- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Glottis IPO

₹13,680/114 shares

Minimum Investment

IPO Details

29 Sep 25

01 Oct 25

₹13,680

114

₹120 to ₹129

NSE, BSE

₹307 Cr

07 Oct 25

Glottis IPO Timeline

Bidding Start

29 Sep 25

Bidding Ends

01 Oct 25

Allotment Finalisation

03 Oct 25

Refund Initiation

06 Oct 25

Demat Transfer

06 Oct 25

Listing

07 Oct 25

Glottis IPO Limited

Founded in 2004, Glottis has established itself as a leader in contract logistics and freight management. With a dedicated workforce, the company provides transportation and supply-chain solutions across industries. Specialising in air, sea, and land logistics, Glottis ensures efficient freight forwarding, customs clearance, and end-to-end logistics. Headquartered in India, the company has over two decades of experience in streamlining complex supply chains. Managing approximately 15 million imports and exports, Glottis continues to expand its reach, delivering excellence in logistics solutions worldwide.

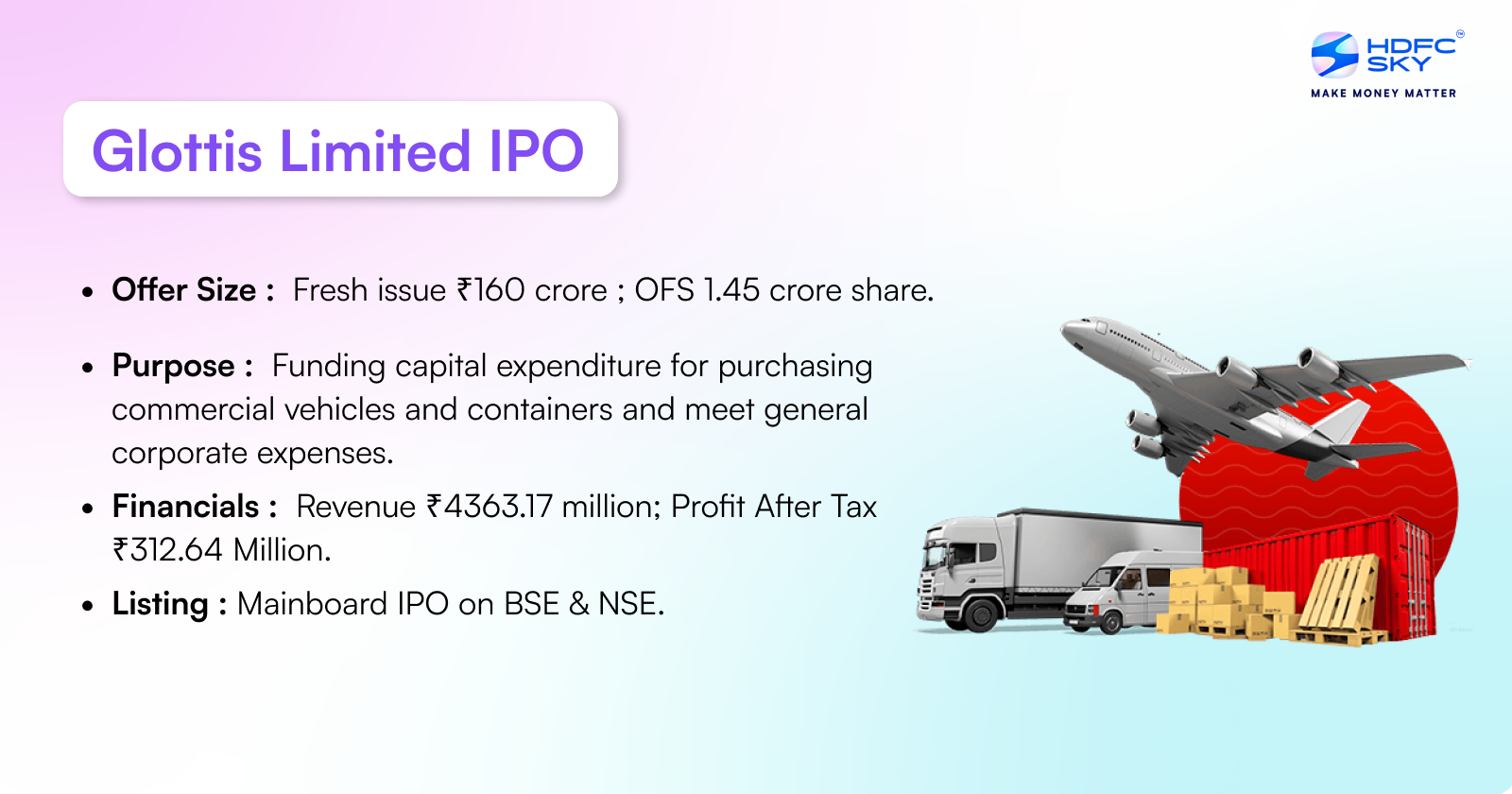

Glottis Limited IPO Overview

Glottis filed its Draft Red Herring Prospectus (DRHP) with SEBI on Monday, February 10, 2025. As per the DRHP, includes a fresh issue of equity shares worth Rs 200 crore and an offer-for-sale of 1.45 crore shares by the promoters. Promoters Ramkumar Senthilvel and Kuttappan Manikandan will each sell 72.85 lakh shares. Both currently hold a 49% stake, each repsectively, in the company. This IPO aims to raise capital while allowing the promoters to partially exit their holdings.

Glottis Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹160 crore

Offer for Sale (OFS): 1.45 crore shares |

| IPO Dates | 29 September 2025 ot 1 October 2025 |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 8,00,00,000 shares |

| Shareholding post -issue | TBA |

Important Dates

| Particulars | Date |

| IPO Open Date | Mon, Sep 29, 2025 |

| IPO Close Date | Wed, Oct 1, 2025 |

| Tentative Allotment | Fri, Oct 3, 2025 |

| Initiation of Refunds | Mon, Oct 6, 2025 |

| Credit of Shares to Demat | Mon, Oct 6, 2025 |

| Tentative Listing Date | Tue, Oct 7, 2025 |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Glottis Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Glottis Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 3.87 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 73.10% |

| Net Asset Value (NAV) | 9.19 |

| Return on Equity | 73.10% |

| Return on Capital Employed (ROCE) | 95.91% |

| EBITDA Margin | 8.12% |

| PAT Margin | 6.23% |

| Debt to Equity Ratio | 0.19 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure requirements of the Company, towards purchase of commercial vehicles and containers | 1325.4 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

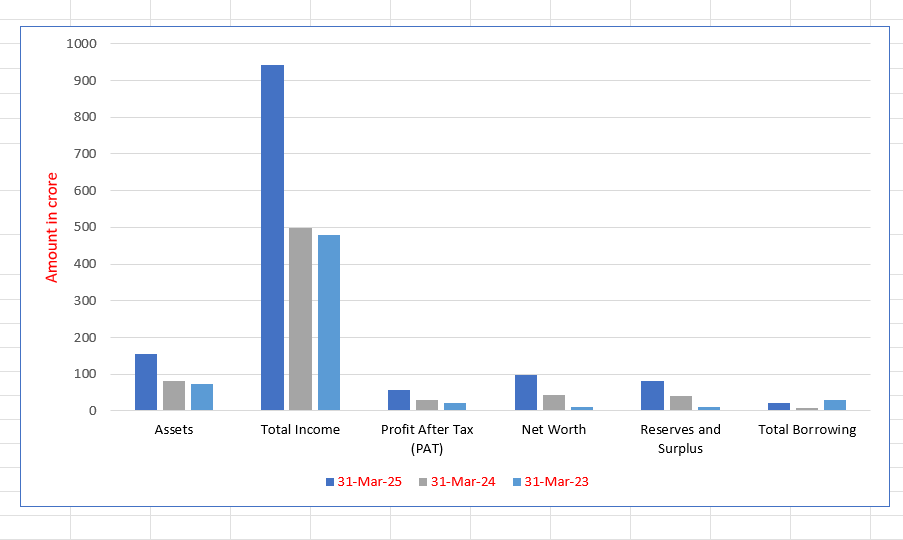

Glottis Limited Financials (in crore)

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 156.10 | 81.72 | 72.08 |

| Total Income | 942.55 | 499.39 | 478.77 |

| Profit After Tax (PAT) | 56.14 | 30.96 | 22.44 |

| Net Worth | 98.53 | 42.35 | 11.52 |

| Reserves and Surplus | 82.53 | 41.35 | 10.52 |

| Total Borrowing | 22.14 | 8.08 | 30.61 |

Financial Status of Glottis Limited

SWOT Analysis of Glottis IPO

Strength and Opportunities

- Established since 2004 with over two decades of experience in freight forwarding and logistics.

- Comprehensive service offerings, including air, sea, land transport, multimodal transport, and 3PL warehousing.

- Strong global presence with a reputation as a world-class freight service provider.

- Advanced tracking systems providing real-time status updates and live tracking of goods.

- Strategic expansion with the opening of a new office in Coimbatore to enhance service delivery.

- Recognition through awards such as "SMART FORWARDER OF THE YEAR-IMPORTS" in 2016, indicating industry acknowledgment.

- Strong network of stakeholders enabling efficient and reliable freight services.

- Commitment to providing environmentally friendly logistics solutions, aligning with global sustainability trends.

- Continuous growth in delivered containers per month, reflecting operational capacity and market demand.

Risks and Threats

- Intense competition in the logistics sector may impact market share and profitability.

- Dependence on global trade dynamics exposes the company to risks from international market fluctuations.

- Regulatory changes in international trade policies could affect operational procedures and costs.

- Economic downturns may reduce demand for freight services, impacting revenue streams.

- Fluctuations in fuel prices can increase operational expenses and affect pricing strategies.

- Challenges in maintaining service quality and customer satisfaction amid rapid expansion.

- Potential supply chain disruptions due to unforeseen events like natural disasters or pandemics.

- Technological advancements may require continuous investment to stay competitive in the logistics industry.

- Talent acquisition and retention challenges in a competitive market may affect service delivery and innovation.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Glottis Limited IPO

Glottis Limited IPO Strengths

- Leading Freight Forwarder in Renewable Energy

Glottis Limited excels in renewable energy logistics, leveraging two decades of expertise. It serves power generation firms, managing complex shipments. With India’s solar sector growing rapidly, government policies drive demand. High-entry barriers, global networks, and industry-tailored solutions position Glottis for sustained growth in this expanding market.

- Expansive Network and Asset Optimisation

Glottis Limited leverages a vast network of intermediaries and strategic asset utilisation. With 171 overseas agents and multiple logistics partnerships, it balances owned and outsourced assets, ensuring efficiency. Fleet expansion and lease strategies enhance operational control, cost savings, and scalability in freight forwarding and inland transportation.

- Scaled Multimodal Logistics Expertise

Glottis Limited offers multimodal logistics solutions across ocean, air, and road freight, alongside warehousing and 3PL services. With operations spanning 119 countries, it utilises trade intelligence to optimise freight flows. Its expertise ensures seamless handling of sensitive components, including solar panels and advanced manufacturing equipment.

- Longstanding Relationships Across Diverse Industries

Glottis Limited has nurtured enduring relationships with customers across various industries, serving 1,662 clients in Fiscal 2024. With tailored logistics solutions, it caters to sectors like renewable energy, engineering, home appliances, and agriculture. Industry growth trends and referrals continue to expand its reach, reinforcing its commitment to reliability and excellence.

- Expanding Global Footprint

With operations spanning Asia, North America, Europe, South America, Africa, and Australia, Glottis Limited has expanded its reach across 119 countries in Fiscal 2024. Strategic local presence in Singapore, the UAE, and Vietnam enhances supply chain management and stakeholder relationships. Our global operations, covering air, water, and road freight, serve diverse industries, ensuring continued growth and market expansion.

- Strong Financial Growth with Proven Performance

Glottis Limited has demonstrated consistent financial growth, marked by rising revenue, profitability, and an improved balance sheet. Our ocean freight volume surged by 61.80% from 58,760 TEUs in Fiscal 2022 to 95,072 TEUs in Fiscal 2024. Profit margins expanded from 3.70% to 6.34%, while EBITDA margins rose from 5.78% to 8.12%, reflecting our focus on efficiency, productivity, and cost optimization

More About Glottis Limited

Glottis Limited offers multimodal integrated logistics solutions, ensuring seamless end-to-end transportation across various modes, including:

- Ocean Freight Forwarding – Project cargo load, full container load (FCL) for both import and export.

- Air Freight Forwarding – Import and export services.

- Road Transportation – Nationwide road logistics services.

- Ancillary Services – Warehousing, storage, cargo handling, third-party logistics (3PL), and customs clearance.

In Fiscal 2024, Glottis Limited successfully handled approximately 95,000 TEUs of imports via ocean freight. By integrating its in-house infrastructure with a network of intermediaries, the company provides comprehensive logistics solutions, adapting to varying volumes and ensuring flexibility in cargo handling.

Market Reach and Global Presence

With a robust network of international freight forwarding agencies, Glottis Limited operates across key markets, including Europe, North America, South America, Africa, the Middle East, and Asia. This expansive reach allows the company to:

- Secure carrier spaces at competitive rates.

- Ensure reliable delivery through pre-booked shipping slots.

- Maintain stable pricing with minimal cancellations.

Competitive Edge in Logistics

The Indian logistics industry is highly competitive, dominated by numerous unorganized players. Unlike these, Glottis Limited offers structured and organized mechanisms for:

- Document Handling – Efficient processing and tracking.

- Customs Clearance – Streamlined and compliant procedures.

- Shipment Tracking – Real-time updates for customers.

- Grievance Management – Structured resolution processes.

To enhance customer experience, the company provides daily reports detailing shipment progress, ensuring transparency and enabling better operational planning.

Industry Expertise and Revenue Streams

Glottis Limited specializes in serving multiple industries, particularly renewable energy, engineering, home appliances, and timber. The company has built expertise in handling complex logistics requirements, particularly for renewable energy projects, covering:

- Solar and wind power infrastructure.

- Energy components such as solar cells and trackers.

- Intelligent power systems.

Expanding Customer Base

The company has witnessed a steady increase in customer engagement:

- Served 1,246 customers across 119 countries in the six months ending September 30, 2024.

- Expanded operations through strategic partnerships in Singapore, UAE, and Vietnam.

Freight Management and Growth Prospects

Glottis Limited focuses primarily on ocean freight, given its strong demand and attractive margins. The Indian ocean freight market, valued at US$ 7.8B in FY24, is expected to grow at 11.9% CAGR, reaching US$ 13.9B by FY29. With two decades of expertise, Glottis Limited continues to leverage its strengths in:

- Operational Track Record – Strong presence in Southern India.

- Strategic Tie-ups – Partnerships with shipping lines and agencies.

- Market Intelligence – Data-driven decision-making.

- Technology Integration – Enhancing logistics efficiency.

- Global Network – Collaborations with international freight forwarders.

Through continuous innovation and customer-centric strategies, Glottis Limited remains a leader in multimodal logistics, fostering long-term partnerships and ensuring reliability in global supply chain management.

Industry Outlook

The Indian logistics industry is a vital component of the nation’s economy, facilitating the seamless movement of goods across diverse sectors. Companies like Glottis Limited, offering comprehensive multimodal logistics solutions, are well-positioned to capitalize on the industry’s robust growth trajectory.

Industry Overview and Growth Prospects

As of 2024, the Indian logistics market is valued at approximately USD 230 billion and is projected to reach USD 360 billion by 2030, reflecting a compound annual growth rate (CAGR) of around 8% during 2025-2030. This expansion is driven by factors such as:

- E-commerce Boom: The rapid rise of online retail has heightened demand for efficient logistics services.

- Government Initiatives: Programs like ‘Make in India’ and infrastructure developments, including dedicated freight corridors and logistics parks, are enhancing sector efficiency.

- Technological Advancements: Integration of AI, IoT, and blockchain is streamlining operations, boosting reliability and efficiency.

Segment-Specific Insights

- Freight and Logistics: Expected to grow from USD 349.37 billion in 2025 to USD 545.56 billion by 2030, at a CAGR of 9.32%.

- Warehousing: Projected to reach USD 34.99 billion by 2027, with a CAGR of 15.64%.

- Domestic Express Logistics: Anticipated to grow at a 14% CAGR over FY23-28, driven largely by e-commerce expansion.

Multimodal Logistics and Infrastructure Development

The government’s focus on developing Multi-Modal Logistics Parks (MMLPs) aims to enhance connectivity and reduce logistics costs. These parks are designed to facilitate seamless intermodal freight movement, improving efficiency across transportation modes.

Regional Investments and Expansion

Significant investments are underway to meet the growing demand for logistics infrastructure. For instance, IndoSpace plans to increase its investment in Tamil Nadu by 41% over the next three years, totaling USD 536 million, to develop industrial parks and create over 8,000 new jobs.

How Will Glottis Limited Benefit

- India’s logistics market is set to reach USD 360 billion by 2030, creating growth opportunities for Glottis Limited.

- The Indian ocean freight market’s 11.9% CAGR supports Glottis Limited’s strong position in this segment.

- Government initiatives like Multi-Modal Logistics Parks (MMLPs) align with Glottis Limited’s integrated logistics solutions.

- E-commerce expansion boosts demand for express logistics, strengthening Glottis Limited’s road and air freight services.

- A global network enables Glottis Limited to secure competitive carrier rates and reliable shipping slots.

- AI, IoT, and blockchain enhance tracking, efficiency, and cost-effectiveness in Glottis Limited’s logistics operations.

- The warehousing market’s projected USD 34.99 billion valuation benefits Glottis Limited’s 3PL and storage solutions.

- Infrastructure investments, including freight corridors, improve logistics efficiency and operational scalability.

- Expertise in renewable energy logistics strengthens Glottis Limited’s partnerships in the growing sector.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue (₹ in million) | EPS (₹) | NAV (₹ per Share) | P/E Ratio | RONW (%) |

| Glottis Limited | 2.00 | 4,971.77 | 3.87 | 5.29 | [•] | 73.10 |

| Peer Groups | ||||||

| Allcargo Logistics Limited | 2.00 | 1,31,878.30 | 1.52 | 25.66 | 27.76 | 5.55 |

| Transport Corporation of India Ltd | 2.00 | 40,242.64 | 45.18 | 256.15 | 23.51 | 17.80 |

Key insights

- Face Value: The face value of all three companies remains uniform at ₹2 per equity share. This suggests a standardized approach to equity structuring, ensuring comparability among them despite differences in size, revenue, and market presence.

- Revenue: Glottis Limited reports ₹4,971.77 million in revenue, significantly lower than its peers. Allcargo Logistics leads with ₹1,31,878.30 million, while Transport Corporation of India (TCI) follows at ₹40,242.64 million, indicating Glottis Limited’s smaller market share.

- Earnings Per Share (EPS): TCI outperforms with an EPS of ₹45.18, showcasing strong profitability. Glottis Limited’s EPS of ₹3.87 surpasses Allcargo’s ₹1.52, highlighting better earnings efficiency despite lower revenue, indicating potential profitability at its current scale.

- Net Asset Value (NAV): Glottis Limited’s NAV is ₹5.29, lower than its peers. TCI leads with ₹256.15, reflecting stronger asset backing per share, followed by Allcargo at ₹25.66, indicating Glottis Limited’s need for asset expansion.

- Price-to-Earnings (P/E) Ratio: Allcargo’s P/E ratio stands at 27.76, while TCI’s is 23.51. Glottis Limited’s P/E is yet to be determined, but a competitive valuation could influence investor sentiment and market perception positively.

- Return on Net Worth: Glottis Limited has a high RONW of 73.10%, significantly outperforming TCI’s 17.80% and Allcargo’s 5.55%. This suggests superior profitability relative to shareholder equity, highlighting its efficient capital utilization and financial performance.

Key Strategies for Glottis Limited

- Expanding Market Reach and Revenue Streams

Glottis Limited aims to enhance market presence by diversifying revenue streams and expanding its asset portfolio. By increasing its fleet of commercial vehicles and incorporating container procurement, the company seeks to reduce reliance on third parties, boost margins, and ensure efficient, independent logistics operations.

- Becoming a Total Logistics Provider

Glottis Limited plans to evolve into a comprehensive logistics provider by expanding its warehousing, distribution, and custom clearance services. By leveraging its inland transportation network, the company will cross-sell solutions, integrate operations, and target diverse industries, strengthening profitability and market position across key geographical regions.

- Global Expansion and Market Penetration

With operations spanning over 119 countries, Glottis Limited seeks to strengthen its international footprint by expanding into new geographies. Through strategic alliances, increased sales initiatives, and new branch offices, the company aims to improve service efficiency, enhance customer reach, and capitalize on global market opportunities.

- Leveraging Governmental Reforms for Growth

Glottis Limited intends to capitalize on government initiatives in renewable energy, manufacturing, and logistics. Policies like PM-KUSUM, Make in India, and PM Gati Shakti present opportunities to enhance operations, invest in infrastructure, and integrate technology, positioning the company for sustainable growth in multiple industries.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Glottis Limited IPO

How can I apply for Glottis Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Glottis Limited IPO?

The IPO includes a fresh issue of ₹200 crore and an offer-for-sale of 1.45 crore shares.

What is the lot size for the Glottis Limited IPO?

The minimum lot size and price details will be announced closer to the IPO date.

When will the Glottis Limited IPO open and close?

The IPO opening and closing dates are 29 September 2025 to 1 October 2025

Who are the promoters of Glottis Limited?

The promoters are Ramkumar Senthilvel and Kuttappan Manikandan, each holding a 49% stake in the company.