- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

- What is Foreign Exchange Market?

- How Does the Foreign Exchange Market Work?

- Importance of Foreign Exchange Market

- Types of Foreign Exchange Markets

- Advantages of the Foreign Exchange Market

- Disadvantages of the Foreign Exchange Market

- How Does the Foreign Exchange Market Affect the Economy?

- Conclusion

- FAQs on Foreign Exchange Market

- What is Foreign Exchange Market?

- How Does the Foreign Exchange Market Work?

- Importance of Foreign Exchange Market

- Types of Foreign Exchange Markets

- Advantages of the Foreign Exchange Market

- Disadvantages of the Foreign Exchange Market

- How Does the Foreign Exchange Market Affect the Economy?

- Conclusion

- FAQs on Foreign Exchange Market

Foreign Exchange Market Overview: Meaning, Functions, Benefits

By HDFC SKY | Updated at: Jul 29, 2025 03:33 PM IST

Summary

The forex market is a global, decentralised platform where currencies are traded 24/5, supporting international trade and investments. With over \$7 trillion in daily turnover, it’s the most liquid financial market. It includes spot, forward, futures, and options trading. Major centres like London and New York drive global activity. Exchange rates are influenced by interest rates, economic data, and geopolitical events. Key currencies include USD, EUR, JPY, and GBP. Retail traders access the market via brokers, with currency pairs classified as major, minor, or exotic.

The foreign exchange market, often called the forex market, decides the value of one country’s currency compared to another worldwide.

The forex market is not just one place but a connected network of financial hubs worldwide. Cities like London, New York, and Tokyo are major centers in the forex market. In these centers, people and big organisations trade currencies. For example, they might buy US dollars using Japanese Yen, or sell Euros to get British Pounds.

Beyond exchanging currencies for travel or business, many traders also try to predict whether a currency’s value will go up or down against another. This is called speculation, and it’s a big part of the forex market.

The foreign exchange market determines the currency exchange rate internationally. It is one of the largest segments of financial markets in the world, comprising a robust network of several financial centres.

This article will simplify the meaning of the foreign exchange market for you. By the time you are finished reading it, you will have a solid grasp of what it is, how it works, and everything in between.

What is Foreign Exchange Market?

Foreign exchange is the process of converting one currency to another. The agreed rate of exchange between both parties becomes your exchange rate. This rate may fluctuate with changing market situations, which causes exchange rate risk. However, major players use foreign exchange trading to lower the exchange rate risk.

The foreign exchange market is a hub for exchanging global currencies. The governing body of the foreign currency market is decentralised. This means that no international agency or government controls it. Usually, governments and commercial banks are key players here but exporters, manufacturers, and importers participate in large numbers as well.

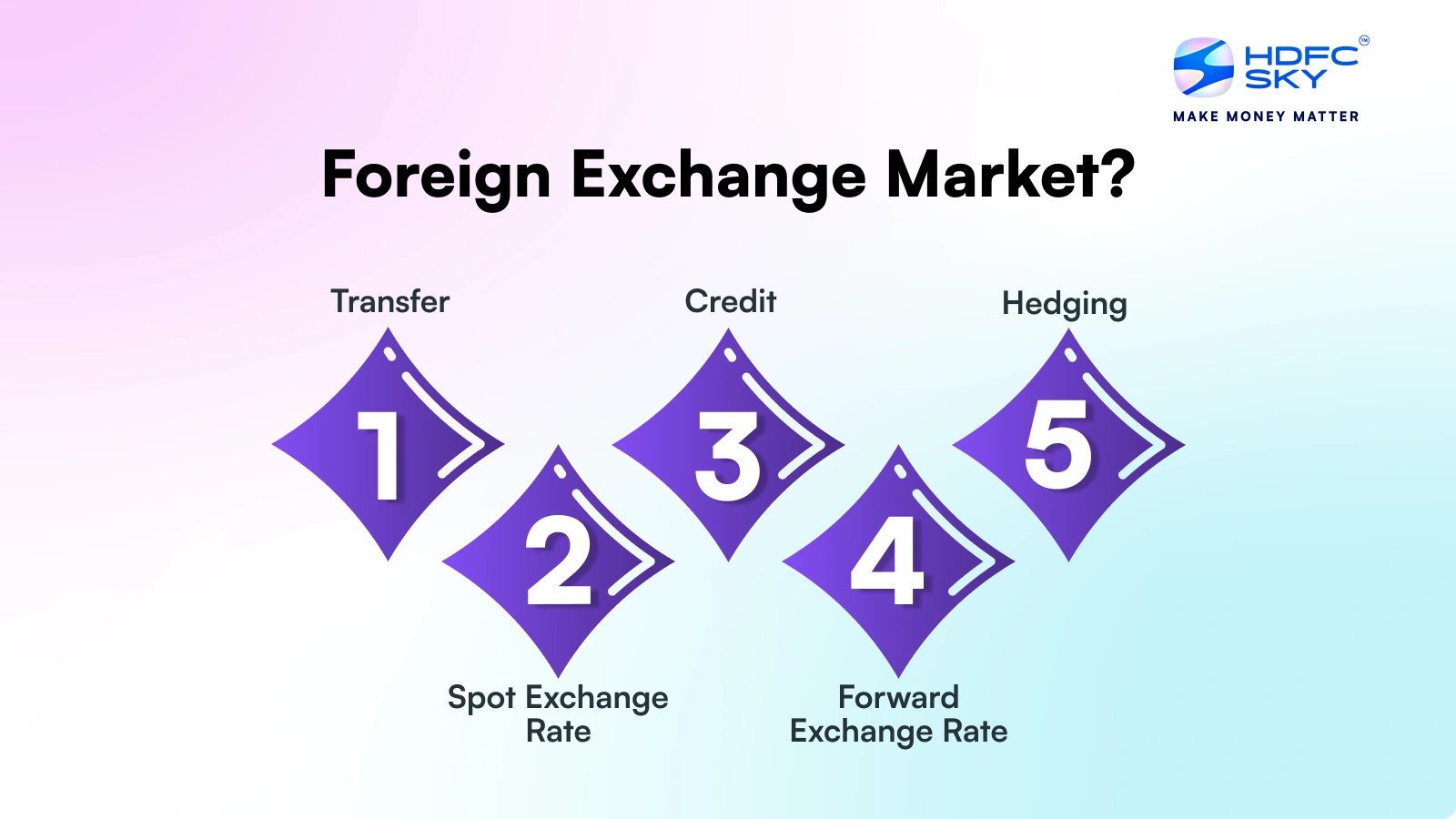

The global foreign exchange market is dynamic. It has high liquidity and transparency. The major function of foreign exchange market are listed below:

- Transfer: The preliminary job of a foreign exchange market is moving money from your country to your proposed country.

- Credit: The foreign exchange market offers credit to its investors. The short-term credit is then used to move goods and services freely across the country’s borders.

- Hedging: Hedging in the foreign exchange market offers protection against fluctuating exchange rates between two currencies.

In the foreign exchange market mainly two types of foreign exchange rates are quoted to traders and other parties-

- Spot Exchange Rate: The spot exchange rate is used for direct exchanges between two currencies. It lasts for a shorter time frame and is generally used for quick currency conversions to fulfill immediate obligations.

For example, a traveller from India exchanges his rupees to get Japanese yen at the Tokyo airport. - Forward Exchange Rate: This is the rate that the concerned parties agree on for future currency exchanges. The period can be up to 12 months.

How Does the Foreign Exchange Market Work?

The working mechanism of the foreign exchange market relies on the currency exchange from one form to another. The participants exchange their currencies to facilitate international trade and investments. If you are a regular trader in this market, you may speculate how the currency price moves. Both the forces of demand and supply impact the rate of foreign exchange. A foreign exchange converter can easily help you in determining the exchange rate.

There are quite a good number of factors influencing currency values. These include geopolitical events, economic indicators, and policies formulated by the central banks. You can make the transactions either online or across the counter. The global foreign exchange market trading operates 24×7 on all five working days of week. This working mode follows the difference in the time zones between several countries.

The foreign exchange market trading facilitates –

- Currency conversion

- Mitigation of foreign exchange risk

- Allows investors to speculate in currencies

Importance of Foreign Exchange Market

Understanding the foreign exchange market importance can be helpful in:

- Enabling businesses to exchange their currencies in the global market and trade seamlessly and efficiently.

- The foreign exchange market determines the currency value. Its impact is evident across trade, investments and travel.

- It encourages companies to invest in foreign markets.

- It offers protection to traders and investors from fluctuating currency values.

- It connects the worldwide economies to promote financial growth to achieve global economic stability.

Types of Foreign Exchange Markets

1. Spot Market

The fastest currency exchange happens in this segment. The transactions are spontaneous here and largely depend on currency exchange rates. Around 1/3rd of the total global currency exchange happens in the Spot Market segment. Usually, you are done with your transactions within 1 or 2 days.

2. Forward/ Futures Market

The concerned parties involved in this segment decide to trade at a specific time in future. The exchange rate is determined today for future transactions.

3. Option Market

Option markets allow investors to insure their underlying currency without buying or selling it from their portfolio due to currency risk and volatility. They are just like stock or index options, which are traded in stock exchanges.

4. Swap Market

The swap market involves an exchange of cash flows derived from several financial instruments. These also include exchanging your liabilities. The cash flows and liabilities are often based on principal amount.

Advantages of the Foreign Exchange Market

The benefits of the foreign exchange market are many. Some of the prominent benefits are listed below-

24×7 Trading

Unlike the securities market, there is no fixed foreign exchange market hours in the global forex market. Global Foreign exchange trading is a 24×7 business due to varying time zones for national foreign exchange markets. However, the Indian foreign exchange market works between 9:00 am to 5:00 pm from Monday to Friday.

High Liquidity

The foreign exchange rate market is highly liquid across the globe. This means that the market is open for transactions at any time. So, if you are a buyer, be assured that you will always have sellers.

Diversification

The foreign exchange market’s transfer function is simply changing money from one currency to another. This lets people move buying power from one country to the next, making it easier for them to diversify their wealth across different currencies.

Transparency

The market is relatively transparent with its traders. You can easily access its real-time data and pricing information.

Disadvantages of the Foreign Exchange Market

The disadvantages of the foreign exchange market are as follows –

Highly Volatile

The high volatility of the foreign exchange market is evidently felt by traders. It means that prices fluctuate quite frequently and are unpredictable. Thus, you may face higher risks.

Fraud Risk

The global scenario of the foreign currency exchange market increases its chances of facing associated frauds and scams. Therefore, you must be cautious when selecting your trading platform and brokers.

Lack of Regulatory Backing

In India it is legally allowed to trade in INR pairs of other major currencies like USD-INR (US Dollars-Indian Rupee), JPY-INR (Japanese Yen-Indian Rupee), etc on permitted exchanges like NSE and BSE. The foreign exchange market in India for other currencies is not as regulated as other segments of the financial markets. Trading in other currency pairs is likely to increase the risk of fraud activities.

Market Complexities

Foreign exchange trading is a complex phenomenon. To start, you need to be thorough with your knowledge and expertise. If you are new to trading, you may initially need hand-holding for sometime before you can grasp the key concepts.

Risk of Exchange Rate

The fluctuating exchange rates could result in significant losses especially during the times of geopolitical upheaval and central bank announcements. Before trading, you should consider all the risk factors.

How Does the Foreign Exchange Market Affect the Economy?

The foreign currency exchange market significantly impacts the economy in multiple ways –

Exchange Rates

The market decides how two currencies will undergo an exchange. This decision impacts the cost of goods importation and export competitiveness. It also impacts the trade balance and overall economic well-being of the country.

Inflation

Even a slight movement in the exchange rate can influence the inflation rate of any country. A depreciating currency increases the import cost, fueling inflation. In this scenario, the central bank must adjust its interest rates to keep the exchange rates under control.

Reserves of Currency

Central banks store large currency exchange reserves to manage their currencies’ value in international markets. These reserves significantly impact a country’s monetary policies and overall financial stability as every country is dependent on each other in this globalised world.

Tourism

Exchange rate fluctuations influence the economy’s appeal to tourists worldwide. A weaker currency attracts more tourists and boosts the national economy by increasing the currency reserves and circulation of money in economy.

Economic Confidence

A strong currency is the key to greater economic confidence. It encourages the citizens to invest and contribute more to economic growth. Conversely, a depreciating currency erodes economic confidence.

Conclusion

The foreign exchange market is vital to the global economy. It enables currency exchange for trading, investing and travelling. The market is acknowledged as one of the largest and most highly liquid markets. The contributions of businesses, banks, and investors drive it. Understanding the basic principles of foreign exchange markets and trading is crucial. Whether you are a trading beginner or a pro, it opens new dimensions to understanding the dynamics of global economies.

Related Articles

FAQs on Foreign Exchange Market

What is the Foreign Exchange Market?

A foreign current exchange market or FX or Forex Trade is a decentralised place where you exchange currencies. This exchange follows a careful consideration of the exchange rate. As the trading volume is high here, the market is considered the largest in the global economy.

What Factors Influence the Foreign Exchange Market?

Some of the key factors which influence foreign exchange rates are Interest rates, inflation, economic growth, currency account deficit, geopolitical stabilities, governmental debt, monetary policies, and market sentiments.

What is the role of Demand and Supply in the Foreign Exchange Market?

Demand and supply forces in the foreign exchange market determine the currency’s exchange rate. There are four scenarios through which demand and supply may trigger change in exchange rate-

Increased demand – exchange rate rises

Decreased demand – exchange rate falls

Increased supply – exchange rate falls

Decreased supply – exchange rate rises

Who are the Key Participants in the Foreign Exchange Market?

Central banks, commercial banks, retail traders, corporations, investment banks, hedge funds, foreign exchange brokers, money transfer companies, and non-banking foreign exchange companies are the key foreign exchange market participants.

What is the Real Effective Exchange Rate (REER)?

REER measures a country’s currency strength by averaging its value against a group of important trading partners’ currencies. This average is “weighted” and these weights are decided by how much trade the country does with each partner country.

What Causes Exchange Rates to Fall?

Although there are many different reasons for a fall in exchange rates of a country the key reasons are-

A country’s currency weakens when it imports more than it exports.

Lower interest rates also make a currency less appealing to investors, decreasing its value.

Economic problems like downturns, high debt, and lower productivity further contribute to a declining exchange rate.

Additionally, factors like inflation, market feelings, political stability, and government actions can also push a currency’s value downwards.