- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Emmvee Photovoltaic Power IPO

IPO Details

11 Nov 25

13 Nov 25

₹14,214

69

₹206 to ₹217

NSE, BSE

₹2,900 Cr

18 Nov 25

Emmvee Photovoltaic Power IPO Timeline

Bidding Start

11 Nov 25

Bidding Ends

13 Nov 25

Allotment Finalisation

14 Nov 25

Refund Initiation

17 Nov 25

Demat Transfer

17 Nov 25

Listing

18 Nov 25

Emmvee Photovoltaic Power Limited

Incorporated in March 2007, Emmvee Photovoltaic Power Limited is a fully integrated manufacturer of solar PV modules and cells. As of May 31, 2025, it boasts a solar PV module capacity of 7.80 GW and a solar cell capacity of 2.94 GW. The company’s offerings include bifacial and mono-facial TOPCon modules and cells, as well as Mono PERC modules, produced across four manufacturing units spanning 22.44 acres in Karnataka. Its Dobbaspet, Bengaluru, facility is one of India’s largest TOPCon solar cell units. Serving 525 customers in 2023‑24, Emmvee caters to IPPs, commercial and industrial clients, and EPC providers, including Ayana Renewable Power, Clean Max Enviro Energy, Hero Rooftop Energy, and others.

Emmvee Photovoltaic Power Limited IPO Overview

Emmvee Photovoltaic Power Limited is launching a book-building IPO of ₹2,900 crore, comprising a fresh issue of 9.88 crore shares aggregating ₹2,143.86 crore and an offer for sale of 3.48 crore shares aggregating ₹756.14 crore. The IPO opens for subscription on November 11, 2025, and closes on November 13, 2025, with allotment expected to be finalized on November 14, 2025. The shares will be listed on the BSE and NSE, with a tentative listing date of November 18, 2025.

The price band for the IPO has been set at ₹206 to ₹217 per share, and the lot size for applications is 69 shares. For retail investors, the minimum investment at the upper price band amounts to ₹14,973. For small non-institutional investors (sNII), the lot size investment is 14 lots (966 shares), totaling ₹2,09,622, while for big non-institutional investors (bNII), it is 67 lots (4,623 shares), amounting to ₹10,03,191. JM Financial Ltd. is acting as the book running lead manager, and Kfin Technologies Ltd. is the registrar for the issue.

Emmvee Photovoltaic Power Limited Upcoming IPO Details

| Parameter | Details |

| IPO Date | November 11, 2025 to November 13, 2025 |

| Listing Date | 18 November 2025 |

| Face Value | ₹2 per share |

| Issue Price Band | ₹206 to ₹217 per share |

| Lot Size | 69 Shares |

| Sale Type | Fresh Capital-cum-Offer for Sale |

| Total Issue Size | 13,36,40,552 shares (aggregating up to ₹2,900.00 Cr) |

| Fresh Issue | 9,87,95,483 shares (aggregating up to ₹2,143.86 Cr) |

| Offer for Sale | 3,48,45,069 shares (aggregating up to ₹756.14 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 59,35,49,550 shares |

| Share Holding Post Issue | 69,23,45,033 shares |

Emmvee Photovoltaic Power IPO Lots

| Application Type | Lots | Shares | Amount (₹) |

| Retail (Min) | 1 | 69 | 14,973 |

| Retail (Max) | 13 | 897 | 1,94,649 |

| S-HNI (Min) | 14 | 966 | 2,09,622 |

| S-HNI (Max) | 66 | 4,554 | 9,88,218 |

| B-HNI (Min) | 67 | 4,623 | 10,03,191 |

Emmvee Photovoltaic Power Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Emmvee Photovoltaic Power Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹6.22 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 69.44% |

| Net Asset Value (NAV) | ₹8.95 |

| Return on Equity (RoE) | 104.60% |

| Return on Capital Employed (RoCE) | 23.33% |

| EBITDA Margin | 30.91% |

| PAT Margin | 15.80% |

| Debt to Equity Ratio | 2.55 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/ prepayment, in full or part, of all or certain outstanding borrowings and accrued interest thereon availed by the Company and the Material Subsidiary | 16079 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

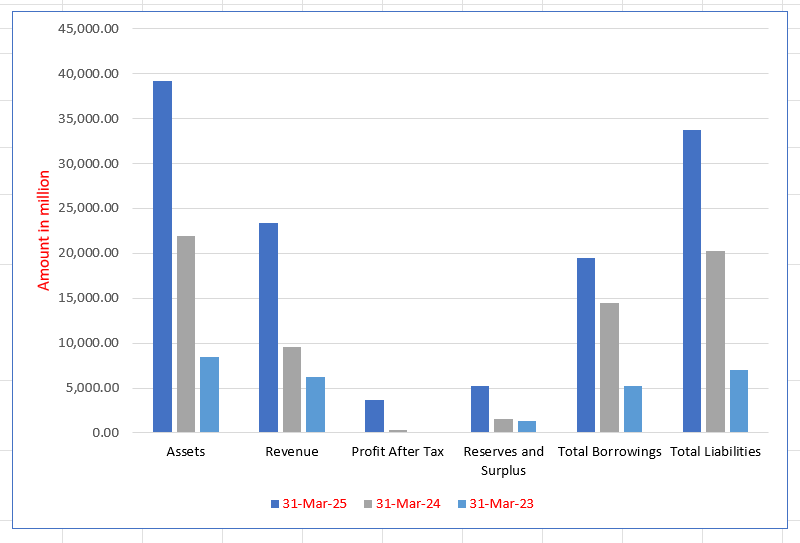

Emmvee Photovoltaic Power Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 39,139.35 | 21,899.88 | 8,407.89 |

| Revenue | 23,356.13 | 9,519.35 | 6,181.26 |

| Profit After Tax | 3,690.14 | 288.99 | 89.71 |

| Reserves and Surplus | 5,260.05 | 1,579.69 | 1,297.03 |

| Total Borrowings | 19,496.86 | 14,412.99 | 5,196.21 |

| Total Liabilities | 33,771.38 | 20,212.27 | 7,002.94 |

Financial Status of Emmvee Photovoltaic Power Limited

SWOT Analysis of Emmvee Photovoltaic Power IPO

Strength and Opportunities

- Established in 2007 with over 30 years of industry experience.

- Robust manufacturing capacity of 6.6 GW for modules and 2.5 GW for cells.

- Diverse product portfolio including TOPCon, Mono PERC, and bifacial modules.

- Strategic location with multiple manufacturing units in Karnataka.

- Strong presence in international markets like Europe, Africa, and the Middle East.

- Recent partnerships with major entities like KPI Green Energy and NTPC.

- Plans for an INR 3,000 crore IPO to fund expansion and innovation.

- Recognition for product reliability, passing all Kiwa PVEL tests.

- Commitment to sustainability and clean energy solutions.

Risks and Threats

- Heavy reliance on government policies and incentives.

- Exposure to fluctuations in raw material prices.

- Intense competition from both domestic and international players.

- Potential challenges in scaling operations to meet growing demand.

- Vulnerability to geopolitical tensions affecting supply chains.

- Risk of technological obsolescence in a rapidly evolving industry.

- Dependence on a limited number of key customers for revenue.

- Environmental factors potentially impacting production and logistics.

- Regulatory challenges and compliance requirements in various markets.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Emmvee Photovoltaic Power Limited

Emmvee Photovoltaic Power Limited IPO Strengths

Second-Largest Integrated Solar PV Manufacturer

Emmvee Photovoltaic Power Limited is India’s second-largest integrated manufacturer of solar PV modules and cells by production capacity, as of March 31, 2025. This integrated model, which spans from cell production to module assembly, helps the company reduce its reliance on external suppliers, control costs, and maintain a high level of quality and supply chain security.

One of India’s Largest Solar PV Module Manufacturers

As one of the largest solar PV module manufacturers in India, the company has a strong track record of delivering quality products. The company has rapidly expanded its production capacity, which has grown by approximately four times from fiscal 2023 to fiscal 2025. The company’s commitment to quality is evidenced by its various certifications and low warranty claims.

Early Adoption of Advanced TOPCon Technology

Emmvee was one of the first companies in India to adopt higher-efficiency TOPCon solar cell manufacturing. This early mover advantage, supported by a research collaboration with Fraunhofer ISE, has allowed the company to establish a strong market presence and leverage an advanced technology that is expected to dominate the solar market in the future.

Advanced Manufacturing Units

The company’s four manufacturing units are strategically located in Karnataka, ensuring efficient logistics and operational control. These facilities feature automated machinery, cleanroom infrastructure, and multi-stage testing, demonstrating a commitment to high-quality, sustainable, and consistent production. The company also employs advanced quality control tools and practices.

Diverse Customer Base and Substantial Orderbook

Emmvee has built a strong reputation with a diverse customer base, including IPPs, EPC service providers, and entities in the C&I sector. This has resulted in a substantial order book and a high rate of repeat customers, which helps stabilize revenue and enhances the company’s credibility within the solar industry.

Experienced Leadership and Management Team

The company is led by an experienced team of promoters and senior management with deep expertise in the solar industry. Their collective experience and strategic vision have been instrumental in driving the company’s rapid expansion, technological advancements, and overall success in the competitive renewable energy sector.

More About Emmvee Photovoltaic Power Limited

Emmvee Photovoltaic Power Limited is the second largest pure-play integrated solar photovoltaic (PV) module and solar cell manufacturer in India by production capacity as of March 31, 2025 (Crisil Report). The company has over 18 years of experience and operates a solar PV module production capacity of 7.80 GW and a solar cell capacity of 2.94 GW as of May 31, 2025.

Technological Edge

Emmvee is among the first in India to adopt high-efficiency TOPCon (Tunnel Oxide Passivated Contact) technology for solar cell production, enhancing module efficiency, performance, and durability. The company manufactures bifacial and mono-facial formats of TOPCon and Mono PERC modules, strengthening its competitive advantage.

Capacity Expansion

- Current capacities (May 31, 2025): 7.80 GW modules, 2.94 GW cells

- Planned expansions: 2.50 GW module line (Fiscal 2026) and 6.00 GW integrated solar cell and module capacity (Fiscal 2028)

- Post-expansion goal: 16.30 GW module and 8.94 GW cell capacity using TOPCon technology

Quality and Certifications

- Modules have received international quality accreditations, including IEC standards, BIS certifications, and UL 61730:2022.

- Warranty claims remain negligible: ₹0.06 million in Fiscal 2025, representing 0.0002% of revenue.

- Third-party assessments confirmed leading durability and PID resistance for Mono PERC modules.

Manufacturing Units

The company operates four units across two Karnataka locations on 22.44 acres, including one of India’s largest TOPCon solar cell facilities at Dobbaspet. A zero liquid discharge system ensures 96.8% water recovery. Collaboration with Fraunhofer ISE enhances R&D and production expertise.

Customers and Order Book

Emmvee serves 525 customers across IPPs, C&I sectors, and EPC service providers, including Ayana Renewable Power, Clean Max Enviro Energy, and Hero Rooftop Energy. As of March 31, 2025, the company had a 4.89 GW outstanding order book, growing at a CAGR of 209.05% from Fiscal 2023.

Leadership and Management

Founded in 2007 by Manjunatha Donthi Venkatarathnaiah, the company benefits from an experienced management team with extensive renewable energy and manufacturing expertise.

Financial Performance

The company has demonstrated strong growth:

- Revenue increased from ₹6,181.26 million in Fiscal 2023 to ₹23,356.13 million in Fiscal 2025 (CAGR 94.38%)

- EBITDA grew from ₹562.72 million to ₹7,219.38 million (CAGR 258.18%)

- Profit after tax rose from ₹89.71 million to ₹3,690.14 million (CAGR 541.36%)

Emmvee continues to fund its growth through internal accruals and debt, highlighting operational efficiency and consistent performance.

Industry Outlook

Market Growth and Projections

- Market Size and CAGR: The Indian solar power market is projected to grow by USD 273.82 billion between 2022 and 2027, with a CAGR of 42.4%.

- Revenue Forecast: The solar energy market generated USD 10.4 billion in 2023 and is expected to reach USD 24.9 billion by 2030, reflecting a CAGR of 13.4%.

- Solar PV Panels Market: The solar PV panels market size was estimated at USD 7.31 billion in 2023 and is expected to grow at a CAGR of 9.4% from 2024 to 2030.

Manufacturing Capacity and Expansion

- Current Capacity: India’s solar PV module manufacturing capacity has reached 91.6 GW, with projections to exceed 100 GW by mid-2025.

- Future Projections: By 2030, India aims to achieve 160 GW of solar module capacity and 120 GW of solar cell capacity.

- Government Initiatives: The Production Linked Incentive (PLI) scheme has been instrumental, contributing to the establishment of 18.5 GW of module capacity and 9.7 GW of cell capacity as of June 2025.

Key Growth Drivers

- Policy Support: Government initiatives like the National Solar Mission and PLI schemes have boosted domestic manufacturing and adoption.

- Technological Advancements: Adoption of high-efficiency technologies such as TOPCon and Mono PERC modules enhances performance and competitiveness.

- Infrastructure Development: Significant investments in advanced manufacturing facilities continue to expand domestic capacity.

Outlook Summary

The Indian solar photovoltaic industry is poised for strong growth, supported by robust policies, technological innovation, and increased manufacturing capacity. Rising domestic production and high-efficiency solar technologies position the sector to meet national renewable energy targets and contribute to global sustainability.

How Will Emmvee Photovoltaic Power Limited Benefit

- Emmvee can leverage the expanding solar PV market, expected to grow at a CAGR of over 13% by 2030, to increase sales and revenue.

- Rising domestic manufacturing capacity and government incentives like the PLI scheme create opportunities to scale production efficiently.

- Adoption of high-efficiency technologies such as TOPCon and Mono PERC modules aligns with industry trends, enhancing Emmvee’s competitiveness.

- Expansion of solar module and cell capacities in India supports Emmvee’s planned capacity additions, enabling it to capture larger market share.

- Policy support for domestic content requirements allows Emmvee to supply modules and cells to government-mandated projects.

- Increasing adoption of renewable energy across utility, C&I, and rooftop segments broadens Emmvee’s customer base and order book potential.

- Technological advancements and infrastructure growth in the sector enhance operational efficiency and profitability for Emmvee.

Peer Group Comparison

| Name of the Company | Revenue

(₹ million) |

Face Value (₹) | P/E | EPS (₹) | RoNW (%) | NAV (₹) |

| Emmvee Photovoltaic Power Limited | 23,356.13 | 2.00 | TBD | 6.22 | 69.44 | 8.95 |

| Peer Groups | ||||||

| Websol Energy Systems Limited | 5,754.60 | 10.00 | 36.45 | 36.66 | 55.65 | 65.88 |

| Waaree Energies Limited | 144,445.00 | 10.00 | 44.03 | 68.24 | 20.34 | 329.96 |

| Premier Energies Limited | 65,187.45 | 1.00 | 49.31 | 21.35 | 33.21 | 62.61 |

Key Strategies for Emmvee Photovoltaic Power Limited

Expansion of Solar Cell and Module Manufacturing Capacity

Emmvee Photovoltaic Power Limited aims to expand its solar PV module manufacturing capacity to meet growing customer demand. With a 2.50 GW line at Sulibele operational by Fiscal 2026 and a planned 6.00 GW facility in ITIR Phase-II by Fiscal 2028, total capacities will reach 16.30 GW for modules and 8.94 GW for cells.

Strategic Backward Integration and Supplier Diversification

Emmvee plans to enhance backward integration by establishing domestic wafer and ancillary component manufacturing units. This reduces reliance on imported materials, mitigates supply chain risks, and improves cost efficiency. The company also aims to onboard additional local suppliers, ensuring consistent production and high-quality solar PV modules.

Leveraging Advanced Technologies to Improve Efficiency

Emmvee continues investing in R&D to advance solar cell efficiency and production processes. Using techniques like laser-enhanced contact optimization, tandem TOPCon structures, and advanced characterization tools, the company explores next-generation technologies to enhance module reliability, performance, and competitiveness while staying at the forefront of solar innovation.

Strengthening Presence Across Domestic Customer Segments

Emmvee intends to expand its distribution network across India, targeting small to medium C&I sectors and government schemes like PM Surya Ghar Yojana, CPSU, and PM KUSUM. Through dedicated sales teams and tender monitoring, the company aims to capture opportunities, increase market share, and raise awareness of solar energy benefits.

Expanding Sales in International Markets

Emmvee focuses on growing its presence globally, especially in the United States. Leveraging integrated manufacturing capabilities, compliance readiness, and partnerships with distributors, the company targets distributed generation and residential sectors, setting up local sales teams to increase exports and capitalize on rising international solar demand.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Emmvee Photovoltaic Power Limited IPO

How can I apply for Emmvee Photovoltaic Power Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of Emmvee Photovoltaic IPO?

Emmvee Photovoltaic IPO is a book build issue of ₹2,900.00 crores. The issue is a combination of fresh issue of 9.88 crore shares aggregating to ₹2,143.86 crores and offer for sale of 3.48 crore shares aggregating to ₹756.14 crores.

What will the company use the IPO proceeds for?

Proceeds will primarily repay outstanding borrowings and fund general corporate purposes.

Who are the promoters of Emmvee Photovoltaic Power Limited?

Promoters include Manjunatha DonthiVenkatarathnaiah, Shubha Manjunatha Donthi, Suhas Donthi Manjunatha, and Sumanth Manjunatha Donthi.

Which stock exchanges will list the IPO?

The equity shares are proposed to be listed on NSE and BSE mainboards.

What were the financial highlights in FY March 2025?

Revenue was ₹2,360.33 crore, Profit After Tax ₹369.01 crore, and EBITDA ₹721.94 crore.