- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Executive Centre India IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Executive Centre India Limited

Executive Centre India Ltd., a subsidiary of The Executive Centre (TEC), is a leading provider of premium flexible workspace solutions in the Asia-Pacific region. The company delivers co-working spaces, fully furnished private offices, virtual offices, meeting rooms, and enterprise-grade solutions designed for businesses of all sizes. As of March 31, 2025, its portfolio included 89 operational centres across 14 cities in seven countries, offering tailored services such as premium co-working spaces, virtual office services, meeting and conference rooms, and comprehensive enterprise workspace solutions.

Executive Centre India Limited IPO Overview

The Executive Centre India Ltd. IPO DRHP was filed with SEBI and the stock exchanges on 23 July 2025 and was under process as of 12 August 2025. The company’s promoters include George Raymond Zage III, Paul Daniel Salnikoff, Willow Holdco Pte. Ltd., The Executive Centre Singapore Pte. Ltd., and Intelletec Limited, holding 100% of shares pre-issue. The IPO is a book-built issue raising ₹2,600.00 crores entirely through fresh shares, with no offer-for-sale component. The equity shares are proposed to be listed on NSE and BSE. Kotak Mahindra Capital Co. Ltd. is the book-running lead manager, and Kfin Technologies Ltd. is the registrar. Key IPO details, including dates, price band, and lot size, are yet to be announced. The face value per share is ₹2, with the total pre-issue shareholding at 34,68,40,810 shares.

Executive Centre India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹2600 crore |

| Fresh Issue | ₹2600 crore |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Executive Centre India Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Executive Centre India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹(2.32) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 2.95% |

| Net Asset Value (NAV) | ₹(78.19) |

| Return on Equity (RoE) | 2.95% |

| Return on Capital Employed (RoCE) | (191.81%) |

| EBITDA Margin | 48.97% |

| PAT Margin | (0.96%) |

| Debt to Equity Ratio | 1.04 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Investment in TEC Abu Dhabi, the direct Subsidiary, for financing the part-payment of the consideration for the acquisition of TEC SGP and TEC Dubai, two of our stepdown Subsidiaries, from one of our Corporate Promoters, TEC Singapore, pursuant to the Internal Restructuring Agreement | 2410 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

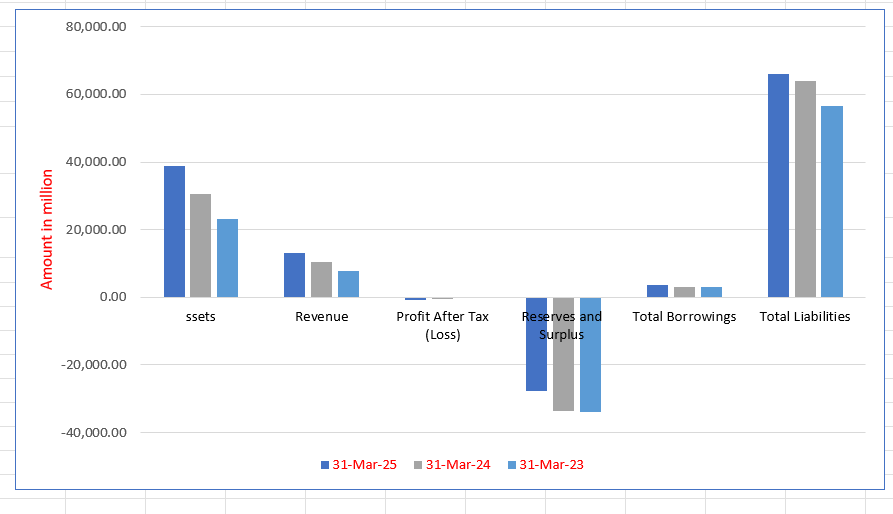

Executive Centre India Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Ssets | 38,888.34 | 30,491.84 | 23,177.81 |

| Revenue | 13,226.43 | 10,366.20 | 7,633.89 |

| Profit After Tax (Loss) | (806.13) | (563.15) | (73.64) |

| Reserves and Surplus | (27,631.21) | (33,770.19) | (33,802.52) |

| Total Borrowings | 3,612.84 | 3,150.46 | 2,991.25 |

| Total Liabilities | 66,172.71 | 63,953.21 | 56,671.51 |

Financial Status of Executive Centre India Limited

SWOT Analysis of Executive Centre India IPO

Strength and Opportunities

- Premium office locations in major Indian cities.

- Diverse workspace solutions: private, coworking, virtual.

- Tailored enterprise solutions for various business sizes.

- Global network with over 220 centres across 36 cities.

- Strong focus on ESG (Environmental, Social, Governance) initiatives.

- Strategic partnerships enhancing service offerings.

- Advanced infrastructure supporting seamless connectivity.

- Growing demand for flexible workspaces post-pandemic.

- Established reputation among professionals and industry leaders.

Risks and Threats

- High operational costs in prime urban areas.

- Limited brand recognition outside metropolitan hubs.

- Dependence on real estate market fluctuations.

- Vulnerability to economic downturns affecting demand.

- Intense competition from local and international coworking providers.

- Potential challenges in maintaining consistent service quality across locations.

- Regulatory challenges in different states.

- Risks associated with long-term lease commitments.

- Limited scalability in tier-2 and tier-3 cities.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Executive Centre India Limited

Executive Centre India Limited IPO Strengths

Premium Grade A Locations in Key Business Hubs

Executive Centre India Limited operates 269 premium workspaces in Grade A properties across Central Business Districts (CBDs) and prime clusters. As of March 31, 2025, 100% of its leasable area in India and the Middle East, and 97% in Southeast Asia, is in Grade A developments. Strategic locations enhance visibility and accessibility for multinational clients.

Strong Landlord Partnerships for Expansion

The company maintains long-term relationships with leading landlords, enabling vertical expansion and favorable lease terms. Key partners include DLF Limited, Prestige Estates, and Dubai World Trade Centre. These collaborations support cost optimization and secure premium locations, with top landlords contributing 32.78% of the total leasable area as of March 2025.

High Client Retention & Multinational Clientele

Executive Centre serves over 1,550 clients, 92.16% of which are MNCs, with an average tenure of 48.97 months. Its diverse client base includes Anaplan, ArcelorMittal, and BBVA. According to Kantar Brand Study, 99% of clients report satisfaction, citing premium infrastructure, CBD locations, and Grade A buildings as key differentiators.

Premium Workspaces with Global Standards

The company designs flexible workspaces with high-end amenities, including ergonomic furniture and hospitality-focused communal areas. Sustainability is prioritized, with 81.40% of operational centers in green-certified buildings. Continuous upgrades, like the Two Horizon Centre refurbishment, ensure modern, functional workspaces that meet evolving client expectations.

Industry-Leading Occupancy & Financial Performance

Executive Centre maintains the highest occupancy rates among peers in India, at 91.58% in FY2025. Its revenue per square foot (₹7,752.08) and REVPOW (₹60,360.70) reflect strong unit economics. A disciplined expansion strategy ensures rapid center maturity, with new locations achieving 64.33% pre-sale occupancy on average.

Self-Sustainable Business Model & Cash Flow Strength

The company’s focus on unit economics ensures profitability, generating ₹7,572.16 million net cash from operations in FY2025. Despite market fluctuations, it maintains revenue growth (31.63% CAGR) and disciplined capital allocation, supported by a data-driven expansion strategy evaluating IRR, payback periods, and rent multiples.

Experienced Leadership & Investor Backing

Led by CEO Paul Salnikoff, the management team brings 30+ years of industry expertise. Prominent investors, including TIGA Investments and Willow Aggregator L.P., provide stable capital and strategic guidance. The board’s governance, combined with senior leadership’s equity alignment, ensures long-term growth and operational excellence.

More About Executive Centre India Limited

Strategic Capital Investments

Executive Centre India Limited (the “Company”) adopts a proactive investment strategy, allocating significant capital to its centers to ensure high-quality facilities and services. This substantial investment minimizes the necessity for frequent refurbishments. The majority of this capital expenditure is consistently directed toward initial investments, which cover construction, mechanical, electrical, and plumbing (MEP) systems, along with furniture, fixtures, and IT infrastructure. For example, initial capital expenditure constituted approximately 89.51% of the total in Fiscal Year 2025 and 85.24% in Fiscal Year 2024.

Focus on Premium Properties and Prime Locations

The Company operates its centers in high-quality, strategically located properties. As of March 31, 2025, 100% of the Company’s operational leasable area in India and the Middle East was situated in Grade A developments. This commitment extends to Southeast Asia, where 97% of its operational leasable area was also in Grade A buildings.

The Company’s portfolio is concentrated in Central Business Districts (CBDs) and other key clusters, a strategic positioning that offers clients significant advantages:

- Access to key business hubs and high-quality infrastructure.

- The ability to leverage the Company’s strong, multi-asset relationships with leading developers and landlords.

- Client-reported top reasons for choosing the Company, including premium infrastructure, CBD locations, and presence in Grade A buildings.

A Client-Driven Expansion Model

The Company’s expansion strategy is fundamentally driven by client demand, with a disciplined and data-driven approach guiding new investments. This model allows the Company to expand its presence by adding new centers in existing buildings, opening new centers in existing markets, or entering new markets entirely.

This proactive approach to identifying and securing high-potential opportunities has resulted in new centers launching with high initial occupancy rates. For instance, new operational centers between Fiscal Years 2023 and 2025 achieved an average pre-sale occupancy rate of 64.33% across all markets. Furthermore, many of the new centers in India have reached operational breakeven—where cash income equals or exceeds outgoing costs—within just one to three months of their launch.

Industry Outlook

The Indian co-working and flexible office space market is experiencing significant growth, driven by evolving work patterns and a surge in startups and freelancers. The market size was valued at approximately USD 761.9 million in 2023 and is projected to reach USD 2.84 billion by 2030, growing at a compound annual growth rate (CAGR) of 20.6% .

Key Growth Drivers:

- Shift to Hybrid Work Models: The increasing adoption of hybrid work arrangements by businesses is fueling demand for flexible workspaces.

- Startup Ecosystem: With over 157,000 startups recognized by the Department for Promotion of Industry and Internal Trade (DPIIT) as of December 2024, the need for cost-effective office solutions is rising .

- Government Initiatives: Programs like ‘Startup India’ are streamlining regulations and providing funding, further encouraging entrepreneurship .

Market Trends:

- Expansion in Tier 2 and Tier 3 Cities: Cities such as Indore, Jaipur, Kochi, and Lucknow are witnessing a rise in co-working spaces, catering to the growing demand in these regions .

- Technological Integration: Co-working spaces are increasingly offering high-speed internet, meeting rooms, power backup, and vibrant networking opportunities to meet the needs of modern professionals

How Will Executive Centre India Limited Benefit

- The company’s presence in premium Grade A properties ensures high demand from businesses seeking quality office spaces, translating into strong occupancy rates.

- Its strategic locations in Central Business Districts provide easy access to key commercial hubs, attracting multinational and high-profile clients.

- Executive Centre’s proactive capital investment in infrastructure and technology enhances client satisfaction and reduces the need for frequent refurbishments.

- The client-driven expansion model allows the company to efficiently enter new markets and scale operations based on actual demand.

- Early operational breakeven of new centers supports cash flow stability and accelerates return on investment.

- Alignment with hybrid work trends positions the company to cater to growing flexible workspace needs.

- Integration of advanced IT systems and modern amenities strengthens its competitive edge in the evolving co-working landscape.

- Expansion into Tier 2 and Tier 3 cities opens new growth avenues aligned with market trends.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue (₹ million) | EPS (₹) | P/E | RoNW (%) | NAV (₹) |

| Executive Centre of India | 2 | 13,226.43 | (2.32) | ** | NA* | (78.19) |

| Group Peers | ||||||

| Awfis Space Solutions Limited | 10 | 12,075.35 | 9.75 | 66.92 | 14.78% | 65.43 |

| Smartworks Coworking Spaces Limited | 10 | 13,740.56 | (6.18) | NA*** | (58.76%) | 10.55 |

Key Strategies for Executive Centre India Limited

Growth in Premium Flexible Workspaces

Executive Centre India Limited plans to expand its leadership in premium flexible workspaces by adding new centers to existing buildings and opening new locations in key business districts. The company is actively pursuing vertical expansions within current properties and opening new centers in its established markets.

Expansion into New Markets

The company’s expansion into new markets is driven by client demand, which helps to mitigate risk and achieve higher initial occupancy rates. Executive Centre India Limited maintains direct relationships with clients to understand their needs and anchor new locations with existing demand.

Deepening Presence in India

Executive Centre India Limited aims to accelerate growth and strengthen its business in India. The company plans to focus on sub-markets with robust infrastructure and rising demand, explore new emerging markets, and invest in sales and marketing to support its continued expansion across the country.

Maintaining Premium Brand Positioning

Executive Centre India Limited is committed to its premium brand positioning by providing clients with Grade-A buildings, personalized services, and amenity-rich workspaces. The company continuously monitors and acts on client feedback to improve its offerings and reinforce its market position through tailored programming and events.

Expanding Business Support Services

The company is enhancing its business support services to increase client engagement and diversify revenue streams. Executive Centre India Limited is expanding its coworking spaces, developing dedicated meeting and event venues, and launching new products, such as management centers for landlords and a limousine service through its app.

Strengthening Financial Discipline

Executive Centre India Limited maintains financial discipline by using a rigorous approach to identify high-potential locations and ensure strong returns on investment. The company is also integrating advanced technologies and leveraging economies of scale to improve operational efficiency, profitability, and market share.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Executive Centre India Limited IPO

How can I apply for Executive Centre India Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of the Executive Centre IPO?

The IPO is a fresh issue aggregating up to ₹2,600.00 crore, with no offer for sale component.

What is the purpose of the IPO proceeds?

Proceeds will fund acquisitions of TEC SGP and TEC Dubai and support general corporate purposes.

Where will the shares be listed?

The equity shares are proposed to be listed on both NSE and BSE mainboards.

What is the face value and issue type of the IPO?

Face value is ₹2 per share; the IPO is a book-building type of fresh issue.

Who are the promoters of Executive Centre India Limited?

Promoters include George Raymond Zage III, Paul Daniel Salnikoff, Willow Holdco Pte. Ltd., and TEC Singapore entities.