- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

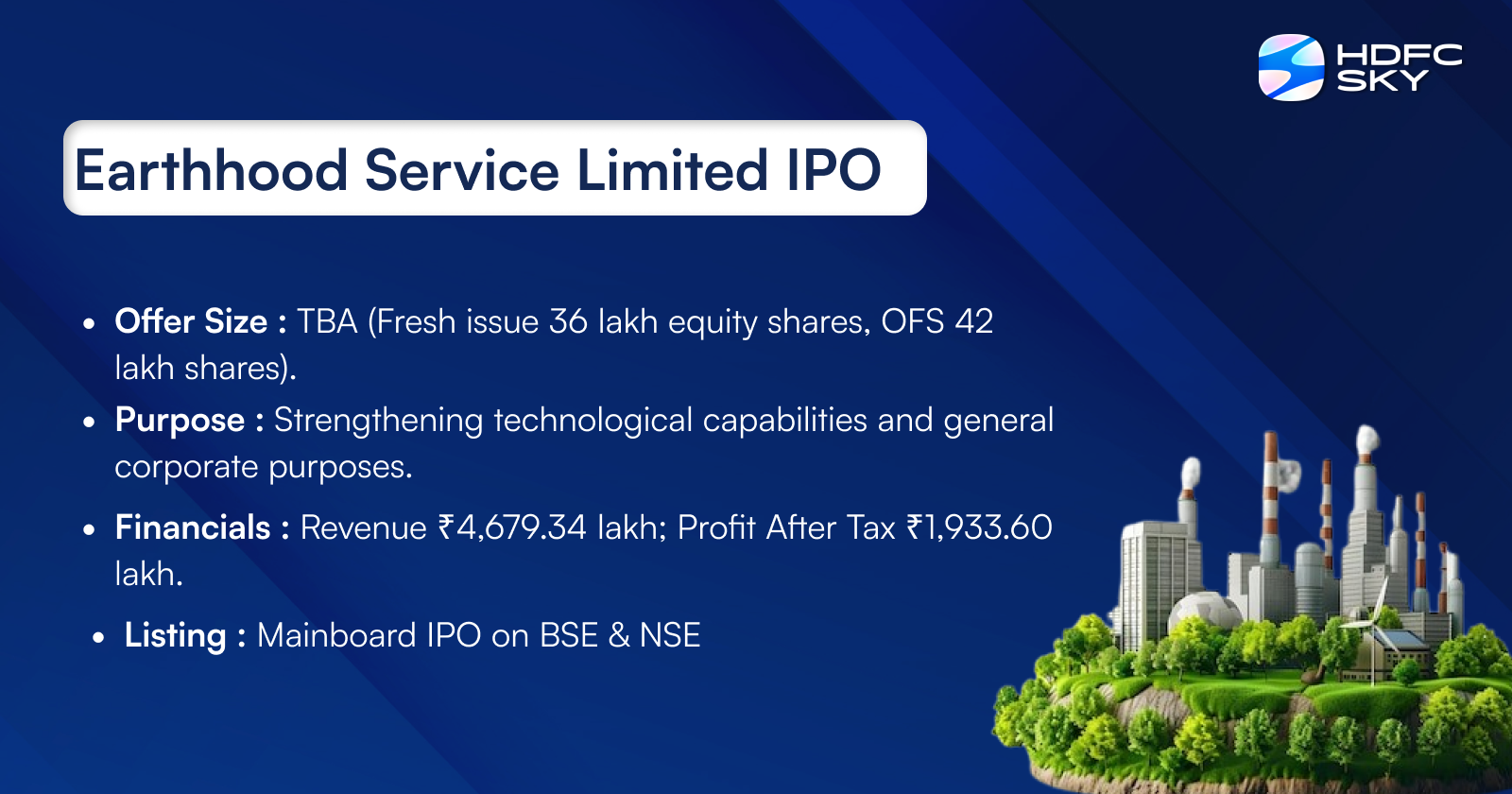

Earthhood Service IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Earthhood Service IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Earthhood Service Limited

Earthood Services Limited, founded in 2012 by Dr. Kaviraj Singh and Ashok Kumar Gautam, is a Gurgaon-based company specialising in sustainability and environmental services. The company provides a wide range of solutions, including carbon validation and verification, ESG advisory and assurance, and FPO advisory. Earthood is committed to combating climate change through innovative digital reporting and verification solutions. The company holds various accreditations, including recognition from the ANSI National Accreditation Board (ANAB), reflecting its commitment to quality and compliance with international standards. Earthood’s mission is to provide reliable and efficient sustainability solutions to help businesses achieve their environmental goals while maintaining transparency and accountability.

Earthhood Service Limited IPO Overview

Earthood Services IPO is a bookbuilding issue of 0.78 crore shares, consisting of a fresh issue of 0.36 crore shares and an offer for sale of 0.42 crore shares. The IPO dates, allotment date, and price bands are yet to be announced. Unistone Capital Pvt Ltd is the book-running lead manager, and Link Intime India Private Ltd is the registrar for the issue. The IPO will be listed on BSE and NSE, with a face value of ₹10 per share. The total issue size and price band details are still pending. As per the DRHP, the company’s pre-issue shareholding is 2,38,49,998 shares, and the promoters of the company are Dr. Kaviraj Singh and Ashok Kumar Guatam.

Earthhood Service Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 36 lakh equity shares

Offer for Sale (OFS): 42 lakh shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 2,38,49,998 shares |

| Shareholding post -issue | TBA |

Earthhood Service Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Earthhood Service Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 75% of the Offer |

| Retail Shares Offered | Not less than 10% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Earthhood Service Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 8.11 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 61.32% |

| Net Asset Value (NAV) | 13.22 |

| Return on Equity | 61.32% |

| Return on Capital Employed (ROCE) | 77.99% |

| EBITDA Margin | 57.51% |

| PAT Margin | 41.32% |

| Debt to Equity Ratio | 0.00 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ lakhs) |

| Funding requirements towards strengthening technological capabilities through the development, ownership and commercialization of proprietary DMRV intellectual property and solutions | 3000 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

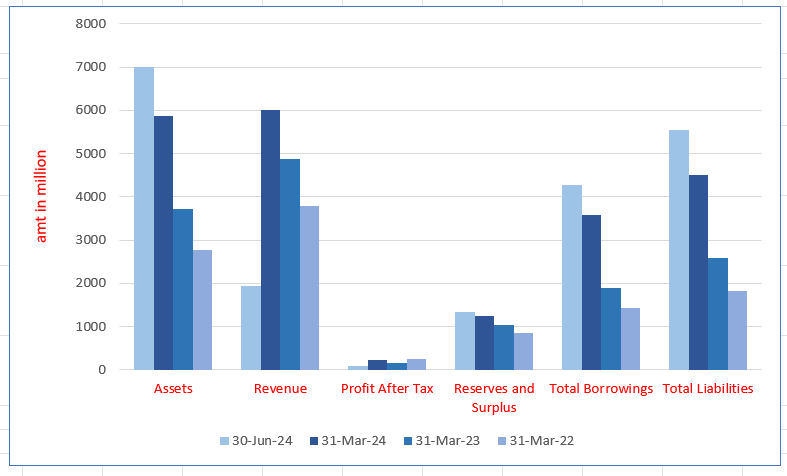

Earthhood Service Limited Financials (in lakhs)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 4877.25 | 3917.94 | 2201.57 | 805.95 |

| Revenue | 2189.13 | 4679.34 | 3239.29 | 1011.17 |

| Profit After Tax | 542.68 | 1933.60 | 1073.58 | 128.20 |

| Reserves and Surplus | 1568.50 | 2199.27 | 1259.02 | 389.22 |

| Total Borrowings | 9.01 | – | 53.56 | 101.78 |

| Total Liabilities | 923.75 | 764.67 | 939.54 | 413.72 |

Financial Status of Earthhood Service Limited

SWOT Analysis of Earthhood Service IPO

Strength and Opportunities

- Expertise in carbon validation and verification, offering specialised services that cater to the growing demand for sustainability solutions across industries and geographies.

- Accreditation from reputed organisations such as ANAB, ensuring credibility and trust among clients seeking reliable sustainability validation and verification services.

- Expanding global presence with offices in strategic locations, enhancing service accessibility and creating new market opportunities in sustainability and ESG consulting.

- Proprietary digital platform ‘Earthlink’ streamlines reporting and verification processes, offering clients enhanced efficiency, transparency, and accuracy in their sustainability initiatives.

- Strong focus on climate change mitigation through innovative solutions, positioning the company as a leader in sustainability efforts globally.

- Diversified service offerings, including ESG advisory, FPO consulting, and sustainability reporting, catering to a wide range of industry requirements.

- Experienced leadership team with deep industry knowledge, guiding the company toward growth, innovation, and enhanced service delivery in a dynamic market.

- Rising global emphasis on sustainability creates significant growth opportunities in sectors like energy, manufacturing, and agriculture seeking carbon neutrality and ESG compliance.

- Potential to expand into emerging markets with rising sustainability regulations and demand for carbon verification, ensuring steady growth and diversification.

- Ability to set industry benchmarks through thought leadership and contributions to policy development, enhancing reputation and market influence.

- Strategic collaborations with international organisations and stakeholders enable the company to leverage resources, expertise, and networks for business growth and market expansion.

Risks and Threats

- Limited brand recognition compared to well-established global competitors, which can impact market expansion efforts and client acquisition in a highly competitive industry.

- Dependence on voluntary carbon market fluctuations, which may lead to revenue inconsistencies and affect long-term business stability and growth prospects.

- Challenges in maintaining consistent service quality across diverse regions due to varying regulatory frameworks, client expectations, and operational complexities.

- Regulatory changes in environmental policies may impose additional compliance burdens, requiring continuous adaptation to evolving laws and standards in different regions.

- Competition from larger, well-funded international firms offering similar services may impact pricing strategies and market positioning efforts.

- Limited financial resources compared to larger competitors, which may constrain investment in research, technology upgrades, and business expansion initiatives.

- Economic downturns and budget constraints of potential clients can reduce demand for sustainability services, impacting revenue streams and business operations.

- Rapid technological advancements require continuous investment in upgrading digital platforms and processes to stay competitive and meet evolving client expectations.

- Increased cybersecurity threats associated with digital reporting platforms may pose risks to data integrity and client confidentiality, requiring stringent security measures.

- Market saturation in developed regions may limit growth prospects, necessitating strategic efforts to differentiate services and explore new opportunities.

- Changing customer expectations and preferences require continuous service innovation and adaptation to maintain relevance and customer satisfaction in a dynamic industry.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Earthhood Service Limited IPO

Earthhood Services Limited is a globally recognised organisation offering carbon validation, verification services, and ESG advisory and assurance services. With clients across India and international markets, the company stands out for its commitment to environmental sustainability. A notable achievement is being ranked as the “Best Verification Company” by Environmental Finance in the Voluntary Carbon Market Rankings for 2023 and 2024.

Accreditations and Expertise

- Accredited by the United Nations Framework Convention on Climate Change (UNFCCC) since 2014 as a Designated Operational Entity (DOE).

- Certified as a Validation and Verification Body (VVB) by Global Accreditation Bureau (GAB) and American National Accreditation Board (ANAB) since 2023 and 2024, respectively.

- Authorised to certify carbon offset projects under prominent registries like VERRA, Gold Standard, and Global Carbon Council.

Core Services Overview

The company offers a range of services across various sectors, ensuring quality and compliance with international standards. Below is a summary of the core services provided:

- Carbon Validation and Verification Services

The company provides validation and verification services for carbon offset projects registered with recognized bodies. It currently holds accreditations from:

- Global Accreditation Bureau (GAB)

- ANSI National Accreditation Board (ANAB)

- United Nations Framework Convention on Climate Change (UNFCCC)

Additionally, the company has applied for accreditation under Article 6.4 of the Paris Agreement. It serves as a Validation and Verification Body (VVB) and a Designated Operational Entity (DOE) under the Clean Development Mechanism (CDM) to certify projects across sectors.

Authorized Registries and Standards

The company is authorized to validate and verify carbon offset projects registered with the following standards:

- Clean Development Mechanism (CDM)

- Verified Carbon Standards (VCS)

- Gold Standards (GS)

- Global Carbon Council (GCC)

- Social Carbon

- International Carbon Registry (ICR)

- PuroEarth

- Climate, Community & Biodiversity Alliance (CCBA) & SD Vista

- Open Forest Protocol (OFP)

- Biocarbon Cert S.A.S.

- Certified Carbon Standards (CERCARBONO)

- American Carbon Registry

- Foundation of Climate Protection & Carbon Offset Klik

- Ormex

- Plan Vivo

CDM projects are currently migrating to Article 6.4 of the Paris Agreement.

Global Presence and Expansion

The company has expanded globally, establishing subsidiaries in:

- UK (2021)

- Turkey (2023)

- Russia and UAE (2024)

The company’s subsidiary is also in the process of obtaining accreditation from the United Kingdom Accreditation Service (UKAS).

Validation and Verification Process

The validation and verification services involve a team of experts, including subject matter specialists, quality officers, and technical experts. The process includes:

- Validation:

- Pre-assessment of projects to ensure compliance with standards.

- Independent evaluation of the Project Design Document (PDD).

- A one-time process typically taking 12-15 weeks.

- Verification:

- Independent audits to verify project performance and emissions reductions.

- Confirmation of compliance with carbon credit standards before credit issuance.

- Environmental, Social, and Governance (ESG) Services

The company provides ESG advisory and assurance services to support organizations in achieving their sustainability goals. Key offerings include:

- ESG reporting and GHG accounting

- Net-zero advisory aligned with Science-Based Targets Initiative (SBTi)

- Life cycle analysis and verification of product carbon footprints

- Compliance advisory for the Carbon Border Adjustment Mechanism (CBAM)

Frameworks Supported

The ESG services are provided under recognized frameworks such as:

- Global Reporting Initiative (GRI)

- Business Responsibility Sustainability Reporting (BRSR)

- Carbon Disclosure Project (CDP)

- Climate Disclosure Standards Board (CDSB)

- Science-Based Targets Initiative (SBTi)

- Task Force on Climate-related Financial Disclosures (TCFD)

Verification and Certification Standards

The company offers ESG verification and assurance services under:

- AA1000 & GRESB Standards

- ISO 14064-3 (GHG Verification)

- PAS 2060 & ISO 14068 (Carbon Neutrality Certification)

- Verification of life cycle analysis

Market Growth and Demand

The ESG consulting market is projected to grow from USD 14 billion in 2023 to USD 60 billion by 2030, driven by:

- Regulatory pressures and compliance requirements

- Growing investor focus on verified ESG data

- Corporate sustainability goals

- Farmer Producer Organisation (FPO) Advisory

The company collaborates with the Small Farmers’ Agri-Business Consortium (SFAC) and Uttarakhand Integrated Horticulture Development Society (UKIHDS) to support Farmer Producer Organizations (FPOs).

Key Services Provided

- Formation of 36 FPOs across Uttarakhand, Rajasthan, and Uttar Pradesh

- Community mobilization and cluster identification

- Business planning and supply chain management

- Resource management for farmer organizations

Role as Cluster-Based Business Organization (CBBO)

As an empanelled CBBO, the company assists in:

- Cluster identification and awareness campaigns

- Baseline surveys and value chain studies

- Development of rating tools and community engagement

Carbon Neutral Initiatives

Earthhood achieved carbon neutrality for its Scope 1, 2, and 3 emissions in 2024, reinforcing its dedication to combating climate change.

Sectoral Expertise

The company provides validation and verification services in the following sectors:

- Renewable Energy: Solar, wind, and hydropower projects.

- Energy Demand: Clean energy products like cookstoves and solar lighting systems.

- Forestry and Agriculture: Afforestation, reforestation, and sustainable land management.

- Waste Management: Landfill gas, biogas, and biomass energy generation.

Voluntary and Regulatory Carbon Markets

Earthhood operates in both voluntary and regulatory carbon markets.

- Voluntary Markets: Clients voluntarily offset emissions by purchasing carbon credits.

- Regulatory Markets: Compliance-driven systems where governments regulate emissions through mechanisms like cap-and-trade.

Commitment to Sustainability

Earthhood’s efforts align with global climate change initiatives like the Kyoto Protocol and Paris Agreement. By certifying carbon credits and driving sustainable practices, the company supports international decarbonisation goals while contributing to the reduction of greenhouse gas emissions.

With its unwavering commitment to environmental stewardship, Earthhood Services Limited remains a leader in driving global climate action.

Industry Outlook

Industry Overview: Carbon Validation and Verification Services

Global Market Outlook

The global carbon credit validation, verification, and certification market is experiencing significant growth, driven by increasing regulatory pressures and corporate sustainability commitments. In 2023, the market was valued at approximately USD 235.4 million and is projected to expand at a compound annual growth rate (CAGR) of 24.3%, reaching USD 1,085.3 million by 2030.

Market Drivers

- Regulatory Pressures: Governments worldwide are implementing stringent climate policies, including carbon pricing and emission trading schemes, necessitating reliable carbon credit validation and verification services.

- Corporate Sustainability Goals: An increasing number of corporations are committing to net-zero emissions targets, driving demand for credible carbon offset solutions.

- Market Expansion: The growth of both voluntary and compliance carbon markets is creating opportunities for validation and verification services.

The market is expected to continue its robust growth trajectory, with projections indicating a market size of USD 1,998.43 million by 2034. This growth is anticipated to be driven by the expansion of carbon markets and the adoption of nature-based solutions, such as reforestation and soil carbon sequestration.

Industry Overview: Environmental, Social, and Governance (ESG) Services

Global Market Outlook

The ESG consulting market is experiencing substantial growth, with the global market size estimated at USD 13.7 billion in 2023 and projected to reach USD 42.8 billion by 2032, growing at a CAGR of 13.5%.

Market Drivers

- Regulatory Pressures: Increasing regulations and compliance requirements are prompting organizations to seek ESG advisory and assurance services.

- Investor Demand: There is a growing focus on verified ESG data from investors, influencing corporate strategies.

- Corporate Sustainability Goals: Organizations are aligning with frameworks such as the Science-Based Targets Initiative (SBTi) to achieve net-zero emissions.

The ESG consulting market is projected to continue its growth, with estimates indicating a market size of USD 166.80 billion by 2034, exhibiting a CAGR of 10.25% during the forecast period. This growth is expected to be driven by increasing demand for sustainability-related services from businesses and governments.

Farmer Producer Organisation (FPO) Advisory Services

Global Market Outlook

The FPO advisory services market is expanding as smallholder farmers seek collective action to enhance bargaining power and access to markets. While specific global market size data is limited, the trend towards FPOs is evident in various regions.

Market Drivers

- Collective Bargaining: FPOs enable smallholder farmers to negotiate better prices and access to resources.

- Market Access: FPOs facilitate entry into larger and more profitable markets.

- Capacity Building: Training and support services enhance the skills and productivity of farmers.

The FPO advisory services market is expected to grow as more regions recognize the benefits of collective action among smallholder farmers. This growth is anticipated to be supported by government policies and international development programs.

Carbon Validation and Verification Services Market Trends

United Kingdom (UK)

- Established carbon market with regulatory frameworks.

- Net-zero by 2050 and demand for carbon credits.

- Growth as businesses align with climate goals.

United Arab Emirates (UAE)

- Active in global carbon markets, investing in renewable energy.

- Leadership in Middle East climate action.

- Continued growth in renewable energy and carbon trading.

Turkey

- Early-stage carbon market development.

- Regulatory support and international cooperation.

- Growth as Turkey aligns with EU standards.

Russia

- Limited national carbon market, active in international trading.

- Global sustainability pressure.

- Modest growth influenced by geopolitical factors.

Latin America

- Potential in forestry and biodiversity, especially in Brazil and Chile.

- Demand from forestry, agriculture, and energy sectors.

- Rapid growth in carbon credit trade.

India

- Key player in global carbon markets, focusing on renewables.

- Paris Agreement commitments and government schemes.

- Expanding market with large-scale renewable energy projects.

ESG Consulting Services Market Insights

United Kingdom (UK)

- Leader in ESG reporting with strong regulations.

- Investor demand for ESG compliance.

- Growth as the ESG reporting framework strengthens.

United Arab Emirates (UAE)

- Focus on sustainable growth, especially in energy and real estate.

- Government sustainability policies.

- Strong growth as Vision 2030 goals progress.

Turkey

- Increasing adoption of ESG frameworks in finance.

- Investor interest and EU alignment.

- Growth in response to regulatory changes.

Russia

- Slow ESG adoption with limited awareness.

- Multinational pressure for ESG practices.

- Slow growth with increasing awareness.

Latin America

- Focus on ESG in countries like Brazil, Mexico, and Argentina.

- Global investment interest and environmental challenges.

- Rapid growth due to high ESG risks and resources.

India

- Growing adoption of ESG frameworks.

- Government initiatives and investor demand.

- Rapid market growth as sustainability initiatives increase.

Farmer Producer Organisation (FPO) Advisory Services

United Kingdom (UK)

- Established advisory market, but FPOs less common.

- Sustainable farming policies.

- Moderate growth in FPO advisory services.

United Arab Emirates (UAE)

- Growing interest in local farming solutions.

- Government support for food security.

- Slow growth in sustainable farming.

Turkey

- Diverse agricultural sector with growing FPO interest.

- Government incentives for collective farming.

- Continued growth as farmers seek better market access.

Russia

- Slow development of FPOs, focusing on market access.

- Government support for rural development.

- Growth as agricultural modernization progresses.

Latin America

- Widespread use of FPOs, especially in Brazil and Colombia.

- Push for food security and rural development.

- Rapid growth with government and NGO support.

India

- Strong promotion of FPOs for smallholder farmers.

- Government schemes for market access.

- Significant growth with ongoing agricultural reforms

How Will Earthhood Service Limited Benefit?

- Growing Market Demand for Carbon Validation and Verification Services

As global regulations around climate change tighten, companies will increasingly seek reliable carbon credit validation and verification services. Earthood’s involvement in this market will position it as a trusted player, providing essential services to help businesses comply with stringent carbon reduction standards. With a projected 24.3% CAGR in the carbon market, Earthood’s contribution to verification will be in high demand, ensuring business growth and expanding market share.

- Expansion of ESG Consulting Services

The rise in corporate sustainability goals and investor demand for ESG compliance will drive substantial growth in the ESG consulting market. Earthood, with its expertise in ESG frameworks, is set to provide advisory services that help companies navigate regulatory pressures and align with sustainability initiatives. The projected market growth of 13.5% CAGR in the global ESG consulting sector will offer Earthood numerous opportunities to serve businesses across various industries looking to strengthen their ESG profiles.

- Increase in Collective Bargaining with FPO Advisory

As the FPO advisory services market grows, Earthood can tap into the emerging need for agricultural cooperatives and collective bargaining strategies. The market is expected to expand in regions like India, Latin America, and Turkey, with government support fostering the formation of FPOs. Earthood can leverage this demand by offering tailored advisory services, helping smallholder farmers gain access to better market opportunities and resources, thereby increasing its presence in agricultural sectors globally.

- Leveraging Global Regulatory Trends

The growing regulatory pressures across various regions, including the EU, the UAE, and India, will continue to drive demand for Earthood’s services. As governments implement stricter environmental regulations and climate policies, Earthood’s ability to offer compliance solutions will be crucial. The company’s expertise in carbon validation and ESG consulting will position it as a key partner for businesses navigating these complex regulatory environments, resulting in long-term business sustainability.

- Advancement of Nature-Based Solutions

As the adoption of nature-based solutions like reforestation and soil carbon sequestration accelerates, Earthood will be well-positioned to provide innovative services in carbon validation. This growing focus on nature-based solutions offers Earthood an opportunity to expand its offerings in environmental markets, assisting businesses in integrating sustainable practices and improving their carbon footprint.

- Regional Expansion with Focused Expertise

With emerging markets in regions such as Latin America, India, and the UAE showing rapid growth in sustainability sectors, Earthood can benefit from establishing a strong foothold in these areas. By offering customized services tailored to local regulatory and market needs, Earthood can expand its reach and contribute to the growth of global carbon, ESG, and FPO markets.

- Supporting Government and International Development Programs

Earthood’s ability to collaborate with government initiatives, such as India’s Farmer Producer Organization (FPO) Scheme or the UAE’s Vision 2030, will be a significant driver of future success. By providing advisory services aligned with these national goals, Earthood can secure strategic partnerships that help accelerate rural development, food security, and sustainability in key emerging markets.

Peer Group Comparison

- The company specializes in providing validation and verification services in the voluntary carbon market, with no listed industry peers in India.

Earthhood Service Limited IPO Strengths

- Accreditations and Registrations with Major Standards

Earthood Services Limited holds numerous accreditations, allowing them to perform validation and verification services globally. Achieving these certifications, including from the UNFCCC, GAB, and ANAB, is a lengthy and intricate process, which creates an entry barrier for competitors. Their expertise in carbon verification positions them to meet rising demand for sustainability services, enhancing market share and establishing them as a leader in the sector.

- Customer Acquisition through Organic Lead Generation

Earthood Services Limited benefits from high visibility and credibility through its listing on major registries like Verra and Gold Standards. This organic lead generation strategy enables the company to acquire clients cost-effectively, without heavy marketing expenditures. In FY 2024, they converted over 83% of project requests into clients, enabling significant resource savings and focusing on high-quality service delivery.

- Global Client Base Across Diversified Industries

Earthood Services Limited has a strong, diverse global client base across industries like energy, manufacturing, and more. Their broad client portfolio includes corporations, public sector entities, and MSMEs. They build long-term relationships through reliable, quality service, with a focus on client satisfaction and expanding their portfolio, which helps in driving business growth and repeat business, ensuring continued success.

- Seasoned Professionals with Extensive Industry Experience

The management team, led by Promoters Dr. Kaviraj Singh and Ashok Kumar Gautam, brings nearly two decades of experience in the climate change sector. Their expertise enables Earthood Services Limited to navigate complex regulations and provide effective solutions. The company’s alliances with industry leaders and regulatory bodies ensure they stay ahead of evolving standards, delivering superior services and contributing to sustainable practices.

- Quality Assurance

Earthood Services Limited maintains stringent quality standards through comprehensive Quality Management Systems (QMS), which are continuously refined based on feedback and evolving industry standards. The company conducts rigorous internal and external reviews, ensuring service consistency and integrity. Their commitment to on-time service delivery, employee training, and ongoing improvements underpins their reputation for excellence, enabling them to meet client expectations and maintain industry leadership.

Key Insights from Financial Performance

- Assets: The company’s assets have shown consistent growth, from ₹805.95 lakhs in FY 2022 to ₹4877.25 lakhs in Sept 2024, reflecting significant expansion and increased capacity over the years.

- Revenue: Revenue peaked at ₹4679.34 lakhs in March 2024, declining to ₹2189.13 lakhs in September 2024, indicating a fluctuation possibly due to market conditions or seasonality.

- Profit After Tax: Profit after tax (PAT) demonstrated a significant increase from ₹128.20 lakhs in FY 2022 to ₹542.68 million in September 2024, showcasing robust profitability.

- Reserves and Surplus: Reserves and surplus grew steadily, from ₹389.22 lakhs in March 2022 to ₹1568.50 million in September 2024, indicating healthy retained earnings and financial stability.

- Total Borrowings: Borrowings declined substantially from ₹101.78 lakhs in FY 2022 to ₹9.01 lakhs in September 2024, suggesting improved debt management and reduced reliance on external financing.

- Total Liabilities: Total liabilities have been fluctuating, with a drop from ₹939.54 lakhs in March 2023 to ₹923.75 lakhs in September 2024, indicating efficient management of liabilities and financial obligations.

Other Financial Details

- Employee Benefit Expense: The employee benefit expense shows a considerable rise, moving from ₹373.99 lakhs in FY 2021-22 to ₹629.54 lakhs in September 2024. This indicates an upward trend in personnel-related costs, potentially due to expansion or salary increases.

- Finance Costs: Finance costs have significantly reduced from ₹55.47 lakhs in March 2024 to ₹16.99 lakhs in September 2024. This decline suggests effective management of interest expenses or a reduction in financial liabilities, improving the overall financial position.

- Depreciation and Amortisation Expense: These costs have remainedrelatively stable, with a small increase from ₹36.35 lakhs in FY 2021-22 to ₹39.15 lakhs in September 2024. This indicates continued investments in tangible and intangible assets, though the growth has been modest.

- Other Expenses: Other expenses have decreased notably, dropping from ₹986.94 lakhs in March 2023 to ₹703.42 lakhs in September 2024. This reduction could reflect cost-cutting measures, more efficient operations, or a decrease in business activity during this period.

Key Strategies for Earthhood Service Limited

- Strengthening Technology Infrastructure

The company aims to enhance operational efficiency by adopting a Digital Monitoring Reporting & Verification (DMRV) system. This system will streamline carbon project validation, reduce errors, improve accuracy, and boost productivity. By automating tasks and integrating technology, the company expects to improve client confidence, reduce delivery timelines, and increase profitability, all while ensuring better data management and operational efficiency.

- Expanding Geographical Reach

To capitalize on emerging markets and regulations, the company plans to expand its geographic presence. By opening offices in key regions and partnering with local firms, the company can foster stronger client relationships, gain regional insights, and enhance credibility. This strategic expansion allows the company to tailor services to specific needs while growing its global footprint and market share.

- Focus on ESG Services

The company will continue to strengthen its ESG services by offering independent verification, auditing, and advisory services. This initiative is aimed at supporting industries in managing ESG reporting and sustainability challenges, addressing increasing regulatory pressures. By leveraging technological advancements and expert services, the company seeks to expand its ESG portfolio, attract more clients, and solidify its position as a leader in ESG advisory and assurance.

- Leveraging Existing CDM Pipeline

The company plans to capitalize on the shift from the Clean Development Mechanism (CDM) to the Paris Agreement’s Article 6.4. Leveraging its existing CDM projects, the company will accelerate the transition to new mitigation and adaptation actions. This will not only help meet emerging customer needs but also establish the company as a competitive player in the growing market for international cooperative approaches to emissions reduction.

- Capitalizing on Emissions Trading Schemes (ETS)

With the growth of domestic emissions trading schemes globally, the company aims to offer validation and verification services to market participants. By expanding its presence in key ETS markets and engaging with local firms and regulators, the company seeks to enhance its market reach and drive growth. A data-driven approach will be used to identify trends, track market performance, and establish the company as a trusted partner in the ETS market.

Competitor Analysis of Earthhood Service Limited

- CleanFuture

CleanFuture specializes in sustainable waste management and recycling solutions. Earthhood Services Limited’s focus on carbon project validation and ESG services offers a distinct niche, reducing direct competition. However, CleanFuture’s established presence in waste management could challenge Earthhood if it diversifies into similar environmental services. Currently, Earthhood’s specialized services provide a competitive edge.

- Earthwise – Full Water Solutions

Earthwise Environmental provides comprehensive water treatment solutions, emphasizing innovative technologies and sustainability. Earthhood’s strengths in carbon validation and ESG services differ from Earthwise’s water-centric focus. While both companies prioritize environmental sustainability, their distinct service offerings minimize direct competition, allowing Earthhood to maintain a strong position in its specialized market.

- EcoRenew Solutions

EcoRenew Solutions focuses on renewable energy projects and sustainability consulting. Earthhood’s expertise in carbon project validation and ESG services complements EcoRenew’s offerings. However, overlapping areas in sustainability consulting could lead to competition. Earthhood’s established reputation in carbon validation provides a competitive advantage, but continuous innovation is essential to maintain its market position.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

What is the structure of Earthood Services Limited's IPO?

The IPO comprises a fresh issue of up to 36 lakh equity shares and an offer for sale of up to 42 lakh equity shares by promoters.

Who is the lead manager for the Earthood Services Limited IPO?

Unistone Capital Private Limited is the merchant banker managing the IPO.

What are the objectives of the IPO?

The funds will be used to enhance technological capabilities, develop proprietary DMRV solutions, and for general corporate purposes.

Who is the registrar for the IPO?

Link Intime India Pvt Ltd has been appointed as the registrar for the IPO.

Is the IPO date announced?

As of now, the IPO dates have not been announced.