- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Futures contract strategies you must know

By HDFC SKY | Updated at: Apr 24, 2025 03:05 PM IST

Summary

In this module, we will learn about some of the future contract strategies employed by market participants.

But before we start off let’s do a quick recap of the main participants in the futures market-

Hedgers or market participants who use futures contracts for risk management purposes to hedge their underlying positions.

Speculators or the individuals/entities who expect the price of an underlying to move in a particular direction and essentially want to place a bet on it. The downside risk here is high as an unfavourable move can cause unlimited loss. And arbitrageurs or participants who exploit mispricing in the market for a financial instrument and take offsetting positions to earn a riskless profit.

Future contracts are used by hedgers to eliminate financial risk and lock in a price based on their specific needs.

For Example, A farmer who produces wheat may feel that price of his produce will fall in the market in upcoming three months. In this case, the farmer can secure a price for his wheat by going short a 3-month futures contract for let’s say Rs 100 per kg which will ensure that he is able to sell his produce for INR 100 per kg regardless of what the price of wheat will be in 3 months down the line.

As mentioned previously, hedging via futures contract is also very popular in the aviation sector. Airline companies go long Jet Fuel contracts to lock in a specific price when fuel prices are rising.

For example, ANS Airways feels that fuel prices are expected to rise in the upcoming month. They can lock in the price for their fuel by going long a 1- month futures contract for let’s $100 per barrel which will help them significantly cut their costs if the fuel prices go up as per expectations.

Speculators take position in a futures contract to gain exposure to a particular underlying unlike hedgers who are trying to avoid exposure to adverse price movements.

Let’s say that the current exchange rate for USD is Rs 75 and you as an investor feel that USD (United States Dollar) will strengthen against INR over the next one month. In order to gain exposure to this expected movement in the exchange rate you could go long a one-month contract to buy USD for INR 77. If after one month, the exchange rate rises to INR 80, you’ll get to buy the dollar for INR 77.

Another popular trading strategy used by market participants is the Bull Calendar Spread.

A calendar spread involves the market participants buying and selling futures contracts on the same underlying but with different expiry dates.

Suppose you expect the price of commodity S to rise in upcoming 3 months and drop in the upcoming 6 months. A Bull Calendar spread would involve you going long the short-term contract of 3-month and going short the longer-term contract of 6 months.

Investors also prefer to go for a Bear Calendar Spread when they expect prices to go down in the near term and rise over the longer term.

In a Bear Calendar spread an investor sells the near-term contract and buys the longer-term contract.

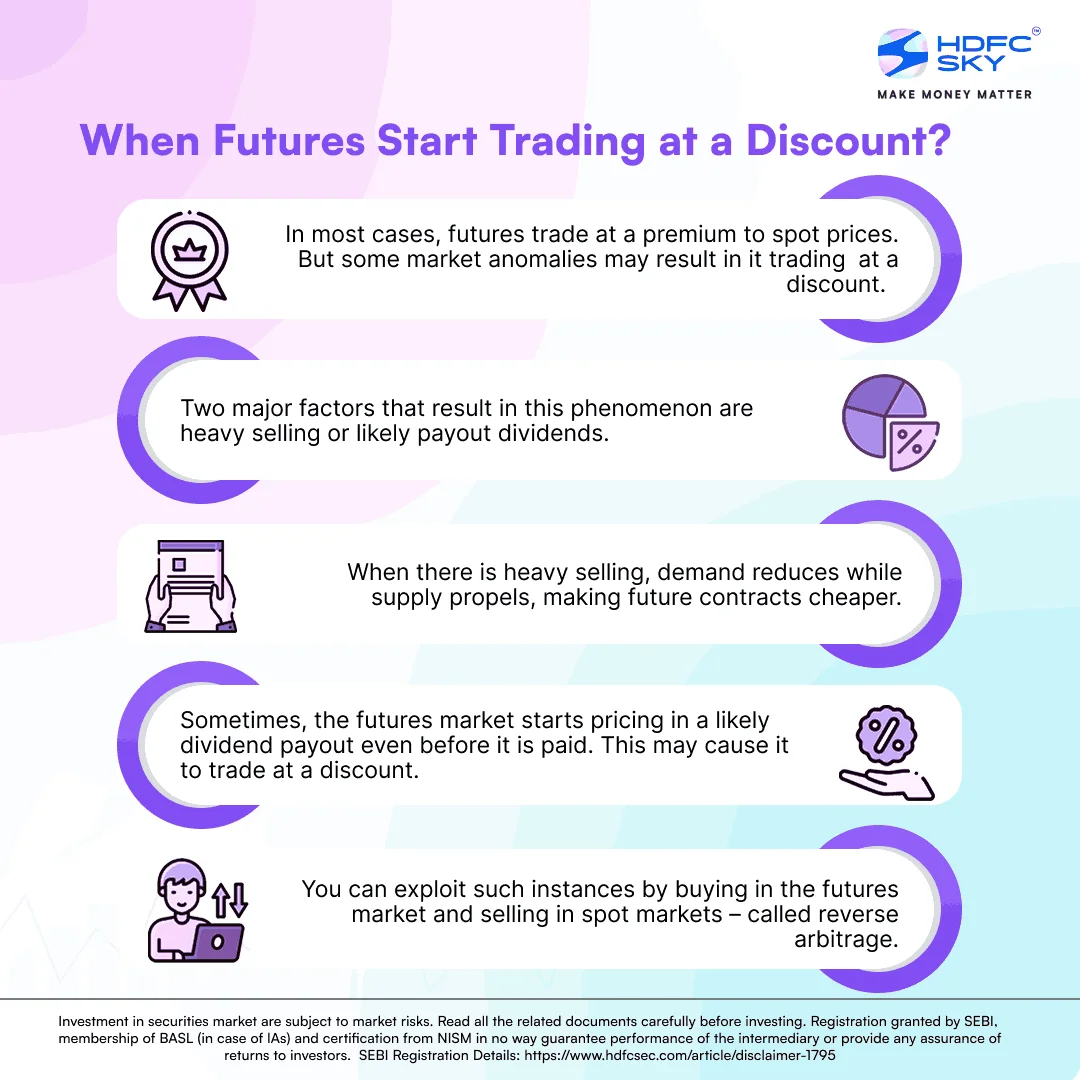

Lastly, we have arbitrageurs who exploit mispricing in the market to earn a riskless profit.

We will explain arbitrage in detail in chapter 12.4.