- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Fujiyama Power Systems IPO

₹14,040/65 shares

Minimum Investment

IPO Details

13 Nov 25

17 Nov 25

₹14,040

65

₹216 to ₹228

NSE, BSE

₹828 Cr

20 Nov 25

Fujiyama Power Systems IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Fujiyama Power Systems Limited (UTL Solar)

Fujiyama Power Systems Limited, also known as UTL Solar, has established itself as a leading name in power electronics since its inception in 1996. The company offers a wide range of high-quality products, including Online and Offline UPS, inverters, battery chargers, solar management units, solar charge controllers, and batteries, catering to diverse customer needs. UTL has had the privilege of serving prominent institutions such as Air India, the Indian Army, Indian Railways, and AIIMS.

With a strong manufacturing unit in Parwanoo, Himachal Pradesh, capable of producing up to 1000 power conditioning units per day, UTL has significantly enhanced its customer support. The company has expanded its reach across several Asian and African countries and aims for further global growth. Renowned for its innovations, UTL introduced SMT inverters with SMD technology and 4-stage charging technology, setting new industry standards. UTL continues to lead with advanced technologies and exceptional products and services.

Fujiyama Power Systems Limited (UTL Solar) IPO Overview

Fujiyama Power Systems IPO is a book-built issue worth ₹828.00 crore. It comprises a fresh issue of 2.63 crore shares totaling ₹600.00 crore and an offer-for-sale of 1.00 crore shares aggregating ₹228.00 crore.The IPO opens for subscription on 13 November 2025 and closes on 17 November 2025. The allotment is expected to be finalised on 18 November 2025, with a tentative listing date on 20 November 2025 on both BSE and NSE.

The price band for the IPO is set at ₹216 to ₹228 per share. The minimum application lot size is 65 shares, requiring an investment of ₹14,820 for retail investors (at the upper price band). For non-institutional investors (NII), the lot size is 14 lots (910 shares) with an investment of ₹2,07,480, and for qualified institutional buyers (QIB), it is 68 lots (4,420 shares), amounting to ₹10,07,760Motilal Oswal Investment Advisors Ltd. is the book-running lead manager, while MUFG Intime India Pvt. Ltd. is the registrar of the issue.

Fujiyama Power Systems Limited (UTL Solar) Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹600 crore

Offer for Sale (OFS): 1,00,00,000 shares (₹228 crore) |

| IPO Dates | 13 November 2025 – 17 November 2025 |

| Price Bands | ₹216 – ₹228 per share |

| Lot Size | 65 shares |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 28,00,95,145 shares |

| Shareholding post-issue | 30,64,10,934 shares |

Fujiyama Power Systems IPO Lots

| Application | Lots | Shares | Amount (₹) |

| Retail (Min) | 1 | 65 | 14,820 |

| Retail (Max) | 13 | 845 | 1,92,660 |

| S-HNI (Min) | 14 | 910 | 2,07,480 |

| S-HNI (Max) | 67 | 4,355 | 9,92,940 |

| B-HNI (Min) | 68 | 4,420 | 10,07,760 |

Fujiyama Power Systems Limited (UTL Solar)IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Fujiyama Power Systems Limited (UTL Solar) IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 1.62 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 18.91% |

| Net Asset Value (NAV) | 8.56 |

| Return on Equity | 18.91% |

| Return on Capital Employed (ROCE) | 26.60% |

| EBITDA Margin | 10.67% |

| PAT Margin | 4.90% |

| Debt to Equity Ratio | 0.84 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Financing the cost of establishing the manufacturing facility in Ratlam, Madhya Pradesh | 2.500 |

| Repayment of outstanding borrowings availed by the company | 3,000 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

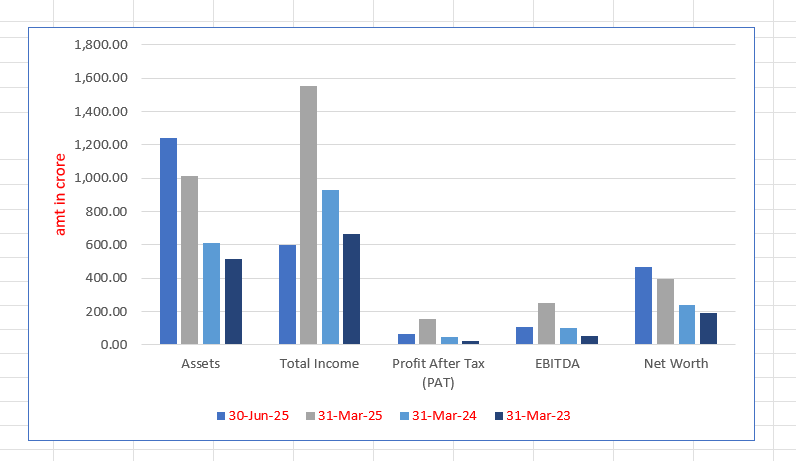

Fujiyama Power Systems Limited (UTL Solar) Financials (in crore)

| Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,243.88 | 1,013.96 | 609.64 | 514.56 |

| Total Income | 597.79 | 1,550.09 | 927.20 | 665.33 |

| Profit After Tax (PAT) | 67.59 | 156.34 | 45.30 | 24.37 |

| EBITDA | 105.89 | 248.52 | 98.64 | 51.60 |

| Net Worth | 464.34 | 396.82 | 239.54 | 193.08 |

| Reserves & Surplus | 436.33 | 368.81 | 215.00 | 70.55 |

| Total Borrowing | 432.83 | 346.22 | 200.19 | 211.14 |

Financial Status of Fujiyama Power Systems Limited (UTL Solar)

SWOT Analysis of Fujiyama Power Systems IPO

Strength and Opportunities

- Healthy financial risk profile with moderate net worth and a comfortable debt protection metric.

- Experienced partners with strong relationships with customers and suppliers, aiding business stability.

- Consistent improvement in operational performance, showing steady revenue and profitability growth.

- Robust product portfolio with diverse solar solutions catering to various customer needs and preferences.

- Strategic focus on innovation and research, leading to the development of efficient solar products.

- Strong focus on sustainability, aligning with global environmental trends and increasing demand for green energy.

- Established presence in both domestic and international markets, increasing brand exposure.

- Potential for expanding into emerging markets with a rising demand for renewable energy solutions.

- Collaborative partnerships with government agencies could lead to favorable policies and incentives.

- Opportunities to tap into large-scale commercial and industrial solar projects for long-term growth.

- Focused on expanding its product offerings to include energy storage solutions, which are gaining demand.

Risks and Threats

- Moderate scale of operations limits growth potential in an intensely competitive market.

- Large working capital requirement could hinder financial flexibility and expansion opportunities.

- Vulnerable to fluctuations in the economy, affecting demand and overall performance.

- Limited brand recognition in certain markets compared to larger industry players.

- Dependence on external suppliers for raw materials, making it susceptible to supply chain disruptions.

- Regulatory challenges and compliance costs could impact operations and profitability in some regions.

- High reliance on government incentives and subsidies, which could be reduced or altered by policy changes.

- Risk of technological obsolescence as newer, more efficient solar technologies enter the market.

- Increasing competition from well-established and new entrants may affect market share.

- Vulnerability to currency fluctuations in international markets where the company operates.

- Environmental factors such as extreme weather or natural disasters could disrupt operations and supply chains.

Live Fujiyama Power Systems IPO News

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Fujiyama Power Systems Limited (UTL Solar) IPO

Manufacturing and Technological Innovation

- Product Range: UTL Solar offers an extensive portfolio of more than 500 SKUs, encompassing solar inverters, panels, and batteries. The company has pioneered several innovations, including the development of the first SMT-based inverter with a single card in India in 2000.

- R&D and Technological Advancements: With strong research and development capabilities, UTL Solar is known for innovations such as the patented Rapid Maximum Power Point Tracking (rMPPT) technology, enhancing solar energy output even in varying environmental conditions. The company also offers hybrid solar systems and online solar PCUs, ensuring continuous and efficient power supply.

Manufacturing Facilities

UTL Solar operates three state-of-the-art manufacturing facilities in India:

- Greater Noida Facility: Specializes in solar panels, inverters, e-Rickshaw chargers, and lithium-ion batteries.

- Parwanoo Facility: Focuses on manufacturing solar PCUs and UPS systems.

- Bawal Facility: Produces tubular batteries.

These facilities are equipped with advanced machinery and certified under ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018, ensuring high-quality standards across the production process.

Distribution and Customer Service

UTL Solar has built a robust distribution network with over 480 distributors, 3,600 dealers, and 1,000 exclusive “Shoppe” franchisees across India. The company provides comprehensive customer support, including installation, subsidy assistance, and post-sales service. A dedicated team of over 400 service engineers ensures customer satisfaction and reliable maintenance services.

Global Presence and Future Plans

In addition to its domestic footprint, UTL Solar exports its products to countries like the USA, Bangladesh, and the UAE. The company plans to expand its manufacturing capacity and further strengthen its presence in the solar market, with an integrated project for manufacturing solar inverters, panels, and batteries in Ratlam, Madhya Pradesh.

With a commitment to innovation and sustainability, UTL Solar continues to drive the growth of rooftop solar solutions, contributing significantly to the renewable energy landscape in India and beyond.

Industry Outlook

India’s Solar Energy Market Growth

India’s solar energy market is expanding rapidly, with an installed capacity of 73 GW in 2023 and a target of 300 GW by 2030. This growth is driven by key initiatives and government support.

Key Drivers

- National Solar Mission and Renewable Energy Programs

- PLI Scheme for domestic solar manufacturing

- Falling costs of solar modules and growing subsidies

Market Outlook

- Solar energy contributed 20% of India’s installed power capacity in FY24.

- It is projected that solar will comprise 40% of the energy mix by FY32.

Key Government Measures Supporting India’s Solar Sector

- Rooftop Solar (RTS) Programme: Launched in phases, aiming for 40,000 MW by 2022, with 10.4 GW installed.

- Jawaharlal Nehru National Solar Mission (JNNSM): Focuses on sustainable growth and energy security through policies like Solar Parks and PM KUSUM.

- International Solar Alliance (ISA): Mobilizing USD 1000 billion for solar power.

- PM KUSUM: Solarizing agricultural pumps to provide renewable energy to 3.5 million farmers.

- PM-Surya Ghar: Subsidized rooftop solar for 1 crore households with financial assistance.

- Solar Parks: Development of 40 GW capacity.

- CPSU Scheme: Solar projects for government entities with domestic module use.

The development of Solar Parks and Ultra-Mega Solar Power Projects addresses key challenges like land acquisition and infrastructure, with progress towards a 40,000 MW target by FY26. Meanwhile, the open-access market is growing, driven by corporate decarbonization, improved economic viability, and RPO compliance, with expected installations of 4-5 GW annually till FY25.

Market Size and Growth of Rooftop Solar Market

- India’s rooftop solar market is expected to grow at a CAGR of 40-43% from FY24 to FY29.

- The sector is set to expand from ~12 GW in FY24 to 100 GW by FY30.

Key Drivers

- Financing Models: Improved options like solar loans and PPAs enhance accessibility.

- Energy Security: Rooftop solar ensures reliable power, addressing grid issues.

- Geographical Distribution: Gujarat, Maharashtra, and Rajasthan lead in solar capacity.

Market Segments

- On-grid systems: Dominating the market due to net metering and subsidies.

- Off-grid systems: Vital for rural electrification, supported by government schemes.

- Hybrid systems: Gaining popularity with falling battery costs and incentives.

Government Initiatives

- Programs like the National Solar Mission and MNRE subsidies are accelerating growth.

Overview of the Solar Panel Market

- Global Initiatives Driving Growth: Climate initiatives like the Paris Agreement push for renewable energy.

- India’s Solar Growth: India’s renewable capacity exceeded 200 GW by October 2024, with a projected CAGR of 25.7% from FY24 to FY29.

- Government Support: India’s National Solar Mission aims for 500 GW non-fossil fuel capacity by 2030.

Key Growth Drivers

- Declining Costs: Reduced solar panel costs through technology advancements.

- Energy Security: Solar solutions help rural electrification and energy access.

- Government Incentives: Schemes like Saubhagya promote adoption.

Solar Technology Developments

- Existing Technologies: Monocrystalline panels, PERC, and thin-film modules dominate the market.

- Emerging Technologies: Perovskite cells, bifacial modules, and organic photovoltaics offer high efficiency.

Overview of the Indian Solar Battery Market

- Market Growth & Outlook:

- Solar battery market in India grew at a CAGR of 5.1% (FY19-24) and expected to grow at 16.8% CAGR (FY24-29).

- Driven by increasing adoption of renewable energy and government policies.

- Key Growth Drivers:

- Adoption of Solar Energy: India’s target of 500 GW solar capacity by 2030.

- Technological Advancements: Innovations in battery types like lithium-ion and sodium-ion.

- Government Incentives: Supportive policies like the National Solar Mission.

- Energy Independence: Growing demand for decentralized energy solutions.

- Environmental Concerns: Push for sustainability in energy consumption.

- Future Outlook:

- Increased demand for solar batteries for residential, commercial, and industrial use.

- Cost reduction due to technological advancements and local manufacturing initiatives.

- Market Growth:

- Solar Inverter Market: Grew from ₹39.25B in 2019 to ₹57.65B in 2023; projected to reach ₹145.97B by 2029.

- Solar UPS Market: Expected to grow from ₹3B in 2023 to ₹7.6B by 2029, driven by demand for reliable power.

- Solar Converter Market: Grew at a CAGR of 14.9% from FY19-24, driven by rising electricity costs and government support.

- Growth Drivers:

- Government incentives and rising electricity prices.

- Technological advancements like MPPT, IoT integration, and hybrid inverters.

- Growing demand for renewable energy and grid integration.

- Future Outlook:

- Significant growth expected through FY29, driven by innovations and government initiatives.

Solar Inverter Market

- Grew from ₹39.25 billion (2019) to ₹57.65 billion (2023).

- Projected to reach ₹145.97 billion by 2029, with a 17% CAGR.

- Growth fueled by renewable energy adoption, advanced technology, and government incentives.

Solar UPS Market

- Witnessing 17% CAGR (FY24-FY29), reaching ₹7.6 billion by FY29.

- Driven by solar energy adoption, declining costs, and rising electricity prices.

Solar Converter Market

- Significant growth at 14.9% CAGR (FY19-FY24).

- Residential segment leads due to affordability, incentives, and increased awareness.

Emerging Technologies

- IoT-enabled systems, bi-directional converters, and AI-driven innovations are enhancing efficiency.

How Will Fujiyama Power Systems Limited (UTL Solar) Benefit?

- Enhanced Market Opportunities

India’s expanding solar energy market, projected to reach 300 GW by 2030, aligns perfectly with UTL Solar’s comprehensive product offerings, including on-grid, off-grid, and hybrid solar systems. The increasing demand for rooftop solar solutions strengthens its growth trajectory in the renewable energy sector.

- Government Incentives and Policies

UTL Solar is poised to benefit from initiatives like the National Solar Mission, PM KUSUM, and the Rooftop Solar Programme. These policies promote solar energy adoption, offering subsidies and incentives that support UTL Solar’s innovative products, including solar inverters, panels, and batteries.

- Technological Innovations

With patented technologies like Rapid Maximum Power Point Tracking (rMPPT) and advanced SMT-based inverters, UTL Solar can leverage its R&D capabilities to stay ahead of competitors. These innovations enhance energy efficiency and performance, aligning with market demand for cutting-edge solar solutions.

- Growing Rooftop Solar Market

India’s rooftop solar sector, expected to grow at a 40-43% CAGR, offers significant opportunities for UTL Solar. With its robust product portfolio and extensive distribution network, the company is well-positioned to capitalise on this expanding market, particularly in leading states like Gujarat and Rajasthan.

- Increased Adoption of Hybrid Systems

As hybrid solar systems gain popularity due to falling battery costs and government incentives, UTL Solar can benefit by expanding its offerings in this segment. Its advanced manufacturing facilities for lithium-ion batteries and solar PCUs position it to capture a significant market share.

- Strong Domestic Manufacturing Base

UTL Solar’s state-of-the-art facilities in Greater Noida, Parwanoo, and Bawal ensure cost-efficient and high-quality production. By aligning with the government’s PLI scheme and Make in India initiative, the company can reduce costs and boost competitiveness in the solar market.

- Expansion in International Markets

By exporting to countries like the USA, Bangladesh, and the UAE, UTL Solar can diversify its revenue streams. The global push for renewable energy, driven by initiatives like the Paris Agreement, enhances UTL Solar’s potential for international growth and recognition.

- Demand for Energy Independence

The rising demand for decentralised energy solutions, including solar batteries and inverters, positions UTL Solar to benefit from energy security concerns. Its range of hybrid inverters and lithium-ion batteries addresses this growing market need effectively.

- Support for Environmental Sustainability

With increasing environmental concerns, UTL Solar can strengthen its market position by promoting its eco-friendly solar solutions. By addressing sustainability goals and supporting India’s 500 GW non-fossil fuel capacity target by 2030, the company aligns with long-term industry trends.

- Advancements in Solar Technology

Emerging technologies like bifacial modules and IoT-enabled systems are transforming the solar industry. UTL Solar’s focus on integrating such innovations into its product offerings ensures a competitive edge and enhanced value for customers in India and abroad.

- Robust Distribution and Customer Support

UTL Solar’s extensive network of 480 distributors, 3,600 dealers, and 1,000 exclusive franchises ensures widespread availability of its products. Comprehensive customer service, including installation and maintenance, strengthens brand loyalty and fosters long-term growth.

Peer Group Comparison

| Name of Company | Revenue

(₹ in millions) |

Face Value per Equity Share

(₹) |

P/E | EPS (Basic) (₹) | RONW (%) | NAV

(₹) |

| Fujiyama Power Systems Limited (UTL Solar) | 9,246.88 | 1 | [●] | 1.62 | 18.91% | 8.56 |

| Waaree Energies | 113,976.09 | 10 | 66.32 | 48.05 | 30.82% | 157.26 |

| Premier Energies | 31,437.93 | 1 | 242.56 | 6.93 | 36.69% | 23.94 |

| Exicom Tele Systems | 10,195.58 | 10 | 41.35 | 6.70 | 8.86% | 59.72 |

| Insolation Energy | 7,371.74 | 10 | 149.54 | 26.63 | 51.20% | 52.00 |

Key Insights

- Revenue: Fujiyama Power Systems Limited (UTL Solar) reported revenue of ₹9,246.88 million, showcasing moderate earnings compared to peers. Waaree Energies leads significantly with ₹113,976.09 million, followed by Premier Energies at ₹31,437.93 million. Insolation Energy and Exicom Tele Systems reported ₹7,371.74 million and ₹10,195.58 million, respectively.

- Face Value per Equity Share: The face value of Fujiyama’s equity share is ₹1, aligning with Premier Energies, while other peers have a face value of ₹10. Though this reflects share structuring differences, it doesn’t impact overall performance or valuation comparison between the companies.

- Price-to-Earnings Ratio (P/E): Fujiyama’s P/E ratio is unavailable ([●]), making valuation unclear. Waaree Energies’ P/E of 66.32 indicates fair pricing relative to earnings. Premier Energies’ 242.56 suggests high valuation expectations, while Exicom’s 41.35 and Insolation’s 149.54 reflect varying investor confidence.

- EPS: Fujiyama’s basic EPS of ₹1.62 is modest compared to peers. Waaree Energies reported ₹48.05, indicating strong profitability. Premier Energies’ ₹6.93 and Exicom’s ₹6.70 show average earnings. Insolation Energy’s ₹26.63 demonstrates its profitability leadership among smaller revenue generators.

- RONW: Fujiyama’s RONW of 18.91% reflects decent efficiency in generating returns for shareholders. Peers show varied performances: Waaree Energies (30.82%) and Premier Energies (36.69%) outshine, while Exicom Tele Systems (8.86%) lags significantly. Insolation Energy leads impressively with a high RONW of 51.20%.

- NAV: Fujiyama’s NAV of ₹8.56 is the lowest among peers, indicating smaller asset backing per share. Waaree Energies tops at ₹157.26, while Premier Energies, Exicom, and Insolation Energy show ₹23.94, ₹59.72, and ₹52.00, respectively, indicating stronger financial positions.

Fujiyama Power Systems Limited (UTL Solar) IPO Strengths

- Diversified Portfolio

Fujiyama Power Systems Limited (UTL Solar) stands out as a leading provider in the rooftop solar industry, offering an extensive range of solar solutions. Their portfolio includes solar PCUs, off-grid, on-grid, and hybrid inverters, panels, and batteries, as well as chargers for E-Rickshaws. This diverse product range ensures resilience against market fluctuations and promotes consistent revenue growth, catering to varied customer preferences and geographical requirements. (Source: CARE Report)

- Extensive Product Range

Fujiyama Power Systems Limited boasts a comprehensive suite of over 500 SKUs, catering to rooftop solar needs. Their offerings include solar panels, inverters, batteries, and innovative solutions like solar charge controllers and lithium-ion battery management systems. Additionally, the company supplies chargers for E-Rickshaws and marine applications, meeting diverse customer demands. Their broad product range enhances customer satisfaction while minimising reliance on any single product category. (Source: CARE Report)

- Market Share and Contribution

As of November 2024, India’s rooftop solar capacity reached 15.1 GW, with Fujiyama contributing 1.4 GW through solar inverters, accounting for 9.2% of the total capacity. This significant market share underscores their role as a prominent player in advancing solar adoption across the nation. Their consistent supply and commitment to quality enhance their reputation as a trusted solar solutions provider. (Source: CARE Report)

- End-to-End Solutions

Fujiyama Power Systems Limited offers end-to-end rooftop solar solutions tailored to specific customer needs and locations. Their integrated portfolio spans off-grid, on-grid, and hybrid systems, complemented by options for tubular lead-acid and lithium-ion batteries. By serving as a one-stop shop, the company simplifies procurement and reduces reliance on multiple OEMs, fostering trust and convenience among customers nationwide.

- Technological Innovation

With 28 years of experience and a robust R&D team, Fujiyama is a pioneer in solar technology. They developed India’s first single-card SMT inverter and continue to innovate with patented rMPPT technology, hybrid inverters, and advanced battery management systems. Their commitment to quality ensures products meet industry standards, delivering reliable, efficient, and cutting-edge solar solutions that address evolving market demands. (Source: CARE Report)

- Robust Distribution Network

Fujiyama has built a vast distribution network, including over 480 distributors, 3,600 dealers, and 1,000 exclusive “UTL Solar Shoppes.” Their trained service engineers provide seamless customer support nationwide. The company’s digital tools, such as the UTL MTL 2.5 app, enhance operational efficiency by optimising dealer and service routes, ensuring superior customer satisfaction and strong sales growth.

Key Insights from Financial Performance

- Assets: The company’s assets have consistently increased, rising from ₹3,999.12 crore in March 2022 to ₹7,280.49 crore by September 2024. This steady growth suggests effective resource allocation and asset management, reflecting a robust financial position and increasing capacity for operations and investment.

- Revenue: Revenue trends show a significant increase, peaking at ₹9,246.88 crore in March 2024 before settling at ₹7,217.35 crore by September 2024. This indicates seasonal fluctuations but overall positive growth compared to earlier years, showcasing the company’s ability to scale operations effectively.

- Profit After Tax: Profit After Tax has shown substantial growth, increasing from ₹285.43 crore in March 2022 to ₹750.90 crore by September 2024. This reflects enhanced profitability driven by better cost management, revenue growth, and operational efficiency.

- Reserves and Surplus: Reserves and surplus have surged from ₹585.29 crore in March 2022 to ₹2,904.37 crore by September 2024. This growth underlines the company’s commitment to reinvesting profits and maintaining a strong equity base to support future expansion.

- Total Borrowings: Borrowings decreased from ₹2,111.44 crore in March 2023 to ₹1,505.61 crore by September 2024, suggesting improved debt management. This reduction highlights efforts to reduce financial liabilities while maintaining sufficient funding for operational needs.

- Total Liabilities: Total liabilities climbed from ₹2,188.50 crore in March 2022 to ₹4,130.75 crore by September 2024. While higher liabilities often signal risk, they align with the growth in assets and revenue, indicating well-planned financial leveraging.

Other Financial Details

- Cost of Material Consumed:The cost of material consumed has consistently increased over the periods, with a significant rise from ₹4,257.58 million in FY 2022 to ₹6,975.10 million in FY 2024, reflecting growth in production and operations.

- Other Operating Expenses:Other operating expenses have grown steadily from ₹88.41 million in FY 2022 to ₹317.36 million in FY 2023 and ₹231.77 million in September 2024. This increase is likely linked to expanding operational activities.

- Employee Benefits Expense:Employee benefits expense saw an increase from ₹328.18 million in FY 2022 to ₹506.16 million in FY 2023, reflecting company growth and the associated rise in workforce compensation, which aligns with expanding operations.

- Finance Costs:Finance costs grew significantly from ₹46.49 million in FY 2022 to ₹257.37 million in FY 2024, driven by an increase in borrowings and financial activities, impacting the company’s financial structure and cost management.

- Depreciation and Amortisation Expense:Depreciation and amortisation expenses rose from ₹13.65 million in FY 2022 to ₹128.08 million in FY 2024, signifying the acquisition of assets and infrastructure, contributing to higher wear-and-tear costs over time.

- Other Expenses:Other expenses increased from ₹471.27 million in FY 2022 to ₹579.32 million in FY 2023, reflecting higher operational costs. These include expenses not directly tied to material consumption or production, indicating broader business expenses.

Key Strategies for Fujiyama Power Systems Limited (UTL Solar)

- Expansion of Manufacturing Capabilities

The company is increasing its manufacturing capacity for solar panels, inverters, and lithium-ion batteries. The installed capacity for batteries and solar products has grown significantly, with additional expansions in Greater Noida and Dadri. These expansions will boost production of solar panels, inverters, and batteries, ensuring better profitability and flexibility to meet domestic demand and capitalize on government solar initiatives like PM Surya Ghar.

- Strengthening Domestic Distribution and Retail Network

To address rising demand, the company is expanding its distribution and retail network across India, focusing on underdeveloped regions. With a strong presence in 23 states and three union territories, the company is working to increase its footprint through exclusive “Shoppe” stores and new distributor partnerships. This strategy will diversify revenue streams, reduce market dependency, and support growth in southern and eastern regions.

- Innovation and Market Opportunities

The company aims to stay ahead by adopting new technologies and continuously developing innovative products. Through R&D and product certifications, it will offer efficient solutions, including hybrid solar systems. It is also leveraging AI for customer engagement and operational efficiency. By integrating these technologies and creating engaging platforms, the company aims to strengthen customer trust and expand market share while capitalizing on the growing demand for solar products.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Fujiyama Power Systems IPO

What is the purpose of Fujiyama Power Systems' IPO?

The IPO aims to raise funds for establishing a manufacturing facility in Ratlam, repaying outstanding borrowings, and general corporate purposes.

Who are the lead managers for the IPO?

Motilal Oswal Investment Advisors Limited and SBI Capital Markets Limited are acting as the book running lead managers for the IPO.

When was the DRHP filed with SEBI?

The Draft Red Herring Prospectus (DRHP) was filed with SEBI on December 28, 2024.

What is the size of the fresh issue in the IPO?

Fujiyama Power Systems IPO is a book build issue of ₹828.00 crores. The issue is a combination of fresh issue of 2.63 crore shares aggregating to ₹600.00 crores and offer for sale of 1.00 crore shares aggregating to ₹228.00 crores.

Is there an offer-for-sale component in the IPO?

Yes, the IPO includes an offer-for-sale of up to 20 million equity shares by existing promoters.

What is the face value of the equity shares in the IPO?

The equity shares in the IPO have a face value of Re 1 each.

How can investors apply for the IPO?

Investors can apply for the IPO online using UPI or ASBA as a payment method. ASBA applications can be done through net banking of their bank account.