- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

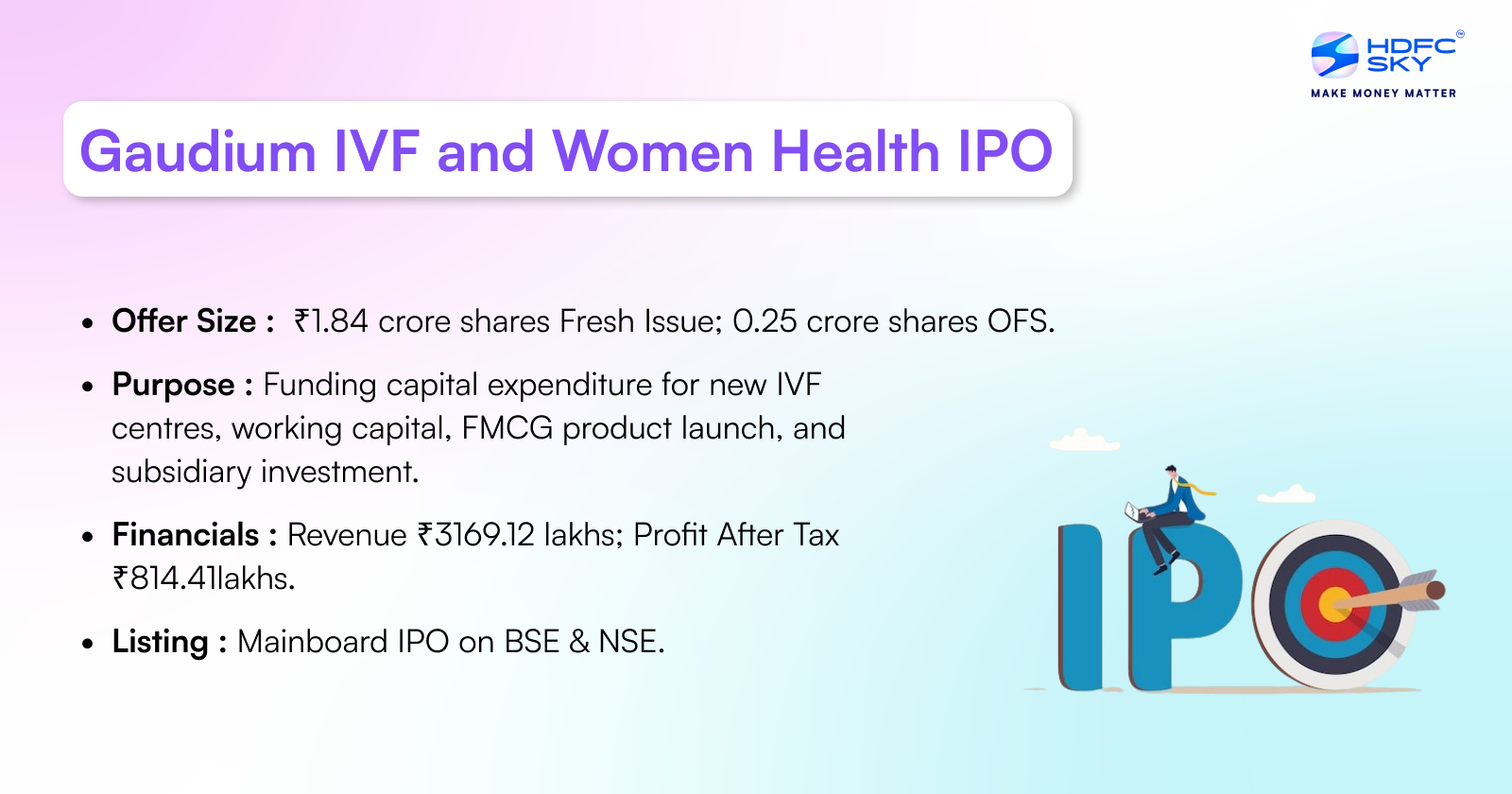

Gaudium IVF and Women Health IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

TBA

TBA

TBA

Gaudium IVF and Women Health Limited

Gaudium IVF and Women Health Limited was founded to fulfill the dreams of motherhood. As one of India’s leading IVF centres, it has brought happiness to thousands of families worldwide. The name “Gaudium,” meaning joy, reflects its commitment to affordable and effective fertility care. Recognized as a top IVF centre, it combines advanced reproductive technology with experienced specialists to provide personalized treatment. With numerous accolades and global recognition, Gaudium remains dedicated to offering world-class fertility solutions, ensuring every patient receives compassionate and expert care.

SWOT Analysis of Gaudium IVF and Women Health IPO

Strength and Opportunities

- Specialized expertise with experienced doctors and embryologists led by Dr. Manika Khanna, ensuring high-quality IVF procedures.

- Strong brand recognition with 30+ locations, establishing trust in fertility treatment across India.

- Experienced leadership under Dr. Manika Khanna, bringing strong industry knowledge and patient care expertise.

- Asset-light model enabling flexible expansion without heavy capital expenditure.

- Entry into the FMCG sector through EKK Global Private Limited, opening new market opportunities.

- Rising demand for fertility treatments due to increasing infertility rates.

- Geographic expansion through the hub-and-spoke model offers growth potential.

- Strategic partnerships with pharmaceutical firms and research institutions can drive innovation.

- Government and insurance support may boost affordability and patient inflow.

- Increasing interest in egg freezing enhances service demand.

Risks and Threats

- Limited presence in smaller cities, making expansion into tier-2 and tier-3 locations operationally challenging.

- High competition in the fertility market, potentially limiting market share growth.

- Regulatory changes in fertility treatment laws may impact operations and revenue.

- Economic instability could reduce consumer spending on fertility treatments.

- Managing procurement, contract manufacturing, and distribution for FMCG products could be complex.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Gaudium IVF and Women Health Limited IPO

Gaudium IVF and Women Health Limited IPO Strengths

- Patient-Centric Approach

Gaudium IVF and Women Health Limited prioritizes personalized care, recognizing the uniqueness of each patient. With dedicated counsellors, the company provides emotional support and guidance throughout the parenthood journey. Patients benefit from quality consultations, confidentiality, transparency, and unwavering assistance during their IVF treatment.

- Expert Team

Founded by Dr. Manika Khanna and Dr. Peeyush Khanna, Gaudium IVF brings over two decades of infertility expertise. The Gaudium IVF Foundation, established in 2014, extends healthcare support to underprivileged communities. Expert gynaecologists and embryologists ensure meticulous and compassionate IVF procedures.

- Modern Technology

Gaudium IVF integrates cutting-edge technology to deliver world-class fertility treatments. The use of INTEGRA Ti™ for ICSI procedures, advanced egg quality assessment tools, Samsung Ultrasound Machines, and sterile operating rooms enhances precision and patient safety.

- Highly Technical USG-Guided Services

Gaudium IVF is equipped to manage complex fertility cases using advanced diagnostic techniques, including hysterosalpingography (HSG), transvaginal scans, follicular monitoring, ultrasound-guided biopsies, transrectal ultrasounds, and ovarian cyst aspiration.

- Flexible Payment Options

Gaudium IVF offers tailored payment plans, allowing patients to choose between lump sum payments or convenient instalments based on their financial preferences. These flexible options ensure affordability without compromising treatment quality.

- Asset-Light Business Model

Gaudium IVF operates an efficient, asset-light model with standardized protocols and internal controls. This approach minimizes dependency on individual practitioners, ensuring scalable, high-quality reproductive care across multiple locations.

- Hubs in Major Cities

With central hubs in Mumbai, Bangalore, Delhi NCR, and Patna, Gaudium IVF provides advanced fertility treatments, including IVF, IUI, embryo freezing, and embryo transfer. These hubs serve as centres of excellence, catering to wider geographic areas.

- Spokes Nearby Hubs

Gaudium IVF extends its reach through smaller spoke centres around central hubs, improving accessibility to consultations, initial treatments, and follow-ups. Patients requiring advanced care are referred to nearby hubs, ensuring seamless, high-quality reproductive health services.

More About Gaudium IVF and Women Health Limited

Gaudium IVF and Women Health Limited, incorporated in 2015, is a leading provider of IVF (In Vitro Fertilization) treatment in India. Operating on a hub-and-spoke model, the company has expanded across multiple states, offering comprehensive fertility care.

Founder and Expertise

Founded by Dr. Manika Khanna, a specialist trained in gynecological endoscopic surgery from Kiel, Germany, and Gynaec Endoscopy from Melbourne IVF Gujarat Private Limited, the company is committed to providing advanced fertility treatments.

PAN-India Presence

- 30+ Locations

- 7 IVF Centers (Hubs)

- 28 Spokes (Strategic alliance with Infertility Expert)

- Major Hubs

- Delhi: Janakpuri & Kailash Colony

- Maharashtra: Mumbai (Khar West)

- Punjab: Ludhiana

- Jammu & Kashmir: Srinagar

- Bihar: Patna

- Karnataka: Bangalore

Global Reach

Gaudium IVF serves patients from various countries, including:

- Canada

- United Kingdom

- United States

- Kenya

- South Africa

- Oman

Fertility Treatments Offered

- IVF (In Vitro Fertilization) – Personalized treatment for couples facing infertility.

- IUI (Intrauterine Insemination) – A simple and effective fertility treatment.

- ICSI (Intracytoplasmic Sperm Injection) – A specialized technique for male infertility.

- PCOS/PCOD Treatment – Hormonal care for reproductive health.

- Male Infertility Solutions – Addressing sperm disorders and hormonal imbalances.

- Endometriosis Treatment – Managing infertility caused by endometriosis.

- Ovulation Induction – Stimulating ovulation for better chances of conception.

- Laser-Assisted Embryo Implantation – Enhancing embryo implantation success rates.

- Infertility Surgeries – Specialized surgical interventions for reproductive health.

- Surrogacy Support – Providing medical assistance for surrogacy-related treatments.

Additional Services

- Hospital Facility (Janakpuri, Delhi) – A 15-bed hospital dedicated to women’s and child care.

- Pharmacy Services – An in-house pharmacy at Janakpuri Center catering to patient needs.

Achievements and Recognition

- Asia’s Greatest Brands 2016 (Singapore)

- Symbol of Brand Excellence Award 2018 (London, UK)

- India Best Practices Award – IVF Chain Company of the Year 2019

International Collaboration

In May 2024, Gaudium IVF entered a collaboration agreement with a company in London to provide IVF consultancy and guidance, acting as the company’s exclusive representative in the region.

With a commitment to innovation, patient care, and expanding fertility services globally, Gaudium IVF continues to be a trusted name in reproductive health.

Industry Outlook

IVF Market in India

- Increasing demand due to late marriages, rising infertility rates, and higher maternal age.

- The Indian IVF market, valued at USD 779 million (CY23), is projected to reach USD 1,874 million by CY29, growing at a CAGR of 15.7%.

- India is a key destination for IVF medical tourism due to affordability, expertise, and infrastructure.

Growth Drivers

- Reproductive Tourism: Affordable IVF in India ($3,000–$4,000 vs. $15,000–$20,000 in the U.S.) attracts global patients.

- Technology Advancements: Innovations like assisted hatching, embryo scope, AI-based embryo selection, and PICSI improve success rates.

- Government Support: Loans, subsidies, and medical visas boost accessibility.

- Delayed Parenthood: Career-focused individuals opt for IVF and egg freezing.

- Rising Infertility: Lifestyle factors and age-related fertility decline increase demand.

- Awareness & Acceptance: Educational campaigns reduce stigma, driving IVF adoption.

How Will Gaudium IVF and Women Health Limited Benefit

- Increased Demand for IVF Services: With rising infertility rates, delayed parenthood, and growing awareness, Gaudium IVF is set to benefit from the increasing demand for fertility treatments in India.

- Expansion in Medical Tourism: India’s affordability, expertise, and advanced infrastructure attract international patients. Gaudium IVF’s global reach in countries like Canada, the UK, and the US strengthens its position in the medical tourism market.

- Technological Advancements:Gaudium IVF integrates innovations like AI-based embryo selection, assisted hatching, and laser-assisted embryo implantation, improving success rates and patient trust.

- Strong PAN-India Presence: With 7 IVF centres and 28 strategic spokes, Gaudium IVF has a well-established network, making fertility care accessible across multiple states.

- Government Support and Policies:Favourable policies, including medical visas, subsidies, and financial assistance for fertility clinics, will help Gaudium IVF expand its services.

- International Collaboration: Its 2024 partnership with a London-based company enhances its global footprint, reinforcing its role as a trusted fertility solutions provider.

- Comprehensive Fertility Solutions: Offering IVF, ICSI, IUI, surrogacy, and specialized treatments for PCOS and male infertility, Gaudium IVF meets diverse patient needs, ensuring sustainable growth.

Gaudium IVF and Women Health Limited IPO Overview

Gaudium IVF and Women Health has filed a Draft Red Herring Prospectus (DRHP) with SEBI for its IPO. The book-built issue includes a fresh issue of ₹1.83 crore equity shares and an offer for sale of 183,544 shares. The IPO will be listed on NSE and BSE, with allocations of 35% for retail investors, 50% for QIBs, and 15% for HNIs. Dr. Manika Khanna is selling shares in the OFS. Sarthi Capital Advisors is the lead manager, and Bigshare Services is the registrar.

Gaudium IVF and Women Health Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 1.89 crore shares

Offer for Sale (OFS): 0.25 crore shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post -issue | TBA |

Gaudium IVF and Women Health IPO Important Dates

| IPO Activity | Date |

| IPO Open Date | TBA |

| IPO Close Date | TBA |

| Basis of Allotment Date | TBA |

| Refunds Initiation | TBA |

| Credit of Shares to Demat | TBA |

| IPO Listing Date | TBA |

Gaudium IVF and Women Health IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Gaudium IVF and Women Health Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 2.70 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 61% |

| Net Asset Value (NAV) | 335.98 |

| Return on Equity | 49.90% |

| Return on Capital Employed (ROCE) | 46.27% |

| EBITDA Margin | 48.28% |

| PAT Margin | 30.89% |

| Debt to Equity Ratio | 0.69 |

Peer Group Comparison

- No Listed peers are available as on the date of Draft Red Herring Prospectus.

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ lakhs) |

| Funding capital expenditure towards establishment of New IVF Centers of our Company | 9469.92 |

| Funding working capital requirements for establishment of New IVF Centres Investment in the Subsidiary, EKK Global Private Limited for

a) Launching of FMCG products; and b) Funding its Working Capital Requirements |

395.23

292.25 2207.75 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

Gaudium IVF and Women Health Limited Financials (in lakhs)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 7227.02 | 5729.28 | 3662.75 | 1777.08 |

| Revenue | 3169.12 | 5348.46 | 4423.69 | 3651.98 |

| Profit After Tax | 814.41 | 1660.12 | 1352.46 | 882.82 |

| Reserves and Surplus | 1085.18 | 3227.94 | 217.86 | 830.40 |

| Total Borrowings | 1947.93 | 1572.58 | 978.11 | 594.82 |

| Total Liabilities | 3072.12 | 2402.32 | 1389.87 | 847.66 |

Key Strategies for Gaudium IVF and Women Health Limited

- Strategic Expansion and Diversification

Gaudium IVF and Women Health Limited is committed to expanding its services beyond core IVF treatments. The company aims to strengthen its presence across India using a Hub-and-Spoke model, ensuring greater accessibility to high-quality reproductive care in underserved regions. Additionally, it is diversifying into the FMCG sector through its wholly owned subsidiary, EKK Global Private Limited, introducing specialized healthcare products.

- Expansion of IVF Centres Using the Hub-and-Spoke Model

Gaudium IVF is expanding its network using a Hub-and-Spoke model, improving IVF accessibility in underserved regions. This approach ensures consistent service quality, centralizes advanced procedures at hubs, optimizes resources, and strengthens patient referrals within the Gaudium IVF network for better reproductive care.

- Diversification into FMCG Products Through EKK Global Private Limited

Leveraging its extensive network of patients, clinics, and healthcare professionals, Gaudium IVF is entering the FMCG sector. Through its subsidiary, EKK Global Private Limited, the company will introduce specialized mother-and-child wellness products and nutraceuticals aimed at supporting maternal health and managing diabetes.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

What is the expected opening date for Gaudium IVF's IPO?

The IPO is anticipated to open in mid-May 2025.

How can investors apply for the Gaudium IVF IPO?

Investors can apply online using UPI or ASBA through their bank’s net banking services.

What is the share allocation for retail investors in the IPO?

Retail investors are allocated 35% of the total shares in the IPO.

What is the face value of each share in the IPO?

Each share in the IPO has a face value of ₹5.

When is the listing date for Gaudium IVF's shares?

The shares are expected to be listed on the BSE and NSE in mid-May 2025.