- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Elevate Campuses IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Elevate Campuses IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Elevate Campuses Limited

Incorporated in 2005, Elevate Campuses Ltd. owns, operates, and manages student accommodation across higher education institutions (HEIs) and K-12 assets. As of August 31, 2025, it serves 94,758 students across 20 Indian cities and one in the UAE under the brands “Good Host Spaces” and “ScholarZ.” Its portfolio includes owned and managed campuses, K-12 assets, and technology-driven community services. Collaborating with institutions like MAHE and MUJ, the company expanded to 21 cities and 33 institutes, adding 21,764 beds and six K-12 assets by August 2025.

Elevate Campuses Limited IPO Overview

Elevate Campuses Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 28, 2025, proposing to raise ₹2,550.00 crores through an Initial Public Offer (IPO). The IPO will be a Book Built Issue comprising a fresh issue of equity shares, with no offer-for-sale component. The company plans to list its equity shares on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

While the Book Running Lead Manager has not yet been announced, Kfin Technologies Ltd. will act as the registrar to the issue. Further details such as IPO opening and closing dates, price band, and lot size will be disclosed in due course.

Elevate Campuses Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹2550 crore |

| Fresh Issue | ₹2550 crore |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post-issue | TBA |

Elevate Campuses Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Elevate Campuses Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Elevate Campuses Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹ |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 7.75% |

| Net Asset Value (NAV) | ₹ |

| Return on Equity (RoE) | 7.75% |

| Return on Capital Employed (RoCE) | 10.02% |

| EBITDA Margin | 65.80% |

| PAT Margin | 13.36% |

| Debt to Equity Ratio | 2.45 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Payment of the purchase consideration for the acquisition of the K-12 Entities and Campuses | 11000 |

| Repayment and/ or prepayment, in full or in part, of certain outstanding borrowings and prepayment penalties, as applicable of availed by our Company and certain of our Subsidiaries, namely GHS Shoolini, GHS Sonipat, Souk HIS UAE and Souk NLCS UAE, through investment in such Subsidiaries; and | 7500 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

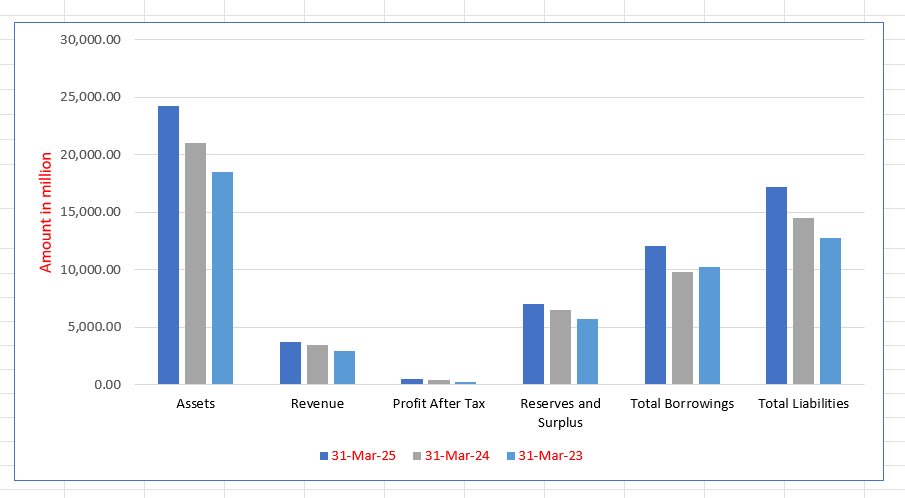

Elevate Campuses Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 24,211.77 | 21,047.37 | 18,499.96 |

| Revenue | 3,698.11 | 3,470.01 | 2,925.01 |

| Profit After Tax | 526.51 | 396.89 | 290.03 |

| Reserves and Surplus | 7,004.98 | 6,535.58 | 5,747.76 |

| Total Borrowings | 12,065.96 | 9,847.11 | 10,261.15 |

| Total Liabilities | 17,184.68 | 14,489.67 | 12,730.08 |

Financial Status of Elevate Campuses Limited

SWOT Analysis of Elevate Campuses IPO

Strength and Opportunities

- Strong leadership in student accommodation and K-12 education platforms.

- Established partnerships with reputed higher-education institutions across India.

- Expanding footprint across 20+ Indian cities and one UAE location.

- Rising demand for organised student housing supports future growth.

- Diversified services including campus operations, technology, and student engagement.

- Growth opportunities in K-12 asset acquisitions and emerging education hubs.

- Balanced mix of asset-heavy and asset-light business models.

- Integration of smart campus technologies enhances student experience.

- Favourable demographics and rising private education enrolments.

Risks and Threats

- High capital intensity due to large real-estate asset ownership.

- Considerable debt obligations linked to expansion and acquisitions.

- Project delays and execution risks in campus development.

- Exposure to regulatory changes in education and real-estate sectors.

- Escalating construction and maintenance costs may pressure margins.

- Increasing competition from institutional and private housing providers.

- Dependence on consistent occupancy rates to sustain profitability.

- Vulnerability to macroeconomic conditions and interest rate fluctuations.

- Currency risks from overseas operations, particularly in the UAE.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Elevate Campuses Limited

Elevate Campuses Limited IPO Strengths

Market Leadership and Scale

Elevate Campuses Limited is India’s largest institutionalized and independent education platform, trusted by leading groups. As of August 31, 2025, their portfolio, including on-campus student accommodation (66,272 beds) and K-12 assets, represents approximately 1.7 times the capacity of the next largest player in the PMSA segment, demonstrating significant market scale and independent operational capability.

Strong Operational Execution and Asset Management

The company possesses strong operating capabilities across the value chain, including sourcing, development, acquisition, and asset repositioning. Their operational skill is evident in the rapid portfolio expansion, increasing student accommodation beds to 66,272 from 44,508 since Financial Year 2023. They actively optimize bed inventory and undertake enhancements, such as renovations, to drive growth and superior value.

Commitment to Superior Student Experience

Elevate Campuses Limited is dedicated to providing a quality, student-centric experience across its properties, creating a ‘home away from home’ with modern amenities and comprehensive support systems. This commitment is reflected in high occupancy rates (e.g., above 99.00% across the Owned Portfolio) and the provision of services like daily meals and efficient handling of over 1,562 service requests daily, ensuring student well-being.

Strategically Located Modern Portfolio

The company holds a quality modern portfolio strategically located across India’s key educational hubs, including four of the top five K-12 hubs and three of the top six HEI hubs, with recent expansion into the GCC region. This prime positioning, combined with the quality of the student accommodation, allows the company to maintain strong occupancy rates, which stood at 99.47% for the Owned Portfolio in Academic Year 2024–2025.

De-Risked Business Model with Cash Flow Visibility

Elevate Campuses Limited utilizes a business model combining asset ownership and asset-light management, underpinned by long-term contracts (typically 50-60 years) with HEIs and K-12 operators. These agreements often include occupancy guarantees and annual escalations, providing stable, inflation-protected revenue and clear cash flow visibility. The operations also benefit from a negative working capital cycle, as fees are received in advance.

Highly Experienced Senior Management Team

The company is guided by a highly experienced senior management team with deep domain expertise in education, real estate investment, and facility management. Their leadership has been instrumental in scaling the portfolio—adding 21,764 beds and six K-12 assets between Academic Year 2023 and August 31, 2025. The team’s strategic oversight ensures operational efficiency and alignment with long-term objectives.

More About Elevate Campuses Limited

Elevate Campuses Limited owns, operates and manages on-campus student accommodation across higher education institutions (HEIs) and holds a significant portfolio of K-12 assets. As of 31 August 2025, it serves a capacity of 94,758 students across 20 cities in India and one city in the United Arab Emirates. The company enables HEIs and K-12 school operators to offer high-quality learning environments that support student development and holistic growth. The student accommodation business functions under the brands “Good Host Spaces” and “ScholarZ”.

Mission & Leadership Position

Elevate’s mission is to build inclusive education communities by delivering modern student accommodation and K-12 assets that nurture student wellbeing and holistic development. The company is recognised as the largest institutionalised and independent education platform engaged in owning, operating and managing on-campus student accommodation across HEIs and owning K-12 assets in India (based on student capacity as of 31 August 2025).

Asset Portfolio

- Owned Portfolio: Five student accommodation campuses totaling 16,934 beds; 16 K-12 assets (including three under development and two student accommodation facilities managed by HEIs and owned by K-12 HoldCos) across eight Indian cities; and two K-12 assets in Dubai, UAE.

- Managed Portfolio: Fourteen student accommodation campuses with 49,338 beds under management as of 31 August 2025.

- Additional services: Provides community and campus technology services such as media coverage of HEIs and the organisation of community-events for its managed portfolio.

Market Context & Operating Capabilities

Elevate operates in the resilient education sector, which requires non-discretionary expenditure and has experienced strong growth. The sector features significant barriers to entry, demanding trusted brands capable of delivering safe, quality environments and managing complex non-academic operations. Elevate’s comprehensive operating capabilities—including deal sourcing, site selection, development, acquisition, asset repositioning and community engagement—enable HEIs and K-12 operators to streamline non-core operations so they can focus on academic outcomes, skill-development and curriculum delivery.

Strategic Advantages & Collaborations

Elevate believes that being an institutionalised, independent, scaled operator gives it strategic advantages in credibility and trust with HEIs and K-12 operators. It benefits from increased operational efficiency and superior service quality. Collaborations with leading educational institutions include campuses of Manipal Academy of Higher Education (MAHE), Manipal University Jaipur (MUJ) and Meraki Education (Meraki).

Growth & Evolution

Since commencing operations as an independent owner and operator of student accommodation in FY 2018, Elevate has broadened its offerings to address the full student lifecycle—from pre-primary to postgraduate studies. It has expanded its asset-light business model via management contracts with HEIs, and scaled its K-12 asset base significantly, driven by a mix of organic growth and strategic acquisitions.

Industry Outlook

The Indian education infrastructure market is witnessing strong expansion across both K-12 assets and student accommodation. The K-12 education segment was valued at around US$ 48.9 billion in 2023 and is projected to reach US$ 125.8 billion by FY 2032, reflecting an annual growth rate of about 10.7 %. At the same time, real-estate demand in the education sector is forecast to exceed 4 billion sq ft by 2034–35, driven by increasing enrolments and institutional expansion.

Student Accommodation Market

Within the student accommodation segment, opportunities are rapidly growing. The organised market currently provides nearly 0.3 million beds, but this is expected to reach 1 million beds by 2030, increasing penetration from 5 % to over 10 %. The overall market is valued at approximately US$ 533.5 million in 2024, projected to rise to US$ 780.5 million by 2030, with a CAGR of around 6.6 % between 2025 and 2030.

Growth Drivers & Key Figures

- Rising higher-education enrolments and student mobility, projected to reach 31 million students by 2036.

- A persistent supply gap in professionally managed student housing, with only 35–40 % of demand currently met.

- A growing shift toward purpose-built student accommodation (PBSA) featuring premium amenities.

- Shared-bed formats account for over 55 % of revenues, while studio accommodations are expected to grow at a CAGR of ~9 % by 2030.

- The K-12 segment continues to expand, supported by favourable demographics, rapid urbanisation, and increasing private investment.

How Will Elevate Campuses Limited Benefit

- The rapid expansion of India’s K-12 and student housing sectors will enable Elevate Campuses Limited to increase its portfolio across Tier-I, Tier-II, and Tier-III cities.

- Rising student mobility and enrolments will drive sustained occupancy across its existing and upcoming campuses.

- The growing demand for purpose-built student accommodation (PBSA) aligns with Elevate’s core business model and operational expertise.

- Increasing private and institutional investment in education infrastructure provides avenues for strategic partnerships and capital access.

- The supply gap in organised student housing presents an opportunity for Elevate to expand its managed and owned bed capacity.

- Growth in K-12 assets allows the company to strengthen its integrated platform supporting learners from school to higher education.

- The strong policy and demographic tailwinds in education will enhance long-term revenue stability and brand visibility.

- Expansion into international markets like the UAE can further diversify earnings and strengthen Elevate’s global positioning.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Elevate Campuses Limited

Capitalizing on Market Potential

The company’s strategy is to leverage significant growth opportunities in India’s large, underserved education market, where there is a considerable demand-supply gap. Their current student accommodation portfolio represents only approximately $0.48\%$ of the Target Addressable Market, positioning them to benefit from the increasing privatization and expansion of the higher education and K-12 segments.

Disciplined Organic and Inorganic Growth

Elevate Campuses Limited is committed to disciplined growth via a balanced mix of organic and inorganic initiatives, underpinned by prudent capital allocation. This involves driving revenue through contractual escalations, optimizing current assets via upgrades, and pursuing greenfield/brownfield development and selective value-enhancing acquisitions in high-potential markets.

Strategic Platform Expansion

The company plans to broaden its Elevate Platform by exploring strategic adjacencies to the existing portfolio. This includes collaborating with foreign and leading public Higher Education Institutions (HEIs), capitalizing on new regulatory environments, and exploring off-campus student housing in key micro-markets where demand exceeds current on-campus capacity.

Tech-Driven Operational Efficiency

Elevate Campuses Limited will continue to invest in data analytics and technology-enabled solutions to enhance the student experience and drive business growth. The company seeks to streamline operations and improve productivity by deploying integrated technology tools, such as mobile applications, to automate processes, manage service requests, and potentially establish new digital revenue streams.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Elevate Campuses Limited IPO

How can I apply for Elevate Campuses Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Elevate Campuses Limited IPO?

The IPO is valued at ₹2,550 crore, comprising a complete fresh issue of equity shares.

When was the DRHP for the Elevate Campuses IPO filed with SEBI?

Elevate Campuses Limited filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 28, 2025.

Where will the equity shares of Elevate Campuses be listed?

The equity shares are proposed to be listed on both the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

What are the primary objectives of the IPO proceeds?

Proceeds will fund K-12 asset acquisitions, debt repayment, strategic growth initiatives, and general corporate purposes.

Who are the promoters of Elevate Campuses Limited?

The company’s promoters are Genius Bidco Holdings Pte. Ltd. and Genius Rajkot Investment Holdings Pte. Ltd.