- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Ganesh Consumer Products IPO

₹14,076/46 shares

Minimum Investment

IPO Details

22 Sep 25

24 Sep 25

₹14,076

46

₹306 to ₹322

NSE, BSE

₹408.80 Cr

29 Sep 25

Ganesh Consumer Products IPO Timeline

Bidding Start

22 Sep 25

Bidding Ends

24 Sep 25

Allotment Finalisation

25 Sep 25

Refund Initiation

26 Sep 25

Demat Transfer

26 Sep 25

Listing

29 Sep 25

Ganesh Consumer Products Limited

Ganesh Consumer Products Limited, headquartered in Kolkata, West Bengal, is a prominent FMCG brand in East India known for its wheat-based derivatives such as maida, sooji, and dalia. Its flagship brand “Ganesh” spans a wide portfolio that includes whole wheat flour, value-added flours, instant mixes, spices, ethnic snacks, and unique variants like sattu and ethnic flours. With 42 products and 232 SKUs, the company launched 11 new products in the last three years. Its strong distribution network of C&F agents, super stockists, and distributors ensures extensive market reach.

Ganesh Consumer Products Limited IPO Overview

Ganesh Consumer Products IPO is a book-built issue worth ₹408.80 crore, comprising a fresh issue of 0.40 crore shares aggregating to ₹130.00 crore and an offer for sale of 0.87 crore shares amounting to ₹278.80 crore. The IPO opens for subscription on 22 September 2025 and closes on 24 September 2025, with allotment expected on 25 September 2025. Shares will be listed on BSE and NSE, with a tentative listing date of 29 September 2025. The price band is fixed at ₹306 to ₹322 per share, and the lot size is 46 shares, requiring a minimum investment of ₹14,812. For sNII investors, the minimum application is 14 lots (₹2,07,368), while for bNII investors, it is 68 lots (₹10,07,216). Dam Capital Advisors Ltd. is the book-running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar to the issue.

Ganesh Consumer Products Limited IPO Details

| Particulars | Details |

| IPO Date | 22 September 2025 to 24 September 2025 |

| Listing Date | 29 September 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹306 to ₹322 per share |

| Lot Size | 46 Shares |

| Total Issue Size | 1,26,95,600 shares (aggregating up to ₹408.80 Cr) |

| Fresh Issue | 40,37,267 shares (aggregating up to ₹130.00 Cr) |

| Offer for Sale | 86,58,333 shares (aggregating up to ₹278.80 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Employee Discount | ₹30 per share |

| Share Holding Pre Issue | 3,63,73,259 shares |

| Share Holding Post Issue | 4,04,10,526 shares |

Ganesh Consumer Products Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Net Offer |

| Retail | Not less than 35% of the Net Offer |

| NII (HNI) | Not more than 15% of the Net Offer |

Ganesh Consumer Products Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 46 | ₹14,812 |

| Retail (Max) | 13 | 598 | ₹1,92,556 |

| S-HNI (Min) | 14 | 644 | ₹2,07,368 |

| S-HNI (Max) | 67 | 3,082 | ₹9,92,404 |

| B-HNI (Min) | 68 | 3,128 | ₹10,07,216 |

Ganesh Consumer Products Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 75.30% |

| Post-Issue | 64.07% |

Ganesh Consumer Products Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹9.74 (Pre-Issue) / ₹8.77 (Post-Issue) |

| Price/Earnings (P/E) Ratio | 33.06 (Pre-Issue) / 36.72 (Post-Issue) |

| Return on Net Worth (RoNW) | 15.81% |

| Net Asset Value (NAV) | ₹61.62 |

| Return on Equity | 15.81% |

| Return on Capital Employed (ROCE) | 19.81% |

| EBITDA Margin | 8.61% |

| PAT Margin | 4.17% |

| Debt to Equity Ratio | 0.22 |

Objectives of the Proceeds

- Prepayment or repayment of certain outstanding borrowings – ₹60.00 Cr

- Capital expenditure for roasted gram and gram flour unit – ₹45.00 Cr

- General corporate purposes

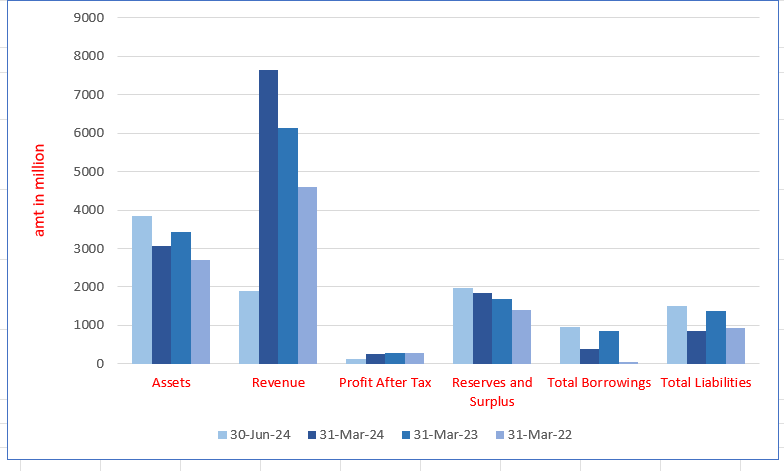

Ganesh Consumer Products IPO Key Financials (in ₹ crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 341.74 | 308.64 | 343.30 |

| Revenue | 855.16 | 765.26 | 614.78 |

| Profit After Tax | 35.43 | 26.99 | 27.10 |

| Reserves and Surplus | 190.47 | 184.98 | 167.95 |

| Total Borrowings | 50.00 | 38.29 | 86.13 |

Financial Status of Ganesh Consumer Products Limited

SWOT Analysis of Ganesh Consumer Products IPO

Strength and Opportunities

- Leading packaged flour brand with strong market share in East India.

- Diversified product portfolio across staples, spices, and ethnic snacks.

- Strong multichannel distributor network and expanding retail footprint.

- Strategic manufacturing units with robust quality standards.

- Experienced promoters and professional management team with growth vision.

Risks and Threats

- Dependence on regional markets may limit pan-India expansion.

- Raw material cost fluctuations may impact profitability margins.

- Intense competition from large FMCG and local unorganised players.

- Regulatory changes in FMCG sector may create operational challenges.

- Rising health-conscious trends could impact demand for traditional flour products.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Ganesh Consumer Products Limited IPO

Ganesh Consumer Products IPO Competitive Strengths

- Leading packaged flour brand in Eastern India with strong consumer trust and recall.

- Diversified product portfolio spanning staples, instant mixes, spices, and ethnic snacks.

- Extensive distributor network with reach across 972 distributors and 28 C&F agents.

- Strategically located modern plants ensuring cost efficiency and high-quality standards.

- Strong promoter vision supported by professional leadership and operational expertise.

- Steady financial performance with consistent revenue growth and profit improvement.

Peer Group Comparison (As on 31 March 2025)

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

| Ganesh Consumer Products Limited | 9.74 | 9.74 | 61.62 | 33.06 | 15.81 | 5.23 |

| Peer Group | ||||||

| Patanjali Foods Limited | 35.94 | 35.94 | 300.36 | 50.15 | 11.96 | 6.01 |

| AWL Agri Business Limited | 9.44 | 9.44 | 71.91 | 27.15 | 13.12 | 3.61 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Ganesh Consumer Products IPO

How can I apply for Ganesh Consumer Products Limited IPO?

You can apply via HDFC SKY platform using UPI-based ASBA facility for a seamless experience.

What is the minimum investment required in Ganesh Consumer Products Limited IPO?

The minimum investment is ₹14,812 for 46 shares at the upper price band.

When will Ganesh Consumer Products Limited IPO shares get listed?

Shares are scheduled to list on BSE and NSE on 29 September 2025.

What is the lot size for Ganesh Consumer Products Limited IPO?

The lot size is 46 shares, and retail investors can apply for up to 13 lots.