- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

GK Energy IPO

₹14,210/98 shares

Minimum Investment

IPO Details

19 Sep 25

23 Sep 25

₹14,210

98

₹145 to ₹153

NSE, BSE

₹464.26 Cr

26 Sep 25

GK Energy IPO Timeline

Bidding Start

19 Sep 25

Bidding Ends

23 Sep 25

Allotment Finalisation

24 Sep 25

Refund Initiation

25 Sep 25

Demat Transfer

25 Sep 25

Listing

26 Sep 25

GK Energy Limited

Incorporated in 2008, GK Energy Limited offers engineering, procurement, and commissioning (EPC) services for solar-powered agricultural water pump systems under the Central Government’s PM-KUSUM Scheme. Between January 2022 and July 2025, it installed numerous solar-powered pumps. The company provides farmers with comprehensive solutions, covering survey, design, supply, installation, testing, commissioning, and maintenance. Operating an asset-light model, GK Energy sources components from specialised vendors under its brand. As of August 2025, it has 12 warehouses across three states and a workforce of 90 employees and 709 workmen, enabling efficient operations in five states.

GK Energy Limited IPO Overview

GK Energy Limited is launching a book building IPO worth ₹464.26 crores, comprising a fresh issue of 2.61 crore shares aggregating ₹400.00 crores and an offer for sale of 0.42 crore shares totaling ₹64.26 crores. The IPO opens for subscription on 19 September 2025 and closes on 23 September 2025, with allotment expected on 24 September 2025 and tentative listing on BSE and NSE on 26 September 2025. The price band is ₹145 to ₹153 per share, with a lot size of 98 shares. Retail investors require a minimum investment of ₹14,994, while sNII and bNII applications require ₹2,09,916 and ₹10,04,598 respectively. IIFL Capital Services Ltd. is the lead manager, and MUFG Intime India Pvt. Ltd. is the registrar.

GK Energy Limited IPO Details

| Particulars | Details |

| IPO Date | 19 Sept 2025 to 23 Sept 2025 |

| Listing Date | 26 Sept 2025 |

| Face Value | ₹2 per share |

| Issue Price Band | ₹145 to ₹153 per share |

| Lot Size | 98 Shares |

| Total Issue Size | 3,03,43,790 shares (aggregating up to ₹464.26 Cr) |

| Fresh Issue | 2,61,43,790 shares (aggregating up to ₹400.00 Cr) |

| Offer for Sale | 42,00,000 shares (aggregating up to ₹64.26 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 17,66,73,476 shares |

| Share Holding Post Issue | 20,28,17,266 shares |

GK Energy Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Net Offer |

| Retail | Not less than 35% of the Net Offer |

| NII (HNI) | Not less than 15% of the Net Offer |

GK Energy Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 98 | ₹14,994 |

| Retail (Max) | 13 | 1,274 | ₹1,94,922 |

| S-HNI (Min) | 14 | 1,372 | ₹2,09,916 |

| S-HNI (Max) | 66 | 6,468 | ₹9,89,604 |

| B-HNI (Min) | 67 | 6,566 | ₹10,04,598 |

GK Energy Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 93.29% |

| Post-Issue | 78.64% |

GK Energy Limited IPO Valuation Overview

| KPI | Value |

| EPS (Pre IPO) | ₹7.54 |

| EPS (Post IPO) | ₹6.57 |

| P/E Ratio | 20.29x (Pre), 23.3x (Post) |

| RoNW | 63.71% |

| ROCE | 55.65% |

| PAT Margin | 12.12% |

| EBITDA Margin | 18.24% |

| Debt to Equity | 0.74 |

| NAV | ₹12.35 per share |

Objectives of the Proceeds

- Funding long-term working capital requirements of ₹322.46 crores.

- Strengthening overall financial position through general corporate purposes.

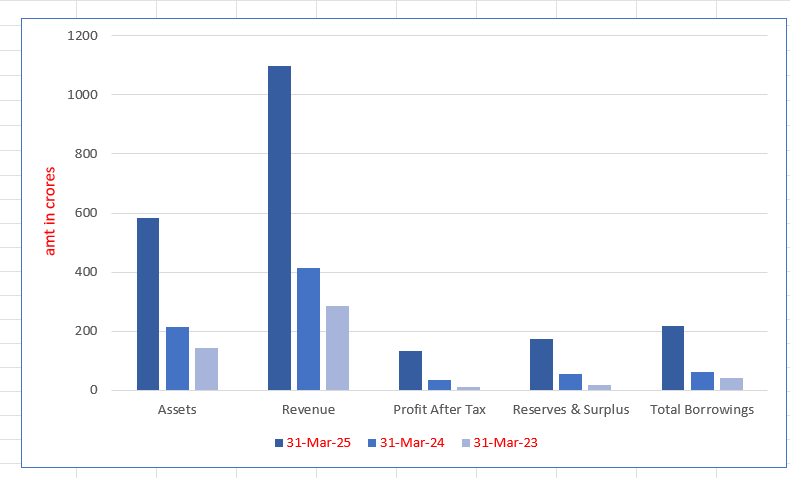

Key Financials (₹ Crores)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 583.62 | 214.08 | 142.82 |

| Revenue | 1,099.18 | 412.31 | 285.45 |

| Profit After Tax | 133.21 | 36.09 | 10.08 |

| Reserves & Surplus | 175.07 | 54.66 | 18.57 |

| Total Borrowings | 217.79 | 62.29 | 42.61 |

SWOT Analysis of GK Energy IPO

Strength and Opportunities

- Strong presence in government-backed solar pump installations

- Asset-light model reduces operational and financial risks

- Diversified presence across multiple states with warehouses

- High return ratios reflecting financial efficiency

Risks and Threats

- High reliance on government policies and subsidy schemes

- Intense competition from established pump and solar equipment players

- Seasonal demand fluctuations in agriculture sector may impact growth

- Rising raw material costs may reduce margins

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About GK Energy Limited IPO

GK Energy occupies a unique position in India’s renewable energy sector, being the largest EPC provider for solar-powered agricultural water pump systems, crucial to the Pradhan Mantri Kisan Urja Suraksha Evam Utthan Mahabhiyan (PM-KUSUM) scheme. This initiative promotes solar adoption among farmers to reduce reliance on conventional energy sources.

Distinguished by its asset-light model, GK Energy sources solar panels and components from third-party suppliers but plans to shift towards in-house production, aiming to improve margins and efficiency.

With over 42,778 solar-powered pump systems installed under PM-KUSUM by 30 September 2024, the company holds around 8.56% of completed orders. Its confirmed project pipeline as of 1 October 2024 stands at INR 759.18 crore, demonstrating its strong foothold in a competitive market.

Peer Group Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (per share) (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

| GK Energy Limited | 7.86 | 7.86 | 12.35 | – | 63.71 | – |

| Shakti Pumps (India) Ltd. | 33.97 | 33.97 | 96.59 | 24.11 | 35.20 | 8.53 |

| Oswal Pumps Limited | 28.21 | 28.18 | 44.56 | 29.00 | 93.00 | 18.57 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On GK Energy IPO

How can I apply for GK Energy IPO?

You can apply for GK Energy IPO online via HDFC Sky using UPI-based ASBA services.

What is the price band of GK Energy IPO?

The IPO price band is fixed between ₹145 and ₹153 per equity share.

What is the minimum investment required in GK Energy IPO?

Retail investors can apply with a minimum of 98 shares, costing ₹14,994.