- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Foodlink F&B Holdings India IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Foodlink F&B Holdings India IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

About Foodlink F&B Holdings India Limited

Incorporated in 2003, Foodlink F&B Holdings (India) Limited is a prominent catering and hospitality provider with operations in India and abroad. Its integrated business model spans Events Catering, Casual Dining Restaurants & Cloud Kitchens, and Banquets under Jade Luxury Banquets. As of December 31, 2024, it operated in India and the UAE, catering events in several countries including Switzerland, Italy, France, and Thailand. The company runs 30 dining and cloud kitchen units, along with five centralised kitchens in key Indian cities.

Foodlink F&B Holdings India Limited IPO Overview

Foodlink F&B Holdings (India) Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on June 28, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is structured as a Book Build Issue, comprising a fresh issue of shares aggregating up to ₹160.00 crore and an Offer for Sale (OFS) of up to 1.20 crore equity shares. The equity shares are proposed to be listed on both NSE and BSE. While the book running lead manager is yet to be declared, MUFG Intime India Pvt. Ltd. has been appointed as the registrar to the issue. Key details such as IPO opening and closing dates, price band, and lot size have not yet been announced.

As per the DRHP, the face value of each share is ₹2, and the issue type is a fresh capital-cum-offer for sale under the bookbuilding process. The fresh issue will consist of shares worth ₹160.00 crore, and the OFS will involve 1,19,53,535 shares of ₹2 each, aggregating up to an amount yet to be disclosed. The company had a pre-issue shareholding of 5,22,98,600 shares, with promoter Sanjay Manohar Vazirani holding 63.4% before the issue. The post-issue shareholding details are yet to be specified.

Foodlink F&B Holdings India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Fresh Issue | ₹160 crore |

| Offer for Sale (OFS) | 1.20 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post -issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Foodlink F&B Holdings India Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Foodlink F&B Holdings India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹(3.10) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | (17.88%) |

| Net Asset Value (NAV) | ₹17.92 |

| Return on Equity (RoE) | – |

| Return on Capital Employed (RoCE) | – |

| EBITDA Margin | 8.12% |

| PAT Margin | (4.04%) |

| Debt to Equity Ratio | – |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding of capital expenditure towards setting up two Proposed Centralized Kitchens by the Company | 408.9 |

| Investment in FGRCS, the Material Subsidiary, for funding of capital expenditure towards setting up four Proposed Casual Dining Restaurants | 454.0 |

| Repayment or prepayment, in full or in part, of all or a portion of certain outstanding borrowings availed by the Company and FGRCS | 284.5 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

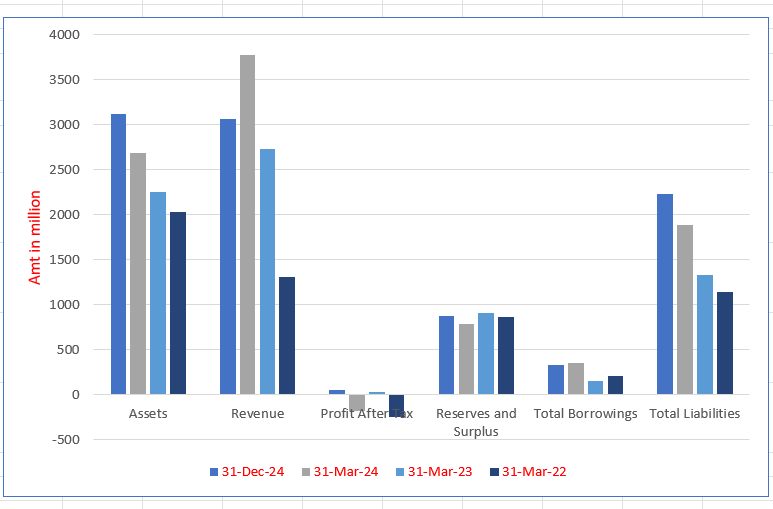

Foodlink F&B Holdings India Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 3119.5 | 2681.34 | 2252.59 | 2030.33 |

| Revenue | 3063.85 | 3771.93 | 2731.32 | 1301.77 |

| Profit After Tax | 51.43 | (184.45) | 31.24 | (253.41) |

| Reserves and Surplus | 871.67 | 779.38 | 904.70 | 859.91 |

| Total Borrowings | 325.85 | 352.99 | 151.78 | 202.27 |

| Total Liabilities | 2230.86 | 1885.44 | 1331.37 | 1141.74 |

Financial Status of Foodlink F&B Holdings India Limited

SWOT Analysis of Foodlink F&B Holdings India IPO

Strength and Opportunities

- Strong growth trajectory with FY24 revenue of ₹384.24 crore, up 39% year-on-year, driven by higher banqueting and restaurant sales.

- Secured a 10-year catering tender for India’s largest convention and exhibition centre in Dwarka in Feb 2024.

- Comfortable capital structure with overall gearing at 0.35x and strong debt coverage ratios.

- Integrated model spanning Events Catering, Casual Dining & Cloud Kitchens, and Banquets under Jade Luxury Banquets.

- Global event footprint—catered in Switzerland, UAE, France, Maldives, and other countries—enhances brand appeal.

- Expansion plans backed by IPO proceeds to build two new centralised kitchens and four restaurants.

- Rising organised catering market in India with strong growth prospects.

- Backing from notable investors adds credibility ahead of IPO.

Risks and Threats

- Moderate and fluctuating profitability, with PBILDT margin declining from 7.34% in FY23 to 5.55% in FY24, and PAT margin down to 0.86%

- Intense competition in luxury catering and organised food service markets, including imitation risks and pricing pressure.

- Dependence on skilled chefs and execution staff; high attrition could disrupt operations.

- Vulnerability to intellectual property and confidentiality breaches, which could erode culinary uniqueness.

- Operational risks like disruption in centralised kitchens, fixed cost burdens, and supply chain issues.

- Brand and reputation risks from negative publicity or regulatory non-compliance.

- Exposure to foreign exchange fluctuations and geopolitical risks due to overseas operations.

- Vulnerability to economic cycles and seasonal demand fluctuations in events and hospitality.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Foodlink F&B Holdings India Limited

Foodlink F&B Holdings India Limited IPO Strengths

India’s Leader in Ultra-Luxury Catering and Integrated F&B

Foodlink F&B Holdings India Limited, India’s largest organised ultra-luxury catering company by Fiscal 2024 revenue, delivers premium events catering, casual dining, cloud kitchens, and banquets. Serving high-profile weddings, MICE, sports, and global celebrations, its curated menus, innovation, and year-round operations position it as the trusted choice for elite clientele.

Trusted Innovator in Global Luxury Catering

Foodlink F&B Holdings India Limited, a global luxury food services leader, delivers curated culinary experiences through innovation, premium quality, and regional expertise. With over 20 years’ experience, it serves marquee clients—celebrities, corporates, HNIs, and government entities—across luxury weddings, sports, and corporate events, fostering lasting relationships through exceptional service and cultural understanding

Extensive Geographic Reach in Luxury Catering

Foodlink F&B Holdings India Limited has built a scalable model that overcomes India’s fragmented culinary landscape, maintaining consistency in regional delicacies. Operating across India and the UAE, it caters simultaneous large-scale events, leveraging technology, logistics, and supply chain expertise to deliver high-quality gastronomy tailored to diverse cultural and regional preferences.

Experienced Leadership Driving Strategic Growth

Foodlink F&B Holdings India Limited is guided by Promoter Sanjay Manohar Vazirani, with over three decades of luxury catering and F&B expertise in India and the UAE. Supported by a seasoned management team, the company combines hands-on leadership, industry knowledge, and structured business heads to drive operations, anticipate trends, and expand integrated food services successfully

More About Foodlink F&B Holdings India Limited

Foodlink F&B Holdings India Limited is a global luxury food services company specialising in curated culinary experiences driven by innovation. According to the F&S Report, it is India’s largest organised ultra-luxury and luxury catering company by Fiscal 2024 revenue, serving weddings, MICE events, sports gatherings, and high-profile celebrations. Its premium quality, customised menus, and regional specialisation have earned the trust of India’s wealthiest families, leading corporates, and international clients.

The company operates in India and the UAE, with events catered across Switzerland, Turkey, Italy, Spain, France, Oman, Qatar, Egypt, Jordan, Maldives, Thailand, and Nigeria.

Integrated Business Segments

Foodlink’s operations span three complementary verticals:

- Events Catering – Core to the brand identity, delivering luxury, customised catering for weddings, sports, social, and corporate events worldwide. Notable capabilities include handling 30,000+ guests at a single event and multiple simultaneous large-scale events. Innovations include dramatic serving styles such as burrito bowls with smoke bubbles and avocado crostini on helium balloons.

- Casual Dining Restaurants & Cloud Kitchens – Established in 2008 (restaurants) and 2022 (cloud kitchens), operating 30 outlets across India and Dubai under brands such as China Bistro, India Bistro, Glocal, and Art of Dum.

- Banquets & Integrated F&B Services – Featuring Jade Banquets in Mumbai and Ahmedabad, and a 10-year exclusive mandate for a large convention centre in Delhi with 6,000+ seating.

Operational Strengths

- Centralised Kitchens – Six facilities (five in India, one in Dubai) producing over 100,000 meals per day, ensuring consistent quality and authentic flavours through a hub-and-spoke model.

- International Infrastructure – Storage facilities in Mumbai and Dubai to support overseas catering.

- Prestigious Clientele – Includes celebrities, cricketers’ families, HNIs, corporates, and government entities.

Key Statistics (Fiscal 2024)

- Events Catering: ₹2,241.15 million (59.42% of revenue)

- Casual Dining & Cloud Kitchens: ₹1,074.74 million (28.49%)

- Banquets & Integrated F&B Services: ₹428.05 million (11.35%)

- Revenue split: 77.16% from India, 22.84% from overseas markets

Market Position

Leveraging a first-mover advantage in luxury catering, Foodlink has built a year-round business model that mitigates seasonality, combining event catering excellence with steady revenue from banquets and dining ventures. This unique integration has positioned the company as a trusted culinary partner for some of the most exclusive events and venues globally.

Industry Outlook

India’s overall foodservice market, encompassing restaurants, catering, and on-demand delivery, is thriving. It is expected to surge from USD 85 billion in 2025 to USD 139.8 billion by 2030, at an estimated CAGR of 10.4%. Key contributors to this growth include rising urban consumption, increasing adoption of digital food delivery, and evolving consumer lifestyles.

Cloud Kitchens & Virtual Catering

- The Indian cloud kitchen market was valued at approximately USD 1.1 billion in 2024 and is projected to grow to USD 2.84 billion by 2030, reflecting a rapid CAGR of ~16.6%.

- Forecasts suggest it could reach USD 3.21 billion by 2033, with a CAGR of 12.7%.

- Other estimates predict growth from USD 969 million in 2023 to USD 1.13 billion in 2024, and further to USD 2.95 billion by 2032, at roughly 13.2% CAGR.

These models are driven by cost efficiency, quick scalability, booming delivery demand, and strong investor interest.

High-End Catering & Luxury Segments

High-end catering—covering weddings, MICE, and luxury celebrations—is witnessing an even sharper rise, with projected CAGR of 25%–30% over the next five years, as demand expands to tier-2 and tier-3 cities.

Growth Drivers at a Glance

- Urbanisation, rising incomes, and digital platforms fuelling food deliveries and curated dining experiences.

- Cost-effective infrastructure of cloud kitchens supporting expansion.

- Luxury lifestyle adoption in emerging cities driving demand for premium culinary events.

- Strong investor interest in scalable, tech-driven food ventures.

How Will Foodlink F&B Holdings India Limited Benefit

- Positioned to capitalise on India’s rapidly expanding foodservice market, projected to grow at a 10.4% CAGR.

- High-end catering expertise aligns with the luxury segment’s forecast 25–30% CAGR, especially in tier-2 and tier-3 cities.

- Cloud kitchen and casual dining operations tap into a segment growing at over 13% CAGR, driven by delivery demand.

- Integrated business model ensures year-round revenue streams, reducing dependency on seasonal events.

- Strong presence in India and the UAE, with overseas catering capabilities, enabling access to global high-value events.

- Centralised kitchens and hub-and-spoke distribution enhance scalability while maintaining quality.

- Prestigious clientele and brand reputation attract repeat business and premium pricing.

- Exclusive banquet mandates secure long-term, stable revenue from large-scale venues.

- Innovation in presentation and menu design caters to evolving luxury dining trends.

- Investor interest in scalable, tech-driven food ventures supports expansion potential.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per DRHP.

Key Strategies for Foodlink F&B Holdings India Limited

Expand Events Catering Across Geographies

Foodlink F&B Holdings India Limited plans to scale its Events Catering operations to new regions, focusing on sports and corporate segments. Leveraging centralized kitchens, enhanced menus, and increased capacity, it aims to serve larger, diverse clientele while capitalising on India’s organised catering market growth and rising international demand.

Expand Casual Dining Restaurants & Cloud Kitchens

Foodlink F&B Holdings India Limited intends to grow its Casual Dining and Cloud Kitchens portfolio on an asset-light model. By opening new China Bistro, India Bistro, Glocal, and Art of Dum outlets in India, UAE, and the UK, the company aims to replicate its templatised model and increase market reach efficiently.

Expand Banquets and Integrated F&B Services Geographically

Foodlink F&B Holdings India Limited aims to extend its Banquets and Integrated F&B Services business across India, leveraging the established ‘Jade’ brand, centralized kitchens, and long-term lease models. New banquets in Delhi, Rajasthan, and other cities will expand customer base, margins, and provide F&B services at large-scale conventions and exhibitions

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Foodlink F&B Holdings India Limited IPO

How can I apply for Foodlink F&B Holdings India Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the issue size of the Foodlink F&B Holdings IPO?

The IPO comprises a fresh issue of equity shares aggregating up to ₹160 crore and an offer for sale of 12 million shares.

Who are the Book Running Lead Managers for the IPO?

Equirus Capital Private Limited and JM Financial Limited are managing the IPO process.

When is the allotment date for the IPO?

The IPO allotment date is expected to be announced after the finalization of the basis of allotment.

What is the listing date for the Foodlink F&B Holdings IPO?

The listing date for the IPO will be announced after the allotment process is completed.