- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Fabtech Technologies IPO

₹13,575/75 shares

Minimum Investment

IPO Details

29 Sep 25

01 Oct 25

₹13,575

75

₹181 to ₹191

NSE, BSE

₹230.35 Cr

07 Oct 25

Fabtech Technologies IPO Timeline

Bidding Start

29 Sep 25

Bidding Ends

01 Oct 25

Allotment Finalisation

03 Oct 25

Refund Initiation

06 Oct 25

Demat Transfer

06 Oct 25

Listing

07 Oct 25

Fabtech Technologies Limited

Incorporated in 2018, Fabtech Technologies Limited is a biopharma engineering solutions provider. The company specialises in delivering turnkey projects such as cleanroom facilities, modular systems, and customised engineering solutions. It also provides end-to-end services, including design, engineering, manufacturing, installation, and project management. Fabtech has expertise in cleanroom technology, HVAC systems, process equipment, clean air solutions, and purified water generation systems. It caters to diverse industries including life sciences, food and beverages, IT, semiconductors, and aeronautics.

Fabtech Technologies Limited IPO Overview

The Fabtech Technologies IPO is a book-built issue worth ₹230.35 crores, consisting entirely of a fresh issue of 1.21 crore shares. The subscription period will open on September 29, 2025, and close on October 1, 2025, with allotment expected to be finalised on October 3, 2025. The shares are proposed to list on both BSE and NSE, with the tentative listing date set for October 7, 2025. The price band for the IPO is fixed at ₹181 to ₹191 per share, while the lot size is 75 shares. For retail investors, the minimum investment is ₹14,325, based on the upper price band. In comparison, the lot size investment for sNII is 14 lots, equal to 1,050 shares and ₹2,00,550, while for bNII it is 70 lots, equating to 5,250 shares and ₹10,02,750. The book running lead manager for the issue is Unistone Capital Pvt. Ltd., and Bigshare Services Pvt. Ltd. will act as the registrar.

Fabtech Technologies Limited IPO Details

| Particulars | Details |

| IPO Date | September 29, 2025 to October 1, 2025 |

| Listing Date | October 7, 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹181 to ₹191 per share |

| Lot Size | 75 Shares |

| Total Issue Size | 1,20,60,000 shares (aggregating up to ₹230.35 Cr) |

| Fresh Issue | 1,20,60,000 shares (aggregating up to ₹230.35 Cr) |

| Offer for Sale | NA |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 3,23,92,239 shares |

| Share Holding Post Issue | 4,44,52,239 shares |

| Employee Discount | ₹9.00 per share |

Fabtech Technologies Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Net Issue |

| Retail | Not less than 35% of the Net Issue |

| NII (HNI) | Not less than 15% of the Net Issue |

Fabtech Technologies Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 75 | ₹14,325 |

| Retail (Max) | 13 | 975 | ₹1,86,225 |

| S-HNI (Min) | 14 | 1,050 | ₹2,00,550 |

| S-HNI (Max) | 69 | 5,175 | ₹9,88,425 |

| B-HNI (Min) | 70 | 5,250 | ₹10,02,750 |

Fabtech Technologies Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 94.61% |

| Post-Issue | [To be updated based on equity dilution] |

Fabtech Technologies Limited IPO Valuation Overview

| KPI | Value |

| EPS (Pre IPO) | ₹14.34 |

| EPS (Post IPO) | ₹10.45 |

| P/E Ratio (Pre IPO) | 13.32x |

| P/E Ratio (Post IPO) | 18.28x |

| ROE | 30.46% |

| ROCE | 24.46% |

| RoNW | 26.83% |

| PAT Margin | 13.83% |

| EBITDA Margin | 14.07% |

| Debt to Equity Ratio | 0.32 |

| Price to Book Value | 3.57 |

Objectives of the Proceeds

- Funding working capital requirements of the company – ₹1,270 Cr

- Pursuing inorganic growth initiatives through acquisitions – ₹300 Cr

- General corporate purposes

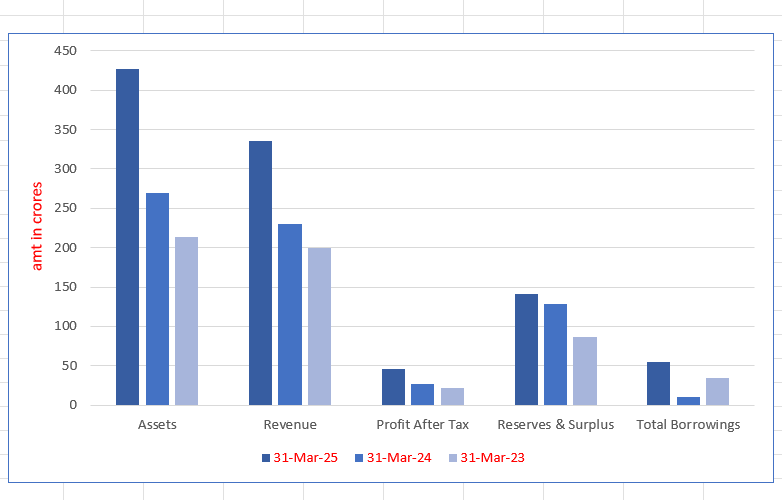

Key Financials (in ₹ Crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 426.56 | 269.24 | 213.86 |

| Revenue | 335.94 | 230.39 | 199.91 |

| Profit After Tax | 46.45 | 27.22 | 21.73 |

| Reserves & Surplus | 140.72 | 128.94 | 86.18 |

| Total Borrowings | 54.62 | 9.88 | 34.29 |

SWOT Analysis of Fabtech Technologies IPO

Strength and Opportunities

- Strong turnkey engineering and integrated service offerings

- Diversified order book across geographies and industries

- In-house software technology and design capabilities

- Experienced leadership and global project execution expertise

Risks and Threats

- Rising competition in engineering and cleanroom solutions

- Dependence on large capital-intensive projects

- Exposure to regulatory compliance risks across markets

- Fluctuating raw material and logistics costs may impact margins

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Fabtech Technologies Limited

Fabtech Technologies IPO Strengths

- Strong turnkey engineering and integrated service offerings

- Diversified order book across industries and geographies

- In-house design and software technology capabilities

- Experienced leadership with Fabtech Group backing

- Track record of executing complex global projects across dosage forms

- Efficient lead funneling leading to higher mandate conversion

Peer Group Comparison

As per the RHP, no directly comparable listed peer companies are available for Fabtech Technologies Limited

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Fabtech Technologies Limited IPO

How can I apply for Fabtech Technologies Limited IPO?

You can apply via HDFCSky using UPI-based ASBA (Application Supported by Blocked Amount).

What is the minimum investment required for Fabtech IPO?

The minimum investment is ₹14,325 for 75 shares at the upper price band.

When will Fabtech Technologies IPO shares be listed?

The shares are scheduled to be listed on BSE and NSE on October 7, 2025.

What is the issue size of Fabtech Technologies IPO?

The IPO issue size is ₹230.35 crores, entirely through fresh issue of shares.