- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Globe Civil Projects IPO

₹14/211 shares

Minimum Investment

IPO Details

24 Jun 25

26 Jun 25

₹14

211

₹67 to ₹71

NSE, BSE

₹119 Cr

01 Jul 25

Globe Civil Projects IPO Timeline

Bidding Start

24 Jun 25

Bidding Ends

26 Jun 25

Allotment Finalisation

27 Jun 25

Refund Initiation

30 Jun 25

Demat Transfer

30 Jun 25

Listing

01 Jul 25

Globe Civil Projects Limited

Founded in 2002 and based in New Delhi, Globe Civil Projects Limited is a full-service EPC firm. The company has executed 37 projects and is currently engaged in 12 more across India. Its clientele spans infrastructure, housing, and commercial sectors. As of 31 August 2024, its order book value stood at ₹892.94 crore. With operations in 11 states and a team of 112 employees, the company maintains a strong execution track record.

Globe Civil Projects Limited IPO Overview

Globe Civil Projects IPO is a book-built issue worth ₹119.00 crores, consisting entirely of a fresh offering of 1.68 crore equity shares. The IPO will open for subscription on 24 June 2025 and will close on 26 June 2025. The basis of allotment is likely to be finalised on Friday, 27 June 2025, with the shares expected to be listed on both BSE and NSE on Tuesday, 1 July 2025. The price band for the IPO has been set between ₹67 and ₹71 per share. Retail investors must apply for a minimum lot size of 211 shares, requiring an investment of ₹14,137. However, to improve chances in case of oversubscription, bidding at the cut-off price is recommended, increasing the amount to approximately ₹14,981. For small non-institutional investors (sNII), the minimum investment is 14 lots (2,954 shares) worth ₹2,09,734, while large non-institutional investors (bNII) are required to invest in 67 lots (14,137 shares), amounting to ₹10,03,727.

Globe Civil Projects Limited IPO Details

| Particulars | Details |

| IPO Date | 24 June 2025 to 26 June 2025 |

| Listing Date | 1 July 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹67 to ₹71 per share |

| Lot Size | 211 Shares |

| Total Issue Size | 1,67,60,560 shares (aggregating up to ₹119.00 Cr) |

| Fresh Issue | 1,67,60,560 shares (aggregating up to ₹119.00 Cr) |

| Offer for Sale | NA |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 4,29,58,439 shares |

| Share Holding Post Issue | 5,97,18,999 shares |

Globe Civil Projects Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Net Issue |

| Retail | Not less than 35% of the Net Issue |

| NII (HNI) | Not less than 15% of the Net Issue |

Globe Civil Projects Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 211 | ₹14,981 |

| Retail (Max) | 13 | 2,743 | ₹1,94,753 |

| HNI (Min) | 14 | 2,954 | ₹2,09,734 |

| S-HNI (Max) | 66 | 13,926 | ₹9,88,746 |

| B-HNI (Min) | 67 | 14,137 | ₹10,03,727 |

Globe Civil Projects Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 88.14% |

| Post-Issue | To be updated |

Globe Civil Projects Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹3.58 |

| Price/Earnings (P/E) | TBD |

| Return on Net Worth (RoNW) | 19.80% |

| Return on Equity (RoE) | 21.95% |

| Return on Capital Employed (ROCE) | 23.07% |

| EBITDA Margin | 13.44% |

| PAT Margin | 4.59% |

| Net Asset Value (NAV) | ₹16.17 |

| Debt to Equity Ratio | 1.60 |

Objectives of the Proceeds

- To meet working capital requirements, ₹75 crore

- Capital expenditure for acquiring construction machinery, ₹14.26 crore

- General corporate purposes

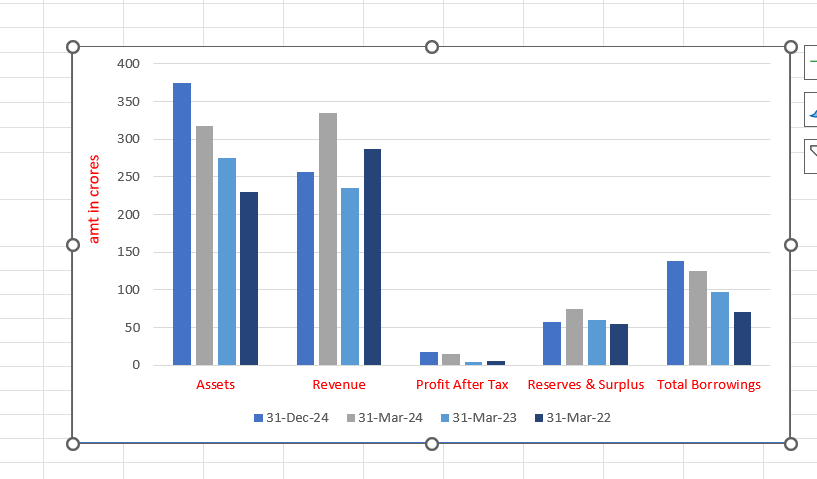

Key Financials (in ₹ Crores)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 374.60 | 317.83 | 275.04 | 229.79 |

| Revenue | 256.74 | 334.81 | 235.17 | 286.78 |

| Profit After Tax | 17.79 | 15.38 | 4.85 | 5.20 |

| Reserves & Surplus | 56.87 | 75.19 | 59.97 | 54.98 |

| Total Borrowings | 137.97 | 124.48 | 97.00 | 70.76 |

SWOT Analysis of Globe Civil Projects IPO

Strength and Opportunities

- Strong track record of 37 completed projects across 11 states.

- Diverse order book of ₹892.94 crore across multiple sectors.

- Expertise across EPC domains including social, logistics, and housing.

- Well-established promoter group with domain experience.

- Growing presence in commercial and government projects.

Risks and Threats

- High dependence on infrastructure project cycles.

- Project delays can impact profitability.

- Exposure to input cost fluctuations.

- High working capital requirements.

- Competition from larger, established EPC players.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Globe Civil Projects Limited

Globe Civil Projects IPO Strengths

- Globe Civil Projects has a proven track record of timely project execution.

- It maintains a strong and diverse project portfolio across India.

- The company benefits from experienced promoters with industry knowledge.

- It has a robust order book ensuring future revenue visibility.

- Its operations are spread across multiple infrastructure and non-infrastructure verticals.

Peer Group Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (per share) (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

| Globe Civil Projects Limited | 3.58 | 3.58 | 18.10 | – | 19.80 | – |

| Peer Groups | ||||||

| B.L. Kashyap and Sons Ltd. | 2.33 | 2.33 | 22.02 | 29.57 | 10.58 | 3.09 |

| Ceigall India Limited | 19.37 | 19.37 | 57.68 | 12.88 | 33.57 | – |

| PSP Projects Ltd | 34.16 | 34.16 | 222.50 | 20.38 | 13.49 | 3.09 |

| Capacite Infraprojects Ltd | 16.09 | 16.09 | 179.30 | 20.56 | 7.93 | 1.46 |

| Ahluwalia Contracts (India) Ltd | 55.95 | 55.95 | 238.84 | 16.41 | 23.43 | 4.28 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Globe Civil Projects IPO

How can I apply for Globe Civil Projects IPO?

You can apply via HDFCSky or any UPI-enabled broker platform using the ASBA process.

What is the minimum investment for Globe Civil Projects IPO?

The minimum retail investment is ₹14,981 for 211 shares.

What is the price band for Globe Civil Projects IPO?

The IPO price band is set between ₹67 to ₹71 per share.

When will Globe Civil Projects IPO be listed?

The tentative listing date for the IPO is 1 July 2025.