- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Grand Housing IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Grand Housing IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Grand Housing Limited IPO

Grand Housing, a Tamil Nadu-based real estate developer, specialises in plotted developments across Chennai and its surroundings. The company acquires land, builds essential infrastructure such as roads, power, water, and sewage systems, and converts it into saleable plots. Its operations span two key segments: residential plots ranging from 600 to 2,400 sq. ft. priced between ₹1,500 and ₹5,000 per sq. ft., and industrial plots from 2 to 9 acres priced between ₹5 million and ₹30 million per acre. With Chennai’s strong housing and industrial demand, Grand Housing has completed 39 projects, is developing 13, and has 7 upcoming as of March 31, 2025.

Grand Housing Limited IPO Overview

Grand Housing Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 29, 2025, to raise funds through an Initial Public Offering (IPO). The proposed IPO will be a Book Build Issue consisting entirely of an Offer for Sale (OFS) of up to 3.55 crore equity shares. The company’s shares are proposed to be listed on both the NSE and BSE. Smart Horizon Capital Advisors Pvt. Ltd. is acting as the Book Running Lead Manager, while Bigshare Services Pvt. Ltd. is the Registrar of the issue. Details such as IPO opening and closing dates, price band, and lot size are yet to be announced.

As per the DRHP, the issue comprises 3,55,00,000 equity shares of ₹5 face value each, aggregating up to ₹[.] crore. It is a 100% Offer for Sale, meaning no fresh shares will be issued. Post-IPO, the total shareholding will remain at 31,92,00,000 shares. The promoters of Grand Housing Ltd. — Vijay Surana J, Suyash Surana, and Chavi Jain — collectively hold 100% of the company’s shares before the issue, and their shareholding will reduce post-IPO. For further information, investors can refer to the Grand Housing IPO DRHP

Grand Housing Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 3.55 crore equity shares |

| Fresh Issue | NA |

| Offer for Sale (OFS) | 3.55 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 31,92,00,000 shares |

| Shareholding post-issue | 31,92,00,000 shares |

Grand Housing IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Grand Housing Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Grand Housing Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹2.36 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 30.48% |

| Net Asset Value (NAV) | ₹7.75 |

| Return on Equity (RoE) | 35.96% |

| Return on Capital Employed (RoCE) | 35.60% |

| EBITDA Margin | 66.93% |

| PAT Margin | 53.99% |

| Debt to Equity Ratio | 0.50 |

Objectives of the IPO Proceeds

- Being entirely an OFS issue, the IPO proceeds will entirely go to the selling shareholders, and the company will not use the proceeds for corporate purposes.

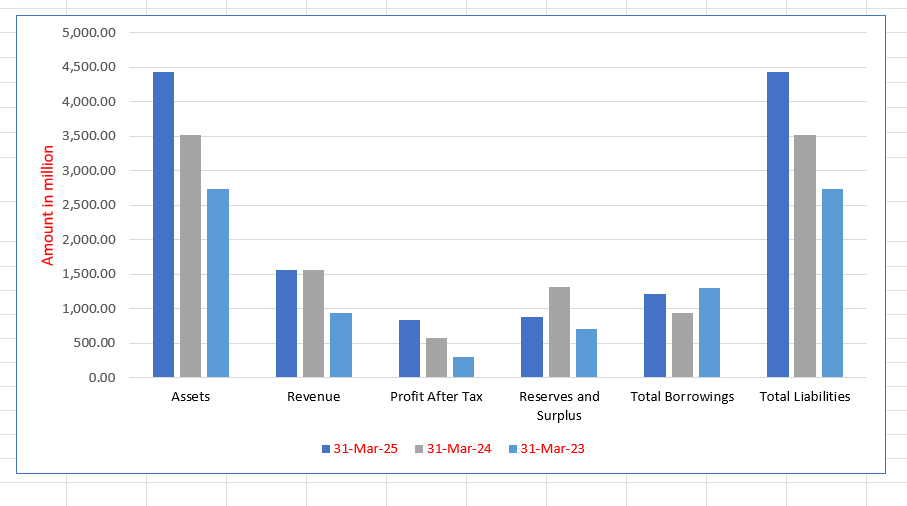

Grand Housing Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 4,428.33 | 3,512.59 | 2,739.40 |

| Revenue | 1,566.58 | 1,560.00 | 946.10 |

| Profit After Tax | 845.85 | 584.21 | 309.27 |

| Reserves and Surplus | 876.61 | 1,320.07 | 709.20 |

| Total Borrowings | 1,220.54 | 935.49 | 1,307.51 |

| Total Liabilities | 4,428.33 | 3,512.59 | 2,739.40 |

Financial Status of Grand Housing Limited

SWOT Analysis of Grand Housing IPO

Strength and Opportunities

- Experienced promoters with over three decades of real estate expertise provide strong leadership.

- Large freehold land bank in Chennai and nearby growth corridors offers significant expansion potential.

- Balanced portfolio of residential and industrial plots caters to diverse customer needs.

- Strong infrastructure growth in Tamil Nadu supports long-term land value appreciation.

- Rising demand for plotted developments in suburban areas increases market reach.

- Planned IPO enhances visibility, transparency, and investor confidence.

- Growing industrialisation provides opportunities for large-scale industrial plot development.

- Healthy balance sheet and manageable debt levels offer financial stability.

- Early presence in emerging corridors ensures strong brand positioning and better margins.

Risks and Threats

- Project execution risk remains high due to multiple ongoing developments and long gestation periods.

- Geographic concentration around Chennai exposes the company to local market fluctuations.

- Real estate industry cyclicality and rising construction costs could affect margins.

- Unsold inventory and slower sales conversion may create cash flow pressure.

- Intense competition from established Chennai developers could limit pricing flexibility.

- Regulatory delays and approval hurdles could postpone project completion.

- Economic slowdowns and high interest rates may reduce property demand.

- Market dependency on housing and industrial demand trends poses future uncertainty.

- Environmental and land clearance issues could delay or complicate project execution.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Grand Housing Limited

Grand Housing Limited IPO Strengths

Established Regional Brand and Reputation

Grand Housing Limited is an established and reputed developer with over 20 years of experience in Chennai’s residential and industrial plotted developments. Their “Grand Magnum” brand is widely recognizable in the region, built on a reputation for ethical dealings and clear property titles. This trust attracts high-net-worth individuals, multinational corporations, and target middle-class customers.

Large, Strategically Located Land Reserves

The company maintains large, fully paid-for land reserves (2,672,123 sq. ft. as of March 31, 2025) secured through two decades of acquisition expertise. These reserves are situated in high-growth areas around Chennai, including key industrial and residential zones, providing a steady project pipeline, protection against land inflation, and the ability to achieve relatively higher profit margins.

Efficient Project Execution and Customer Focus

Grand Housing Limited employs a detailed internal system for project execution, ensuring timely and on-budget completion with consistent quality. Their customer-centric approach focuses on developing desirable plots with amenities like black-topped roads, CCTV, and walkways. This efficiency, combined with customer goodwill, translates into strong sales and high customer referrals.

Resilient Financial Performance from Business Model

The company’s focus on plotted developments, which require lower capital investment and offer a quicker turnaround time, enables healthy financial performance. This business model has driven significant growth, with the EBITDA Margin increasing to $66.93\%$ in Fiscal 2025 and the Debt-to-Equity Ratio remaining low ($0.50$ as of March 31, 2025), reflecting prudent financial management.

Experienced Promoters and Management

Grand Housing Limited benefits from a team of experienced promoters and senior management with considerable expertise in the Indian real estate industry. Their collective knowledge in land acquisition, regulatory navigation, and modern marketing (including digital) drives business growth and enables the identification and execution of suitable projects that successfully meet evolving customer preferences in Tamil Nadu.

More About Grand Housing Limited

Grand Housing Limited is a prominent real estate developer in India, primarily engaged in plotted developments across Tamil Nadu, with a strong concentration in and around Chennai. The company focuses on acquiring land parcels, developing key infrastructure such as roads, water supply, sewage systems, and power connections, and converting them into developable and saleable plots. In some cases, Grand Housing Limited also consolidates contiguous parcels to create large, economically viable projects.

Business Segments

Grand Housing Limited operates under two major segments:

- Residential Plots – These plots typically range from 600 sq. ft. to 2,400 sq. ft., priced between ₹1,500 and ₹5,000 per sq. ft. They are primarily sold to homeowners seeking to build individual houses or villas. Each development includes black-topped roads, streetlights, walkways, avenue trees, fencing, and CCTV surveillance to ensure customer convenience and safety.

- Industrial Plots – Ranging from 2 acres to 9 acres, priced between ₹5 million and ₹30 million per acre, these plots cater to enterprises for setting up factories, warehouses, and other facilities. The main focus in this segment is on road development and providing access-ready land.

Strategic Location and Market Presence

The company’s operations are strategically based in Chennai, a city known for its urban growth, cultural richness, and robust industrial base. As South India’s largest industrial and commercial hub, Chennai offers strong connectivity through its ports and infrastructure, attracting both residents and businesses.

Project Portfolio and Land Reserves

As of March 31, 2025, Grand Housing Limited has:

- 39 Completed Projects

- 13 Ongoing Projects

- 7 Upcoming Projects: Together, these projects cover approximately 598.31 lakh sq. ft. of saleable area. In addition, the company holds land reserves of about 83.13 lakh sq. ft. (1,908.52 acres), earmarked for future development.

Industry Outlook

The Indian real estate market is witnessing robust expansion. Valued at approximately USD 482 billion in 2024, it is projected to reach around USD 1,184 billion by 2033, reflecting a compound annual growth rate (CAGR) of nearly 10.5% between 2025 and 2033. Other projections estimate growth from USD 584 billion in 2024 to USD 845 billion by 2030, implying a CAGR of about 7.3%.

Key growth drivers include rapid urbanisation, rising disposable incomes, favourable government policies such as RERA and Smart Cities initiatives, and large-scale infrastructure investments that continue to enhance land accessibility and valuation.

Focus on Plotted Developments: Residential and Industrial Land

Within the broader real estate industry, plotted developments—covering both residential and industrial land—are gaining strong traction. For residential plots, rising preference for customised homes, particularly in emerging urban and suburban corridors, has significantly boosted demand. On the industrial front, India’s growing manufacturing and logistics ecosystem, supported by the “Make in India” initiative and the expansion of e-commerce, has increased the need for large industrial plots suitable for factories and warehouses.

Between January 2022 and May 2025, developers launched nearly 4.7 lakh residential plots valued at around ₹2.4 lakh crore across major Tier I and II cities.

Growth Drivers and Key Figures

- Urban population growth: By 2026, around 600 million people (about 40% of India’s population) are expected to live in urban areas.

- Infrastructure expansion: Improved transport, highways, and metro networks are pushing real estate growth in suburban areas.

- Industrial and corporate demand: Rising manufacturing and logistics facilities are fuelling industrial plot demand.

- Land scarcity in metros: Developers are shifting towards peripheral plotted developments, ensuring quicker turnaround and lower execution risk.

How Will Grand Housing Limited Benefit

- Grand Housing Limited is well-positioned to capitalise on India’s rapid real estate growth, especially within the plotted development segment that aligns with its core business.

- Rising urbanisation and growing demand for customised residential spaces will enhance the company’s residential plot sales in and around Chennai.

- Expansion of industrial corridors and government initiatives like “Make in India” will boost demand for the company’s industrial plots.

- Increasing infrastructure projects across Tamil Nadu, including highways and metro networks, will improve land value and accessibility in its target regions.

- Shifting developer preference toward plotted developments ensures faster project execution and quicker revenue realisation for the company.

- With an established brand presence and experienced management, Grand Housing Limited can efficiently scale operations across high-growth zones.

- The company’s large land reserves will enable it to meet rising residential and industrial land demand over the next decade.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Grand Housing Limited

Focus on Plotted Developments with Emphasis on the Industrial Segment

Grand Housing Limited plans to strengthen its focus on plotted developments, particularly within the industrial segment. Industrial projects offer quicker execution, fewer regulatory hurdles, and higher margins due to larger land parcels and less price-sensitive corporate buyers, ensuring efficient capital utilisation and accelerated growth.

Acquiring Land in High-Growth Strategic Locations

The company aims to expand its land reserves by acquiring plots in Chennai’s fast-growing residential and industrial corridors. Targeting key regions like Sengadu, Mappedu, Koppur, Araneri, and Illuppur, Grand Housing Limited intends to leverage Chennai’s connectivity, manufacturing ecosystem, and rising real estate demand for sustainable expansion.

Strengthening Operations Through Modern Technology

Grand Housing Limited plans to enhance efficiency by adopting advanced technologies such as CAD for layout design, AI for geographic growth evaluation, and CRM systems for customer management. Integration of property tech solutions like virtual tours and blockchain will further improve transparency, service quality, and operational excellence.

Enhancing Brand Visibility and Customer Relationships

To build a stronger market presence, Grand Housing Limited intends to invest in strategic marketing campaigns, social media outreach, and digital storytelling. The company also plans to launch loyalty and referral programmes that foster trust, ensure repeat investments, and position the brand as a customer-centric real estate developer.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Grand Housing Limited IPO

How can I apply for Grand Housing Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the Grand Housing Limited IPO about?

Grand Housing Limited’s IPO is a Book Build Issue comprising a complete Offer for Sale of up to 3.55 crore shares.

When was the Grand Housing IPO filed with SEBI?

The company filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 29, 2025.

How will the IPO proceeds be utilised?

As it is an Offer for Sale, all proceeds will go to the selling shareholders, not the company.

Where will Grand Housing Limited’s shares be listed?

The equity shares are proposed to be listed on both the NSE and BSE after the IPO.

Who are the lead manager and registrar for the IPO?

Smart Horizon Capital Advisors Pvt. Ltd. is the book-running lead manager, and Bigshare Services Pvt. Ltd. is the registrar.