- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

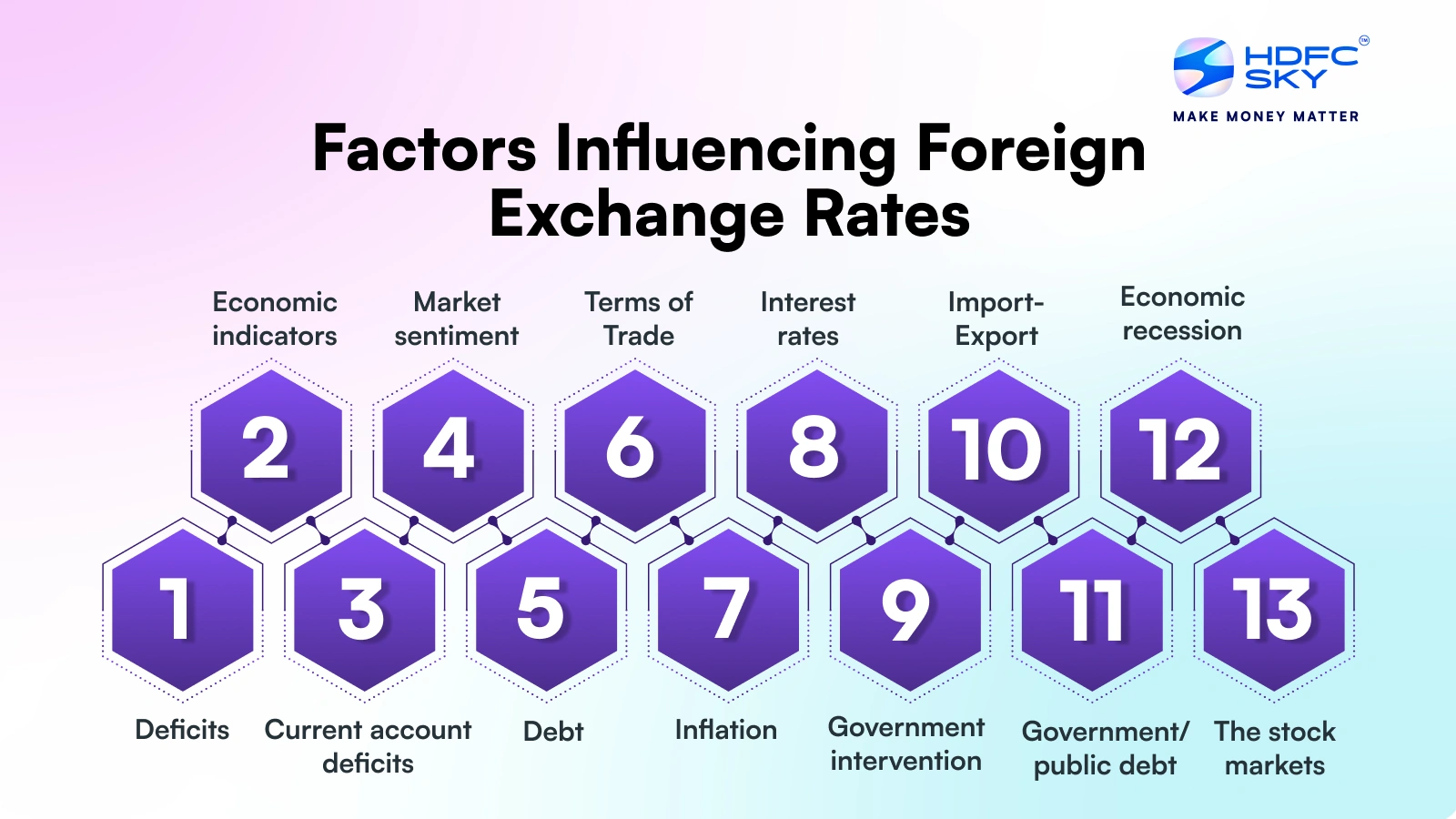

Factors Influencing Foreign Exchange Rates: A Complete Guide

By HDFC SKY | Updated at: Jul 24, 2025 06:32 PM IST

- Interest Rates & Inflation: Countries with lower inflation typically see appreciation in currency value. Higher interest rates attract foreign capital, boosting exchange rates.

- Current Account Deficits: A high deficit shows a country is importing more than exporting, exerting downward pressure on its currency.

- Public Debt Levels: High national debt can deter investors due to inflation fears or risk of default, weakening the currency.

- Political Stability & Performance: Economies with strong governance and stability tend to attract more foreign investment, strengthening their currency.

- Economic Performance: Positive economic indicators (GDP growth, employment rates) build investor confidence, leading to currency appreciation.

- Speculation & Market Sentiment: Expectations of future currency strength can drive traders to buy, influencing short-term exchange rate movements.

- Balance of Trade: A surplus (exports > imports) supports a stronger currency, while a trade deficit can weaken it.

- Government Intervention: Central banks can buy/sell currencies or alter interest rates to manage exchange rates.

Foreign exchange rates which measure the price of one currency in terms of another, are affected by numerous factors, and have a significant impact on the global economy including international trade, investments, and even your travel plans.

Understanding factors affecting foreign exchange rates can help you better navigate the world of finance. Let us now discuss all the factors which affect them in this blog and understand the topic of Forex in detail.

What is Foreign Exchange Rate?

Simply put, a foreign exchange rate is the value of one country’s currency in terms of another country’s currency. In other words, it’s the rate at which you can exchange one currency for another.

For example, as an Indian if you have to make a payment in US Dollars ($), you must know how much Indian Rupees you will need to shell out to have 1 US Dollar ($). Accordingly based on this exchange rate, you can have the amount of US Dollars ($) that you need to pay. This rate is constantly changing due to several economic and political factors.

Factors Influencing Exchange Rates

Understanding the factors influencing foreign exchange rate is crucial for anyone involved in Forex Trading, investment, or even planning a vacation abroad. Let’s dive into the key factors shaping foreign currency exchange rates.

Inflation

Inflation is one of the key factors that affect foreign exchange rates. When a country experiences high inflation, its currency typically weakens compared to other currencies.

For example, if India’s inflation rate is 6% while the US inflation rate is 2%, the Indian Rupee might depreciate against the US Dollar. You might find that ₹75,482 that once bought $1,000 now only buys $985.

Interest rates

Interest rates and exchange rates often move in tandem. When a country’s central bank raises interest rates, it attracts foreign investment, increasing demand for the local currency and causing it to appreciate.

Deficits

A country’s trade deficit or surplus is also one of the factors that influences foreign exchange rates. A trade deficit happens when a country imports more goods and services than it exports. This situation can lead to a depreciation of the local currency as there is more demand for foreign currencies to pay for imports.

Debt

A nation’s debt can impact its currency. A significant debt burden can also scare off investors, who may drive down the currency’s price. For instance, if India’s debt-to-GDP ratio goes from 85% to 90%, that may raise some eyebrows among international investors, which could weaken the Rupee.

Import-Export

The balance of trade, or the difference between a country’s exports and imports, is amongst the key determinants of the foreign exchange market. A trade surplus (exporting more than importing) tends to appreciate a country’s currency, whereas a trade deficit will see depreciation.

Economic indicators

Various economic indicators, such as the GDP growth rate, employment figures, and manufacturing output, are also factors affecting the foreign exchange market. Positive economic data generally strengthens a currency, while negative data can weaken it.

Political stability and economic performance

Economic performance and political stability majorly impact a country’s exchange rate. Countries with stable political environments and strong economies typically have stronger currencies.

Market sentiment

The foreign exchange market is heavily influenced by market sentiment and speculation. Rumours, news, and expectations about future economic or political events can cause rapid fluctuations in exchange rates.

Government/public debt

High levels of government debt is also one of the factors that affect the forex market. It can lead to inflation and cause a country’s currency to depreciate. Investors might be less willing to hold government bonds if they believe the risk of default is high.

Terms of Trade

Terms of trade refer to the ratio between a country’s export and import prices. If a country’s exports are more expensive or its imports cheaper, its terms of trade have improved, which can lead to an appreciation of its currency.

Current account deficits

A current account deficit occurs when a country spends more on imports than it earns from exports. It can lead to the depreciation of the local currency as there is more demand for foreign currencies to pay for the excess imports.

Government intervention

Governments and central banks can intervene in the foreign currency exchange market to influence their currency’s value. It might involve buying or selling large amounts of currency or adjusting interest rates.

The stock markets

The dynamics of stock markets are also among the factors affecting forex rates. A country’s stock market performance often correlates with its currency value. A strong stock market can attract foreign investment, increasing demand for the local currency and causing it to appreciate.

Economic recession

During economic recessions, currencies tend to weaken as investors seek safer assets. For instance, during a global economic downturn, currencies of emerging markets like India might depreciate against those of more stable economies.

Why is the Exchange Rate Important?

Several reasons highlight the importance of the foreign exchange rate. For companies participating in global commerce, exchange rates directly affect the price of imports and the earnings from exports. Exchange rates have implications for investment returns. Even for individuals, exchange rates are the rates that govern how much you will receive against a foreign currency when travelling regionally or abroad.

Exchange rates can also signal a country’s economic health. A strong currency always reflects a robust economy, while a weakening currency may lead to economic trouble.

Impact of Foreign Exchange on the Economy

The impact of foreign exchange rate fluctuations can be far-reaching:

- A strong currency can render a country’s exports more expensive and imports more affordable, risking a trade deficit.

- Conversely, a weak currency can increase exports but also raise the cost of imports, contributing to inflation.

- Exchange rates influence inflation, interest rates, and even employment levels.

- A falling Indian rupee might increase the cost of imported goods, creating inflation. The RBI can raise interest rates in response, which can then affect borrowing costs and economic growth.

Conclusion

The world of foreign exchange is complex and dynamic, influenced by a myriad of factors ranging from economic indicators to political events and market sentiment. Understanding these factors can help you make more informed decisions, whether you are a business owner, an investor, or simply planning your next international trip.

Related Articles

FAQs on Factors Influencing Foreign Exchange Rates

What are the different types of foreign exchange rates?

There are several types of foreign exchange rates, including fixed, floating, and pegged rates. Central banks set fixed rates, floating rates are determined by supply and demand in the forex market, and pegged rates are fixed to another currency or basket of currencies.

How does market sentiment influence exchange rates?

Market sentiment can significantly impact exchange rates. Positive sentiment about a country’s economic prospects can strengthen its currency, while negative sentiment can weaken it. News, economic data releases, and geopolitical events can all sway market sentiment.

How does inflation affect exchange rates?

Inflation typically leads to a depreciation of a country’s currency. When inflation is high, the currency’s purchasing power decreases, making it less attractive to foreign investors and potentially leading to a lower exchange rate.

How do interest rates impact currency exchange rates?

Higher interest rates generally strengthen a country’s currency, attracting foreign investment. When a country raises its interest rates, its currency often appreciates as investors seek higher returns.

How do global economic conditions impact exchange rates?

International economic conditions can also influence exchange rates. When the global economy is uncertain, investors typically rush to ‘safe-haven’ currencies such as the US Dollar or Swiss Franc, which can appreciate those currencies against others.

Can a country's imports and exports affect foreign exchange rates?

Yes, a country’s import and export balance, known as the trade balance, can significantly affect exchange rates. A trade surplus (more exports than imports) typically strengthens a currency, while a trade deficit can weaken it.

What strategies can individuals use to mitigate the impact of exchange rate fluctuations?

Individuals can use strategies like hedging, diversifying investments across different currencies, or using forward contracts to lock in exchange rates for future transactions. It’s also wise to stay informed about economic indicators and geopolitical events that might impact exchange rates.