- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Epack Prefab Technologies IPO

₹14,162/73 shares

Minimum Investment

IPO Details

24 Sep 25

26 Sep 25

₹14,162

73

₹194 to ₹204

NSE, BSE

₹504 Cr

01 Oct 25

Epack Prefab Technologies IPO Timeline

Bidding Start

24 Sep 25

Bidding Ends

26 Sep 25

Allotment Finalisation

29 Sep 25

Refund Initiation

30 Sep 25

Demat Transfer

30 Sep 25

Listing

01 Oct 25

Epack Prefab Technologies Limited

Epack Prefab Technologies Limited, founded in 1999 in Greater Noida, holds ISO 9001:2015 and ISO 14001:2015 certifications. The company specialises in engineering, fabrication, and project management, delivering comprehensive pre-engineered building solutions across multiple industries. Alongside pre-engineered steel structures, its advanced manufacturing facilities produce cold roll-formed sections in intricate profiles. These serve diverse sectors, including airport terminals, logistics, construction, automobiles, railways, material handling, power generation, hospitals, and schools. Epack Prefab remains committed to innovation and excellence in the pre-engineered building industry.

Epack Prefab Technologies Limited IPO Overview

Epack Prefab Technologies IPO is a book-built issue worth ₹504.00 crores, comprising a fresh issue of 1.47 crore shares aggregating to ₹300.00 crores and an offer for sale of 1.00 crore shares aggregating to ₹204.00 crores. The IPO opens for subscription on September 24, 2025, and closes on September 26, 2025, with the allotment expected to be finalized by September 29, 2025. The shares are set to list on BSE and NSE, with a tentative listing date of October 1, 2025.

The IPO price band is fixed between ₹194.00 and ₹204.00 per share, with a lot size of 73 shares. For retail investors, the minimum investment required is ₹14,892 based on the upper price band. For small non-institutional investors (sNII), the lot size is 14 lots (1,022 shares), amounting to ₹2,08,488, while for big non-institutional investors (bNII), it is 68 lots (4,964 shares), amounting to ₹10,12,656. Monarch Networth Capital Ltd. is appointed as the book-running lead manager, and Kfin Technologies Ltd. serves as the registrar for the issue. Prior to the IPO, the company’s total shareholding stands at 8,82,51,792 shares. The promoters of Epack Prefab Technologies are Sanjay Singhania, Ajay DD Singhania, Bajrang Bothra, Laxmi Pat Bothra, and Nikhil Bothra.

Epack Prefab Technologies Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 1,47,05,882 shares (aggregating up to ₹300.00 Cr)

Offer for Sale (OFS): 1,00,00,000 shares of ₹2 (aggregating up to ₹204.00 Cr) |

| IPO Dates | 24 September 2025 to 26 September 2025 |

| Price Bands | ₹194 to ₹204 per share |

| Lot Size | 73 shares |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 8,82,51,792 shares |

| Shareholding post -issue | 10,04,51,997 shares |

Epack Prefab Technologies IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 73 | ₹14,892 |

| Retail (Max) | 13 | 949 | ₹1,93,596 |

| S-HNI (Min) | 14 | 1,022 | ₹2,08,488 |

| S-HNI (Max) | 67 | 4,891 | ₹9,97,764 |

| B-HNI (Min) | 68 | 4,964 | ₹10,12,656 |

Epack Prefab Technologies Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Epack Prefab Technologies Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 5.54 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 29.12% |

| Net Asset Value (NAV) | 21.80 |

| Return on Equity | 15.14% |

| Return on Capital Employed (ROCE) | 13.46% |

| EBITDA Margin | 10.35% |

| PAT Margin | 5.13% |

| Debt to Equity Ratio | 0.69 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Financing the capital expenditure requirements for setting up new manufacturing facility at Ghiloth Industrial Area, Shahjahanpur, Alwar in Rajasthan for manufacturing of continuous Sandwich Insulated Panels and pre-engineeredsteel building | 1016.18 |

| Financing the capital expenditure towards expansion of existing manufacturing facility at Mambattu (Unit4) in Andhra Pradesh for increasing the pre-engineeredsteel building capacity | 580.96 |

| Repayment and/or pre-payment, in full or part, of certain borrowings availed by ourCompany | 700 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

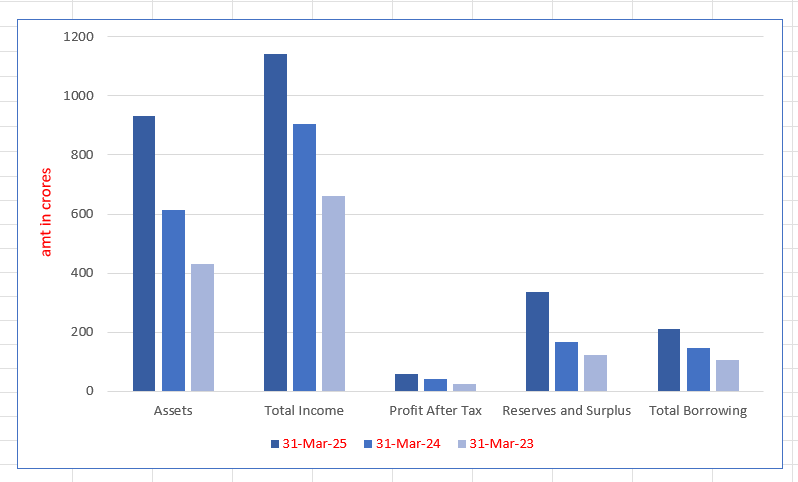

Epack Prefab Technologies Limited Financials (in crore)

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 931.02 | 613.72 | 432.05 |

| Total Income | 1,140.49 | 906.38 | 660.49 |

| Profit After Tax | 59.32 | 42.96 | 23.97 |

| Reserves and Surplus | 337.01 | 165.08 | 122.22 |

| Total Borrowing | 210.23 | 145.31 | 105.93 |

Financial Status of Epack Prefab Technologies Limited

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Epack Prefab Technologies Limited

Epack Prefab Technologies Limited IPO Strengths

- Strong and Diverse Market Presence in the Pre-Engineered Steel Buildings Industry

Epack Prefab Technologies Limited ranks among India’s top three PEB companies, achieving a 55.48% CAGR in its Prefab Business. With a diverse portfolio, nationwide presence, and record-breaking project execution, it is well-positioned to benefit from India’s growing prefabricated construction sector, driven by sustainability, efficiency, and technological advancements.

- Strategic Manufacturing Network with Strong Design and Execution Capabilities

Epack Prefab Technologies Limited operates four strategically located manufacturing facilities across India, enhancing cost efficiency and timely delivery. With dedicated project execution teams, in-house design centers, and advanced software integration, the company ensures precise, custom-engineered solutions. Its nationwide sales presence and export potential strengthen market reach and competitiveness.

- Strong Customer Relationships Across Industries

The company has built enduring relationships with customers across various industries, focusing on quality, cost efficiency, and timely execution. Serving over 1,200 customers in its Pre-Fab Business, it continues expanding its market presence, leveraging strong client partnerships for sustained growth in Indian and global markets.

- Strong Financial Performance and Order Book

The company achieved strong financial growth, driven by operational efficiency, market expansion, and economies of scale. It ranks among the fastest-growingPre-Fab businesses. A solid balance sheet supports strategic initiatives, ensuring financial stability, growth opportunities, and enhanced access to performance guarantees crucial for sustaining business operations.

- Experienced Leadership and Skilled Workforce Driving Growth

Experienced promoters and a skilled management team drive our growth. With deep industry expertise, they’ve built successful businesses, including EPACK Durable and EPack Petrochem. Our leadership, supported by 789 employees and 1,508 labourers, ensures strategic execution, market expansion, and talent development for sustained success.

More About Epack Prefab Technologies Limited

Established in 1999, Epack Prefab Technologies Limited has over 25 years of industry expertise. The company operates in two key verticals. Its Pre-Fab Business offers turnkey solutions for designing, manufacturing, installing, and erecting pre-engineered steel buildings and prefabricated structures. Meanwhile, its EPS Packaging Business focuses on producing expanded polystyrene (EPS) sheets and blocks, serving industries like construction, packaging, and consumer goods.

Strong Financial Growth

- Demonstrates rapid revenue growth, achieving a CAGR of 41.79% between FY22 and FY24.

- The Pre-Fab Business has experienced a CAGR of 55.48% during the same period.\

- Holds the third-largest production capacity in the pre-engineered steel building industry.

- Commands an 8% market share in the EPS Packaging Business.

Pre-Fab Business

- Offers a comprehensive range of solutions, including pre-engineered steel buildings, modular structures, LGSF, and Sandwich Insulated Panels.

- Specializes in turnkey projects, covering design, engineering, manufacturing, transportation, installation, and erection.

- Manufacturing capacity:

- 133,924 MTPA for pre-engineered buildings.

- 510,000 SQM for Sandwich Insulated Panels.

- Manufacturing facilities strategically located in:

- Greater Noida (Uttar Pradesh)

- Ghiloth (Rajasthan)

- Mambattu (Andhra Pradesh)

- Design centers based in:

- Noida (Uttar Pradesh)

- Hyderabad (Telangana)

- Vishakhapatnam (Andhra Pradesh)

- Focuses on process innovation, cost efficiency, and advanced technology adoption.

EPS Packaging Business

- Specializes in EPS Shape Molded and Block Molded products.

- Product portfolio includes:

- EPS Sheets

- Packaging boxes for electronic goods

- Hand-molded packaging solutions

- Manufacturing capacity: 8,400 MTPA (as of December 31, 2024).

- EPS products are valued for their lightweight, insulation properties, and impact resistance, catering to various industries.

- Holds an 8% market share in India’s EPS packaging segment (FY24).

Branding and Industry Recognition

- Pre-Fab Business solutions are marketed under the ‘EPACK PREFAB’ brand.

- EPS Packaging products are sold under the ‘EPACK PACKAGING’ brand.

- Awards and Certifications:

- Golden Book of World Records: Recognized for the fastest erection of a pre-engineered factory building in Mambattu, Andhra Pradesh.

- ISO 9001:2015 and ISO 14001:2015 certified.

Leadership and Workforce

- Led by experienced promoters with extensive industry expertise.

- Supported by a management team of qualified professionals specializing in construction, packaging, and engineering.

- Maintains a strong track record of expansion and consistent business growth.

Industry Outlook

The pre-engineered buildings (PEB) industry in India is poised for significant growth, driven by rapid urbanization, industrial expansion, and the need for cost-effective, time-efficient construction solutions.

Market Growth and Projections

- Pre-Engineered Buildings: The Indian PEB market was valued at approximately USD 0.468 billion in 2023 and is projected to reach USD 0.88 billion by 2032, growing at a compound annual growth rate (CAGR) of 7.40%.

- Prefabricated Buildings: The broader prefabricated buildings market in India is expected to grow from USD 15.07 billion in 2025 to USD 23.13 billion by 2030, at a CAGR of 8.95%.

Key Growth Drivers

- Urbanization and Infrastructure Development: Rapid urban growth necessitates efficient construction methods, with PEBs offering reduced construction times and costs.

- Industrial Expansion: Sectors such as logistics, automotive, and power generation are increasingly adopting PEBs for their structural needs.

- Steel Demand: India’s steel demand is projected to grow by 8-9% in 2025, driven by steel-intensive construction in housing and infrastructure.

Challenges

- Import Competition: The influx of cheaper steel imports, particularly from China, poses challenges to domestic steel producers, potentially impacting raw material availability and pricing for PEB manufacturers.

How Will Epack Prefab Technologies Limited Benefit

- Market Expansion

EpackPrefab’s strong position in the pre-engineered buildings (PEB) sector aligns with India’s growing market, expected to reach USD 0.88 billion by 2032. Its turnkey solutions enable it to capitalize on increasing infrastructure and industrial demand.

- Rising Infrastructure Investments

With rapid urbanization driving PEB adoption, EpackPrefab’s comprehensive design-to-installation capabilities position it to secure large-scale projects across logistics, power, healthcare, and education, ensuring sustained revenue growth in a booming construction market.

- Steel Demand Surge

India’s projected 8-9% steel demand growth enhances opportunities for EpackPrefab’s pre-engineered steel structures. Its extensive manufacturing capacity ensures cost-effective production, meeting the rising demand for steel-intensive infrastructure and industrial projects.

- Competitive Manufacturing Edge

Operating three strategically located manufacturing facilities, Epack Prefab optimizeslogistics and cost efficiency. Its large-scale production capacity for PEBs and Sandwich Insulated Panels strengthens its competitive advantage in a growing prefabricated construction industry.

- Industry Recognition and Expertise

With 25 years of expertise, ISO certifications, and record-setting project execution, Epack Prefab enjoys strong industry credibility. Its brand recognition and advanced technological approach drive client trust and long-term business expansion.

Peer Group Comparison

| Name of Company | Face Value

(₹) |

Revenue

(₹ million) |

Basic EPS (₹) | P/E | RoNW

(%) |

NAV

(₹) |

| Epack Prefab Technologies Limited | 2.00 | 9,049.02 | 5.54 | NA | 29.12% | 21.80 |

| Peer Group | ||||||

| Pennar Industries Limited | 5.00 | 31,305.70 | 7.29 | 24.49 | 11.89% | 64.95 |

| Everest Industries Limited | 10.00 | 15,754.52 | 11.42 | 60.23 | 3.06% | 378.37 |

| Interarch Buildings Limited | 10.00 | 12,933.00 | 58.68 | 28.04 | 20.45% | 308.43 |

| Beardsell Limited | 2.00 | 2,449.50 | 2.10 | 18.71 | 12.68% | 17.99* |

Key Insights

- Face Value: Epack Prefab Technologies Limited has a face value of ₹2.00 per share, similar to Beardsell Limited, while other industry peers have higher face values, ranging from ₹5.00 to ₹10.00. A lower face value may indicate affordability and potential for better liquidity in the stock market.

- Revenue: With revenue of ₹9,049.02 million, Epack Prefab Technologies Limited lags behind Pennar Industries (₹31,305.70 million) and Everest Industries (₹15,754.52 million). However, it outperforms Beardsell Limited, which reported revenue of ₹2,449.50 million, showcasing steady market presence.

- Basic EPS (Earnings Per Share): Epack Prefab Technologies Limited reports a Basic EPS of ₹5.54, lower than Everest Industries (₹11.42) and Interarch Buildings (₹58.68). However, it surpasses Beardsell Limited (₹2.10), indicating better profitability per share compared to smaller peers.

- Price-to-Earnings Ratio (P/E): While the P/E ratio for Epack Prefab Technologies is unavailable, its peers show a range from 18.71 (Beardsell Limited) to 60.23 (Everest Industries). A lower P/E suggests undervaluation, while a higher P/E reflects strong investor expectations for future earnings.

- Return on Net Worth (RoNW): Epack Prefab Technologies has an impressive RoNW of 29.12%, the highest among peers, outperforming Interarch Buildings (20.45%) and Pennar Industries (11.89%). This indicates superior profitability and efficient utilization of shareholder funds.

- Net Asset Value (NAV): With a NAV of ₹21.80, Epack Prefab Technologies is positioned between Beardsell Limited (₹17.99) and Pennar Industries (₹64.95). However, it trails behind Everest Industries (₹378.37) and Interarch Buildings (₹308.43), reflecting differences in asset strength and valuation.

Key Strategies for Epack Prefab Technologies Limited

- Expansion to Meet Growing Demand

Epack Prefab Technologies Limited is expanding manufacturing in Rajasthan and Andhra Pradesh, adding capacity to capture market share. This growth aligns with rising demand for pre-engineered steel buildings, driven by construction investments, government policies, and sustainable building solutions.

- Expanding Global and Domestic Presence

Epack Prefab Technologies Limited is strengthening its sales and marketing footprint across India while exploring international markets like Bhutan, Oman, Nepal, and Bangladesh. With growing demand, strategic hiring, and global exhibitions, the company aims to expand its pre-engineered steel building solutions worldwide.

- Strengthening Customer Relationships and Expanding Market Share

Epack Prefab Technologies Limited aims to enhance customer retention by offering tailored solutions, expanding its sales and business development teams, and improving after-sales support. By leveraging brand credibility and strategic outreach, the company seeks to drive repeat business and market penetration.

- Strengthening Technology Infrastructure and Design Capabilities

Epack Prefab invests in advanced design technologies, automation, and AI to enhance efficiency, minimize errors, and streamline workflows. With a skilled team and integrated systems, the company drives innovation, improves customer satisfaction, and strengthens its competitive edge in pre-engineered steel buildings.

- Commitment to Sustainable Pre-Engineered Steel Buildings

Epack Prefab focuses on eco-friendly pre-engineered steel buildings, reducing material waste, carbon footprint, and costs. With recyclable materials, faster construction, and green certifications, the company aligns with sustainability goals while enhancing efficiency, quality, and adaptability in modern construction projects.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On EPack Prefab Technologies IPO

What is the size of the EPack Prefab Technologies IPO?

The IPO includes a fresh issue of ₹300 crore and an offer for sale ₹204 crore

When is the EPack Prefab Technologies IPO expected to open?

The IPO is will openon 24 September 205 and close on 26 September 2025

What is the face value of EPack Prefab Technologies' shares?

The face value of each share is ₹2.

Who are the merchant bankers for this IPO?

The IPO is managed by Monarch Networth Capital Limited and Motilal Oswal Investment Advisors Limited.

How will the funds raised be utilized?

Proceeds will finance capital expenditures for new manufacturing sites and expansion of existing facilities