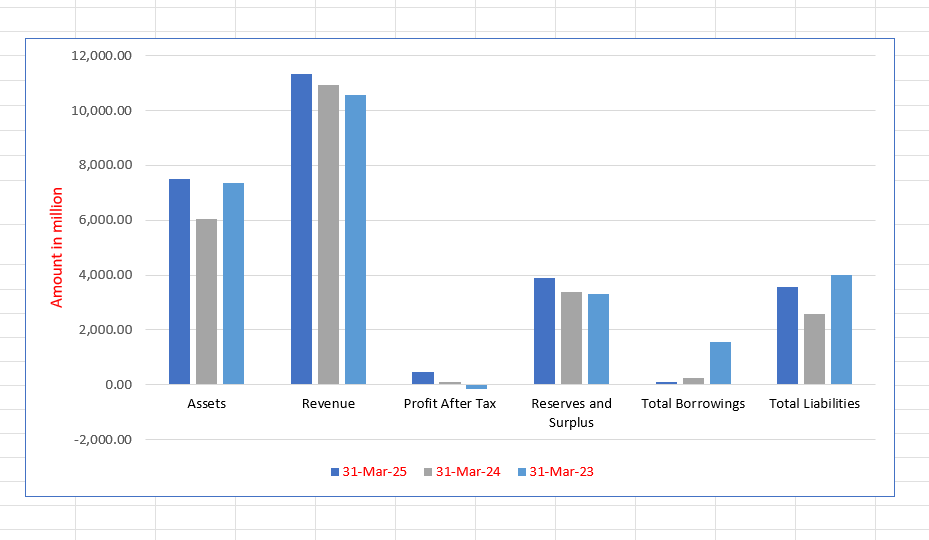

Duroflex Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 7,520.67 | 6,042.30 | 7,372.94 |

| Revenue | 11,342.50 | 10,952.96 | 10,574.87 |

| Profit After Tax | 471.63 | 112.00 | (154.74) |

| Reserves and Surplus | 3,895.67 | 3,397.91 | 3,311.85 |

| Total Borrowings | 97.97 | 232.16 | 1,541.01 |

| Total Liabilities | 3,565.24 | 2,584.63 | 4,001.33 |

Financial Status of Duroflex Limited

SWOT Analysis of Duroflex IPO

Strength and Opportunities

- Vertically integrated manufacturing model ensuring cost control and quality.

- Strong, trusted brand portfolio with high consumer awareness and recognition.

- Diversified omnichannel distribution network spanning online and offline platforms.

- In-house R&D capabilities driving continuous product innovation and development.

- Pan-India presence with a wide and deep retail footprint.

- Backing by marquee institutional investors providing strategic guidance.

- Experienced promoter group complemented by a professional management team.

- Growing branded foam, institutional, and OEM business segments.

- Benefitting from the underpenetrated and rapidly growing Indian sleep solutions market.

- Successful celebrity and influencer collaborations enhancing brand appeal.

Risks and Threats

- Dependence on the Indian market makes it susceptible to domestic economic cycles.

- Intense competition from both organized and unorganized players in the market.

- Historical volatility in profitability as seen in past financial performance.

- Risks associated with executing the expansion plan for new COCO stores.

- Fluctuations in raw material prices impacting cost structures and margins.

- Inventory management challenges across a complex supply chain and network.

- Potential for negative impact from changes in import/export duties and regulations.

- Increasing marketing and advertising costs required to maintain brand salience.

- Operational risks linked to managing a large and growing workforce.

- Dependence on key management personnel for strategic direction and growth.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Duroflex Limited

Duroflex Limited IPO Strengths

Vertically Integrated Manufacturing Operations

Duroflex Limited operates a highly vertically integrated business model, controlling everything from foam production to the final product. This integration, difficult for non-backward-integrated peers to replicate quickly, provides enhanced control over product quality, optimizes costs, and ensures supply chain stability, giving the company a significant competitive advantage in the market.

Strong Brand Equity and Multi-Pronged Marketing

Duroflex Limited benefits from strong brand recognition and customer affinity, being a leading name in the premium mattress segment. Its marketing strategy is multifaceted, involving celebrity collaborations, athletic partnerships, and content-driven campaigns that educate consumers on sleep health, effectively building trust and aspiration around its Duroflex and Sleepyhead brands.

Diversified Omnichannel Distribution Network

Duroflex Limited has built a well-diversified, pan-India omnichannel distribution network. This includes its own COCO experience centres, a vast general trade network, a strong presence on e-commerce platforms, and institutional/OEM sales. This multi-channel approach ensures wide product availability and allows the company to reach diverse customer segments effectively.

R&D Driven Product Innovation and Portfolio

Duroflex Limited possesses strong in-house R&D capabilities that drive a continuous cycle of product innovation and enhancement. The company follows a structured product development process, from conceptualization to test launches, enabling it to introduce advanced and differentiated sleep solutions like adjustable mattresses and smart beds that meet evolving consumer demands.

Experienced Promoter and Professional Management

Duroflex Limited is led by a third-generation, entrepreneurial promoter group whose vision has been instrumental in its growth. This leadership is complemented by a seasoned professional management team with extensive cross-industry experience, creating a robust organizational framework capable of executing the company’s strategic ambitions and future growth plans.

More About Duroflex Limited

Duroflex Limited is a prominent and integrated sleep solutions company in India, with a business legacy that dates back to 1963. Incorporated in 1981, the company has evolved into a multi-brand, multi-channel leader in the comfort and furniture space.

Product Portfolio

The company markets a comprehensive range of products under its powerful brands:

- Duroflex: Positioned as an orthopaedic and therapeutic mattress brand.

- Sleepyhead: Aims at a younger demographic with innovative and trendy products.

- Perfect Rest: Caters to the value segment. Its product lineup includes a wide variety of mattresses (including innovative products like firmness-adjustable and smart beds), sofas, recliners, upholstered beds, pillows, and other accessories.

Manufacturing Prowess

Duroflex operates seven technology-enabled, vertically integrated manufacturing facilities across India. A key strength is its in-house foam production capability, which is the primary raw material for its products. This backward integration allows for stringent quality control, cost optimization, and supply chain resilience. The facilities are equipped with imported machinery and automation technologies, adhering to high-quality standards with certifications from Sedex, ISO, and BIS.

Distribution and Reach

The company’s omnichannel strategy ensures a wide and deep market penetration:

- COCO Stores: 73 company-owned experience centres as of June 30, 2025, allowing customers to interact with products.

- General Trade: A network of 375 distributors and over 5,576 trade stores.

- E-commerce: Strong presence on its own websites and major online marketplaces.

- Institutional & OEM: Supplies to hospitality, healthcare, and other institutions, and manufactures white-label products for national and international brands.

- Branded Foam: Sells foam as an intermediate good to other manufacturers, including some competitors.

Financial Performance

Duroflex has demonstrated a strong financial turnaround and growth trajectory. For the fiscal year ended March 31, 2025, the company reported a consolidated revenue from operations of ₹11,342.50 million and a Profit After Tax of ₹471.63 million, showcasing significant improvement in profitability.

Industry Outlook

The Indian sleep and comfort solutions industry is poised for robust growth, driven by rising disposable incomes, urbanization, and increasing health consciousness.

Market Growth and Drivers

The Indian mattress market is highly underpenetrated and fragmented, offering immense growth potential. The organized segment is expected to gain share from the unorganized sector due to rising brand awareness. Key growth drivers include:

- Rising Disposable Income: Enabling consumers to upgrade to branded, premium products.

- Urbanization and Nuclear Families: Leading to higher demand for modern furniture and sleep solutions.

- Health and Wellness Awareness: Consumers are increasingly recognizing the importance of quality sleep for overall well-being, boosting demand for orthopaedic and therapeutic mattresses.

- Real Estate and Hospitality Boom: Growth in residential real estate and the underpenetrated hotel industry (with less than one organized hotel room for every eight in China) directly fuels demand for mattresses and furniture.

- E-commerce Expansion: Online platforms have significantly increased the reach and accessibility of branded sleep products.

Product-Specific Prospects

Within the broader industry, specific product categories are seeing heightened demand:

- Premium and Smart Mattresses: Products with features like adjustable firmness, smart controls, and advanced materials are gaining traction.

- Furniture and Accessories: There is a growing trend of integrated home furnishing, where consumers purchase coordinated beds, sofas, and recliners, presenting a large cross-selling opportunity.

- Branded Foam: The demand from various industries like automotive, footwear, and packaging for high-quality foam provides a steady B2B revenue stream.

The industry is expected to continue its strong growth trajectory, with a healthy CAGR projected over the coming years, making it an attractive space for well-positioned players like Duroflex.

How Will Duroflex Limited Benefit

- Benefit from the underpenetrated and rapidly expanding Indian mattress and furniture market, driving volume growth.

- Leverage increasing health consciousness to cross-sell and up-sell its orthopaedic and therapeutic product ranges.

- Capitalize on the shift from unorganized to organized players through its strong brand equity and trusted product portfolio.

- Utilize its omnichannel distribution strength to capture growth from both online and offline retail expansion.

- Grow its institutional and OEM business by supplying to the booming hospitality, co-living, and healthcare sectors.

- Exploit its vertical integration to maintain cost competitiveness and protect margins amidst rising input costs.

- Use its in-house R&D to introduce innovative products that cater to evolving consumer preferences for smart and premium comfort solutions.

- Expand its branded foam segment by supplying to a wide array of industries, leveraging internal manufacturing scale.

Peer Group Comparison

| Name of Company | Face Value (₹) | Revenue (₹ million) | P/E Ratio | EPS (₹) | RoNW (%) | NAV (₹) |

| Duroflex Limited | 1.00 | 11,342.50 | [●] | 4.93 | 11.82% | 41.67 |

| Peer Group | ||||||

| Sheela Foam Limited | 5.00 | 34,391.90 | 76.92 | 8.84 | 3.19% | 278.84 |

Key Strategies for Duroflex Limited

Product Portfolio Innovation and Expansion

Duroflex Limited intends to leverage its innovation capabilities to expand its existing product portfolio and develop new ranges. The strategy includes deepening its mattress offerings under both the Duroflex and Sleepyhead brands and significantly expanding its furniture product range, including sofas, recliners, and smart products. This aims to increase wallet share from existing customers and attract new ones, thereby driving market share and business scale.

Profitable Expansion of Distribution Channels

Duroflex Limited aims for focused growth across each distribution channel. This involves strategically expanding its COCO store network into new geographies with slightly larger formats to showcase furniture, deepening its general trade presence in high-potential markets, and further boosting e-commerce sales by revamping its websites and strengthening partnerships with online platforms to enhance market penetration.

Strengthening Branded Foam and Institutional Business

Duroflex Limited plans to aggressively grow its institutional and OEM sales by leveraging the high-volume growth potential in the hospitality, co-living, and healthcare sectors. The strategy also focuses on increasing exports to international OEM customers and supplying to prominent domestic retail chains, thereby diversifying revenue streams and utilizing its manufacturing scale effectively.

Enhanced Brand Building through Targeted Marketing

Duroflex Limited will continue to invest in building its brand equity through a holistic marketing strategy across digital, social, and traditional platforms. The company intends to deploy differentiated content, community engagement, and commerce initiatives to improve reach and acquire new customers, while also focusing on thought leadership around the importance of sleep to drive brand relevance and sales.

Technology Investment for Customer Experience and Efficiency

Duroflex Limited intends to leverage technology, including artificial intelligence (AI), to enhance customer experience and operational efficiencies. Initiatives include deploying AI for retail analytics in COCO stores, personalizing marketing campaigns, automating customer service with chat tools, and enhancing its proprietary order management systems to better serve distribution partners and improve decision-making across the value chain.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Duroflex Limited IPO

How can I apply for Duroflex Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the lot size for the Duroflex IPO?

The lot size and the minimum investment required will be announced closer to the IPO date.

What is the core business of Duroflex Limited?

Duroflex Limited is a leading manufacturer and retailer of mattresses, furniture, and sleep solutions under brands like Duroflex and Sleepyhead.

Where will the Duroflex IPO be listed?

The equity shares of Duroflex Limited are proposed to be listed on both the BSE and the NSE.

What is the face value of Duroflex’ s equity shares?

The face value of Duroflex Limited’s equity shares is ₹1 per share.