- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

ESDS Software Solution IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

ESDS Software Solution IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

ESDS Software Solution Limited

ESDS Software Solution Limited is an AI-enabled cloud and Data Centre services provider in India, delivering integrated solutions across cloud infrastructure, managed services, and software platforms. It offers Infrastructure as a Service (IaaS), Managed Services, and Software as a Service (SaaS) to help organizations efficiently manage and scale their IT infrastructure. Operating four Tier III-certified Data Centres in Nashik, Navi Mumbai, Bengaluru, and Mohali, ESDS supports diverse sectors through continuous infrastructure management, cybersecurity, disaster recovery, and cloud-hosted software solutions.

ESDS Software Solution Limited IPO Overview

The ESDS Software IPO is structured as a bookbuilding issue and consists entirely of a fresh issue of shares. The official IPO dates and price band have not yet been announced, and the allotment date is also pending confirmation. Dam Capital Advisors Ltd (formerly IDFC Securities Ltd) and Systematix Corporate Services Limited are the book-running lead managers for the IPO, while Link Intime India Private Ltd has been appointed as the registrar. The IPO will be listed on both the BSE and NSE. As per the Draft Red Herring Prospectus (DRHP), the face value of each share is ₹1, and the fresh issue will aggregate up to ₹600 crore. The company had 10,04,27,753 shares prior to the issue. The IPO details, including lot size, total issue size, and final listing date, will be available upon further announcements. The IPO was filed with SEBI on April 4, 2025. The promoters of ESDS Software include Piyush Prakashchandra Somani, Komal Piyush Somani, and the P.O. Somani Family Trust. The pre-issue shareholding stands at 46.06%, with the post-issue shareholding to be determined after calculating equity dilution.

ESDS Software Solution Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹600 crores

Offer for Sale (OFS): NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 10,04,27,753 shares |

| Shareholding post -issue | TBA |

ESDS Software Solution Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

ESDS Software Solution Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

ESDS Software Solution Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 1.35 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 6.60% |

| Net Asset Value (NAV) | 22.21 |

| Return on Equity | 6.23% |

| Return on Capital Employed (ROCE) | 14.53% |

| EBITDA Margin | 35.56% |

| PAT Margin | 4.75% |

| Debt to Equity Ratio | 0.65 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Purchase and installation of cloud computing and other equipment and other infrastructure for the data centres | 4807.29 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

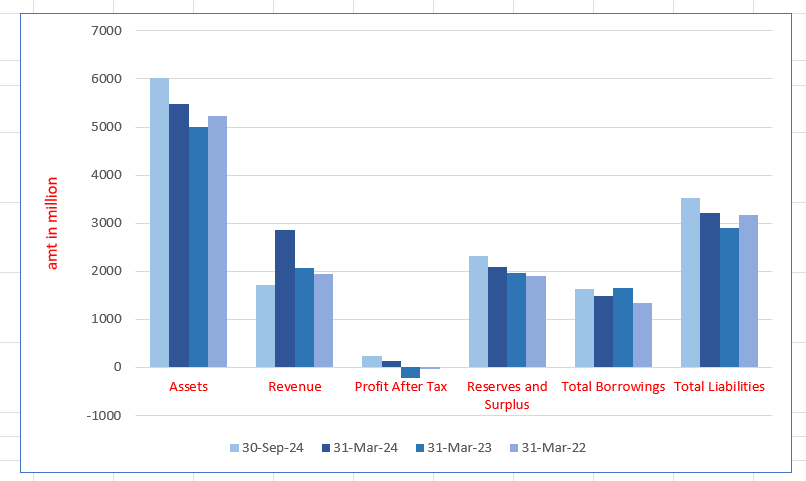

ESDS Software Solution Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 6017.76 | 5477.09 | 5006.96 | 5225.58 |

| Revenue | 1721.50 | 2865.18 | 2075.66 | 1953.58 |

| Profit After Tax | 239.34 | 136.10 | (224.60) | (26.63) |

| Reserves and Surplus | 2314.78 | 2079.75 | 1963.07 | 1897.03 |

| Total Borrowings | 1637.14 | 1490.44 | 1648.29 | 1334.80 |

| Total Liabilities | 3522.63 | 3212 | 2905.42 | 3172.85 |

Financial Status of ESDS Software Solution Limited

SWOT Analysis of ESDS Software Solution IPO

Strength and Opportunities

- Offers integrated cloud, data center, and managed services, providing end-to-end IT solutions for clients.

- Operates four Tier III-certified data centers in India, ensuring high availability and reliability for hosted services.

- Serves a diverse clientele, including public sector units, BFSI, and smart city projects, reducing dependency on a single sector.

- Provides AI-driven solutions and proprietary platforms like eNlight Cloud, enhancing service differentiation.

- Demonstrates strong financial growth, with a 17% CAGR in revenue over recent fiscal years.

- Engages in strategic collaborations with government initiatives, positioning itself as a partner in national digital transformation efforts.

- Offers flexible billing models and scalable solutions, catering to the varied needs of small to large enterprises.

- Maintains a strong focus on cybersecurity, with extensive monitoring and threat mitigation services.

- Leverages a customer-centric approach, offering personalized solutions and support, leading to high client satisfaction.

Risks and Threats

- Faces intense competition from global cloud service providers, potentially impacting market share and pricing strategies.

- Vulnerable to cybersecurity threats, which could compromise client data and affect reputation.

- Rapid technological changes require continuous innovation and investment to stay competitive.

- Regulatory changes in data protection and cloud services could impact operations and compliance requirements.

- Dependence on key clients for a significant portion of revenue may pose risks if contracts are lost or not renewed.

- Potential service disruptions due to infrastructure failures can affect client trust and satisfaction.

- High capital expenditure requirements for data center expansion and technology upgrades can strain financial resources.

- Talent acquisition and retention in specialized areas like AI and cybersecurity remain challenging in a competitive job market.

- Economic fluctuations and budget constraints in client organizations can lead to reduced IT spending, affecting revenue.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

ESDS Software Solution Limited IPO Strengths

A Leading Cloud and Cybersecurity Innovator in India

ESDS Software Solution Limited is a prominent Indian provider of end-to-end cloud, managed services, Data Centre infrastructure, and software solutions. Among the first to adopt cloud technology in India, it launched its first Data Centre in Nashik in 2010 and introduced eNlight Cloud in 2011. Offering integrated IaaS, SaaS, and SECaaS, ESDS serves diverse sectors—BFSI, government, and enterprise—ensuring digital continuity, compliance, and cost efficiency.

Strong Long-Term Relationships with Trusted Clients

ESDS Software Solution Limited has cultivated enduring partnerships with over 100 banks and leading organisations such as STPI and Larsen & Toubro. Its diversified offerings enable service across multiple industries, driving strong customer retention. The share of customers with relationships exceeding three and five years rose from 30.80% to 49.28% and 9.79% to 23.25%, respectively, between Fiscal 2022 and Fiscal 2024.

Strong Government Partnerships and Policy Advocacy

ESDS Software Solution Limited actively supports India’s data localisation and digital security initiatives through strong collaborations with government bodies. As an empanelled MeitY STQC cloud provider and STPI partner, it delivers compliant, scalable solutions. Its involvement in policy advocacy via the Cloud Computing Innovation Council further reinforces its role in shaping data governance, promoting transparency, and enabling secure public sector digital transformation.

Trusted Government Empanelment and Pioneering AI-Driven Cloud Technology

ESDS Software Solution Limited, empanelled by MeitY STQC, is authorised to offer public, private, and government community cloud solutions that meet rigorous national security standards. Through policy advocacy and patented AI-powered eNlight cloud with vertical auto-scaling, ESDS delivers optimised, scalable, and efficient cloud services. Its asset-light model enables rapid deployment, empowering India’s secure and innovative digital transformation.

Transparent and Flexible Customized Billing Models

ESDS Software Solution Limited offers a versatile billing system allowing customers to pay based on transactions, branches, users, custom consumption metrics, or business KPIs. Their patented eNlight vertical autoscaling enables a unique pay-per-consumption model, charging only for resources used. This flexible approach democratizes cloud access, supports cost optimisation, enhances operational efficiency, and drives strong customer retention and scalable growth.

Strength and Experience of Leadership and Management

ESDS Software Solution Limited credits its growth to the expertise of its Directors, Key Managerial Personnel, and Senior Management. Led by Chairman and Managing Director Piyush Prakashchandra Somani, with over 19 years in IT, the company benefits from strong vision and leadership. Its diverse team of 1,027 skilled professionals drives innovation and delivers secure, scalable cloud and IT solutions.

More About ESDS Software Solution Limited

ESDS Software Solution Limited is a prominent end-to-end provider of AI-enabled cloud infrastructure, managed services, Data Centre solutions, and software services in India. It stands as one of only two companies in the country delivering a full spectrum of these offerings, with the largest revenue from operations in Fiscal 2024 (Nexdigm Report).

Comprehensive Cloud and Infrastructure Solutions

ESDS offers a robust platform combining:

- Infrastructure as a Service (IaaS): Including colocation, Data Centre services, cloud computing, and cloud services.

- Managed Services: 24/7 IT support, backup, recovery, migration, security operations, and database administration.

- Software as a Service (SaaS): Software products delivered on subscription basis, along with a digital marketplace called “SPOCHUB” hosting both in-house and third-party applications.

These services focus on cost reduction while ensuring security, flexibility, scalability, and reliability for customers.

Pioneering Community Cloud Services

Among the first in India, ESDS pioneered community cloud services—multi-tenant cloud infrastructure designed for organisations with similar compliance, security, and regulatory needs. This includes verticals such as BFSI (Banking, Financial Services, and Insurance), Government, and Enterprises.

Infrastructure Footprint

ESDS operates four Tier 3 certified Data Centres located in Nashik, Navi Mumbai, Bengaluru, and Mohali, covering over 60,000 sq. feet. These are interconnected via a high-speed fibre-optic backbone ensuring secure, reliable data exchange with 99.95% guaranteed uptime and disaster recovery support.

Market and Customer Base

- The Indian cloud market is growing rapidly, driven by initiatives like Digital India, with an expected CAGR of 15.8% through 2030 (Nexdigm Report).

- ESDS caters to diverse sectors: BFSI, Government, and Enterprises across healthcare, education, energy, manufacturing, and more.

- As of September 2024, ESDS served approximately 1,398 customers.

Innovation and Patents

The company’s patented vertical autoscaling cloud technology, “eNlight Cloud,” optimises server usage and power consumption while maintaining high security and performance.

Industry Outlook

Market Growth and Projections

- Cloud Computing: The Indian cloud computing market is projected to grow from USD 21.37 billion in 2025 to USD 52.22 billion by 2030, reflecting a CAGR of 19.57%.

- Data Centres: India’s data centre capacity is expected to expand from 3.31 thousand MW in 2025 to 6.69 thousand MW by 2030, at a CAGR of 15.11%.

Growth Drivers

- Digital India Initiatives: Government programs like Digital India, Smart Cities, and Atmanirbhar Bharat are accelerating cloud adoption and data centre development.

- AI and 5G Integration: The rise of AI and the rollout of 5G are increasing demand for scalable and secure cloud infrastructure.

- E-commerce and Digital Services: The rapid growth of e-commerce and digital services is driving the need for robust data storage and processing capabilities .

Sector Dynamics

- Investment Surge: Major players like Amazon and Microsoft are investing heavily in India’s cloud infrastructure. Amazon plans to invest $12.7 billion by 2030, while Microsoft is committing $3 billion to expand its Azure and AI capabilities.

- Regional Hubs: Cities like Chennai, Navi Mumbai, and Hyderabad are emerging as key data centre hubs due to favorable policies and infrastructure development.

- Sustainability Focus: There is a growing emphasis on green data centres, with operators investing in renewable energy and energy-efficient technologies.

Strategic Implications

- Infrastructure Demand: The surge in cloud adoption and AI integration is driving the need for advanced data centre infrastructure.

- Policy Support: Government incentives and initiatives are creating a conducive environment for industry growth.

- Technological Advancements: Emphasis on AI, 5G, and sustainability is shaping the future of the cloud and data centre sector.

How Will ESDS Software Solution Limited Benefit

- ESDS Software Solution Limited is well-positioned to benefit from the rapid growth of India’s cloud computing market, projected to reach USD 52.22 billion by 2030, by leveraging its comprehensive AI-enabled cloud infrastructure and managed services.

- Its four Tier 3 certified Data Centres across key cities align with the expanding data centre capacity in India, ensuring reliable, secure, and scalable solutions amid rising demand.

- Government initiatives like Digital India and increasing AI and 5G adoption create strong market drivers that ESDS can capitalize on through its pioneering community cloud services tailored for BFSI, Government, and enterprise sectors.

- ESDS’s patented “eNlight Cloud” vertical autoscaling technology enhances efficiency and sustainability, aligning with the sector’s emphasis on energy-efficient infrastructure.

- The company’s robust SaaS offerings and digital marketplace “SPOCHUB” support diverse customer needs, contributing to its large and growing client base of nearly 1,400 customers.

- Substantial investments by global tech giants validate the market potential, presenting partnership and growth opportunities for ESDS in India’s evolving cloud ecosystem.

Peer Group Comparison

| Name of Company | Revenue (₹ million) | Face Value (₹) | EPS (₹) | NAV (₹) | P/E (₹) | P/E (₹) | RoNW (%) |

| ESDS Software Solution Limited | 2,865.18 | 1.00 | 1.35 | 22.21 | [●] | [●] | 6.60 |

| Peer Groups | |||||||

| E2E Networks Limited (2) | 944.64 | 10.00 | 15.11 | 44.77 | 152.16 | 156.40 | 33.74 |

Key Strategies for ESDS Software Solution Limited

Infrastructure Expansion and Optimization

ESDS Software Solution Limited invests heavily in scaling data centre resources and upgrading technology to enhance performance, security, and cost-efficiency. Focused on cloud and GPU nodes, the company replaces end-of-life systems and adopts next-generation infrastructure for improved resource utilization and operational growth.

AI/ML-Driven Automation and Service Enhancement

ESDS leverages AI/ML to simplify customer onboarding and automate provisioning, while enhancing industry-specific cloud solutions. The company’s AI-driven automation improves operational efficiency, supports self-service, and evolves customer experiences, enabling intelligent, scalable cloud services tailored to diverse enterprise needs.

Government and Business Collaboration

ESDS expands its public sector presence through partnerships with government agencies and third-party vendors. Collaborations include core banking hosting, smart city projects, and digital service platforms, broadening service reach while integrating advanced technologies like AI, RPA, and IoT to deliver comprehensive digital transformation solutions.

Brand Leadership Strengthening

ESDS promotes its expertise via thought leadership events, advocacy participation, and targeted marketing campaigns. The company focuses on AI and cloud innovation, driving awareness and engagement to maintain its leadership position and reinforce trust among enterprises and government stakeholders.

Renewable Energy Transition for Sustainability

Committed to environmental responsibility, ESDS plans a full transition to renewable energy within four years. Already deploying solar installations, the company aims to meet rising data centre demands sustainably, benefiting from green energy policies while reducing carbon emissions and operational costs.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

ESDS Software Solution Limited IPO

How can I apply for ESDS Software Solution Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the ESDS Software IPO?

The IPO aims to raise ₹600 crore through a fresh issue of equity shares.

What is the face value of each share in the IPO?

Each equity share in the IPO has a face value of ₹1.

When will the ESDS Software IPO open for subscription?

The IPO dates are yet to be announced; investors should await official updates.

On which stock exchanges will the ESDS Software IPO be listed?

The shares will be listed on both the BSE and NSE stock exchanges.

What is the minimum investment amount for retail investors?

The minimum investment amount for retail investors is expected to be around ₹15,000.

What is the objective of the ESDS Software IPO?

Proceeds will fund cloud infrastructure expansion and data center equipment, enhancing service capabilities