- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Glass Wall Systems IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Glass Wall Systems (India) Limited

Incorporated in 2010, Glass Wall Systems (India) Limited is a leading façade solutions and fenestration provider with operations in India, the United States, and Australia. With over two decades of industry experience, the company has completed more than 150 projects as of March 31, 2025. Its operations span three verticals: domestic façade solutions offering design, engineering, fabrication, and EPC services; international façade product supply for overseas contractors; and premium fenestration solutions through its subsidiary Yes Systems Private Limited (ORIA brand), collaborating with global partners like LIBART and OIKAS. The company serves real estate developers, contractors, hospitals, airports, and corporations across commercial, residential, and institutional projects.

Glass Wall Systems Limited IPO Overview

Glass Wall Systems (India) Limited filed a Draft Red Herring Prospectus (DRHP) with SEBI on September 5, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is structured as a Book Build Issue, comprising a fresh issue of ₹60.00 crores and an offer for sale (OFS) of up to 4.02 crore equity shares. The shares are proposed to be listed on the NSE and BSE, with MUFG Intime India Pvt. Ltd. acting as the registrar. Key details, including IPO dates, price bands, and lot size, are yet to be announced. The company’s promoters, Jawahar Hariram Hemrajani and Eshan Jawahar Hemrajani, currently hold 64.11% of equity pre-issue.

Glass Wall Systems (India)Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹60 crore |

| Offer for Sale (OFS) | 4.02 crore equity share |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 8,46,38,550 shares |

| Shareholding post-issue | TBA |

Glass Wall Systems IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Glass Wall Systems (India) Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Glass Wall Systems (India) Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹5.20 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 28.54% |

| Net Asset Value (NAV) | ₹20.22 |

| Return on Equity (RoE) | 32.75% |

| Return on Capital Employed (RoCE) | 38.32% |

| EBITDA Margin | 23.73% |

| PAT Margin | 17.90% |

| Debt to Equity Ratio | 0.06 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure requirement for setting up of a glass processing unit (“GPU Project”) as part of planned backward integration of the Company at our Vile Bhagad Facility | 500 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

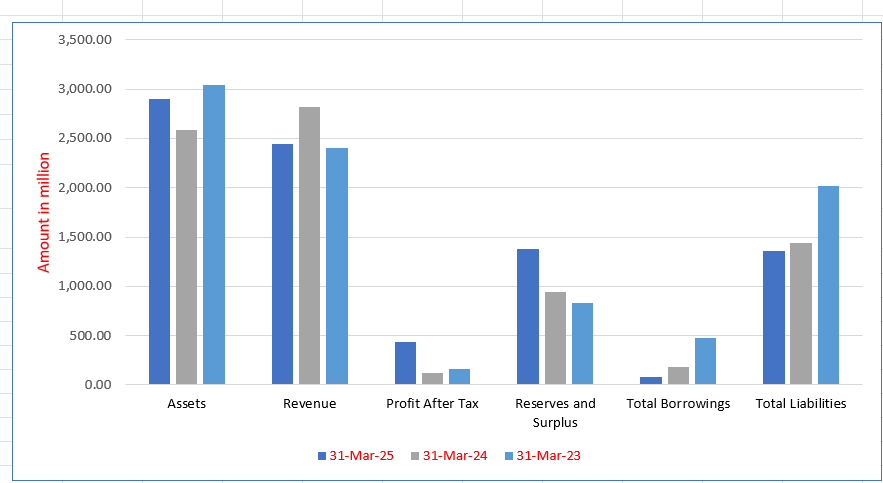

Glass Wall Systems (India) Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 2,895.73 | 2,583.41 | 3,039.30 |

| Revenue | 2,447.61 | 2,821.71 | 2,405.11 |

| Profit After Tax | 438.09 | 119.53 | 161.11 |

| Reserves and Surplus | 1,383.16 | 946.04 | 827.51 |

| Total Borrowings | 84.64 | 185.46 | 471.32 |

| Total Liabilities | 1,360.73 | 1,442.98 | 2,017.40 |

Financial Status of Glass Wall Systems (India)Limited

SWOT Analysis of Glass Wall Systems IPO

Strength and Opportunities

- Leading façade fabricator in India with over 150 completed projects

- Extensive experience in designing, manufacturing, and project management

- Strong presence in international markets, including the USA and Australia

- Diverse client base across residential, commercial, and hospitality sectors

- Established relationships with prominent clients such as Wipro, Tata, and Lodha Group

- Robust design and manufacturing facilities in India

- Adoption of advanced technologies in façade solutions

- Recognition as India's largest façade exporter in 2024

- Strong project management capabilities ensuring timely delivery

Risks and Threats

- Intense competition in the façade solutions industry may pressure profit margins

- Dependency on skilled labor and potential challenges in scaling operations

- Exposure to currency fluctuations and geopolitical risks in international markets

- Potential delays in project timelines due to supply chain disruptions

- Vulnerability to changes in construction industry regulations and standards

- Environmental and sustainability concerns related to construction materials and practices

- Rising costs of raw materials impacting overall project budgets

- Potential challenges in maintaining quality standards across diverse international projects

- Risks associated with large-scale projects, including financial and operational uncertainties

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Glass Wall Systems (India) Limited

Glass Wall Systems (India) Limited IPO Strengths

Strong Market Position and Expanding Global Footprint

Glass Wall Systems (India) Limited holds market leadership domestically, which is bolstered by its nearly two decades of experience and successful project delivery. The company has strategically expanded into international markets over the last three Fiscals and entered the luxury domestic fenestration sector via the Yes Systems acquisition, reinforcing its competitive edge and potential for sustained success.

Comprehensive End-to-End Façade Expertise

The company offers full-lifecycle expertise in the domestic façade industry, covering design through to execution, to provide comprehensive, innovative client solutions. By strategically focusing on commercial projects, it secures beneficial contract terms, including shorter timelines and favorable payments. Glass Wall Systems emphasizes high-quality, sustainable materials and construction, aligning its façade systems with modern energy efficiency and environmental responsibility standards.

Strategic Global Positioning and High Export Growth

As one of the few Indian players with an established international presence, Glass Wall Systems is well-positioned to leverage global opportunities. The company strategically focuses on exporting façade panels, which diversifies operations and improves profit margins due to significantly higher global realization per square foot. This strategy has resulted in an impressive CAGR of 170.48% in export sales from Fiscal 2023 to Fiscal 2025.

Diversified Business Through Strategic Acquisition

The acquisition of Yes Systems represents a strategic consolidation of high-margin business, enhancing profitability and operational efficiency. This move positions the company to tap into the explosively growing ultra-luxury domestic fenestration market, which has seen a 30.7% CAGR in revenue from Fiscal 2020 to Fiscal 2025. This integration diversifies offerings and leverages established brand equity and expertise for sustained success.

Marquee Client Base and Proven Project Track Record

The company’s success is built on a marquee client base and robust project execution capabilities, with promoters having over two decades of industry experience. Glass Wall Systems maintains strong, long-standing relationships with key real estate players like Embassy and Prestige, leading to significant repeat business. This proven domestic track record and its international client base in the US and Australia ensure a solid foundation and a robust pipeline of projects.

Advanced Design, Engineering, and Manufacturing

Glass Wall Systems is driven by strong in-house design and engineering capabilities, utilizing advanced software like AutoCAD and a team of over 35 designers. Its large, strategically located Vile Bhagad Facility has a developed manufacturing area of over 20,295 square meters and is near the Nhava Sheva port, facilitating seamless exports. The ISO-certified facility features advanced CNC machinery and a production capacity of 200 panels daily.

Focus on Sustainable and High-Performance Solutions

The company is deeply committed to providing environmentally sustainable and high-performing façade solutions. It boasts the lowest embodied carbon in its products, supported by an exclusive agreement with Dow Corning for low and carbon-neutral silicone. The adoption of a zero-waste program and the use of green aluminum and silicones underscore its alignment with global green construction trends, enhancing its appeal to international clients.

Experienced Promoters and Professional Management Team

Glass Wall Systems is guided by experienced promoters, with Mr. Jawahar Hariram Hemrajani and Mr. Eshan Jawahar Hemrajani possessing approximately 33 and 11 years of façade solutions experience, respectively. A professional management team, including senior leaders with up to 23 years of sector expertise, contributes to strategic planning and business development. This experienced leadership is well-positioned to capitalize on future growth opportunities.

More About Glass Wall Systems (India) Limited

Glass Wall Systems (India) Limited is a premium façade solutions and fenestration provider with operations across India, the United States, and Australia. Ranked as the second-largest façade solutions provider in India by revenue for FY 2024 and FY 2025, the company is also the nation’s largest façade exporter in 2024. With over two decades of experience, it has successfully completed more than 150 projects as of March 31, 2025, demonstrating expertise in delivering innovative and sustainable building envelope solutions.

Façade and Fenestration Solutions

Glass Wall Systems offers advanced façade and fenestration systems that integrate architectural design, precision engineering, and high-performance materials. Its solutions include:

- Curtain wall facades, storefront facades, unitized and semi-unitized curtain walls, and frameless façades

- High-performance windows, doors, skylights, and partition systems

- Systems enhancing thermal efficiency, acoustic performance, and structural integrity

These solutions meet international standards such as ASTM and Australian/New Zealand regulations, ensuring both aesthetic appeal and functional performance.

Business Verticals

Operations are organized into three main verticals:

- Domestic Façade Solutions – Comprehensive design, engineering, fabrication, supply, and EPC services for real estate developers, contractors, and corporate clients.

- International Façade Products Supply – Tailored sustainable façade products for contractors and façade companies overseas.

- Fenestration Solutions – High-end fenestration offerings under subsidiary Yes Systems Private Limited, targeting luxury residential developers and high-net-worth individuals, with premium collaborations including Swiss brand partnerships.

Manufacturing and Project Management

The company operates a primary manufacturing facility at Vile Bhagad, Maharashtra, with ISO-certified processes and advanced CNC machinery, producing 140 panels per month with ongoing expansion. Project management capabilities include a team of over 44 professionals ensuring timely execution of complex projects.

Sustainability Initiatives

Glass Wall Systems adopts a sustainability-first approach, incorporating solar-powered operations, zero-waste recycling, low-carbon materials, and ISO 14001:2015 environmental certification. Strategic supplier partnerships maintain quality while minimizing environmental impact.

Leadership and Financial Performance

Promoters Jawahar Hariram Hemrajani and Managing Director Eshan Jawahar Hemrajani combine extensive industry expertise, strategic vision, and international experience. Supported by MO Alternate Investment Advisors Private Limited, the company demonstrates consistent revenue growth, profitability, and operational efficiency, reflecting a strong market position and financial stability.

Industry Outlook

The Indian façade and fenestration industry is experiencing robust growth, driven by urbanization, infrastructure development, and a shift towards energy-efficient building solutions. This sector encompasses the design, manufacturing, and installation of building envelopes, including curtain walls, windows, doors, and skylights.

Market Size and Growth

- The Indian façade market was valued at approximately USD 3.06 billion in 2024 and is projected to reach USD 5.58 billion by 2033, growing at a CAGR of 6.9%

- The fenestration market, particularly the aluminium windows and doors segment, is estimated at USD 6.5 billion in 2024, with steady growth anticipated due to increasing demand in residential and commercial sectors

Growth Drivers

- Urbanization: Rapid urban development and the construction of smart cities are fueling demand for modern façade solutions.

- Energy Efficiency: Growing emphasis on sustainability and energy conservation is driving the adoption of high-performance fenestration systems.

- Infrastructure Projects: Government initiatives and private investments in commercial and residential projects are expanding market opportunities.

- Technological Advancements: Innovations in materials and design are enhancing the functionality and aesthetics of façade systems.

Product Segments

- Curtain Wall Systems: These non-structural cladding systems are gaining popularity in high-rise buildings for their aesthetic appeal and performance.

- Unitized and Semi-Unitized Systems: Prefabricated units offer faster installation and improved quality control.

- Frameless Glass Systems: These provide a sleek, modern look and are increasingly used in luxury residential and commercial projects.

- Aluminium Windows and Doors: Known for durability and thermal efficiency, these are widely used in both residential and commercial applications.

How Will Glass Wall Systems (India) Limited Benefit

- Glass Wall Systems (India) Limited can leverage the growing Indian façade market, projected to reach USD 5.58 billion by 2033, to expand its domestic and international revenue streams.

- Rising demand for energy-efficient and sustainable building solutions allows the company to promote its high-performance fenestration systems.

- Urbanization and smart city projects create opportunities for large-scale façade installations and high-value contracts.

- Technological advancements in materials and prefabricated systems enable the company to offer innovative, faster-to-install, and cost-effective solutions.

- Growth in the luxury residential and commercial sectors aligns with the company’s premium fenestration offerings under Yes Systems.

- Increased adoption of aluminium windows and doors supports expansion of its diverse product portfolio.

- Strategic positioning in domestic and overseas markets allows Glass Wall Systems to strengthen its brand as a leading exporter.

- Sustainability trends and compliance with international standards enhance the company’s market credibility and appeal to environmentally conscious clients

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue (₹ million) | EPS (₹) Basic | NAV (₹ ) | P/E | RoNW (%) |

| Glass Wall Systems (India) Limited | 2.00 | 2,447.61 | 5.20 | 20.22 | N.A. | 28.54 |

| Peer Group | ||||||

| Innovator Façade Systems Limited | 10.00 | 2,213.74 | 8.49 | 85.65 | 21.67 | 9.91 |

Key Strategies for Glass Wall Systems (India) Limited

Expand Global Market Presence

Glass Wall Systems (India) Limited plans to strategically expand its presence in both existing and new international markets like Canada and Europe, building upon its strong foundation in the USA and Australia. The company aims to leverage its expertise in sustainable façade solutions and establish local partnerships to capitalize on significant global market opportunities and diversify client relationships.

Enhance Domestic Market Leadership

The company is committed to reinforcing its dominant position in the domestic Indian façade and fenestration market, which is projected for significant growth. Glass Wall Systems (India) Limited will selectively pursue projects with financially credible clients and favorable terms, while continuing to deepen relationships with marquee clients by offering innovative, high-performance façade solutions.

Grow Luxury Fenestration Business

Glass Wall Systems (India) Limited will expand its high-end fenestration business by integrating its Subsidiary, Yes Systems, under the ‘ORIA’ brand. This strategic move leverages synergies to access the rapidly growing, margin-accretive ultra-luxury residential segment. The company will utilize partnerships with brands like LIBART and OIKOS to offer a comprehensive, differentiated product portfolio.

Boost Efficiency and Competitiveness

To drive profitability and growth, Glass Wall Systems (India) Limited is undertaking strategic capacity expansion (33% increase) and backward integration, including establishing an in-house glass processing unit. These initiatives, along with technological advancements and an in-house testing rig, will enhance operational efficiency, streamline the supply chain, and reinforce its market competitiveness and product quality.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Glass Wall Systems (India) Limited IPO

How can I apply for Glass Wall Systems (India) Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When was the Glass Wall Systems IPO filed with SEBI?

The company filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 5, 2025.

What is the structure of the Glass Wall Systems IPO?

It is a Book Building IPO with a fresh issue of ₹60 crore and an Offer for Sale of 4.02 crore shares.

On which stock exchanges will the shares be listed?

The equity shares are proposed to be listed on both NSE and BSE.

Who are the promoters of Glass Wall Systems (India) Limited?

Jawahar Hariram Hemrajani and Eshan Jawahar Hemrajani are the company’s promoters.

What is the face value of the shares being issued in the IPO?

The face value of each equity share in the IPO is ₹2.