- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Gem Aromatics IPO

₹14,214/46 shares

Minimum Investment

IPO Details

19 Aug 25

21 Aug 25

₹14,214

46

₹309 to ₹325

NSE, BSE

₹451.25 Cr

26 Aug 25

Gem Aromatics IPO Timeline

Bidding Start

19 Aug 25

Bidding Start

21 Aug 25

Bidding Start

22 Aug 25

Bidding Start

25 Aug 25

Bidding Start

25 Aug 25

Bidding Start

26 Aug 25

Gem Aromatics Limited

Gem Aromatics Limited, with over 20 years of experience, manufactures speciality ingredients in India, including essential oils, aroma chemicals, and value-added derivatives. Its portfolio of 70 products spans four categories: mint and derivatives, clove and derivatives, phenol, and other synthetic and natural ingredients. Serving 225 domestic and 44 international clients across 18 countries in FY2025, the company supplies oral care, cosmetics, nutraceuticals, pharmaceuticals, wellness, and personal care sectors. Sales are conducted via direct B2B channels, its U.S. subsidiary, and third-party agencies, supported by an in-house R&D team of 13 scientists advancing its value-added formulations.

Gem Aromatics Limited IPO Overview

Gem Aromatics IPO is a book-built issue worth ₹451.25 crores, comprising a fresh issue of 0.54 crore shares aggregating ₹175.00 crores and an offer for sale of 0.85 crore shares aggregating ₹276.25 crores. The IPO opens for subscription on 19 August 2025 and closes on 21 August 2025, with allotment expected on 22 August 2025. It is proposed to list on BSE and NSE on 26 August 2025. The price band is ₹309 to ₹325 per share, with a lot size of 46 shares for retail, requiring a minimum investment of ₹14,214. For sNII and bNII, the lot size investments are ₹2,09,300 and ₹10,01,650, respectively. Motilal Oswal Investment Advisors Ltd. is the book-running lead manager, and Kfin Technologies Ltd. is the registrar.

Gem Aromatics Limited IPO Details

| Particulars | Details |

| IPO Date | 19 August 2025 to 21 August 2025 |

| Listing Date | 26 August 2025 |

| Face Value | ₹2 per share |

| Issue Price Band | ₹309 to ₹325 per share |

| Lot Size | 46 Shares |

| Total Issue Size | 1,38,84,615 shares (aggregating up to ₹451.25 Cr) |

| Fresh Issue | 53,84,615 shares (aggregating up to ₹175.00 Cr) |

| Offer for Sale | 85,00,000 shares (aggregating up to ₹276.25 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 4,68,52,523 shares |

| Share Holding Post Issue | 5,22,37,138 shares |

Gem Aromatics Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50.00% of the Net Issue |

| Retail | Not less than 35.00% of the Net Issue |

| NII (HNI) | Not less than 15.00% of the Net Issue |

Gem Aromatics IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 46 | ₹14,950 |

| Retail (Max) | 13 | 598 | ₹1,94,350 |

| S-HNI (Min) | 14 | 644 | ₹2,09,300 |

| S-HNI (Max) | 66 | 3,036 | ₹9,86,700 |

| B-HNI (Min) | 67 | 3,082 | ₹10,01,650 |

Gem Aromatics IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 75% |

| Post-Issue | 55.06% |

Gem Aromatics Limited IPO Valuation Overview

| KPI | Value |

| EPS (Pre-IPO) | 11.39 |

| EPS (Post-IPO) | 10.22 |

| Price/Earnings (P/E) Ratio | 28.52 (Pre), 31.8 (Post) |

| Return on Net Worth (RoNW) | 18.80% |

| Net Asset Value (NAV) | 60.61 |

| Return on Equity (ROE) | 18.80% |

| Return on Capital Employed (ROCE) | 16.02% |

| EBITDA Margin | 17.55% |

| PAT Margin | 10.56% |

| Debt to Equity Ratio | 0.78 |

Objectives of the Proceeds

- Prepayment/repayment of borrowings of company and subsidiary, ₹140.00 Cr

- General corporate purposes to support business expansion and operations

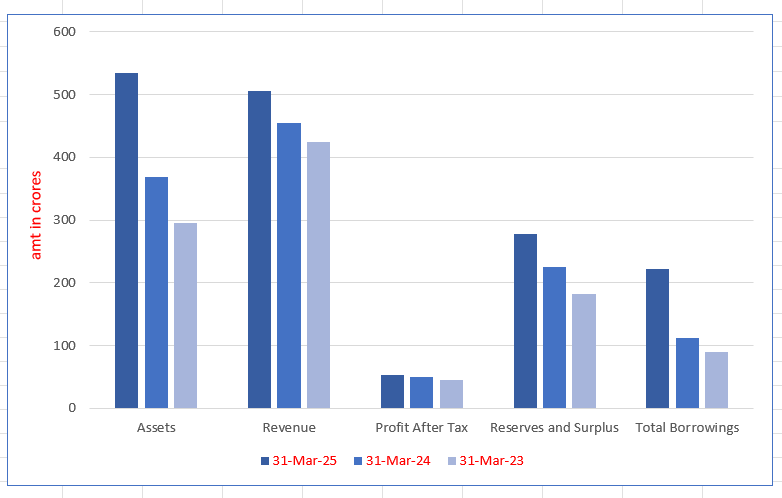

Key Financials (₹ Crores)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 534.52 | 368.57 | 295.76 |

| Revenue | 505.64 | 454.23 | 425.09 |

| Profit After Tax | 53.38 | 50.10 | 44.67 |

| Reserves and Surplus | 278.26 | 224.88 | 182.36 |

| Total Borrowings | 222.37 | 111.13 | 89.36 |

SWOT Analysis of Gem Aromatics IPO

Strength and Opportunities

- Reputed Indian manufacturer of specialty ingredients with strong market presence.

- Wide product portfolio with continuous R&D and innovation capabilities.

- Long-standing relationships with global and domestic customers.

- Strategically located manufacturing facilities focusing on sustainability.

- Experienced promoters and management team driving growth.

Risks and Threats

- Dependence on limited product segments could limit revenue diversification.

- High competition from larger domestic and international chemical manufacturers.

- Fluctuating raw material prices may impact profitability.

- Export operations exposed to foreign exchange fluctuations.

- Regulatory changes in chemical manufacturing may increase compliance costs.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Gem Aromatics Limited

Gem Aromatics IPO Strengths

- Established Indian manufacturer of specialty ingredients, including essential oils, aroma chemicals, and value-added derivatives.

- Extensive product portfolio supported by ongoing research, innovation, and development initiatives.

- Maintains long-term partnerships with prominent domestic and international customers.

- Manufacturing facilities strategically positioned with an emphasis on sustainable practices.

- Promoters and management team bring extensive experience and industry expertise.

Peer Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (per share) (₹) | P/E (x) | RoNW (%) |

| Gem Aromatics | 11.39 | 11.39 | 60.61 | – | 18.80 |

| Clean Science and Technology | 24.88 | 24.88 | 133.29 | 57.33 | 18.67 |

| Privi Speciality Chemicals | 47.87 | 47.87 | 282.47 | 50.51 | 16.95 |

| Camlin Fine Sciences | -8.03 | -7.95 | 46.23 | – | -16.01 |

| Yasho Industries | 5.32 | 5.32 | 348.09 | 374.92 | 1.46 |

| S H Kelkar and Company | 5.40 | 5.40 | 90.66 | 42.33 | 5.83 |

| Oriental Aromatics | 10.20 | 10.20 | 196.20 | 36.97 | 5.20 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Gem Aromatics IPO

How can I apply for Gem Aromatics IPO?

You can apply via HDFC Sky using UPI-based ASBA facility for a smooth application process.

What is the minimum investment required for the IPO?

Retail investors need to invest at least ₹14,214 for one lot of 46 shares in this IPO.

When will the IPO allotment be finalized?

The allotment for Gem Aromatics IPO is expected to be finalized on 22 August 2025.

On which stock exchanges will Gem Aromatics IPO list?

The IPO is proposed to list on BSE and NSE with tentative listing date 26 August 2025.