- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Eldeco Infrastructure & Properties IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Eldeco Infrastructure & Properties IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Eldeco Infrastructure & Properties Limited IPO

Founded in 2000, Eldeco Infrastructure & Properties Ltd. is a prominent real estate developer in North India with a strong presence across Delhi-NCR and several tier II and III cities. As of March 31, 2025, the company had 19 ongoing projects covering 7.24 million sq. ft. of saleable area and 18 forthcoming projects spanning 7.37 million sq. ft. across 14 cities. Its key developments include Eldeco Fairway Reserve in Gurugram and Eldeco La Vida Bella in Greater Noida, offering excellent regional connectivity.

Eldeco Infrastructure & Properties Limited IPO Overview

Eldeco Infrastructure & Properties Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 30, 2025, to raise funds through an Initial Public Offering (IPO). The proposed IPO is a book-built issue amounting to ₹1,000 crore, comprising a fresh issue of ₹800 crore and an offer for sale (OFS) of ₹200 crore. The equity shares are proposed to be listed on both the NSE and BSE. While Kfin Technologies Ltd. has been appointed as the registrar to the issue, the book-running lead manager has not yet been announced.

Details such as the IPO opening and closing dates, price band, and lot size are still awaited. The issue carries a face value of ₹5 per share and will include both fresh capital and an OFS component. Before the issue, the company had a total shareholding of 6,49,51,062 shares. The promoters of Eldeco Infrastructure & Properties Ltd. are Pankaj Bajaj and Bandana Kohli, who collectively held 100% of the company’s shares prior to the IPO.

Eldeco Infrastructure & Properties Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹1000 crore |

| Fresh Issue | ₹800 crore |

| Offer for Sale (OFS) | ₹200 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post-issue | TBA |

Eldeco Infrastructure & Properties IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Eldeco Infrastructure & Properties Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Eldeco Infrastructure & Properties Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | (₹10.00) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | (16.69%) |

| Net Asset Value (NAV) | ₹ |

| Return on Equity (RoE) | (16.69%) |

| Return on Capital Employed (RoCE) | – |

| EBITDA Margin | (16.44%) |

| PAT Margin | (9.17) |

| Debt to Equity Ratio | 4.05 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment / prepayment of certain outstanding borrowing (including secured non-convertible debentures) availed by Eldeco Infracon Realtors Limited, one of our Material Subsidiaries | 6000 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

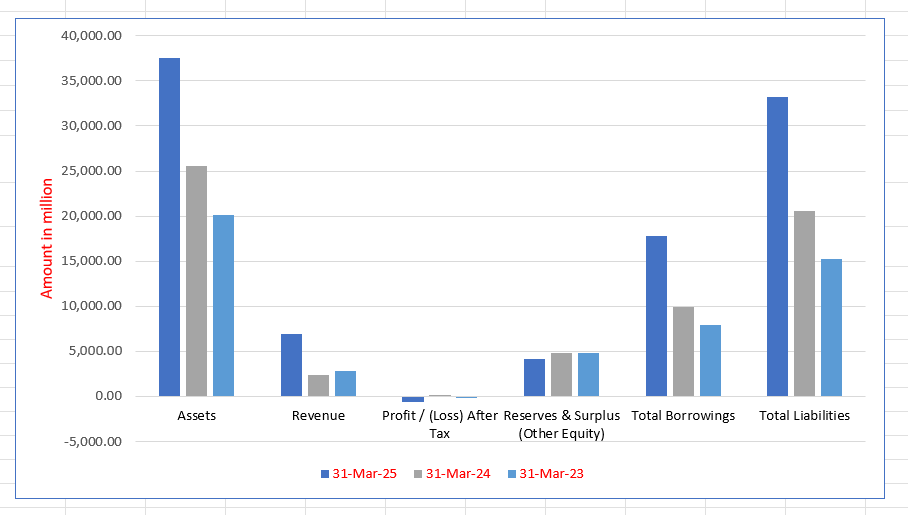

Eldeco Infrastructure & Properties Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 37,553.98 | 25,578.99 | 20,094.46 |

| Revenue | 6,949.78 | 2,407.27 | 2,877.57 |

| Profit / (Loss) After Tax | (637.63) | 101.12 | (206.29) |

| Reserves & Surplus (Other Equity) | 4,159.71 | 4,832.79 | 4,769.39 |

| Total Borrowings | 17,852.49 | 9,918.78 | 7,967.62 |

| Total Liabilities | 33,219.74 | 20,583.73 | 15,192.43 |

Financial Status of Eldeco Infrastructure & Properties Limited

SWOT Analysis of Eldeco Infrastructure & Properties IPO

Strength and Opportunities

- Strong brand legacy delivering more than 200 projects across North India.

- Experienced workforce and use of best-in-class consultants and contractors.

- Presence in residential, commercial and industrial sectors, including a flagship industrial park.

- Geographic footprint across NCR, Uttarakhand, Punjab, Haryana and newer markets.

- Proven record of timely delivery and customer satisfaction in multiple cities.

- Opportunity to capitalise on rising demand for affordable and premium housing in Tier II/III cities.

- Scope for expanding industrial and warehouse development given logistics growth and industrial park expertise.

Risks and Threats

- High dependency on the volatile real-estate market; cyclicality may hurt revenue.

- Large land-bank and inventory exposure increase financial risk and carrying cost.

- Regulatory and policy shifts (RERA, approval delays) pose execution risk in the real-estate sector.

- Rising input costs (land, labour, materials) squeeze margins if pricing power is weak.

- Intense competition from both national and regional developers may pressure pricing and market share.

- Macro-economic headwinds such as higher interest rates could slow buyer demand.

- Project delays or land-title/legal issues can lead to cost overruns and reputational damage.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Eldeco Infrastructure & Properties Limited

Eldeco Infrastructure & Properties Limited IPO Strengths

Established Developer with Diversified Portfolio

Eldeco is an established North Indian real estate developer with a strong, brand-led portfolio. As of March 31, 2025, the company had completed 82 residential projects, totaling 20.16 million sq. ft. of saleable area. Its projects are strategically diversified across micro-markets (with a heavy focus on Delhi-NCR) and various price points, ensuring multiple revenue streams.

Robust Pipeline and Clear Cash Flow Visibility

The company maintains a substantial project pipeline, featuring 19 ongoing and 17 forthcoming residential projects. This provides visibility for consistent regular cash flows through construction-linked payment schedules. This prudent strategy, which utilizes joint development agreements and largely self-funded projects from customer advances, enables prudent working capital management.

Early-Mover Advantage in North Indian Markets

Eldeco’s core strategy involves an early and sustained focus on high-potential Tier II and Tier III cities across North India, such as Bareilly and Rudrapur. By identifying underpenetrated markets early, the company secures favorable cost structures and gains a competitive first-mover advantage, while delivering amenities comparable to those in metropolitan cities

Strong Execution and Comprehensive Project Management

Eldeco possesses end-to-end execution capabilities, managing the entire project lifecycle from land acquisition to final handover. The company ensures timely project delivery—often ahead of schedule—through internal monitoring systems and a centralized oversight process. A wide distribution network and over 850 channel partners drive consistent customer traffic and high sales velocity.

Experienced Leadership and Stable Management Team

The company is led by Promoter Pankaj Bajaj, who has over 25 years of industry experience. The senior management team is highly qualified, possessing an average of 18 years of sector experience with the company. This stable, experienced leadership, supported by 115 in-house engineers, fosters a positive work environment and ensures timely project execution and business expansion.

More About Eldeco Infrastructure & Properties Limited

Eldeco Infrastructure & Properties Limited (EIPL) is a leading North India-based real estate developer with over 25 years of legacy in residential, commercial, and industrial real estate. Since 2000, the company has delivered over 86 projects spanning more than 50 million sq. ft., establishing a strong reputation for quality, on-time delivery, and customer trust. As of March 31, 2025, EIPL has 19 ongoing projects (7.24 million sq. ft.) and 18 forthcoming projects (7.37 million sq. ft.) across 14 cities in North India.

Regional Presence

EIPL’s footprint extends across Delhi, Noida, Greater Noida, Gurugram, Panipat, Bareilly, Ludhiana, Panchkula, Sirmaur, Rudrapur, and Neemrana, covering both Tier I and Tier II/III cities. The company has strategically positioned itself in rapidly urbanising regions that are witnessing infrastructure growth and increasing housing demand.

Market Position

EIPL caters to mid-income and high-income segments, with products ranging from plotted developments and premium villas to luxury apartments. The company has also diversified into commercial real estate through projects like Eldeco Centre, a Grade-A, IGBC LEED-certified office and retail hub in South Delhi, which has won multiple industry awards.

Project Development Approach

- Integrated Townships: EIPL develops large-scale communities offering plots, apartments, schools, healthcare, and retail spaces.

- Collaborative Design: The company partners with reputed national and international architects such as AEDAS, Studio Lotus, and Design Cell.

- Quality & Compliance: Every project undergoes stringent material testing, third-party inspections, and continuous site audits.

- Efficient Operations: A multi-city project management model ensures timely execution, supported by over 850 authorised channel partners.

Brand and Recognition

The ‘Eldeco’ brand symbolises reliability, excellence, and customer-centricity. The company’s premium ‘Terra Grande’ brand targets high-income clientele seeking vacation homes. Its achievements include accolades like “Developer of the Year – Residential (North)”, “Iconic Commercial Project”, and “Best Commercial Project of the Year”, affirming its leadership in the North Indian real estate market.

Industry Outlook

The Indian real estate sector, covering residential, commercial, industrial, and infrastructure-linked development, is set for strong growth in the coming decade. The overall market size stands at approximately USD 570.4 billion in 2024 and is projected to reach around USD 1.31 trillion by 2034, reflecting a CAGR of about 8.7% from 2025-34. The residential segment alone is expected to reach USD 639.3 billion by 2030, growing at an estimated CAGR of 9.9% between 2025-30.

Key Drivers

- Urbanisation and rising disposable incomes are fueling housing demand, particularly in Tier II and Tier III cities.

- Government initiatives such as affordable housing schemes, infrastructure investment, and regulatory reforms (RERA, Smart Cities Mission) are boosting transparency and buyer confidence.

- Rapid expansion in logistics, warehousing, and commercial real estate is driving demand for mixed-use projects and integrated townships.

- Availability of low home loan interest rates and tax incentives continues to support residential demand.

- Growing interest from institutional investors and REITs is enhancing liquidity and long-term sector stability.

Segment-Specific Outlook for Residential & Commercial

- The residential market is witnessing strong momentum in the mid-income and premium segments as buyers prioritise quality living spaces with better amenities. The mid-income housing category remains a key growth engine.

- Commercial real estate, especially Grade A office space and logistics parks, is forecast to grow at a CAGR of nearly 19.8%, reaching approximately USD 253 billion by 2033.

- Co-working and hybrid office formats are also contributing to sustained commercial space absorption.

Regional & Product Relevance

North India, including NCR and adjoining Tier II/III cities, is emerging as one of the fastest-growing zones. For developers of large-scale townships, group housing, and integrated residential-commercial communities, this region offers substantial opportunities. Many cities in this region are undergoing rapid urban infrastructure upgrades, supporting long-term housing and commercial growth.

How Will Eldeco Infrastructure & Properties Limited Benefit

- Eldeco Infrastructure & Properties Limited (EIPL) is well-positioned to benefit from the strong growth of India’s real estate sector, particularly in the residential and commercial segments.

- The company’s strategic focus on North India aligns with the region’s rapid urbanisation and infrastructure expansion.

- Its diverse portfolio of integrated townships, mid-income housing, and premium developments positions it to capture rising demand in Tier II and Tier III cities.

- EIPL’s established presence in high-growth corridors such as Delhi-NCR, Gurugram, and Noida enables it to leverage increasing urban migration and housing affordability trends.

- With a strong brand reputation, efficient project management, and partnerships with reputed architects, the company can attract premium buyers and investors.

- The growing investor interest and policy support for organised developers enhance EIPL’s prospects for sustainable revenue growth.

- Expanding into commercial and mixed-use spaces provides additional growth momentum amid rising office and retail demand.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Eldeco Infrastructure & Properties Limited

Focused North India Expansion

Eldeco will maintain its strong presence in the North Indian market, particularly the fast-growing Delhi-NCR and key Tier II/III cities. The company leverages its ability to manage multiple projects simultaneously in high-growth areas. It will also selectively pursue opportunities in other high-potential Indian cities, such as Goa, for strategic diversification.

Residential Focus with Commercial Expansion

The company will sustain its primary focus on residential projects, developing market-appropriate vertical formats for Tier I cities and horizontal townships for Tier II/III cities. Concurrently, Eldeco will strategically evaluate and develop commercial and industrial projects based on location viability and market potential, balancing its portfolio risk and capitalizing on market maturation.

Prudent Capital Management

Eldeco aims to prudently manage financial risks and deleverage its balance sheet by focusing on generating strong operational cash flows from its development portfolio. The company will utilize Joint Development Agreements (JDAs) and joint ventures to be capital efficient and reduce upfront land acquisition costs, alongside potentially refinancing existing borrowings.

Modern and Sustainable Development

Eldeco intends to leverage its brand to develop modern, high-quality, and green properties. The strategy focuses on aesthetically designed houses with functional layouts, guided by market analysis. The company remains committed to implementing environmental sustainability practices (like energy and water conservation) in construction to gain a competitive advantage.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Eldeco Infrastructure & Properties Limited IPO

How can I apply for Eldeco Infrastructure & Properties Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of Eldeco Infrastructure & Properties Limited IPO?

The IPO size is ₹1,000 crore, comprising a fresh issue of ₹800 crore and an offer for sale of ₹200 crore.

Where will the shares of Eldeco Infrastructure & Properties Limited be listed?

The equity shares will be listed on both the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

What is the objective of the Eldeco Infrastructure & Properties Limited IPO?

The proceeds will be used for debt repayment of its subsidiary and for general corporate purposes.

Who are the promoters of Eldeco Infrastructure & Properties Limited?

The company’s promoters are Pankaj Bajaj and Bandana Kohli, holding 100% pre-issue stake.

Has the IPO price band and dates been announced yet?

No, the IPO price band, opening, and closing dates are yet to be declared by the company.