- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Euro Pratik Sales IPO

₹14,100/60 shares

Minimum Investment

IPO Details

16 Sep 25

18 Sep 25

₹14,100

60

₹235 to ₹247

NSE, BSE

₹451.31 Cr

23 Sep 25

Euro Pratik Sales IPO Timeline

Bidding Start

16 Sep 25

Bidding Ends

18 Sep 25

Allotment Finalisation

19 Sep 25

Refund Initiation

22 Sep 25

Demat Transfer

22 Sep 25

Listing

23 Sep 25

Euro Pratik Sales Limited IPO

Euro Pratik Sales Limited is among India’s leading decorative wall panel brands, recognized as one of the largest organised players in the industry. The company pioneered the introduction of Decorative Wall Panel products such as Louvers, Chisel, and Auris in India while developing unique design templates for Decorative Wall Panels and Decorative Laminates, aligning with modern architectural and interior trends. With expertise in promoting products under the “Euro Pratik” and “Gloirio” brands, the company aims to expand internationally while strategically exploring growth opportunities.

Euro Pratik Sales Limited IPO Overview

Euro Pratik Sales IPO is a book-built issue worth ₹451.31 crore, entirely an offer for sale of 1.83 crore shares. The IPO opens on 16 September 2025 and closes on 18 September 2025, with allotment expected on 19 September 2025. It is scheduled to list on BSE and NSE on 23 September 2025. The price band is ₹235 to ₹247 per share, with a lot size of 60 shares. Retail investors need a minimum investment of ₹14,820, while sNII and bNII investments are ₹2,07,480 and ₹10,07,760, respectively. Axis Capital Ltd. is the lead manager, and MUFG Intime India Pvt. Ltd. is the registrar. Before the IPO, Euro Pratik’s total shareholding stands at 10,22,00,000 shares. The company’s promoters are Pratik Gunvantraj Singhvi, Jai Gunvantraj Singhvi, Pratik Gunwantraj Singhvi HUF, and Jai Gunwantraj Singhvi HUF.

Euro Pratik Sales Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: NA

Offer for Sale (OFS): ₹451.31 crore |

| IPO Dates | 16 September 2025 to 18 September 2025 |

| Price Bands | ₹235 to ₹247 per share |

| Lot Size | 60 Shares |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 10,22,00,000 shares |

| Shareholding post -issue | 10,22,00,000 shares |

Important Dates

| IPO Activity | Date |

| IPO Open Date | 16 September 2025 |

| IPO Close Date | 18 September 2025 |

| Basis of Allotment Date | 19 September 2025 |

| Refunds Initiation | 22 September 2025 |

| Credit of Shares to Demat | 22 September 2025 |

| IPO Listing Date | 23 September 2025 |

Euro Pratik Sales IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 60 | ₹14,820 |

| Retail (Max) | 13 | 780 | ₹1,92,660 |

| S-HNI (Min) | 14 | 840 | ₹2,07,480 |

| S-HNI (Max) | 67 | 4,020 | ₹9,92,940 |

| B-HNI (Min) | 68 | 4,080 | ₹10,07,760 |

Euro Pratik Sales Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Euro Pratik Sales Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 6.19 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 40.39% |

| Net Asset Value (NAV) | 785.34 |

| Return on Equity | 44.03% |

| Return on Capital Employed (ROCE) | 55.17% |

| EBITDA Margin | 40.15% |

| PAT Margin | 20.25% |

| Debt to Equity Ratio | – |

Objectives of the IPO Proceeds

The Promoter Selling Shareholder will be entitled to the entire proceeds of the Offer after deducting his portion of the Offer expenses and relevant taxes thereon. The Company will not receive any proceeds from the Offer

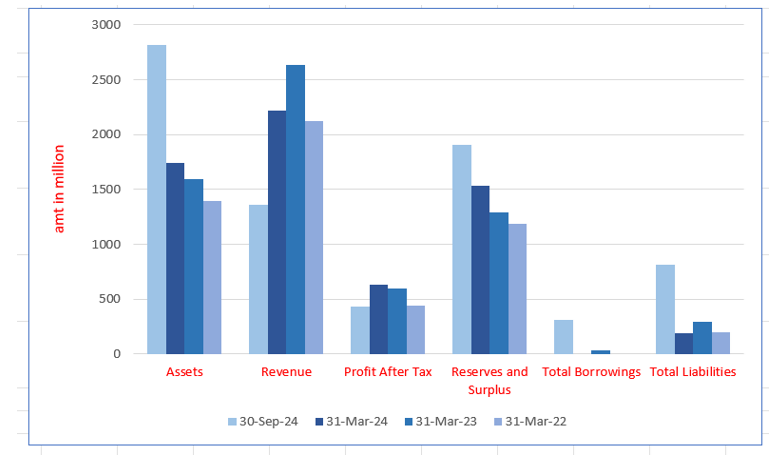

Euro Pratik Sales Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 2816.49 | 1744.92 | 1591.20 | 1394.57 |

| Revenue | 1361.42 | 2216.98 | 2635.84 | 2119.15 |

| Profit After Tax | 434.07 | 629.07 | 595.65 | 445.23 |

| Reserves and Surplus | 1905.89 | 1537.50 | 1295.12 | 1191.10 |

| Total Borrowings | 307.05 | – | 30.00 | – |

| Total Liabilities | 811.25 | 187.59 | 291.02 | 197.41 |

SWOT Analysis of Euro Pratik Sales IPO

Strength and Opportunities

- Strong presence in over 130 cities across India, ensuring a vast distribution network.

- Expansion into international markets, including Nepal and Dubai, highlighting global growth potential.

- Diverse product portfolio with over 3,000 SKUs across 30 categories, catering to various consumer needs.

- Asset-light business model with contract manufacturing in South Korea, China, and the USA, increasing efficiency.

- Strong financial growth with rising revenue and net worth in recent years.

- Brand endorsements by Hrithik Roshan and Kareena Kapoor Khan enhance market visibility.

- Plans for a ₹730 crore IPO to fund further growth and market expansion.

- Continuous innovation in design to align with market trends and customer demands.

- Strong marketing strategies targeting metros and tier-II/III cities, increasing reach.

Risks and Threats

- Reliance on third-party suppliers without long-term agreements, leading to supply chain vulnerabilities.

- Intense competition from organized retail chains, local retailers, and e-commerce platforms.

- Operates in a highly competitive market, requiring continuous innovation and marketing efforts.

- Fluctuations in raw material prices and foreign exchange rates impact procurement costs.

- Dependence on a few suppliers for raw materials could lead to disruptions.

- The IPO is structured as an Offer for Sale (OFS), raising concerns about capital for expansion.

- Rapid global expansion exposes the company to geopolitical and regulatory risks.

- The asset-light model may limit control over manufacturing quality and processes.

- Economic downturns or shifts in consumer spending habits could affect demand.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Euro Pratik Sales Limited IPO

Euro Pratik Sales Limited IPO Strengths

- Market Leader in Decorative Wall Panels

Euro Pratik Sales Limited is one of India’s largest organized decorative wall panel brands, with a 15.87% market share by revenue. In Fiscal 2023, it generated ₹1,742.89 million from decorative wall panels. Its market leadership is driven by innovation, strategic expansion, and strong brand positioning.

- Diverse Product Portfolio

With 30+ product categories and 3,000+ designs, Euro Pratik leads in decorative wall panels and laminates. Their exclusive first-to-market products, like Louvers and Chisel, cater to evolving consumer trends. They offer durable, eco-friendly, and innovative solutions that meet varied residential and commercial architectural and design needs.

- Innovative and Trend-Driven Approach in Decorative Wall Panels and Laminates

Euro Pratik Sales Limited stays ahead in Decorative Wall Panels and Laminates through continuous innovation, market analysis, and distributor engagement. With 104+ product catalogues launched in four years, a strong design strategy, and global insights, the company ensures competitive, trend-driven offerings that align with evolving consumer preferences and industry advancements.

- Asset-Light Business Model with Global Partnerships

Euro Pratik Sales Limited follows an asset-light business model, focusing on product design and development while outsourcing manufacturing to global contract partners, including Miga, South Korea. This strategy minimizes capital investment, enhances flexibility, ensures quality, reduces operational costs, and allows the company to focus on branding, merchandising, and market expansion.

- Pan-India Presence with a Strong Distribution Network

Euro Pratik Sales Limited has a well-established distribution network spanning 25 states and five union territories, ensuring strong market presence and operational efficiency. With 172 distributors, the company strategically expands its reach, enhances brand visibility, supports distributors, and fosters consumer engagement, driving seamless product availability across India.

- Experienced Promoters and Management Team

Euro Pratik Sales Limited is led by experienced promoters and a skilled management team with deep expertise in decorative wall panels and laminates. Their strategic leadership, industry knowledge, and operational excellence drive business growth, market expansion, and innovation, ensuring long-term success and a competitive edge in the industry.

- Proven Financial Performance and Strong Balance Sheet

Euro Pratik Sales Limited has demonstrated strong financial growth, with rising EBITDA, improved margins, and increasing profitability. With total equity of ₹2,005.24 million and low leverage, the company maintains financial stability. Its positive cash flows and strategic financial management position it well for sustainable growth and long-term success.

More About Euro Pratik Sales Limited

Euro Pratik Sales Limited operates in the decorative wall panel and laminate industry as a prominent seller and marketer. Recognized as one of India’s leading brands, the company holds a 15.87% market share in the organized Decorative Wall Panels sector, with a total revenue of ₹1,742.89 million from wall panel sales in Fiscal 2023 (Source: Technopak Report).

Product Innovation and Market Positioning

- Develops unique design templates aligned with modern architectural and interior trends.

- Recognized for innovative products like Louvres, Chisel, and Auris at the India Coverings Expo (2019-2022).

- Offers a wide product range, including 30+ categories and 3,000+ designs.

- Operates as a fast-fashion brand with 104 product catalogues introduced in the last four years.

Sustainable and High-Quality Products

- Provides eco-friendly alternatives to traditional materials like wallpaper, wood, and paint.

- Products are anti-bacterial, anti-fungal, and free from lead and mercury.

- Made from recycled and environmentally sustainable materials.

Extensive Distribution Network

- 172 distributors across 25 states and 5 union territories in India.

- Presence in 88 cities, including Metros, Mini-metros, Tier-I, Tier-II, and Tier-III cities.

- Warehouses spanning 143,774 sq. ft. in Bhiwandi, Maharashtra, near Nhava Sheva port.

- Exports to 6 countries, including Singapore, UAE, Australia, Bangladesh, Burkina Faso, and Nepal.

Brand Ambassadors

- Hrithik Roshan represents the Euro Pratik brand.

- Kareena Kapoor Khan endorses the Gloirio brand.

Asset-Light Business Model

- Manufacturing outsourced to 26 contract manufacturers in South Korea, China, and the USA.

- Designs are produced according to strict quality and specification standards.

Experienced Leadership

- Led by Pratik Gunvantraj Singhvi (Chairman & MD) with 19 years of experience.

- Jai Gunvantraj Singhvi (Executive Director & CFO) brings 13 years of expertise.

Recent Acquisitions for Expansion

- Vougue Decor – Acquired by Gloirio for wall cladding and decorative panels.

- Euro Pratik Laminate LLP – Specializing in wall panels, louvers, and designer laminates.

- Millennium Decor – Focused on interior decorative panels.

- EuroPratik Intex LLP – Acquired a 53% stake in exterior wall panels.

- Euro Pratik USA, LLC – 50.10% controlling interest for US market expansion.

Euro Pratik Sales Limited continues to scale operations through strategic acquisitions, innovative product designs, and an expanding global presence, solidifying its position as a leader in the decorative wall panel industry.

Industry Outlook

Decorative Wall Panels and Laminates in India

Market Growth and Projections

- The global wall panels market was valued at USD 17.16 billion in 2023 and is projected to reach USD 23.12 billion by 2031, growing at a CAGR of 4.3% from 2024 to 2031.

- India’s interior design market is expected to grow from $31.5 billion in 2023 to $67.4 billion by 2032, indicating a robust demand for decorative wall panels and laminates.

Key Growth Drivers

- Real Estate Expansion: India’s real estate sector is projected to reach USD 1 trillion by 2030, contributing approximately 13% to the country’s GDP. This growth fuels demand for interior decor products, including wall panels and laminates.

- Urbanization: With over 40% of India’s population expected to reside in urban areas by 2030, there’s an increasing need for residential and commercial spaces, boosting the interior decor market.

- Consumer Preferences: Rising disposable incomes and exposure to global design trends have led consumers to seek aesthetic and durable interior solutions, enhancing the demand for decorative laminates.

Market Segmentation

- Residential Sector: This segment holds the largest share in the decorative panels market, driven by renovations and new housing projects.

- Commercial Sector: Growth in retail, hospitality, and corporate spaces contributes to increased adoption of decorative wall panels and laminates

How Will Euro Pratik Sales Limited Benefit

- Market Leadership Growth: With a 15.87% market share in organized decorative wall panels, Euro Pratik Sales Limited is poised to expand its dominance as demand surges in India’s $67.4 billion interior design market by 2032.

- Increased Revenue Opportunities: India’s booming real estate sector, expected to reach $1 trillion by 2030, will drive demand for wall panels and laminates, leading to significant revenue growth for Euro Pratik Sales Limited.

- Consumer-Driven Product Demand: Rising disposable incomes and global design influences will boost demand for aesthetic, durable interior solutions, aligning with Euro Pratik’s innovative designs like Louvres, Chisel, and Auris.

- Sustainability Advantage: As eco-friendly products gain popularity, Euro Pratik’s lead-free, anti-bacterial, and sustainable materials will attract environmentally conscious buyers, strengthening its market position.

- Stronger Distribution Network: With 172 distributors across 25 states and exports to six countries, Euro Pratik is well-positioned to capitalize on growing domestic and international demand for decorative wall panels.

- Asset-Light Manufacturing Edge: By outsourcing production to 26 contract manufacturers, Euro Pratik minimizes capital investment while scaling operations efficiently to meet rising market demand.

- Brand Influence and Market Expansion: Endorsements from Hrithik Roshan and Kareena Kapoor Khan enhance brand recognition, driving consumer preference and aiding penetration into Tier-II and Tier-III cities.

- Strategic Acquisitions for Growth: Recent acquisitions, including Vougue Decor and Euro Pratik USA, expand its portfolio and international presence, increasing market reach and product diversification.

Euro Pratik Sales Limited IPO Overview

Euro Pratik Sales IPO is a complete offer-for-sale (OFS), raising ₹730 crore through equity shares of ₹1 face value. The company won’t receive proceeds, as funds go to selling shareholders. Promoters divesting stakes include Pratik Gunvantraj Singhvi (₹45.7 crore), Jai Gunvantraj Singhvi (₹45.1 crore), Pratik Gunwantraj Singhvi HUF and Jai Gunwantraj Singhvi HUF (₹253.4 crore), along with Dipty Pratik Singhvi and Nisha Jai Singhvi, each selling stakes worth ₹66.2 crore, per the DRHP details.

Euro Pratik Sales Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: NA

Offer for Sale (OFS): ₹730 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post -issue | TBA |

Euro Pratik Sales IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Euro Pratik Sales Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 6.19 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 40.39% |

| Net Asset Value (NAV) | 785.34 |

| Return on Equity | 44.03% |

| Return on Capital Employed (ROCE) | 55.17% |

| EBITDA Margin | 40.15% |

| PAT Margin | 20.25% |

| Debt to Equity Ratio | – |

Euro Pratik Sales IPO Peer Group Comparison

| Name of Company | Face Value (₹) | EPS (₹) Basic | EPS (₹) Diluted | NAV (₹ per share) | P/E | RoNW (%) |

| Euro Pratik Sales Limited | 1 | 16.19 | 6.19 | 785.34 | – | 40.39 |

| Listed Peers | ||||||

| Greenlam Industries Limited | 1 | 10.82 | 10.82 | 85.34 | 55.18 | 12.68 |

| Asian Paints Limited | 1 | 56.95 | 56.94 | 194.82 | 40.47 | 29.74 |

| Berger Paints India Limited | 1 | 10.02 | 10.02 | 46.14 | 45.75 | 21.75 |

| Indigo Paints Limited | 10 | 30.95 | 30.87 | 189.44 | 44.69 | 16.50 |

Key Insights

- Face Value: Euro Pratik Sales Limited and most of its peers, except Indigo Paints Limited, have a face value of ₹1 per share. Indigo Paints Limited has a face value of ₹10, indicating a different stock structuring approach.

- Earnings Per Share (EPS): Euro Pratik Sales Limited has a basic EPS of ₹16.19 and a diluted EPS of ₹6.19, lower than Asian Paints and Indigo Paints but higher than Greenlam and Berger Paints, reflecting moderate profitability.

- Net Asset Value (NAV): Euro Pratik Sales Limited has the highest NAV at ₹785.34, significantly above its peers. This indicates strong asset backing per share, suggesting higher book value strength than competitors.

- Price-to-Earnings Ratio (P/E): The P/E ratio is unavailable for Euro Pratik Sales Limited. Among listed peers, Greenlam (55.18), Berger Paints (45.75), Indigo Paints (44.69), and Asian Paints (40.47) indicate premium valuations.

- Return on Net Worth (RoNW): Euro Pratik Sales Limited leads with a RoNW of 40.39%, higher than all its listed peers, showcasing superior profitability relative to its net worth, indicating efficient capital utilization and strong financial performance.

Objectives of the IPO Proceeds

The Promoter Selling Shareholder will be entitled to the entire proceeds of the Offer after deducting his portion of the Offer expenses and relevant taxes thereon. The Company will not receive any proceeds from the Offer

Euro Pratik Sales Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 2816.49 | 1744.92 | 1591.20 | 1394.57 |

| Revenue | 1361.42 | 2216.98 | 2635.84 | 2119.15 |

| Profit After Tax | 434.07 | 629.07 | 595.65 | 445.23 |

| Reserves and Surplus | 1905.89 | 1537.50 | 1295.12 | 1191.10 |

| Total Borrowings | 307.05 | – | 30.00 | – |

| Total Liabilities | 811.25 | 187.59 | 291.02 | 197.41 |

Key Strategies for Euro Pratik Sales Limited

- Expand into New Markets

Euro Pratik Sales Limited seeks international growth while strengthening its presence in India. By assessing demographics, infrastructure, and demand, the company strategically enters new markets. Subsidiaries in UAE and the USA enhance expansion efforts, diversifying revenue streams globally.

- Enhance Distribution and Inventory Management

The company aims to expand its distribution network beyond metros, targeting small cities and international markets. Strengthening logistics, optimizing inventory systems, and leveraging technology ensure timelyfulfillment, reduced stockouts, and improved supply chain efficiency, enhancing distributor and consumer satisfaction.

- Strengthen Brand Awareness and Market Positioning

Euro Pratik Sales Limited invests in traditional and digital advertising, social media engagement, and industry collaborations. Trade show participation, brand endorsements, and influencer partnerships increase visibility, while targeted campaigns and online platforms enhance product penetration and consumer recall.

- Prioritize Product Innovation and Portfolio Expansion

Consumer preferences drive continuous product innovation at Euro Pratik Sales Limited. The company develops unique designs, introduces new materials, and gathers market feedback before large-scale launches. A pipeline of upcoming products ensures relevance, competitive edge, and sustained growth.

- Leverage Digital Transformation and E-Commerce Growth

Euro Pratik Sales Limited enhances its online presence by integrating digital marketing, e-commerce platforms, and optimized user experiences. Product catalogs, streamlined inquiry systems, and data-driven strategies improve consumer engagement, broadening accessibility while strengthening the company’s market reach and competitiveness.

- Strengthen Strategic Partnerships and Industry Collaborations

The company fosters relationships with architects, interior designers, and construction firms to drive referrals and market influence. Collaborations with distributors, brand ambassadors, and trade professionals amplify brand presence, ensuring greater consumer trust and long-term industry leadership.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Euro Pratik Sales Limited IPO

What is the structure of the Euro Pratik Sales Limited IPO?

The IPO is entirely an Offer For Sale (OFS) by promoters, with no fresh issue component.

Who are the selling shareholders in this IPO?

The OFS includes equity shares from promoters Pratik Gunvantraj Singhvi, Jai Gunvantraj Singhvi, and their respective HUFs.

What is the face value of the equity shares being offered?

The equity shares have a face value of ₹1 each.

What is the total issue size of Euro Pratik Sales Limited IPO?

The IPO aims to raise ₹451.31 crore through the Offer For Sale (OFS) route.

What does Euro Pratik Sales Limited specialize in?

The company is engaged in the business of decorative and lifestyle interior products, catering to both residential and commercial spaces.

How will the IPO proceeds be utilized?

Since the IPO is an Offer For Sale, proceeds will go to selling shareholders rather than the company for business expansion.