- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Fractal Analytics IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Fractal Analytics IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Fractal Analytics Limited

Fractal Analytics, founded in March 2000, is a worldwide enterprise AI and analytics company that supports major businesses in making more intelligent decisions. With over two decades of experience, the company cerates AI solutions by a combination of its deep technical know-how with domain and functional expertise. Fractal’s strengths comprise its leadership in a strong-growing AI market, long-standing partnerships with leading global clients, integrated technical and domain expertise, a culture of transparency and trust, a proven track record of innovation, and founder-led leadership with a long-term vision

Fractal Analytics Limited IPO Overview

Fractal Analytics Ltd. has filed a Draft Red Herring Prospectus (DRHP) with SEBI on August 12, 2025 to raise funds through Initial Public Offer (IPO). Fractal Analytics Ltd. IPO is a Book Build Issue of ₹4,900.00 crores consisting of a fresh issue of shares worth Rs ₹1,279.30 crores and an offer for sale (OFS) of ₹3,620.70 crores. The equity shares are proposed to be listed on NSE and BSE. Kotak Mahindra Capital Company Limitedd. is the book running lead manager and MUFG Intime India Private Limited. is the registrar of the issue. Key details like IPO dates, IPO price bands and lot size are yet to be announced. The promoters of the company are Srikanth Velamakanni, Pranay Agrawal, Chetana Kumar, Narendra Kumar Agrawal and Rupa Krishnan Agrawal and their shareholding pre-issue is 18.30%

Fractal Analytics Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹4900 crore |

| Fresh Issue | ₹1279.30 crore |

| Offer for Sale (OFS) | ₹3620.70 |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 14,15,52,559 shares |

| Shareholding post-issue | 15,96,46,975 shares |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Fractal Analytics Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Fractal Analytics Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹14.49 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 12.6% |

| Net Asset Value (NAV) | ₹104 |

| Return on Equity (RoE) | 12.72% |

| Return on Capital Employed (RoCE) | 15.76% |

| EBITDA Margin | 14.40% |

| PAT Margin | 8% |

| Debt to Equity Ratio | 0.15 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Investment in one of our Subsidiaries, Fractal USA, for pre-payment and/ or scheduled repayment, in full or in part, of its borrowings | 2649 |

| Purchase of laptops | 571 |

| Setting-up new office premises in India | 1211 |

| Investment in (a) research and development; and (b) sales and marketing under Fractal Alpha | 3551 |

| Funding inorganic growth through unidentified acquisitions and other strategic initiatives, and general corporate purposes | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

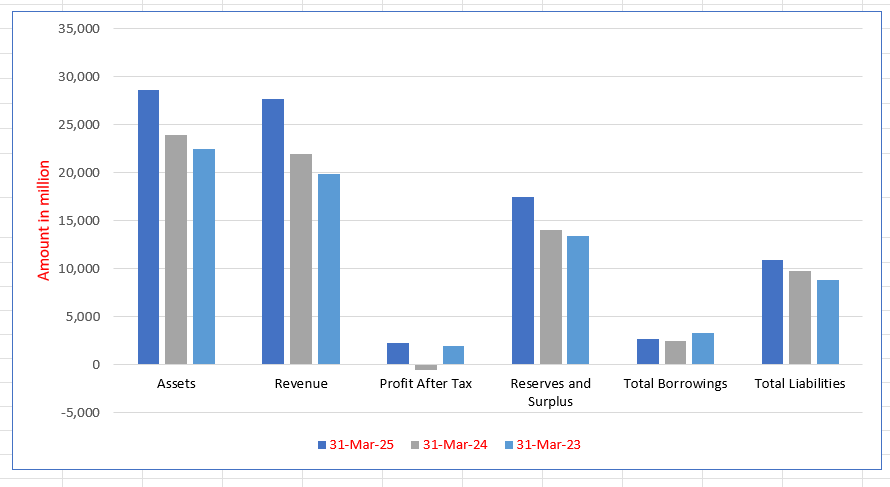

Fractal Analytics Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 28,576 | 23,920 | 22,487 |

| Revenue | 27,654 | 21,963 | 19,854 |

| Profit After Tax | 2206 | (547) | 1944 |

| Reserves and Surplus | 17,501 | 14,026 | 13,400 |

| Total Borrowings | 2662 | 2501 | 3256 |

| Total Liabilities | 10,922 | 9721 | 8853 |

Financial Status of Fractal Analytics Limited

SWOT Analysis of Fractal Analytics IPO

Strength and Opportunities

- Deep expertise in AI, advanced analytics, and enterprise AI solutions.

- Strong industry focus, offering tailored solutions in sectors like healthcare, CPG, and insurance

- G͏lobal presence with dual headquarte͏rs in Mumbai and New York, serving Fortune 500 clients

- Reco͏gnised͏ as͏ a lead͏e͏r in ind͏ependent ana͏lyst reports such as Forrester and Everest Group

- Strong R&͏D commitment and innovation in generative AI, neuroscience, ͏a͏nd neuro-design

- Strategic acquisitions and partnerships expanding product offerings

- IPO readiness and strong valuation, backed by significant funding

- Pr͏oven cred͏ibility as a “Great Place ͏to W͏ork” across multiple regions.

- Broad product suite including Cuddle.ai, Qure.ai, Eugenie, and Asper.ai.

Risks and Threats

- Heavy dependence on data quality; flawed client data can undermine analytics accuracy

- Intense competiti͏on ͏from ͏big pl͏ayers like Accenture, IBM, Wipro, and TCS

- Talent acquisition and retention challenges amid rising demand for AI experts

- Rapid t͏echn͏ologica͏l c͏hang͏e in AI͏ demands continuous R&D investment or risk obsolescence

- Vulnerability to poor data governance, compliance lapses, and inefficiencies

- Price pressure and margin sque͏eze due to crowde͏d ͏analytics services market

- Potential regulatory scrutiny or investor expectations ahead of going public

- Market shifts or economic downturns may impact large enterprise client budgets.

- Reliance on a few industries͏ i͏ncreases exposure to ͏sector-͏specifi͏c risks.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Fractal Analytics Limited

Fractal Analytics Limited IPO Strengths

Leading Player in a Large and Growing AI Market

Fractal is India’s leading pure-play enterprise data, analytics and AI company, recognised globally, with capabilities across the DAAI value chain. They recorded revenue growth at a CAGR of 18.0% over Fiscals 2023 to 2025 compared to the DAAI global third-party market’s CAGR of 11.0%, demonstrating their ability to win market share. While incorporated in India, they cater to a global clientele, with 91.6% of their revenue in Fiscal 2025 from clients located outside of India. They have also achieved global recognition through various industry awards.

Long-Standing and Growing Relationships with Marquee, Global Clients Contributing to A Diversified Revenue Base

Fractal works with marquee clients across focus industries such as CPGR, TMT, HLS and BFSI. Their clients include Citi, Costco, Franklin Templeton, Mars, Mondelez, Nationwide, Nestle, Philips, among others. Their revenue base is diversified both across and within our focus industries. Their revenues from their focus industries grew at a CAGR of 16.8% from Fiscal 2023 to Fiscal 2025. They strive to be a strategic partner to clients by delivering a wide range of end-to-end AI solutions across business functions and teams.

Deep and integrated technical, domain and functional expertise

The company designs, builds and delivers end-to-end AI solutions to clients across industries leveraging their technical, domain and functional capabilities and expertise. They have strong AED capabilities including Gen AI, machine vision, algorithmic decision making, cloud and data engineering, behavioural science and human-centred design, amongst others. Their AI expertise and capabilities are further strengthened through partnerships with large-scale cloud infrastructure providers such as Google Cloud, foundation model providers, AI labs such as Open AI, software companies, leading enterprise AI software providers such as C3 AI, and data aggregators such as Nielsen IQ.

Track Record of Inventing and Investing To Benefit Clients

Fractal has demonstrated a track record of inventing, by identifying emerging trends in AI, developing new AI solutions, which is evidenced by investments in R&D and acquiring businesses to expand our capabilities. Employees are encouraged to innovate through participation in conferences and expos, interaction with the research community as well as publishing of research papers. These have been recognized by global journals and conferences including Artificial Intelligence Applications & Innovations (“AIAI”), IEEE, ICLR, NeurIPS and Cognitive Computational Neuroscience (“CCN”).

Culture of Trust, Transparency & Freedom to Nurture Talent

The company continually strive to enhance AED capabilities by scaling their teams and upskilling and reskilling them. They focus on continuously training and upskilling employees through training and development programmes which include, (i) Fractal certified programs, external learning partnerships, internal learning programs, our in-house training academy and training through Analytics Vidhya. They have been awarded “Great Place to Work” by Great Place to Work® in India consistently for the last eight years (CY 2018 to 2025).

Experienced Founders-Led Management Team Focused on Building Fractal for the Long Term

The founders have been leading the business for over 25 years since inception and have been instrumental in AI vision and thought leadership. The co-founder, Srikanth Velamakanni, brings extensive expertise in AI. The co-founder, Pranay Agrawal has been recognised as one of Analytics India Magazine’s Top 20 CEOs of Data Science Service Providers, 2023. In 2019, Indian Institute of Management, Ahmedabad awarded Srikanth and Pranay the Young Alumni Achiever’s Award in the field of Entrepreneurship. The directors have diverse business experience in areas including technology, investment, marketing and consulting and many of them have held senior leadership positions in well-known organisations.

More About Fractal Analytics Limited

Company Overview

Founded in the year 2000, Fractal Analytics Limited stands as a globally renowned enterprise AI company. With more than 25 years of operational history, the company’s vision is to enhance decision-making in client enterprises through advanced AI-driven solutions. As of March 31, 2025, Fractal’s offerings are organized into two main segments:

- Fractal.ai, a company that excels in providing a variety of AI services and products, is primarily supported by Cogentiq, its leading agentic AI platform.

- Fractal Alpha operates as a group of autonomous AI businesses, focusing on serving core clients, expanding into new geographical markets, and reaching a broader audience.

These segments together address a wide array of needs across various industries and functions, providing tailor-made solutions for every business challenge.

Client-Centric Solutions

Fractal Analytics delivers end-to-end AI solutions that assist enterprises in navigating the entire AI transformation journey. Key areas of business impact include:

- Customer behaviour insights: Generative AI used to design customer intelligence systems for asset managers.

- Operational efficiency: AI-powered call auditing and sentiment monitoring engines for healthcare payers.

- Product innovation: Data-led insights enabling faster consumer goods launches.

- Sustainability: AI-driven product concept generators to track consumer trends.

- Executive decision-making: Building AI infrastructure for payments platforms to enhance growth strategies.

In Fiscal 2025, Fractal served 113 “Must Win Clients” (MWCs), including Citi, Costco, Nestlé, Philips, Mars, and Franklin Templeton. Notably, it partnered with a majority of the “magnificent seven” companies

Industry Focus

The company’s domain expertise spans:

- Consumer Packaged Goods & Retail (CPGR)

- Technology, Media & Telecom (TMT)

- Healthcare & Life Sciences (HLS)

- Banking, Financial Services & Insurance (BFSI)

By Fiscal 2025, Fractal worked with 10 of the 20 largest CPG companies, eight of the top 20 TMT players, and several leading BFSI, HLS, and retail enterprises.

Recognition & Innovation

Fractal has been consistently recognised as a global leader in analytics and AI by Forrester and Everest Group. Its research initiatives include Kalaido.ai (a diffusion-based text-to-image model), Vaidya.ai (medical foundation models), and Project Ramanujan (reasoning models).

Culture & Growth

Fractal’s people-centric culture has earned it recognition as a “Great Place to Work” across multiple countries. With a strong leadership team and sustained client relationships, the company continues to expand its AI capabilities to create long-term value and aspires to be the most respected enterprise AI company worldwide

Industry Outlook

Technological advancements, a competent workforce, and more corporate acceptance are fuelling India’s fast growth in A͏I and a͏nalitycs in͏d͏ustry. India’s artificial intelligence (AI) ͏marke͏t is expected to ͏grow at a CA͏GR of 25–35%, reaching $17Bn ͏by 2027.

Important Drivers of Growth

- From pilot programs to extensive AI deployments, companies are moving from one level to another to enhance operational effi͏ciency and decision-making.

- With over 420,000 AI AI p͏rofessionals and a 15% yearly g͏ro wth rate in AI-related job function, India has the second largest AI t͏alen͏t base in the world.

- Government Projects: The India AI ͏Mission and other infrastructure improvements help create a good environment for AI development.

Segmentation of the market

- Data Analytics: Growing at a CAGR of 35.8% from 2025 to 2030, the In͏dian data͏ a͏nalytics market is forecast to reach $21.3 Bn by 2030.

- With a CAGR of 7.66%, this segment is expected to increase from $2.34 billion in 2025 to $3.38 billion by 2030.

How Will Fractal Analytics Limited Benefit

- Fractal Analytics can ride the expanding AI and analytics opportunity in India, tapping into the $17 billion industry it is expected to reach by 2027.

- Growing enterprise acceptance of AI solutions provides an opportunity to expand its client base in industries such as BFSI, healthcare, retail, and CPG.

- The firm can leverage the expertise of India’s AI talent to boost its R&D strength and drive faster innovation in offerings such as Fractal.ai and Fractal Alpha.Government policies favoring AI adoption create a conducive market for scaling up operations and making strategic alliances.

- Increasing need for data-driven insights enables Fractal to offer sophisticated solutions for customer behavior analysis, operational optimization, and product development.

- Scaling up in growing markets can fuel revenue growth and enhance Fractal’s international footprint.

- Fractal’s experience in autonomous AI businesses enables it to develop customized solutions that address changing client needs, making it competitive in the long term.

- Advanced AI infrastructure access and industry trends support Fractal in sustaining leadership in enterprise AI solutions.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Fractal Analytics Limited

Acquire and Grow “Must Win Clients”

Fractal Analytics focuses on creating exceptional value for its “must win clients” by leveraging AI across enterprises. The company deepens client relationships, strengthens sales, account management, and alliances teams, and integrates client data ecosystems, while upskilling talent and using Gen AI for go-to-market initiatives globally.

Enhance Client Outcomes and Satisfaction

Fractal Analytics prioritizes client satisfaction through integrated teams led by business partners who understand client priorities. The company aligns AI solutions to meet these priorities, measuring success via NPS, and continuously improving delivery, technical capabilities, and engagement to enhance enterprise decision-making and client outcomes.

Expand Capabilities through AI Research and Product Innovation

Fractal Analytics invests in AI research and innovation to stay ahead of technological advancements. By exploring Gen AI, quantum computing, and computational neuroscience, the company develops new AI solutions, acquires complementary businesses, and builds products to align with client readiness, value creation, and enterprise adoption.

Advance Frontiers in AI and Consumer-Facing Products

Fractal Analytics develops advanced AI systems, including Kalaido.ai and Vaidya.ai, focusing on knowledge, reasoning, and action systems. It publishes research, open sources models, and launches consumer AI products to demonstrate real-world applications, co-creating capabilities with educational institutions and inspiring enterprise clients to adopt AI solutions.

Build AI Products for Enterprise Clients

Fractal Analytics invests in Cogentiq, its agentic AI platform, to accelerate AI product development with low-code, security, governance, and interoperability features. It advances multi-agent systems like Pioneer, ports existing products to enterprise-ready solutions, and spins off successful AI initiatives as independent Fractal Alpha companies.

Continue Building a Great Place to Work

Fractal Analytics fosters a culture of trust, transparency, and freedom, focusing on talent recruitment, upskilling, and leadership development. It encourages peer learning, leverages AI-powered tools for operational efficiency, and enhances internal processes to support continuous employee growth and high-performance AI solution delivery.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Fractal Analytics Limited IPO

How can I apply for Fractal Analytics Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When will Fractal Analytics IPO Open?

The Fractal Analytics IPO dates are not announced. Please check back again after some time.