- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Eldorado Agritech IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Eldorado Agritech IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Eldorado Agritech Limited

Incorporated on 16 June 2009, Eldorado Agritech Limited operates in the agriculture, forestry, and fishing sector, focusing on seed production and distribution. Under its brand Srikar Seeds, the company offers 226 hybrid and OPV seeds across 47 crops, including maize, paddy, wheat, cotton, bajra, and vegetables. Additionally, Eldorado Agritech holds 269 registered agrochemical formulations with the Central Insecticides Board & Registration Committee and has filed nine product patents under the Indian Patents Act, strengthening its innovation and product portfolio in the agricultural sector.

Eldorado Agritech Limited IPO Overview

Eldorado Agritech Ltd. has submitted a Draft Red Herring Prospectus (DRHP) with SEBI on September 3, 2025, aiming to raise funds through an Initial Public Offer (IPO). The company plans a Book Building Issue of ₹1,000.00 crore, comprising a fresh issue of shares worth ₹340.00 crore and an offer for sale (OFS) of ₹660.00 crore. The equity shares are proposed to be listed on the NSE and BSE. Anand Rathi Advisors Ltd. is appointed as the book running lead manager, while Bigshare Services Pvt. Ltd. will act as the registrar of the issue. Key IPO details, including dates, price bands, and lot size, are yet to be announced. For further information, refer to the Eldorado Agritech IPO DRHP.

The IPO will have a face value of ₹2 per share and will follow a fresh capital-cum-offer for sale structure. The total issue size, aggregating up to ₹1,000.00 crore, includes a fresh issue of ₹340.00 crore and an OFS aggregating ₹660.00 crore. The shares will be listed on BSE and NSE through a bookbuilding process. As of now, the DRHP has been filed with SEBI on September 3, 2025. Specific details regarding IPO dates, issue price bands, lot size, and the exact number of shares for the fresh issue and OFS are yet to be disclosed.

Eldorado Agritech Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹1000 crore |

| Fresh Issue | ₹340 crore |

| Offer for Sale (OFS) | ₹660 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post-issue | TBA |

Eldorado Agritech IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Eldorado Agritech Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Eldorado Agritech Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹5.22 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 33.58% |

| Net Asset Value (NAV) | ₹17.71 |

| Return on Equity (RoE) | 34.60% |

| Return on Capital Employed (RoCE) | 23.75% |

| EBITDA Margin | 25.16% |

| PAT Margin | 16.28% |

| Debt to Equity Ratio | 1.12 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Prepayment or repayment of a portion of certain outstanding borrowings availed by the Company and its Subsidiary | 2450 |

| Prepayment or repayment of a portion of certain outstanding borrowings availed by the Company | 1632 |

| Prepayment or repayment of a portion of certain outstanding borrowings availed by the its Subsidiary | 818 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

Based on this format-

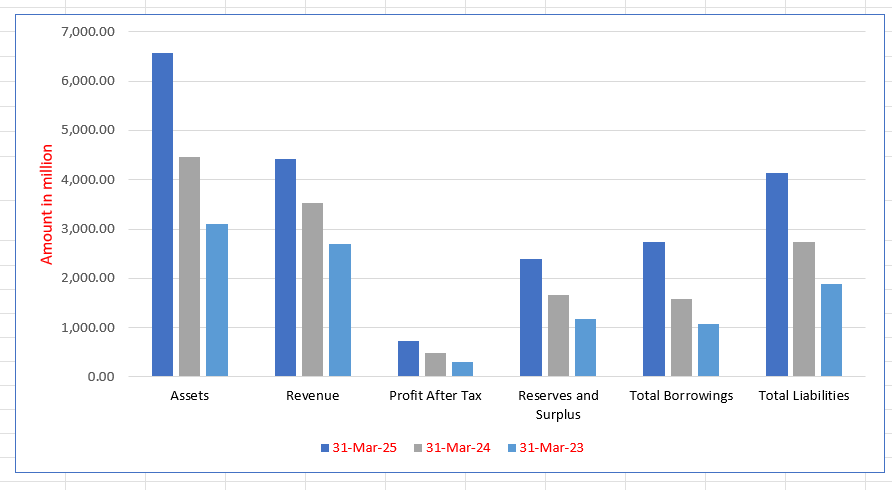

Eldorado Agritech Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 6,576.67 | 4,451.53 | 3,105.06 |

| Revenue | 4,414.81 | 3,522.02 | 2,698.14 |

| Profit After Tax | 718.60 | 487.78 | 293.30 |

| Reserves and Surplus | 2,392.49 | 1,669.82 | 1,182.33 |

| Total Borrowings | 2,728.49 | 1,574.63 | 1,076.83 |

| Total Liabilities | 4,138.28 | 2,735.80 | 1,876.83 |

Financial Status of Eldorado Agritech Limited

SWOT Analysis of Eldorado Agritech IPO

Strength and Opportunities

- Established market position in the agriculture sector.

- Diverse product portfolio of 226 hybrid and OPV seeds across 47 crops.

- Strong dealer network with over 8,500 dealers across 20 states.

- Significant R&D capabilities recognized by the Department of Scientific and Industrial Research.

- Robust financial performance with a 24% CAGR in revenue over the last four years.

- Product registrations with the Central Insecticides Board & Registration Committee (CIBRC) and filed patents under the Indian Patents Act.

- Comprehensive 'seed to harvest' solutions, including agrochemicals and bio-products.

- Plans for IPO to raise ₹1,000 crore, enhancing capital for expansion.

- Experienced promoters with over two decades in the agriculture sector.

Risks and Threats

- Working capital-intensive operations due to advances provided to farmers.

- Geographic concentration risk, primarily operating in select regions.

- Sensitivity to weather and climatic conditions affecting crop yields.

- Elongated working capital cycle, averaging 175 days in FY24.

- High reliance on bank borrowings for working capital requirements.

- Exposure to risks inherent in the agrochemicals sector.

- Intense competition from established players in the agrochemical industry.

- Potential dilution of control due to public listing.

- Regulatory and compliance challenges associated with IPO process.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Eldorado Agritech Limited

Eldorado Agritech Limited IPO Strengths

Diversified and Synergistic Product Portfolio

Eldorado Agritech Limited possesses a well-diversified portfolio spanning seeds, bio-stimulants, agrochemicals, and speciality fertilizers. This integrated ‘seed to harvest’ approach establishes the company as a one-stop solutions provider. The portfolio creates operational synergies, optimizes resource allocation, enhances risk mitigation, and facilitates effective cross-selling opportunities, strengthening its market position.

Extensive Pan-India Distribution Network

The company has a robust pan-India presence, supported by a vast and growing distribution network of dealers across 18 states. This extensive reach, bolstered by strong, long-term relationships with active dealers, ensures timely product delivery, reduces regional dependency, and provides a consistent channel for demand generation and market penetration throughout the year.

Deep Farmer Engagement and Connect

Eldorado employs a multi-faceted farmer engagement strategy combining traditional outreach like field demonstrations and village meetings with digital initiatives such as social media campaigns and mobile messaging. This structured, year-round approach builds trust, drives product adoption, and provides critical agronomic support across all crop stages, fostering strong brand loyalty at the grassroots level.

Robust Research and Development Capabilities

Eldorado Agritech Limited demonstrates a strong commitment to R&D, evidenced by its significant investment in expanding its R&D team, farm acreage, and laboratory infrastructure. Its systematic R&D process focuses on developing high-yield, stress-resistant seed varieties and effective crop care formulations tailored to diverse Indian agro-climatic conditions, ensuring a steady pipeline of innovative products.

Accelerated Financial Growth and Market Position

The company is recognized as the fastest-growing agro-sciences company in its listed peer set, achieving a notable revenue CAGR of 27.92% from Fiscal 2023 to 2025. This rapid growth is complemented by significant expansion in both EBITDA and PAT margins, underscoring its successful business model and efficient scaling operations within the sector.

Experienced Leadership and Governance

Eldorado is led by qualified and experienced Promoters with deep expertise in plant physiology and agriculture, supported by a professional management team and board. This leadership provides strong strategic vision and corporate governance, which are instrumental in driving the company’s growth and adaptability in the dynamic agro-sciences market.

More About Eldorado Agritech Limited

Eldorado Agritech Limited is an integrated agro-sciences company offering comprehensive ‘seed to harvest’ solutions. The company engages in R&D, production, and distribution of a wide range of hybrid and open pollinated seeds, bio-stimulants, agrochemicals, and specialty fertilizers. According to industry reports, Eldorado is one of the fastest-growing and most diversified agro-sciences firms in India.

Product Portfolio & Performance

- Seeds: Portfolio includes 226 commercialized hybrids and OPVs across 47 crops such as maize, paddy, cotton, and vegetables. In Fiscal 2025, seeds contributed 63.02% of total revenue.

- Crop Care Products: Includes bio-stimulants, agrochemicals, and specialty fertilizers. As of June 30, 2025, the company held 269 agrochemical registrations and 43 specialty fertilizer registrations.

Revenue Breakdown (Fiscal 2025):

- Total Revenue: $4,414.81 million

- Seeds: $2,782.41 million

- Bio-stimulants: $720.03 million

- Agrochemicals: $666.29 million

- Specialty Fertilizers: $246.08 million

Operations & Supply Chain

Eldorado operates R&D farms across 188.16 acres and has a pan-India distribution network covering 18 states. The company works with over 16,000 dealers and employs a structured supply chain with integrated production, processing, and logistics capabilities.

Innovation & Partnerships

Through its material subsidiary, Srikar Biotech Private Limited, the company engages in advanced seed and crop care product development. It collaborates with national and international research institutions for germplasm acquisition and technology licensing.

Leadership & Workforce

Led by promoters with 17 years of experience in agriculture and plant sciences, Eldorado employs 1,371 professionals (as of June 30, 2025), supporting its innovation-driven growth strategy

Industry Outlook

India’s agro-sciences industry is experiencing robust growth, driven by advancements in agricultural practices, increasing demand for food security, and government initiatives promoting sustainable farming. The sector encompasses various segments, including seeds, agrochemicals, biostimulants, and specialty fertilizers.

Seeds Segment

- Market Size & Growth: The Indian seed industry is projected to grow at a CAGR of 8.5% from 2025 to 2030, driven by the adoption of hybrid seeds and increased agricultural productivity.

- Key Drivers: Advancements in seed technology, government support for seed development, and rising demand for high-yielding varieties.

- Challenges: Intellectual property issues and the need for regulatory approvals for new seed varieties.

Agrochemicals Segment

- Market Size & Growth: The Indian agrochemicals market is expected to reach USD 9 billion in 2025 and grow at a CAGR of 7.10% to reach USD 12.70 billion by 2030.

- Key Drivers: Increasing adoption of herbicides, strong domestic manufacturing capacity, and policy incentives favoring sustainable inputs.

- Challenges: Regulatory hurdles and the need for awareness among farmers regarding the benefits of agrochemicals.

Biostimulants Segment

- Market Size & Growth: The India biostimulants market is projected to grow from $410.78 million in 2025 to $1,135.96 million by 2032, exhibiting a CAGR of 15.64%.

- Key Drivers: Increasing agricultural productivity, consumer preference for organic and high-quality food products, and advancements in biotechnological research.

- Challenges: Regulatory delays and limited awareness among farmers.

Specialty Fertilizers Segment

- Market Size & Growth: The India specialty fertilizer market is expected to reach USD 1.27 billion in 2025 and grow at a CAGR of 6.80% to reach USD 1.77 billion by 2030.

- Key Drivers: Advancements in precision farming technologies, shift towards organic farming, and increasing government support for sustainable agriculture.

- Challenges: High production costs and the need for farmer education on the benefits of specialty fertilizers.

How Will Eldorado Agritech Limited Benefit

- Diversified product portfolio across seeds, bio-stimulants, agrochemicals, and specialty fertilizers positions Eldorado to capture growth in multiple high-demand segments.

- Strong R&D capabilities and collaborations with national and international institutions enhance innovation in high-yielding seeds and advanced crop care solutions.

- Pan-India distribution network with over 16,000 dealers ensures wide market reach and consistent revenue generation.

- Expertise in hybrid and open-pollinated seeds supports adoption of modern farming practices, boosting farmer loyalty and repeat business.

- Strategic investments in specialty fertilizers and biostimulants align with rising demand for sustainable and precision agriculture.

- Integrated supply chain, from production to logistics, reduces operational inefficiencies and enhances profitability.

- Robust registrations of agrochemicals and specialty fertilizers provide regulatory advantage and market credibility.

- Experienced leadership team drives strategic growth, ensuring scalability and long-term industry relevance.

- Positioned to benefit from increasing government support and growth in the Indian agro-sciences sector.

Peer Group Comparison

| Name of the Company | Face value

(₹) |

P/E | EPS (%) | RoNW (%) | NAV

(₹) |

Revenue

(in ₹ million) |

| Eldorado Agritech Limited | 2 | NA | 5.22 | 33.58 | 17.71 | 4,414.81 |

| Peer Group | ||||||

| Kaveri Seeds Company Limited | 2 | 21.13 | 55.10 | 20.61 | 292.28 | 12,049.70 |

| Dhanuka Agritech Limited | 2 | 24.51 | 65.55 | 22.34 | 311.17 | 20,351.52 |

| Rallis India Limited | 1 | 58.75 | 6.43 | 6.70 | 97.92 | 26,629.40 |

Key Strategies for Eldorado Agritech Limited

Geographic Market Expansion

Eldorado Agritech Limited intends to increase its domestic market share by deepening penetration in existing states and entering new Indian regions like Kerala and Assam. Internationally, it aims to grow in Nepal and Bangladesh and enter new markets in Africa and Southeast Asia.

Dealer Network and Farmer Outreach Strengthening

The company plans to strengthen its dealer network with competitive margins and loyalty benefits. It will enhance farmer outreach through field visits, demonstrations, free samples, and by building relationships with local influencers and progressive farmers to promote product adoption.

Integrated ‘Seed to Harvest’ Solution Offering

Eldorado Agritech Limited will leverage its position as a diversified agro-sciences company to offer integrated “seed to harvest” solutions. This strategy aims to build trust with farmers, increase conversion potential across product lines, and enable cost-efficient customer acquisition.

Research and Development (R&D) Enhancement

The company will increase its R&D expenditure and personnel to develop new high-yielding, stress-tolerant hybrids and OPVs. It plans to invest in advanced breeding technologies, data management software, and expand its R&D farm infrastructure across multiple Indian states.

Production Capacity and Operational Efficiency

Eldorado Agritech Limited aims to expand its seed processing, storage, and specialty fertilizer manufacturing capacities. It plans to achieve backward integration by setting up a ‘Technicals’ manufacturing facility and will digitalize its supply chain for improved efficiency and traceability.

Branding and Farmer Engagement Initiatives

The company will strengthen its brand through direct farmer engagement via a toll-free helpline (‘Srikar Kisan Seva’), a planned ‘Farmer Connect’ app, and soil testing services. Its strategy includes both physical marketing activities and digital initiatives to build loyalty and drive product adoption.

Sales and Marketing Team Expansion

Eldorado Agritech Limited aims to continue expanding its sales and marketing department to strengthen its market reach. This growth supports its objectives of reaching underserved geographies and increasing farmer awareness of new products through enhanced promotional activities.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Eldorado Agritech Limited IPO

How can I apply for Eldorado Agritech Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of Eldorado Agritech Limited IPO?

The IPO is a ₹1,000 crore Book Build Issue, including a ₹340 crore fresh issue and ₹660 crore OFS.

When was the IPO filed with SEBI?

Eldorado Agritech filed its Draft Red Herring Prospectus (DRHP) with SEBI on 3 September 2025.

Where will Eldorado Agritech shares be listed?

The equity shares are proposed to be listed on the NSE and BSE mainboards.

What will the company use the IPO proceeds for?

Proceeds will fund repayment of borrowings and general corporate purposes, strengthening the company’s financial position.

What is the face value and type of IPO?

The IPO has a face value of ₹2 per share and is a Bookbuilding IPO with a fresh capital-cum-offer for sale.