- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

- What is an ETF and Why Should Women Invest?

- Categories of ETFs You Can Invest In

- How to Start Investing in ETFs?

- Pros and Cons of ETF Investing for Women

- Common Misconceptions About ETFs and How to Overcome Them?

- Building a Simple ETF Portfolio for Long-Term Growth

- Conclusion: ETF Investing Made Easy for Women

- FAQs on ETF Investing for Women

- What is an ETF and Why Should Women Invest?

- Categories of ETFs You Can Invest In

- How to Start Investing in ETFs?

- Pros and Cons of ETF Investing for Women

- Common Misconceptions About ETFs and How to Overcome Them?

- Building a Simple ETF Portfolio for Long-Term Growth

- Conclusion: ETF Investing Made Easy for Women

- FAQs on ETF Investing for Women

ETF Investing for Women: Simple Steps to Get Started

By HDFC SKY | Published at: May 26, 2025 02:17 AM IST

The money market today is witnessing many transformations. Not only have many new financial products been introduced, but more and more are now focusing on the most discerning customers: working women.

For women who manage so much in their lives, ETFS can be among the ideal investment options for women! Here’s an ETF guide where we discuss the ins and outs of women investing in ETFs. Read on.

What is an ETF and Why Should Women Invest?

ETFs are exchange-traded funds. Simply put, it is like a basket of different investments, such as stocks or bonds, that you can buy and sell on the stock market, just like a regular stock. ETFs help you invest in many things at once, making it safer and easier to grow your money over time.

It sounds similar to a mutual fund, right? Well, yes, it is. Just like mutual funds, ETFs pool a group of securities into a fund. However, unlike MFs, ETFs are traded on the stock exchange. Also, ETFs are more passive in nature; they mimic the performance of an index.

While ETFs can be a part of every financial portfolio, they can suit women investors who are looking for a simple, low-cost way to grow wealth over time. If you are new to investing, this is also ideal for you!

ETF investing for beginners is perfect as it spreads your money across many stocks or bonds, reducing risk. Also, ETFs are flexible, easy to buy and sell, and can fit different financial goals.

Categories of ETFs You Can Invest In

In our ETF investing guide, let us now get into the details. Listed below are the different categories of ETFs that you should know about:

| Categories of ETFs | Details |

| Equity ETF | Equity ETFS track various benchmark equity indices from a certain industry or sector, such as the Nifty Midcap 100 and the NSE Nifty 50. In some cases, equity ETFs also track international equity indices. Such ETFs are typically called passive investments. |

| Debt ETF | Debt ETFs provide exposure to various debt securities, such as corporate and government bonds. These ETFs are traded on stock exchanges like the NSE throughout the day, similar to stocks. Typically, they are passively managed, meaning they aim to track a specific debt index and are used to invest in fixed-income assets. |

| Gold ETF | As the name suggests, gold ETFs generally invest in gold bullion. Such an ETF is preferred as it allows you exposure to gold, but at the same time, you do not have to invest in physical gold. |

| ETFs with International Exposure | These types of ETFs mimic the returns of foreign stock indexes. When you invest in ETFs with international exposure, you can access foreign markets, increasing your growth potential. |

How to Start Investing in ETFs?

For beginners, investing in ETFs can seem tricky. However, if you keep a few things in mind, ETF investing can be quite simple. The first thing you need to focus on is choosing the right category of ETF. Each category comes with its own set of risks and rewards, so choose carefully.

You then need to focus on the trading volume. Higher trading volumes suggest stronger liquidity and tighter bid-ask spreads. On the other hand, ETFs with lower trading volumes often face weaker liquidity and wider bid-ask spreads, which can impact your trading costs.

Once you are certain about starting the journey, ETF investing for beginners can be taken to the next step. This is where the actual investing starts. You can buy/ sell ETFs through your demat trading account.

You can place your bid to buy the units at the market or limit prices. If your ETF investing aim is long-term wealth building, you can also hold the units in your Demat account.

Pros and Cons of ETF Investing for Women

Some of the pros of investing in ETFs for women:

- Diversification: Instead of picking many stocks or bonds, one ETF lets you invest in a whole basket at once. This spreads your investment risk easily, which is great if you’re starting or prefer a simpler approach.

- Lower Investment Costs: ETFs often have lower fees (called expense ratios) than many other investment funds. Lower costs mean more money stays invested and can grow over time.

- Clear View of Investments: Most ETFs regularly show exactly which investments (stocks, bonds, etc.) they hold. This transparency helps you understand where your money is invested.

- Simple to Buy and Sell: You can buy and sell ETFs easily through a brokerage account during stock market trading hours, just like buying a company share. This makes managing your investments straightforward.

Some of the cons of investing in ETFs for women:

- Trading Fees Can Add Up: While many brokers offer low or zero commission, you might still pay fees each time you buy or sell an ETF. Frequent trading can make these costs significant.

- Price Difference When Buying/Selling (Spread Costs): There’s usually a small difference between the price you can buy an ETF for and the price you can sell it for (called the bid-ask spread). This gap can be wider for ETFs that aren’t traded very often, acting like a hidden cost.

- Risk of Too Much Trading: Because ETFs are easy to buy and sell, some people might be tempted to trade too often based on short-term market news. This can lead to higher costs and potentially lower returns than long-term investing.

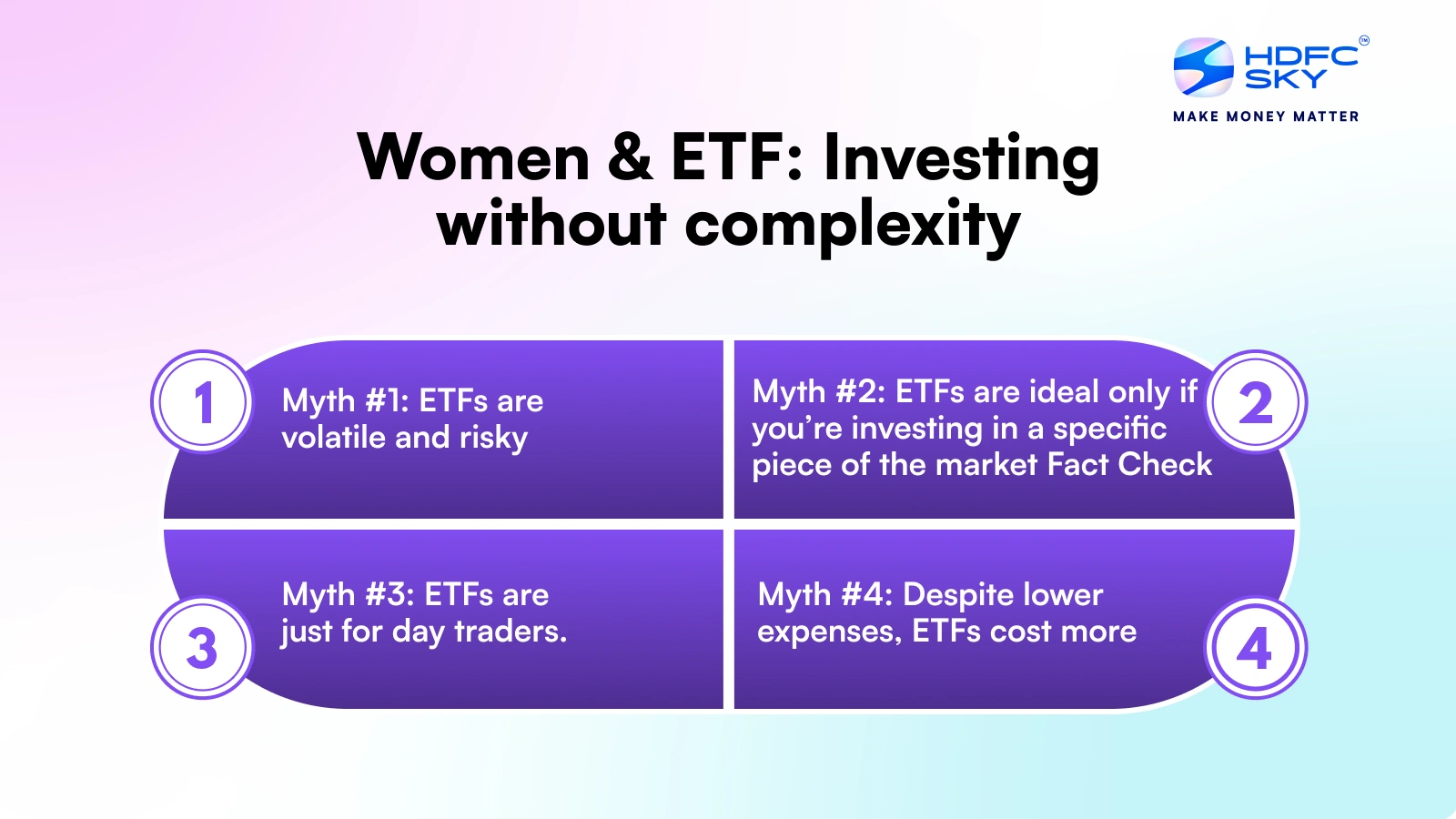

Common Misconceptions About ETFs and How to Overcome Them?

As compared to other investment products, ETFs are relatively new. Here are some common misconceptions about ETFs and facts that can help overcome them:

- Myth #1: ETFs are volatile and risky

- Fact Check: Aren’t all financial products risky? ETF prices are directly related to the value of its underlying securities. Simply put, when it comes to the market, the risk is driven by the asset you invest in, not necessarily the investment vehicle used.

- Myth #2: ETFs are ideal only if you’re investing in a specific piece of the market

- Fact Check: ETFs can be used for a much wider range of purposes. They invest in a pool of diversified assets. You need to find what best suits your needs.

- Myth #3: ETFs are just for day traders.

- Fact Check: Because ETFs offer trading flexibility, they are well-suited for short-term traders. However, they are equally suitable for long-term portfolios that aim to build a stronger portfolio cost-effectively.

- Myth #4: Despite lower expenses, ETFs cost more

- Fact Check: Thanks to digitisation and market competition, brokerage is much cheaper than it used to be. While trading too frequently can increase transaction costs, longer holdings can make booking costs negligible.

Building a Simple ETF Portfolio for Long-Term Growth

As an investor, there are certain things to know before investing in ETFs. Make sure you keep them in mind:

- Analyse your investment goals. Factor in things like the time horizon you wish to invest for, the ETF category that aligns with your goals, and the amount you can comfortably invest in a month/year without disturbing your budget.

- Take some time to choose an asset that combines bonds, equities, gold, etc.

- Once you are sure about the beginner ETFs to invest in, you can choose the ETF and follow the long-term plan.

- While ETFs are passive investments, make sure you keep tracking them regularly.

Conclusion: ETF Investing Made Easy for Women

ETFs are becoming popular among all kinds of investors. Women investors may find ETFs quite appealing, as these instruments can facilitate wealth creation. They also offer a clear view of investments, diversification, and the ease of buying and selling.

As with all other investment options, as women investing in ETFs, you should thoroughly research and understand ETFs and their pros and cons, and you can align them correctly in your portfolio.

Related Articles

FAQs on ETF Investing for Women

How can ETFs fit into your investment strategy?

ETFs are investment options that suit almost all kinds of investors. For short-term investors, ETFs offer flexibility and convenience, allowing them to buy/ sell anytime they want. Investors with a long-term horizon can also hold their ETFs for a longer duration.

Why invest in ETFs?

ETFs are becoming quite popular. Some of the reasons for their popularity are the lower cost of managing them, the removal of unsystematic risks that are specific to the investment option, and the diversification that can spread different market sectors and segments. Another reason that ETFs are a good investment option for women is that the invested units can be liquidated easily.

How to invest in an ETF?

ETF investing for beginners can be simple. You would need a demat account to buy or sell ETFs. As ETFs are listed on the stock exchange, you can trade them like equity shares. You can place a bid and choose to buy the units at the market price or the limit price. You also have the option of holding the units in your demat account.

What is an ETF, and how does it differ from mutual funds?

ETFs and mutual funds are investment options that offer diversification. Their main difference is in the way they are traded.

An ETF is a marketable security that tracks an index and is traded like stocks on exchanges. Mutual funds are purchased and sold at their net asset value (NAV). ETFs offer real-time pricing, lower expense ratios, and greater flexibility, but require a demat account.

How do dividends work with ETFs, and how are they paid to investors?

Companies whose stocks are held in the fund can pay dividends to their shareholders. The ETF issuers collect these dividends. The shareholders can receive the dividends in cash or reinvest them in other ETF shares.