- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Factors affecting the movement of a stock

By HDFC SKY | Updated at: May 15, 2025 11:41 AM IST

Summary

So far, we have learned that the stock market is where people buy and sell stocks electronically. We also understand that trade happens only when there is a buyer and a seller for a stock at any price point. Also, there are thousands of such transactions taking place at once in the stock market. But it is usual to wonder how one person can buy a stock at a particular price when another person wants to sell it at the same price.

This happens because they have different views on the stock — this is essentially the gist of the market.

Let us understand this with an example. Let’s assume a news report alleges a scam at a listed company, ABC Ltd. The market reacts to this news and the ABC stock tanks 20% — say from Rs 100 to Rs 80. Two traders, Ram and Shyam, are tracking the developments of this company.

Ram believes that since the news of the scam has just hit the market, there is a potential for ABC’s stock to fall further. He, therefore, finds it sensible to exit his holdings in the stock even though it has already shed 20%, Ram is a seller of the ABC stock.

Meanwhile, Shyam thinks a 20% fall in the stock price based on just allegations of a scam is unjustified. What if the news proves false? After all, the company has decent financials and growth prospects seem bright. He believes the stock may soon see a sharp bounce back, which could even take it beyond the Rs 100 mark. So, he will be a buyer at Rs 80.

Both Ram and Shyam will approach their respective brokers to execute what they think is the right strategy to deal with the stock based on the latest available information. The stockbroker will send their orders to the exchange where the orders would match, and voila, a trade is made!

But why is the price constantly changing? This is because there are always hundreds of such Rams and Shyams (buyers and sellers) trading stocks. The last trade recorded on a stock exchange will be the stock’s most recent price.

What are the key factors that can affect a stock’s price?

Apart from the daily demand and supply dynamics, multiple reasons can affect share price movement. The stock can move up or down when the company announces its quarterly earnings report, expansion plans, dividend, etc. or even when it launches any new products in some cases.

If the announcement or any piece of information on the company is positive, then the demand for the stock tends to rise as the number of buyers in its stock will typically exceed the number of sellers. This leads to a jump in the stock price.

On the other hand, if the information is negative for the company, more people are likely to rush to sell the stock causing the price to fall.

To conclude, a trade occurs because there will always be two parties with contrasting views on a stock at any price point. Second, the stock will rise if the new information is positive and fall when it is negative.

So how do we gauge where the market is if there is no news? We do this by looking at the bid-ask spread (hold your horses, we are getting to it). Remember, the price you see on your computer screen is not (necessarily) the price you will be able to trade a share at; it is merely the last price at which that stock was traded.

What exactly is the bid-ask spread?

The bid price is the best price at which a buyer is willing to buy a specific number of shares of any company at a given time. Similarly, the ask price is the best price at which a seller will sell a stock.

The ask price will always be higher than the bid price. The difference between the ask price and bid price is called the bid-ask spread.

Bid-ask Spread = Ask price – Bid price.

In the equity market, there are bids at multiple prices with different volumes. The same goes for ask prices.

If the bid and ask prices match, a trade occurs. Those orders then disappear from the market, leaving the other bids and asks that haven’t been matched yet.

Now, this may seem like a simple concept, but you can get a lot of information just by looking at the bid-ask spread.

Liquidity of stocks: Stocks that are liquid i.e., shares that can be easily and efficiently bought/sold without a major impact on their price, will typically have a low bid-ask spread. Meanwhile, with illiquid stocks, the bid-ask spread can be wider.

Risk of stocks: When you place a market order (we’ll discuss this in detail later), the idea is to get it as close to the bid/ask price as possible. The lower the spread, the lower the risk. This is because you’ll be able to get the stock at a price much close to what you perceive is fair. If the spread is large, it could drastically affect your expected return.

Indicates the direction of stocks: If the spread narrows, with more bids coming in to match the ask price, you can expect the stock to move up. This is because more buyers are willing to match the higher ask price of the seller. On the other hand, if the ask price moves towards the bid price, expect the stocks to fall. Traders track this in real-time and tweak their trades accordingly.

So, is conforming to the bid-ask spread your only option? Also, what if there is a drastic move in the price of the stock? Won’t that force me to trade a stock at a price far from the market price at which I decided to trade the stock? And who comes up with the bid and ask price anyway?

Your trading platform allows you to place different types of orders. Let’s go through each, and you’ll figure out the answers to all your queries.

Types of Order

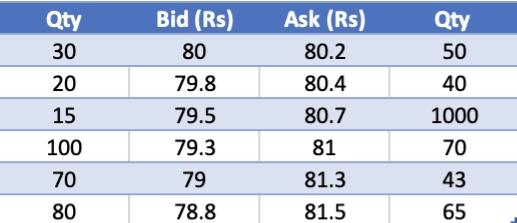

Market Order: This is an order to buy or sell a stock at the existing market price. For example, let’s assume the bid and ask price for the stock of A Ltd is as follows:

Now, if you place a market order of 100 shares, you will get 50 shares at Rs 80.2, the next 40 shares at Rs 80.4 and the remaining 10 shares at Rs 80.7. The effective per share cost would be Rs 80.33. Market orders will get executed immediately and most likely at the ask price (for buy orders) and bid price (for sell orders) at that point in time.

Limit Order: This is an order to buy or sell a stock at a specified price or better. A limit order prevents you from potentially buying/selling stocks at a price you do not want. Hence, if the market price is not in line with the limit order price, your order will not execute.

Let’s understand this with an example. Let’s assume you place a limit order to sell 100 shares of A Ltd at Rs 80. The market will immediately sell 30 shares at the existing offer of Rs 80. Then you will have to wait until another buyer comes along and bids at Rs 80 or better to fill the balance of the order.

Remember, the rest of the order will not be fulfilled unless the shares trade at Rs 80 or above. If the stock stays below Rs 80 a share, you might never be able to offload the stock.

Day Order: This is a type of limit order that can only be executed till the end of the day’s session. So, in the above example, if the stock of A Ltd never reaches Rs 80 during the session, your order will expire automatically.

Fill or Kill (FOK): This is a type of limit order that either fulfils the complete order immediately or not at all. Continuing our above example, if you place a FOK to sell 100 shares of A Ltd at Rs 80, your order will be cancelled as the market can only accommodate 30 shares at Rs 80.

Stop Order: Also called the stop-loss order, this type of order is designed to limit an investor’s loss on a position. A stop order sells a stock when it reaches a specific price. This comes in handy if you don’t want to hold the stock of A Ltd if it falls below Rs 75 and you don’t have time to monitor the market constantly. In this case, you can place a stop order at Rs 75. When the stock hits Rs 75, the order will be executed.

It is important to note that you may not be able to sell the stock at exactly Rs 75. If the stock price is rapidly falling, the order may be executed at a price significantly lower than Rs 75.

Think of a stop order as a market order which triggers when the stock reaches your specified price.