- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Fusion CX IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Fusion CX Limited

Fusion CX, formerly Fusion BPO Services, is a global customer experience transformation leader, founded in 2004 by Pankaj Dhanuka and Kishore Saraogi. With a technology-driven model, the company offers integrated CX services across voice, email, chat, social media, and messaging for sectors like telecom, healthcare, BFSI, and retail. Operating in 15 countries with 10,500+ experts, Fusion CX blends AI innovation with human empathy to deliver personalised, scalable solutions. Its multilingual capabilities and domain expertise help brands enhance acquisition, retention, and engagement, driving measurable outcomes and operational excellence across every customer touchpoint.

Fusion CX Limited IPO Overview

Fusion CX Ltd, a customer experience service provider based in Kolkata, has submitted its draft red herring prospectus (DRHP) to the Securities and Exchange Board of India (SEBI) to seek approval for launching an initial public offering (IPO) aimed at raising ₹1,000 crore.

As outlined in the DRHP filed on Monday, the proposed IPO consists of a fresh issue of equity shares worth ₹600 crore and an Offer for Sale (OFS) of shares amounting to ₹400 crore. The OFS will involve the partial divestment of holdings by the company’s promoters, P N S Business Private Ltd and Rasish Consultants Private Ltd.

In addition, Fusion CX Ltd may consider raising up to ₹120 crore through a Pre-IPO placement. Should this placement be executed, the total size of the fresh issue will be adjusted accordingly.

Fusion CX Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹600 crores

Offer for Sale (OFS): ₹400 crores |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post -issue | TBA |

Fusion CX Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Fusion CX Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Fusion CX Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 2.88 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 13.42% |

| Net Asset Value (NAV) | 21.44 |

| Return on Equity | 13.37% |

| Return on Capital Employed (ROCE) | 19.56% |

| EBITDA Margin | 10.55% |

| PAT Margin | 3.66% |

| Debt to Equity Ratio | 1.08 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment or prepayment of borrowings | 2,918.95 |

| Investment in tech upgrades for its subsidiaries Omind Technologies Inc. and Omind Technologies Pvt Ltd. | 747 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

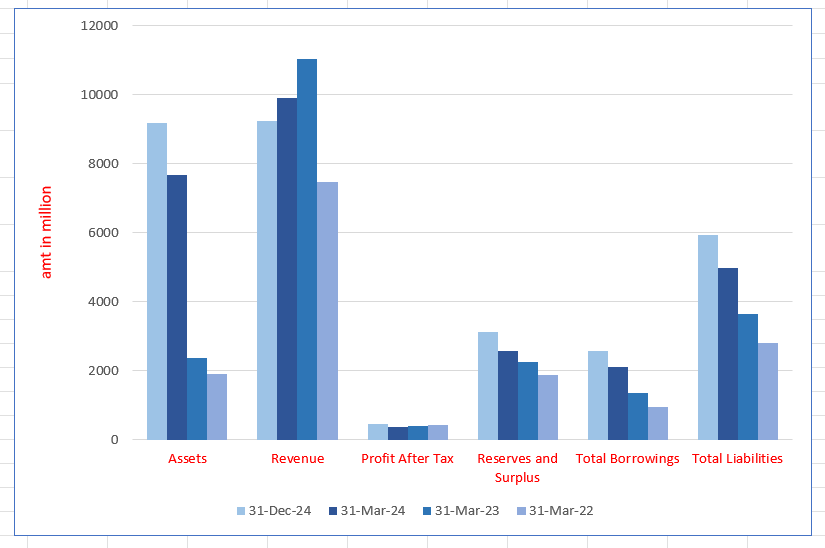

Fusion CX Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 9192.53 | 7680.16 | 2372.09 | 1903.83 |

| Revenue | 9255.51 | 9913.15 | 11,049.91 | 7480.21 |

| Profit After Tax | 472.39 | 362.60 | 398.38 | 438.71 |

| Reserves and Surplus | 3141.24 | 2585.40 | 2246.08 | 1872.33 |

| Total Borrowings | 2583.67 | 2106.09 | 1349.61 | 959.22 |

| Total Liabilities | 5925.28 | 4968.75 | 3660.06 | 2804.90 |

Financial Status of Fusion CX Limited

SWOT Analysis of Fusion CX IPO

Strength and Opportunities

- Strong global presence with 40 offices across 15 countries, including India, the US, and Europe.

- Over 20 years of experience in delivering customer experience solutions across diverse industries.

- Multilingual capabilities supporting over 12 Indian languages and global languages like Spanish and Mandarin.

- Advanced AI and ML technologies, including voice bots, chatbots, and AI-powered quality management systems.

- Recent acquisition of S4 Communications enhances capabilities in telecom and utilities sectors.

- Expansion into emerging markets like Chennai and Mumbai, creating significant employment opportunities.

- Strong client base across 250+ businesses in sectors such as BFSI, healthcare, retail, and telecom.

- ISO 27001:2022 certification ensures adherence to global data security standards.

- Minority Business Enterprise certification reflects commitment to diversity and inclusion.

Risks and Threats

- Heavy reliance on offshore operations may expose the company to geopolitical and economic risks in certain regions.

- Rapid expansion may lead to operational challenges and integration issues across new facilities.

- Intense competition in the BPO sector may pressure profit margins and client retention.

- Potential cybersecurity threats and data privacy concerns in handling sensitive customer information.

- Integration of acquired companies may present cultural and operational alignment challenges.

- Dependence on local talent pools may limit scalability in regions with talent shortages.

- Economic downturns or industry-specific slowdowns could impact client budgets and service demand.

- Regulatory changes in data protection laws across different regions may require continuous compliance efforts.

- Potential challenges in maintaining diversity goals while scaling operations globally.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Fusion CX Limited IPO

Fusion CX Limited IPO Strengths

Global delivery network across 15 countries with 40 scalable delivery centres providing 24×7 multichannel support

Fusion CX Limited operates 40 scalable delivery centres across 15 countries, divided into Latin America, North America, EMEA, and Southeast Asia. Combining onshore, nearshore, and offshore hubs, it delivers 24×7 multilingual support in 28 languages. Leveraging AI, cloud tech, and robust infrastructure, Fusion CX ensures efficient, cost-effective, and culturally aligned customer service worldwide.

Continuous focus on strategic R&D investments to develop in-house, AI-driven solutions focused on CX transformation

Fusion CX Limited invests strategically in R&D to create AI-driven, in-house CX solutions like Arya, Mind WorkPlace, and MindVoice. With development centres in India, it enhances operational efficiency, scalability, and customer engagement through automation, advanced analytics, and digital platforms, supported by innovative third-party tools like MindSpeech.

Proven track record of inorganic growth and integration adding capabilities and driving financial growth

Fusion CX Limited strategically acquires companies across telecom, healthcare, retail, BFSI, and HTT to enhance capabilities in customer acquisition, onboarding, KYC, fraud prevention, and tech support. Key acquisitions since 2018 have expanded global delivery, deepened vertical expertise, and increased revenue through seamless integration and targeted market expansion.

Diversified operations with domain expertise and long-standing customer relationships

Fusion CX Limited serves multiple industries with customised multilingual, multichannel CX solutions across telecom, HTT, travel, BFSI, retail, and healthcare. Strong, long-term customer relationships—with top clients averaging over nine years—support a balanced revenue portfolio and sustained growth through tailored services and deep domain expertise

Agile, customer-centric approach driving tailored CX solutions

Fusion CX Limited integrates customer focus into operations, using agile methods and real-time feedback to deliver responsive, customised CX solutions. Its end-to-end capabilities, sector expertise, and strategic acquisitions enable quick adaptation to client needs and market changes, ensuring scalable growth and strong global presence for timely service delivery.

Diverse Board, seasoned leadership, and skilled workforce driving growth

Fusion CX Limited boasts a diverse Board and experienced promoters with 47 years combined expertise. Supported by a strong management team and over 22,000 skilled employees worldwide, it prioritises strategic recruitment and tailored training, fostering talent aligned with business needs to deliver superior, industry-specific customer experience and operational excellence.

More About Fusion CX Limited

Fusion CX, formerly known as Fusion BPO Services, stands at the forefront of customer experience (CX) transformation worldwide. Established in 2004 by co-founders Pankaj Dhanuka and Kishore Saraogi, the company has experienced remarkable growth under their visionary leadership. Pankaj’s focus on growth and operational efficiency, coupled with Kishore’s deep industry insight, laid the groundwork for the company’s enduring success.

Fusion CX offers a comprehensive suite of services designed to enhance customer experience across diverse industries. Under Customer Engagement, the company provides customer service, inbound and outbound call centre support, technical assistance, live chat, email, and social media management. In the Digital Solutions segment, Fusion CX delivers cutting-edge offerings such as data annotation, digital transformation, cognitive automation, AI-powered quality management systems (AI QMS), Perfect Pitch solutions, voice services, and speech analytics.

The company also supports clients through Utility Billing and Lead Generation services. Its advanced Capabilities include right shoring, multilingual support, omnichannel delivery, and quality assurance. These integrated solutions enable Fusion CX to drive operational excellence, elevate customer interactions, and deliver measurable outcomes for businesses globally.

Comprehensive, Technology-Driven CX Solutions

Fusion CX specialises in delivering complex, high-end, and integrated customer service solutions across multiple communication channels. With technology at the core of its operations, the company provides cost-effective, scalable solutions tailored to industry needs.

Service Channels:

- Voice

- Chat

- Social Media

- Messaging

Industry Focus:

- Telecom and Utilities

- Healthcare and Life Sciences

- HTT (High-Tech Technology)

- BFSI (Banking, Financial Services, and Insurance)

- Retail

Global Presence, Personalised Delivery

With a robust global footprint and a focus on multilingual service delivery, Fusion CX combines AI innovation with human empathy to create seamless and scalable customer experiences.

By the Numbers:

- 10,500+ employees

- 40 delivery centres

- 15 countries

- 190+ global clients

Fusion CX Approach: Transforming Interactions

Fusion CX goes beyond managing customer interactions—it transforms them. By integrating people, processes, and intelligent platforms, the company delivers measurable results that drive client growth and ensure operational excellence.

Industry Outlook

India’s Business Process Outsourcing (BPO) and Customer Experience (CX) industry is experiencing robust growth, driven by digital transformation, AI integration, and a focus on omnichannel engagement.

Growth Projections:

- BPO Market: Expected to triple from $49.87 billion in 2025 to $139.35 billion by 2033, with a CAGR of 12.64%.

- Contact Center Software: Projected to grow from $1.4 billion in 2024 to $8.8 billion by 2033, at a CAGR of 20.6%.

- CRM Market:Anticipated to reach $6.68 billion by 2030, growing at a CAGR of 18.1%.

Key Growth Drivers:

- AI & Automation: Adoption of AI, NLP, and RPA enhances efficiency and service quality.

- Cloud Migration: Shift to cloud-based solutions offers scalability and cost-effectiveness.

- Omnichannel Engagement: Integration of voice, chat, email, and social media channels improves customer experience.

- Skilled Workforce: Continuous upskilling initiatives ensure a competitive edge.

How Will Fusion CX Limited Benefit

- Fusion CX Limited is set to benefit significantly from the Indian BPO and CX industry’s projected CAGR of 12.64% by aligning with its rapid digital transformation.

- Its AI-powered quality management systems, cognitive automation, and speech analytics match the rising demand for intelligent automation solutions.

- The company’s omnichannel delivery through voice, chat, email, and social media meets the market’s push for seamless customer engagement.

- With services across high-growth sectors like BFSI, telecom, and healthcare, Fusion CX is well-positioned to tap into industry-specific CX demand.

Peer Group Comparison

| Particulars | Face Value (₹) | EPS (₹) | NAV per Share (₹) | P/E | RoNW (%) | Total Income (₹ Mn) |

| Fusion CX Limited | 1.00 | 2.88 | 21.44 | [●] | 13.42 | 10,215.28 |

| Peer Groups | ||||||

| FirstSource Solutions Limited | 10.00 | 7.52 | 5.30 | 49.69 | 13.95 | 63,730.89 |

| eClerx Services Limited | 10.00 | 106.15 | 46.42 | 31.84 | 22.84 | 29,911.78 |

| Alldigi Tech Limited | 10.00 | 42.00 | 161.08 | 22.36 | 26.07 | 4,762.70 |

| Inventurus Knowledge Solutions Ltd | 1.00 | 22.37 | 67.67 | 69.62 | 32.04 | 18,579.38 |

| Sagility India Limited | 10.00 | 0.53 | 15.02 | 82.26 | 3.55 | 47,815.04 |

| Hinduja Global Solutions Limited | 10.00 | 27.52 | 1,609.49 | 19.06 | 1.78 | 50,877.81 |

Key Strategies for Fusion CX Limited

Driving Growth through Client Retention, Wallet Expansion, and Geographic Reach

Fusion CX Limited focuses on retaining clients, expanding wallet share, deepening market presence, and entering new geographies to fuel growth. The company has grown high-value clients contributing over USD 3 million from four in Fiscal 2022 to seven by December 2024, supported by delivery centers in Belize, El Salvador, Colombia, and Jamaica serving North America and beyond.

Accelerating growth through strategic Gen AI-driven innovation

Fusion CX Limited leverages Generative AI to transform customer experience with personalized, real-time interactions. Investments in AI-powered platforms like Arya and MindVoice enhance automation, employee support, and engagement across sectors, driving operational efficiency, proactive CX solutions, and scalable, technology-enabled growth across industries.

Strategic growth through targeted acquisitions and partnerships

Fusion CX Limited pursues strategic acquisitions to enhance capabilities, expand market reach, and accelerate innovation. By acquiring niche, technology-focused, and regional providers, it delivers integrated CX solutions. Partnerships strengthen vertical expertise, geographic presence, and AI-driven automation, supporting long-term growth aligned with the Company’s global vision and operational excellence.

Focused growth in high-value corporate accounts through up-selling and cross-selling

Fusion CX Limited leverages strong client relationships and advanced technology to expand among large corporates. A dedicated enterprise growth team drives targeted onboarding, while structured account management and Gen AI-enabled playbooks support scalable up-selling and cross-selling, increasing wallet share and deepening client engagement.

Operational efficiency through right-shoring and cost optimization

Fusion CX Limited optimizes CX operations by balancing onshore, nearshore, and offshore delivery for cost efficiency, agility, and quality. Strategic acquisitions expand global centres, while automation and cross-skilling enhance productivity and flexibility, ensuring scalable, culturally aligned, and compliant customer support worldwide.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Fusion CX Limited IPO

How can I apply for Fusion CX Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When will the Fusion CX Limited IPO open for subscription?

The IPO open and close dates are yet to be announced by the company.

What is the total issue size of Fusion CX Limited IPO?

The total issue size is ₹1,000 crore, including fresh issue and Offer for Sale (OFS).

On which stock exchanges will Fusion CX Limited be listed?

Fusion CX Limited will be listed on both BSE and NSE exchanges.

What is the face value of shares in Fusion CX Limited IPO?

The face value of each share is ₹1 as stated in the IPO details.

Will Fusion CX Limited conduct a Pre-IPO placement?

Yes, the company may raise up to ₹120 crore through a Pre-IPO placement.