- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Flywings Simulator Training IPO

₹1,08,600/600 shares

Minimum Investment

IPO Details

05 Dec 25

09 Dec 25

₹1,08,600

600

₹181 to ₹191

NSE

₹57.05 Cr

12 Dec 25

Flywings Simulator Training IPO Timeline

Bidding Start

05 Dec 25

Bidding Ends

09 Dec 25

Allotment Finalisation

10 Dec 25

Refund Initiation

11 Dec 25

Demat Transfer

11 Dec 25

Listing

12 Dec 25

Flywings Simulator Training Centre Ltd.

Incorporated in 2011 and headquartered in Gurgaon, Flywings Simulator Training Centre Ltd. provides comprehensive aviation training, including cabin crew, ground staff, emergency procedures, first aid, and safety operations. The company serves domestic and international airlines, using advanced simulators and training devices like A-320 CEET, Boeing 787 door trainers, fire trainers, and water survival drills. Over the last three years, Flywings has trained more than 20,000 aviation professionals, ensuring high-quality, practical, and industry-aligned training.

Flywings Simulator Training IPO Overview

Flywings Simulator Training Centre IPO is a book-built issue worth ₹57.05 crore, consisting of a fresh issue of 0.25 crore shares aggregating ₹47.99 crore and an offer for sale of 0.05 crore shares aggregating ₹9.05 crore. The IPO opens on 5 December 2025 and closes on 9 December 2025, with allotment expected on 10 December 2025. The company will list on NSE SME, with a tentative listing date of 12 December 2025. The price band is ₹181–₹191 per share, with a lot size of 600 shares. Gretex Corporate Services Ltd. is the book-running lead manager, Bigshare Services Pvt. Ltd. is the registrar, and Gretex Share Broking Pvt. Ltd. is the market maker.

Flywings Simulator Training IPO Details

| Particulars | Details |

| IPO Date | 5 December 2025 to 9 December 2025 |

| Listing Date | 12 December 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹181 to ₹191 per share |

| Lot Size | 600 Shares |

| Total Issue Size | 29,86,800 shares (aggregating up to ₹57.05 Cr) |

| Reserved for Market Maker | 1,49,400 shares (₹2.85 Cr) |

| Fresh Issue (Ex Market Maker) | 23,63,400 shares (₹45.14 Cr) |

| Offer for Sale | 4,74,000 shares (₹9.05 Cr) |

| Net Offered to Public | 28,37,400 shares (₹54.19 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | NSE SME |

| Shareholding Pre Issue | 76,64,328 shares |

| Shareholding Post Issue | 1,01,77,128 shares |

Flywings Simulator Training IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Net Issue |

| Retail | Not less than 35% of the Net Issue |

| NII | Not less than 15% of the Net Issue |

Flywings Simulator Training IPO Lot Size

| Application | Lots | Shares | Amount |

| Individual Investors (Retail) Min | 2 | 1,200 | ₹2,29,200 |

| Individual Investors (Retail) Max | 2 | 1,200 | ₹2,29,200 |

| S-HNI Min | 3 | 1,800 | ₹3,43,800 |

| S-HNI Max | 8 | 4,800 | ₹9,16,800 |

| B-HNI Min | 9 | 5,400 | ₹10,31,400 |

Flywings Simulator Training IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 85.69% |

| Post-Issue | To be calculated |

Objectives of the Proceeds

- Capital expenditure towards pilot training equipment: ₹35.34 Cr

- General corporate purposes

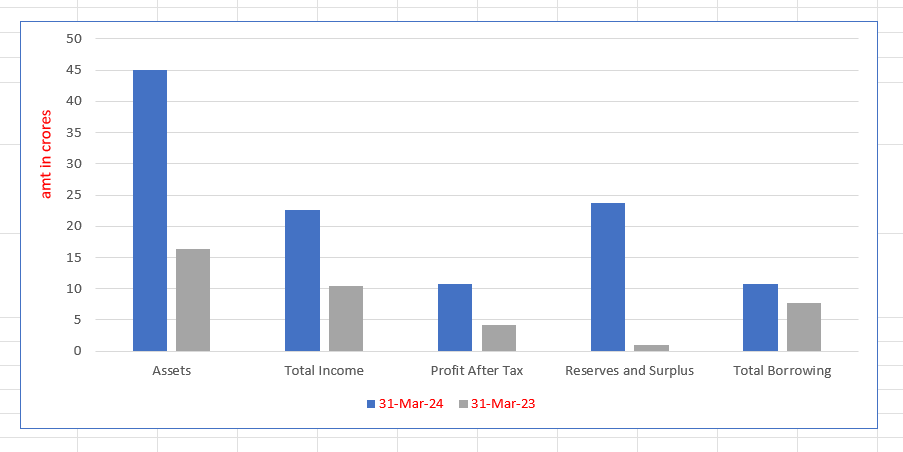

Key Financials (Standalone, ₹ Crore)

| Particulars | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 44.95 | 16.38 |

| Total Income | 22.60 | 10.44 |

| Profit After Tax | 10.74 | 4.16 |

| Reserves and Surplus | 23.74 | 1.07 |

| Total Borrowing | 10.70 | 7.67 |

Financial KPIs (FY March 2025)

| KPI | Value |

| ROE | 34.75% |

| ROCE | 28.62% |

| Debt/Equity | 0.37 |

| RoNW | 34.75% |

| PAT Margin | 54.02% |

| EBITDA Margin | 66.85% |

| Price to Book Value | 3.75 |

| Market Capitalization | ₹194.38 Cr |

| EPS Pre-IPO | 14.24 |

| EPS Post-IPO | 5.42 |

| P/E (Pre-IPO) | 13.41 |

| P/E (Post-IPO) | 35.22 |

SWOT Analysis of Flywings Simulator Training IPO

Strength and Opportunities

- Experienced promoters and skilled management team

- Well-established domestic market presence

- Strong relationships with domestic airlines

- State-of-the-art simulator infrastructure

- Recurring revenue from repeat training contracts

Risks and Threats

- Limited international presence

- Regulatory changes may impact operations

- High dependency on airline clients

- High operational costs and maintenance

- Competition from emerging training providers

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Flywings Simulator Training Centre Ltd.

Flywings Simulator Training Centre IPO Strengths

- Promoters and management have extensive experience in aviation training.

- Strong, specialized simulator infrastructure aligned with majority of Indian fleet types.

- Recurring revenue from training contracts with domestic and international airlines.

- Regulatory compliance model ensures operational flexibility and reliability.

- Strategic location in Gurgaon with high entry barriers for competitors.

- Well-established presence in aviation training for over a decade.

Peer Group Comparison

- As per the DRHP, there are no comparable listed peer of the company and therefore information related to peer is not provided

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Flywings Simulator Training Centre IPO

How can I apply for Flywings IPO?

Apply via HDFC SKY using UPI-based ASBA application process only.

What is the minimum lot size for retail investors?

Retail investors must apply for a minimum of 1,200 shares per lot.

Who is the book running lead manager for the IPO?

Gretex Corporate Services Ltd. is the book running lead manager for the IPO.

On which exchange will the IPO be listed?

The IPO will list on NSE SME, tentatively on 12 December 2025.