- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Excelsoft Technologies IPO

₹14,250/125 shares

Minimum Investment

IPO Details

19 Nov 25

21 Nov 25

₹14,250

125

₹114 to ₹120

NSE, BSE

₹500 Cr

26 Nov 25

Excelsoft Technologies IPO Timeline

Bidding Start

19 Nov 25

Bidding Ends

21 Nov 25

Allotment Finalisation

24 Nov 25

Refund Initiation

25 Nov 25

Demat Transfer

25 Nov 25

Listing

26 Nov 25

Excelsoft Technologies IPO

Incorporated in 2000, Excelsoft Technologies Limited is a global vertical SaaS company specialising in the learning and assessment market. The company provides technology-based solutions across various segments via cloud-based platforms, continuously innovating with AI-based products in digital assessments and proctoring. Over the years, Excelsoft has earned global recognition, receiving awards such as the e-Assessment Association Award and the Brandon Hall Group Awards. With over two decades of experience, the company offers customised, compliant, and secure solutions for enterprise clients worldwide, adhering to the latest EdTech industry standards and best practices.

Excelsoft Technologies Limited IPO Overview

Excelsoft Technologies is launching a book-built IPO worth ₹500 crore, which includes a fresh issue of 1.50 crore shares amounting to ₹180 crore and an offer for sale of 2.67 crore shares totalling ₹320 crore. The subscription window will open on November 19, 2025, and close on November 21, 2025, with the allotment expected on November 24, 2025. The company is set to list on the BSE and NSE, with the tentative listing date scheduled for November 26, 2025. The IPO price band has been fixed at ₹114 to ₹120 per share, and investors can apply with a lot size of 125 shares. For retail applicants, the minimum investment stands at ₹15,000 based on the upper price band. sNII investors can participate with a minimum of 14 lots (1,750 shares) amounting to ₹2,10,000, while bNII investors can enter with 67 lots (8,375 shares) requiring ₹10,05,000. Anand Rathi Advisors Ltd. is managing the issue as the book-running lead manager, and MUFG Intime India Pvt. Ltd. is serving as the registrar.

Excelsoft Technologies Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹500 crore (4,16,66,666 shares) |

| Fresh Issue | 1,50,00,000 shares (₹180 crore) |

| Offer for Sale (OFS) | 2,66,66,666 shares (₹320 crore) |

| IPO Dates | November 19, 2025 to November 21, 2025 |

| Price Band | ₹114 – ₹120 per share |

| Lot Size | 125 shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding Pre-Issue | 10,00,84,164 shares |

| Shareholding Post-Issue | 11,50,84,164 shares |

Excelsoft Technologies Important Dates

| Event | Date |

| IPO Open Date | Wed, Nov 19, 2025 |

| IPO Close Date | Fri, Nov 21, 2025 |

| Tentative Allotment | Mon, Nov 24, 2025 |

| Initiation of Refunds | Tue, Nov 25, 2025 |

| Credit of Shares to Demat | Tue, Nov 25, 2025 |

| Tentative Listing Date | Wed, Nov 26, 2025 |

Excelsoft Technologies IPO Lots

| Application Type | Lots | Shares | Amount |

| Retail (Min) | 1 | 125 | ₹15,000 |

| Retail (Max) | 13 | 1,625 | ₹1,95,000 |

| S-HNI (Min) | 14 | 1,750 | ₹2,10,000 |

| S-HNI (Max) | 66 | 8,250 | ₹9,90,000 |

| B-HNI (Min) | 67 | 8,375 | ₹10,05,000 |

Excelsoft Technologies IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Excelsoft Technologies Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) (Pre-/Post-IPO) | 3.47/2.09 |

| Price/Earnings (P/E) Ratio (Pre-/Post-IPO) | 34.62/57.46 |

| Return on Net Worth (RoNW) | 10.38% |

| Net Asset Value (NAV) | 29.71 |

| Return on Equity | 10.38% |

| Return on Capital Employed (ROCE) | 16.11% |

| EBITDA Margin | 31.40% |

| PAT Margin | 14.87% |

| Debt to Equity Ratio | 0.05 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding of capital expenditure for the purchase of land and construction of new building at Mysore property | 719.66 |

| Funding of capital expenditure for upgradation and external electrical systems of existing facility at Mysore | 395.11 |

| Funding upgradation of our Company’s IT Infrastructure (Software, Hardware, and Communications & Network Services). | 546.35 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

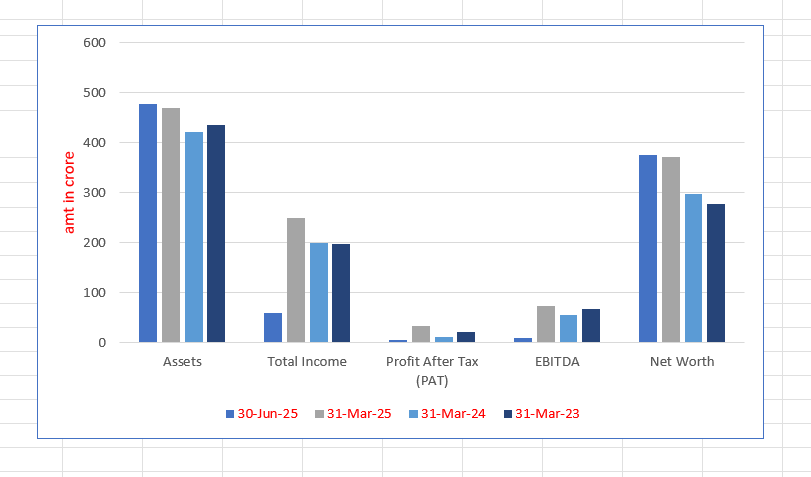

Excelsoft Technologies Limited Financials (in crore)

| Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 478.34 | 470.49 | 421.03 | 436.13 |

| Total Income | 60.28 | 248.80 | 200.70 | 197.97 |

| Profit After Tax (PAT) | 6.01 | 34.69 | 12.75 | 22.41 |

| EBITDA | 10.18 | 73.26 | 54.97 | 68.18 |

| Net Worth | 375.95 | 371.29 | 297.30 | 278.08 |

| Reserves and Surplus | 274.25 | 269.66 | 295.71 | 276.48 |

| Total Borrowing | 37.82 | 26.59 | 76.73 | 118.09 |

Financial Status of Excelsoft Technologies Limited

SWOT Analysis of Excelsoft Technologies IPO

Strength and Opportunities

- AI-powered assessment solutions enhance product offerings.

- Wide range of digital learning platforms for varied markets.

- Extensive experience in cloud-based platforms for learning.

- Strong international presence with clients across 17 countries.

- Robust security certifications ensure compliance and reliability.

- Customisable solutions tailored to educational institutions.

- Proven track record with awards and accolades in the industry.

- Increasing demand for AI-based learning and assessment tools.

- Strategic focus on student success and retention solutions.

Risks and Threats

- Dependence on technology may lead to vulnerability in cybersecurity.

- High competition from other EdTech and SaaS providers.

- Risk of technological obsolescence due to rapid tech evolution.

- Regulatory challenges in global markets.

- Continuous investment required for innovation and development.

- High dependency on partnerships for growth.

- Potential challenges in scaling AI technology.

- Market saturation may limit growth potential.

- Changes in educational policies may impact business strategies.

Live Excelsoft Technologies IPO News

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Excelsoft Technologies Limited IPO

Excelsoft Technologies Limited IPO Strengths

- Expertise in Product Engineering and Implementation

Excelsoft Technologies specialises in product engineering, development, and implementation for digital learning, assessments, and information management systems. They offer scalable, secure, and user-centric solutions, ensuring data security and cloud migration. Excelsoft’s long-term global customer relationships drive loyalty, innovation, and growth, with clients such as Pearson and AQA Education.

- Expertise in Compliant Digital Learning Solutions

Excelsoft Technologies excels in delivering fully compliant digital learning and assessment solutions globally. With subsidiaries in the UK, USA, Singapore, and India, and a presence in Dubai and Malaysia, they offer scalable, customised solutions across regions. Their expertise ensures adherence to global standards, enhancing learning experiences worldwide.

- Delivering Tailored Solutions Through Flexibility and Innovation

Excelsoft Technologies excels in leveraging diversified technologies and agile methodologies to provide tailored solutions for global clients. Their ability to adapt to various tech stacks and continuously upskill ensures optimal, scalable, and cost-efficient products. By customising solutions for specific customer needs, Excelsoft drives innovation, growth, and a competitive edge in the market.

- Robust Operating Parameters

Robust operating parameters are crucial for enhancing efficiency and consistency. They define processes, performance metrics, and decision-making frameworks, enabling smooth execution. By streamlining workflows, reducing errors, and improving resource allocation, they ensure high-quality outcomes and scalability, supporting long-term growth while maintaining flexibility and accountability across the organisation.

- Experienced Management Team and Promoters

Excelsoft Technologies is led by a skilled management team with over 30 years of experience in IT and EdTech. Dhananjaya Sudhanva, the Chairman & Managing Director, guides the company’s technology and sales operations, while Shruthi Sudhanva drives strategic planning. Their leadership ensures growth, innovation, and market competitiveness.

More About Excelsoft Technologies Limited

Excelsoft Technologies Limited is a global vertical SaaS company specialising in the learning and assessment market. The company offers technology-based solutions for educational institutions, corporate clients, and government bodies. With over two decades of expertise, it provides scalable cloud-based platforms with open APIs to enhance performance and security.

Global SaaS Market Growth

Vertical SaaS has rapidly gained prominence, with predictions indicating that it could make up nearly 50% of the global SaaS market by 2030 (Source: Arizton Report). Excelsoft Technologies is well-positioned to capitalise on this trend by offering specialised, industry-tailored solutions, particularly in the high-stakes assessment market.

Key Offerings and Solutions

- AI-based Assessment & Proctoring: Provides AI-driven solutions for qualifications, certification bodies, and academic institutions worldwide.

- Learning Systems: Supports digital learning solutions for publishers, covering subscription management, digital asset management, and analytics.

- Learning Management Systems (LMS): Offers customised solutions for academic institutions and corporations.

- Student Success Solutions: Assists universities in student enrolment, academic advising, and career planning.

- Education Technology Services: Aids clients in modernising legacy platforms while improving scalability and security.

AI and Innovation Focus

Excelsoft Technologies integrates AI, Machine Learning, and Big Data analytics into its products, notably in assessment and proctoring solutions. The company is investing in AI-based products like Large Language Models (LLMs) and device-specific small LLMs, improving user experience and monitoring capabilities.

Global Clientele and Certifications

Excelsoft serves 71 clients across 17 countries. Its products are compliant with global security and quality standards, holding certifications like ISO/IEC 27001:2013 for ISMS, ISO 9001:2015, and Cyber Essentials Plus.

Company History and Development

Founded in 2000 as Excelsoft Technologies Private Limited, the company has grown into a global leader in the learning and assessment market. In 2024, it became a public limited company and rebranded as Excelsoft Technologies Limited.

Revenue Distribution and Growth

Excelsoft’s revenue has grown steadily, reaching ₹1,982.97 million in Fiscal 2024. Despite a decrease in EBITDA and Profit after Tax, the company continues to expand its footprint across various jurisdictions and verticals

Industry Outlook

SaaS Market Overview

- Market Size and Growth: India’s SaaS market is projected to grow from $14 billion in 2024 to over $70 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of approximately 31%.

- Key Drivers:

- Digital Transformation: Businesses are increasingly adopting cloud solutions for scalability and efficiency.

- Global Demand: Indian SaaS companies are gaining traction in international markets, contributing to export growth.

EdTech Market Overview

- Market Size and Growth: The Indian EdTech market was valued at approximately $5.55 billion in 2023 and is expected to reach $17 billion by 2030, with a CAGR of 17.3%.

- Key Drivers:

- Internet Penetration: Increased access to affordable internet and smartphones has expanded the reach of digital learning platforms.

- Government Initiatives: Policies promoting digital education and skill development are fuelling market growth.

How Will Excelsoft Technologies Limited Benefit

- Excelsoft is positioned to benefit from the rapid growth of India’s SaaS market, projected to reach over $70 billion by 2030.

- With its specialised focus on vertical SaaS for learning and assessment, Excelsoft can capture a significant share of this expanding market.

- The EdTech sector’s growth to $17 billion by 2030 creates ample opportunities for Excelsoft’s AI-based assessment solutions and learning management systems.

- The company’s integration of AI, machine learning, and Big Data analytics into its products ensures it remains at the forefront of educational innovation.

- Excelsoft’s scalable cloud-based platforms with open APIs enhance performance and security, attracting educational institutions, corporate clients, and government bodies globally.

- The growing demand for digital learning and assessment solutions, combined with government support for education technology, positions Excelsoft to capitalise on emerging opportunities.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per DRHP.

Key Strategies for Excelsoft Technologies Limited

- Expanding Customer Reach Globally

Excelsoft Technologies Limited aims to increase revenue by strengthening relationships with existing clients and expanding into new global markets. The company focuses on identifying untapped geographies with high potential, analysing industry trends, and offering tailored solutions to reach new customers and grow its clientele.

- Strengthening Brand Positioning

The company focuses on enhancing its brand visibility and positioning in the market to foster long-term customer loyalty. By using targeted market research, optimised digital marketing, and customer insights, Excelsoft aims to build strong customer relationships and maintain consistency across all communication channels.

- Innovation in Product Portfolio

Excelsoft Technologies Limited prioritises innovation by continually improving its existing product portfolio and developing new solutions based on market demand. The company engages in customer feedback, industry trends, and competitive analysis to ensure its products remain competitive and meet evolving customer needs, including potential AI-driven enhancements.

- Augmenting Sales & Marketing Efforts

To expand its reach, Excelsoft plans to build geographically diverse sales and marketing teams. This will involve setting up new offices in key regions, optimising marketing budgets based on regional demand, and ensuring local relevance to drive growth, increase market penetration, and build a robust global clientele.

- Exploring Strategic Acquisitions

Excelsoft Technologies is keen to pursue synergistic acquisition opportunities to accelerate growth. By acquiring complementary businesses or forming collaborations, the company aims to enhance its technology capabilities, expand its market presence, and improve its product offerings to maintain a competitive edge in the industry.

- Expanding into the AI Sector

Excelsoft plans to venture into AI-driven innovations within its product suite. By developing AI-powered tools, such as personalised assessment platforms and smart proctoring solutions, the company aims to enhance the learning experience and increase operational efficiencies across various educational and assessment technologies.

- Enhancing Customer Experience

Excelsoft is committed to delivering superior customer experiences by tailoring offerings to individual preferences. The company aims to provide fast responses, proactive problem-solving, and high-quality service to turn satisfied customers into repeat buyers and brand advocates, ensuring long-term business sustainability.

- Entering Emerging Markets

Excelsoft Technologies intends to expand its market presence by entering emerging markets such as Egypt, France, Italy, Brazil, and the Philippines. This strategy focuses on diversifying its geographical footprint and reaching new customer segments, while maintaining a strong brand presence in established regions globally.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Excelsoft Technologies Limited IPO

How can I apply for Excelsoft Technologies Limited IPO?

You can apply via HDFC Sky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

How is the IPO structured?

Excelsoft Technologies IPO is a book build issue of ₹500.00 crores. The issue is a combination of fresh issue of 1.50 crore shares aggregating to ₹180.00 crores and offer for sale of 2.67 crore shares aggregating to ₹320.00 crores.

Who are the promoters selling shares in the IPO?

The promoters are Pedanta Technologies Private Limited and Dhananjaya Sudhanva.

What will Excelsoft do with the IPO proceeds?

Funds will be used for capital expenditure, including facility expansion and IT infrastructure upgrades.

Has Excelsoft Technologies appointed merchant bankers for the IPO?

Yes, Anand Rathi Advisors Limited is the Book Running Lead Manager for the issue.